TRON Price Analysis: TRX Retests Critical Demand Zone – Can Bulls Spark a Rally Toward $0.50?

As of January 27, 2026, the TRON (TRX) cryptocurrency is undergoing a significant technical test, retracing toward a well-established demand zone between $0.26 and $0.27. This price action follows a notable 2025 rally and subsequent consolidation, placing TRX at a potential inflection point. Market analysts are now scrutinizing whether the network’s fundamental growth as a dominant stablecoin settlement layer can translate into renewed bullish momentum capable of challenging the $0.50 resistance level in the coming months.

TRON’s Strategic Position as a Stablecoin Powerhouse

TRON’s price trajectory cannot be divorced from its fundamental network utility. Throughout 2025, the blockchain solidified its reputation as the leading global network for stablecoin transfers and settlements. According to a comprehensive Q4 2025 report from blockchain analytics firm Nansen, TRON consistently processed between 8 and 12 million transactions daily. This high throughput, combined with persistently low transaction costs, made it the preferred infrastructure for high-frequency financial applications.

The network’s dominance is not accidental. A strategic partnership announced in late 2025 between the TRON ecosystem and River’s chain abstraction stablecoin infrastructure, backed by an investment from TRON founder Justin Sun, aims to accelerate this growth. This collaboration is designed to funnel cross-ecosystem assets and liquidity onto the TRON blockchain. Consequently, it will provide users with native access to high-yield opportunities directly within the ecosystem.

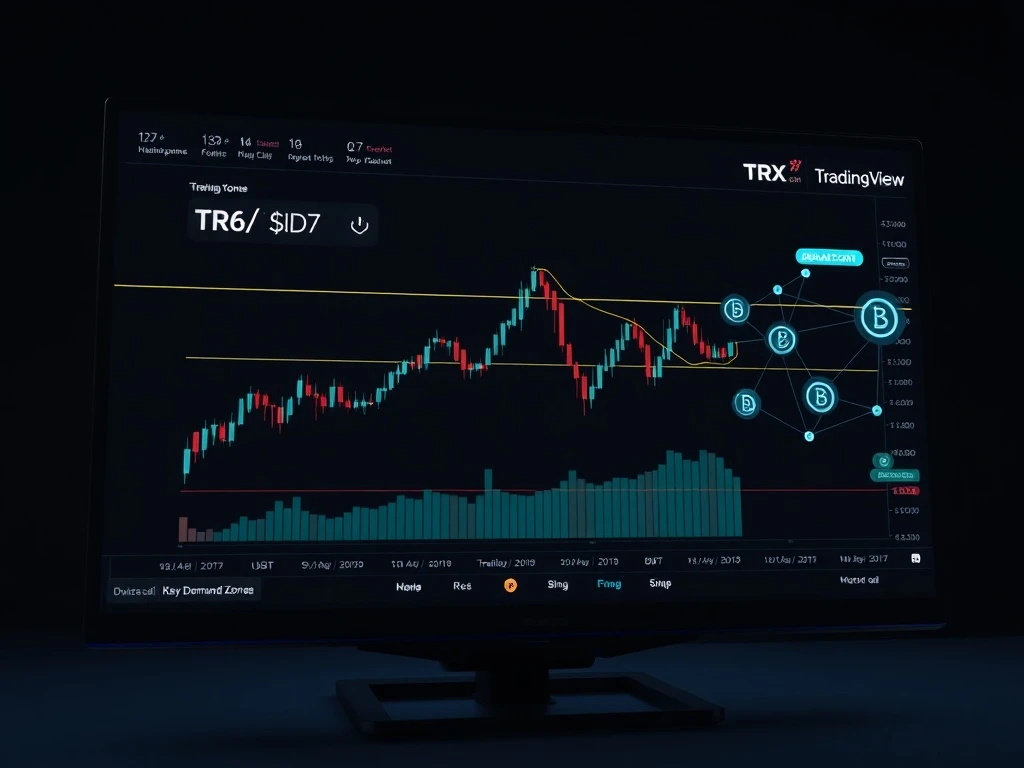

Technical Analysis: Decoding TRX’s Price Structure

On higher timeframes, TRX maintains a broader uptrend despite recent pullbacks. The altcoin staged an impressive rally from approximately $0.21 to a peak near $0.37 by August 2025. However, the following months saw a multi-month retracement. This corrective phase found significant support at the 61.8% Fibonacci retracement level of the prior swing move, precisely at $0.2718.

This critical level was tested twice in November and December 2025, with buyers successfully defending it on both occasions. The subsequent price recovery above $0.29 re-established a bullish structure on the daily chart. Currently, TRX is retesting a former supply zone, which has now transformed into a potential demand zone based on recent price acceptance. This retest is a common technical phenomenon that often precedes the next directional move.

Key Metrics: MVRV Bands and Cost Basis Distribution

Beyond pure price action, on-chain metrics provide crucial context for TRX’s valuation. Data from Glassnode reveals that TRX’s Market Value to Realized Value (MVRV) pricing bands indicate the asset is neither significantly overvalued nor undervalued. Importantly, the 2025 rally did not push TRX into overvalued territory according to these bands, which are constructed to identify zones of extreme unrealized profit or loss among holders. This metric suggests there is latent strength for a potential upward move.

Furthermore, a cost basis distribution heatmap highlights a dense concentration of investor holdings between $0.26 and $0.27, established since June 2025. This range represents the average acquisition price, or cost basis, for a large segment of the TRX supply. In market mechanics, such zones often act as strong support, as investors who are “at cost” are less likely to sell, and new buyers may see value. Any further price dips would likely encounter substantial buying interest at this long-term technical support level.

The Macro Context: Bitcoin and Market Sentiment

While TRON’s fundamentals are robust, its near-term upside remains tethered to broader market conditions. The performance of Bitcoin (BTC) and overall capital inflows into the cryptocurrency sector will be decisive factors. A positive sentiment shift across the digital asset market, potentially driven by institutional adoption or regulatory clarity, could provide the tailwinds necessary for TRX to attempt a breakout. Conversely, continued macro uncertainty could prolong consolidation within the current range.

The interplay between TRON’s strong standalone utility and its correlation with the wider market creates a complex but navigable landscape for analysts. The network’s proven use-case for stablecoin settlement provides a fundamental floor, while speculative momentum will dictate the ceiling.

Conclusion

TRON (TRX) stands at a compelling technical juncture as it retests the key $0.26-$0.27 demand zone in early 2026. The blockchain’s undeniable growth as a stablecoin settlement layer, evidenced by massive daily transaction volumes and strategic partnerships, forms a solid foundational thesis. Technically, the defense of Fibonacci support and a neutral MVRV valuation suggest room for appreciation. For TRX to rally toward and potentially surpass the $0.50 mark, it will require a confluence of sustained network growth, a bullish reaction at the current demand zone, and a supportive macro environment for cryptocurrencies. Traders and investors should monitor the $0.26-$0.27 zone closely, as its integrity will likely determine the next major trend for TRX.

FAQs

Q1: What is the key demand zone for TRON (TRX)?

The critical demand zone for TRX is identified between $0.26 and $0.27. This area represents a high-density cost basis for many holders and has acted as strong support during previous market tests.

Q2: What does the MVRV pricing band data indicate for TRX?

The MVRV (Market Value to Realized Value) pricing bands suggest TRX is currently in a neutral valuation zone. It is neither overvalued nor undervalued, indicating the 2025 rally did not exhaust its potential and there may be fundamental strength for future moves.

Q3: Why is TRON considered a leading stablecoin network?

TRON consistently processes 8-12 million transactions daily with low fees and high throughput. This technical efficiency, combined with major partnerships like the one with River’s infrastructure, has made it the preferred blockchain for stablecoin transfers and DeFi settlements.

Q4: What could drive TRX toward $0.50?

A rally toward $0.50 would likely require a successful hold of the current demand zone, continued growth in TRON’s network utility (especially in stablecoins), and a positive shift in overall cryptocurrency market sentiment led by Bitcoin.

Q5: What is the significance of the 61.8% Fibonacci retracement level?

The 61.8% Fibonacci level at $0.2718 is a key technical indicator derived from the prior price swing. It is a common retracement depth in financial markets where trends often find support before resuming, which TRX did in late 2025.