PENGUIN Memecoin Skyrockets 564% in Stunning Rally Triggered by White House Social Media Post

In a dramatic display of digital asset volatility intersecting with political spectacle, the Nietzschean Penguin (PENGUIN) memecoin exploded by approximately 564% on Friday, January 17, 2026, following a viral social media post from the official account of the United States White House. This unprecedented surge, occurring against a backdrop of broader market uncertainty, underscores the powerful and often unpredictable influence of mainstream attention on cryptocurrency valuations.

PENGUIN Memecoin Catalyzes a Meteoric Rise

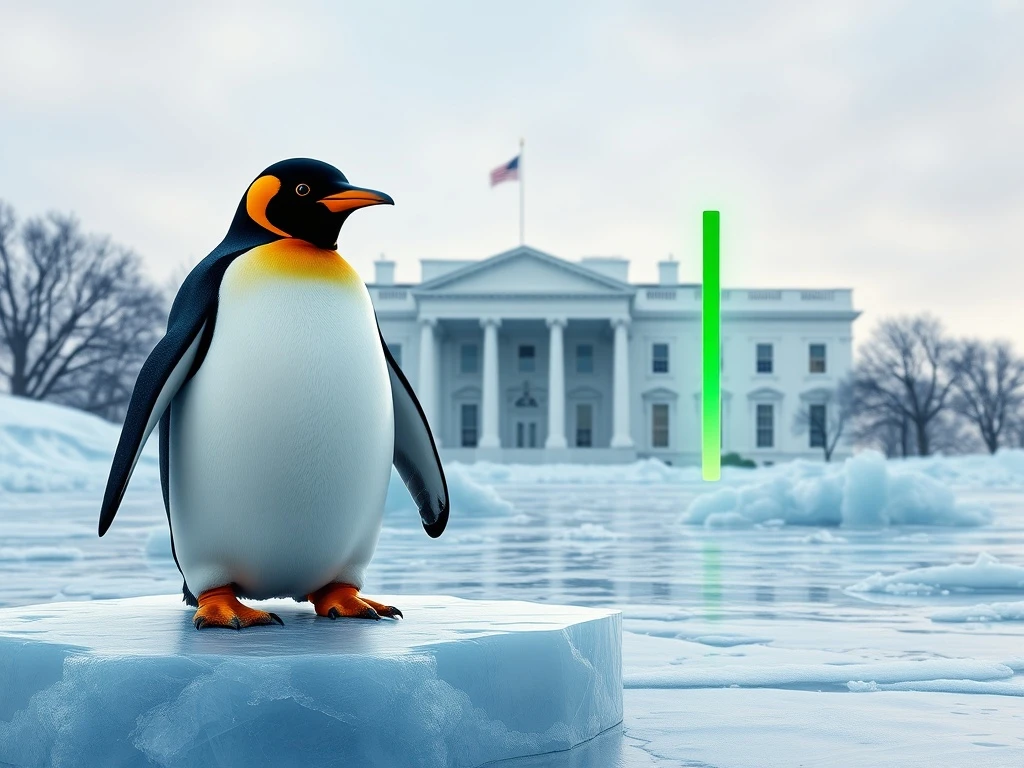

The catalyst for the rally was a seemingly innocuous image posted on platform X. The post featured a depiction of US President Donald Trump and a penguin walking hand-in-hand through a snowy landscape. Consequently, within hours, the obscure PENGUIN token, a Solana-based asset, transformed from a niche digital curiosity into a trading phenomenon. Data from on-chain analytics trackers reveals the sheer scale of the movement. Specifically, before the post, PENGUIN held a modest market capitalization of around $387,000. However, in the subsequent 24-hour period, trading volume skyrocketed to an astonishing $244 million, according to data aggregator SolanaFloor.

Currently, the token’s market capitalization sits near $136 million, with a price of about $0.13 per token, as reported by DEXScreener. This price action represents one of the most acute single-event-driven rallies in the recent memecoin cycle. Alon Cohen, co-founder of the memecoin launchpad Pump.fun, which hosted PENGUIN’s creation, commented on the event’s significance. He stated, “The early success of PENGUIN is proof that onchain trading was never dead, just a sleeping giant waiting for the right moment.”

Solana Ecosystem and the 2026 Memecoin Landscape

This event did not occur in a vacuum. The PENGUIN surge erupted during a period of broad contraction within the memecoin sector. After being a standout performer in 2024, the market faced a severe correction. Numerous celebrity-endorsed tokens witnessed declines exceeding 80% from their peaks, leading to widespread investor skepticism. Furthermore, the year 2025 saw a staggering failure rate, with an estimated 11.6 million crypto tokens becoming defunct, largely due to an oversaturation of memecoins launched on platforms like Pump.fun.

Nevertheless, January 2026 showed flickering signs of life. The total market capitalization for memecoins briefly jumped 23%, climbing from roughly $38 billion in December to over $47 billion. Analysis from Santiment, a crypto market intelligence firm, confirmed this activity was paired with a sharp spike in social media discussions about memecoins. Vincent Liu, Chief Investment Officer at Kronos Research, provided expert context: “Memecoins typically lead when risk appetite returns. The rebound in the Fear and Greed Index from extreme fear toward neutral reinforces this shift.”

Analyzing the Impact of Political and Social Signals

The PENGUIN episode highlights a critical evolution in market dynamics. Increasingly, cryptocurrency valuations, particularly for highly speculative assets like memecoins, demonstrate hypersensitivity to signals from traditional centers of influence, including political institutions. This creates a new layer of market analysis where social media sentiment from official channels must be monitored alongside traditional technical and fundamental indicators. The rapid price discovery and immense liquidity provided by decentralized exchanges on networks like Solana enable these viral movements to unfold at breathtaking speed, often leaving retail traders reacting to, rather than anticipating, the volatility.

However, the rally proved transient for the broader sector. By the time of publication, the total memecoin market cap had receded to approximately $39 billion. This retracement illustrates the current market temperament, characterized by sideways movement punctuated by sharp, short-term rallies and subsequent pullbacks. The PENGUIN token itself, while still vastly elevated from its pre-rally levels, remains subject to the extreme volatility inherent to its asset class.

Conclusion

The 564% surge of the PENGUIN memecoin following a White House social media post serves as a potent case study for the modern digital asset era. It underscores the potent mix of blockchain technology, social media virality, and political theater that can drive market movements. While the long-term sustainability of such gains is questionable, the event undeniably proves that latent speculative energy within the cryptocurrency market, particularly on chains like Solana, can be ignited by unforeseen external catalysts. For investors and observers, the PENGUIN phenomenon reinforces the need for heightened awareness of the non-financial signals that can now precipitate major financial outcomes in the crypto space.

FAQs

Q1: What is the PENGUIN memecoin?

The Nietzschean Penguin (PENGUIN) is a memecoin, a type of cryptocurrency often inspired by internet culture and humor, launched on the Solana blockchain. Its value is primarily driven by community sentiment and speculative trading rather than underlying utility.

Q2: Why did the PENGUIN price surge?

The primary catalyst was a viral social media post from the official US White House account on X, featuring an image of President Trump with a penguin. This triggered massive speculative buying and a 564% price increase within a short timeframe.

Q3: What blockchain is PENGUIN on?

PENGUIN is built on the Solana layer-1 blockchain network, known for its high transaction speeds and low costs, which facilitates the rapid trading often seen with memecoins.

Q4: How does a White House post affect cryptocurrency prices?

Official posts from major institutions like the White House generate immense mainstream attention and social media discussion. In the highly sentiment-driven memecoin market, this surge in visibility can lead to a rapid influx of traders speculating on the momentum, regardless of the post’s original intent.

Q5: Is the memecoin market recovering in 2026?

Data shows a brief recovery in January 2026, with the total market cap rising 23%. However, the market remains volatile and has since given up most of those gains. The PENGUIN surge was an isolated, event-driven rally within a still-challenging broader environment for memecoins.