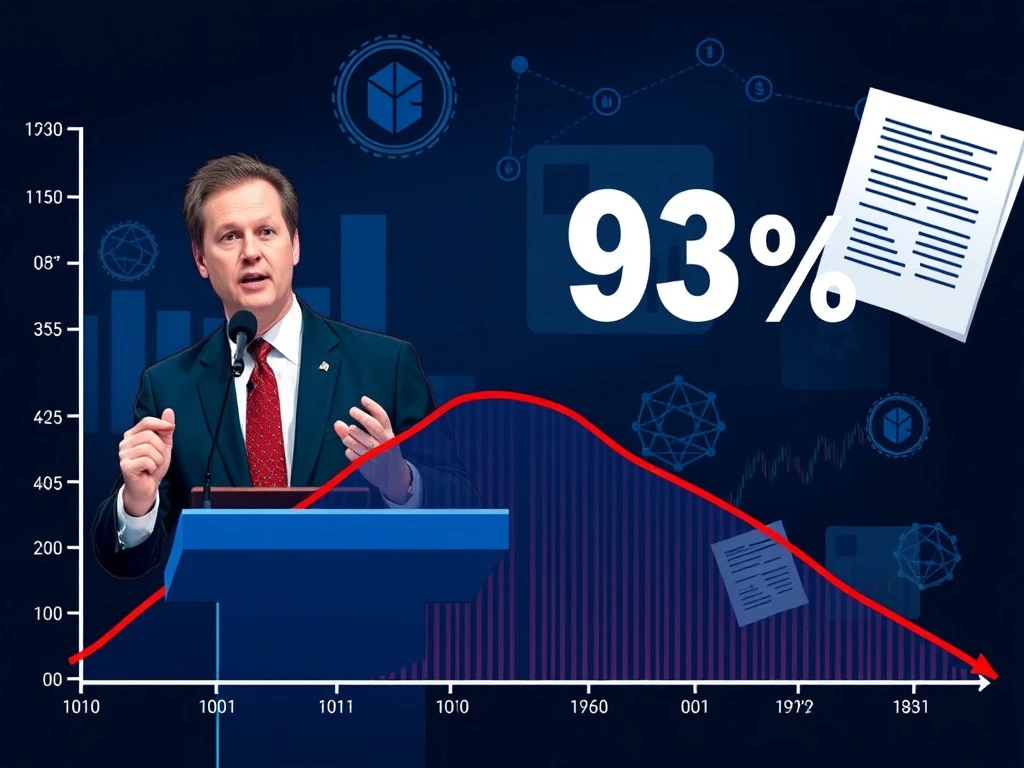

USDC CEO’s Shocking Endorsement: PURCH Token Plummets 93% After Jeremy Allaire Promotion

In a stunning development that has rocked cryptocurrency markets, Circle CEO Jeremy Allaire faces intense scrutiny following his promotion of the PURCH token, which subsequently experienced a catastrophic 93% price collapse. The controversy, first exposed by blockchain investigator ZachXBT, raises serious questions about executive responsibility and market manipulation in the digital asset space. This incident represents one of the most significant endorsement-related crashes in recent cryptocurrency history, occurring against a backdrop of increasing regulatory scrutiny and investor protection concerns.

USDC CEO’s Controversial Token Endorsement

Jeremy Allaire, co-founder and CEO of Circle, the company behind the USDC stablecoin, publicly endorsed the PURCH token in late 2024. His promotion reached approximately 783,800 viewers through social media platforms, creating immediate market interest in the previously obscure cryptocurrency. Allaire’s endorsement carried significant weight given his position as leader of one of the world’s largest stablecoin issuers, with USDC maintaining a market capitalization exceeding $25 billion at the time of the incident.

The PURCH token, described as a microcap cryptocurrency with limited liquidity, experienced rapid price appreciation following Allaire’s public support. However, this surge proved temporary. Within weeks, the token entered a precipitous decline, ultimately losing 93% of its value from peak levels. Market analysts immediately noted the unusual correlation between the high-profile endorsement and the subsequent collapse, prompting investigations into potential market manipulation.

Blockchain Investigator Exposes Promotion Fallout

On-chain investigator ZachXBT brought the controversy to public attention through detailed blockchain analysis. His investigation revealed the precise timeline of events, documenting the token’s price movements relative to Allaire’s promotional activities. ZachXBT’s findings, shared across social media platforms, highlighted several concerning patterns:

- Timing correlation: The token’s peak coincided directly with maximum visibility of Allaire’s endorsement

- Volume anomalies: Trading volume spiked 1,200% during the promotion period

- Holder concentration: Analysis revealed unusually concentrated token ownership before the crash

- Price manipulation indicators: Several technical indicators suggested coordinated selling pressure

ZachXBT’s investigation methodology involved tracking wallet addresses, analyzing transaction patterns, and correlating on-chain data with social media activity. His work represents a growing trend of independent blockchain forensics holding industry figures accountable for their public statements and market influence.

Regulatory Implications and Market Impact

The PURCH token collapse occurs during a period of heightened regulatory attention toward cryptocurrency promotions. Regulatory bodies worldwide have increasingly focused on influencer endorsements and executive communications that may impact market prices. This incident raises several important considerations for market participants and regulators alike.

First, the case highlights the substantial influence that established industry figures wield in cryptocurrency markets. Unlike traditional financial markets where executive communications face strict disclosure requirements, cryptocurrency promotions often operate in regulatory gray areas. Second, the rapid price collapse demonstrates the vulnerability of microcap tokens to manipulation, particularly when endorsed by influential figures.

Market data reveals broader impacts beyond the PURCH token itself. Following the controversy, several related developments occurred:

| Impact Area | Specific Effect | Timeframe |

|---|---|---|

| USDC Market Position | Minor outflows observed | 2 weeks post-incident |

| Regulatory Scrutiny | Increased SEC inquiries | Ongoing |

| Industry Standards | Calls for disclosure guidelines | Developing |

| Investor Confidence | Microcap skepticism increased | Immediate |

Historical Context of Cryptocurrency Endorsements

This incident follows a pattern of controversial cryptocurrency endorsements with significant market consequences. Historically, high-profile promotions have frequently preceded substantial price volatility. However, the scale and visibility of this particular case distinguish it from previous incidents. Several factors contribute to its significance within the broader cryptocurrency ecosystem.

The involvement of a major stablecoin executive adds substantial weight to the controversy. Stablecoin issuers occupy particularly sensitive positions within cryptocurrency markets, serving as bridges between traditional finance and digital assets. Their executives’ actions therefore carry implications beyond individual token promotions, potentially affecting broader market stability and institutional adoption.

Furthermore, the timing coincides with ongoing regulatory developments. Multiple jurisdictions are currently considering or implementing stricter rules governing cryptocurrency promotions and influencer marketing. This incident provides regulators with concrete examples of potential market manipulation through executive endorsements, likely accelerating regulatory responses.

Expert Analysis and Industry Response

Industry experts have offered varied perspectives on the controversy. Some emphasize the need for clearer disclosure requirements when industry figures promote specific assets. Others highlight the importance of investor education regarding the risks associated with microcap cryptocurrencies. Several consistent themes emerge from expert commentary.

Market analysts note that microcap tokens inherently carry higher risks due to limited liquidity and potential manipulation vulnerabilities. When combined with high-profile endorsements, these risks can amplify dramatically. The PURCH token case demonstrates how quickly retail investors can suffer losses in such scenarios, particularly when entering positions near peak prices following promotional activity.

Industry associations have begun discussing potential self-regulatory measures. Proposed guidelines include voluntary disclosure of promotional relationships, clearer risk warnings, and limitations on executive endorsements of particularly volatile assets. These discussions reflect growing recognition within the cryptocurrency industry that responsible promotion practices benefit long-term market development.

Investor Protection Considerations

The PURCH token collapse raises critical questions about investor protection in cryptocurrency markets. Unlike traditional securities markets with established disclosure regimes and investor protection mechanisms, cryptocurrency markets often operate with fewer safeguards. This incident highlights several areas requiring attention from both regulators and industry participants.

First, disclosure standards for promotional activities remain inconsistent across jurisdictions. Some regions have implemented specific rules governing cryptocurrency promotions, while others rely on general advertising standards. Second, investor education regarding the risks of microcap investments appears insufficient, particularly given the accessibility of these assets through mainstream trading platforms.

Third, market surveillance capabilities for detecting manipulation patterns require enhancement. While investigators like ZachXBT demonstrate what’s possible through blockchain analysis, systematic monitoring remains limited. Finally, recourse mechanisms for investors harmed by potentially misleading promotions need clarification and strengthening across most jurisdictions.

Conclusion

The controversy surrounding Jeremy Allaire’s promotion of the PURCH token and its subsequent 93% collapse represents a significant moment for cryptocurrency markets. This USDC CEO endorsement incident highlights the substantial influence industry leaders wield and the potential consequences when that influence intersects with volatile microcap assets. As blockchain investigator ZachXBT’s findings demonstrate, transparent analysis can illuminate concerning market patterns that might otherwise remain obscured. The broader implications extend beyond this specific case, touching on regulatory development, investor protection, and industry standards for responsible promotion. Moving forward, this incident will likely influence how cryptocurrency executives approach public endorsements and how regulators address market manipulation concerns in digital asset markets.

FAQs

Q1: What exactly did Jeremy Allaire do regarding the PURCH token?

Jeremy Allaire, CEO of Circle (issuer of USDC), publicly endorsed the PURCH token through social media platforms. His promotion reached approximately 783,800 viewers and coincided with significant price appreciation followed by a 93% collapse.

Q2: Who exposed this controversy and how?

Blockchain investigator ZachXBT exposed the controversy through detailed on-chain analysis. He tracked wallet addresses, analyzed transaction patterns, and correlated blockchain data with social media activity to document the timeline and market impact.

Q3: Why is this incident particularly significant?

This incident is significant because it involves a major stablecoin executive, highlights manipulation vulnerabilities in microcap tokens, and occurs during increased regulatory scrutiny of cryptocurrency promotions. The 93% collapse represents substantial investor losses following high-profile endorsement.

Q4: What are the regulatory implications of this case?

The case may accelerate regulatory efforts to establish clearer rules for cryptocurrency promotions, particularly regarding disclosure requirements for industry figures. It provides concrete examples of potential market manipulation that regulators can reference when developing policies.

Q5: How does this affect ordinary cryptocurrency investors?

This incident underscores the risks associated with microcap cryptocurrency investments, especially following high-profile endorsements. Investors should exercise particular caution with assets experiencing rapid price appreciation after promotional activity and conduct independent research before investing.