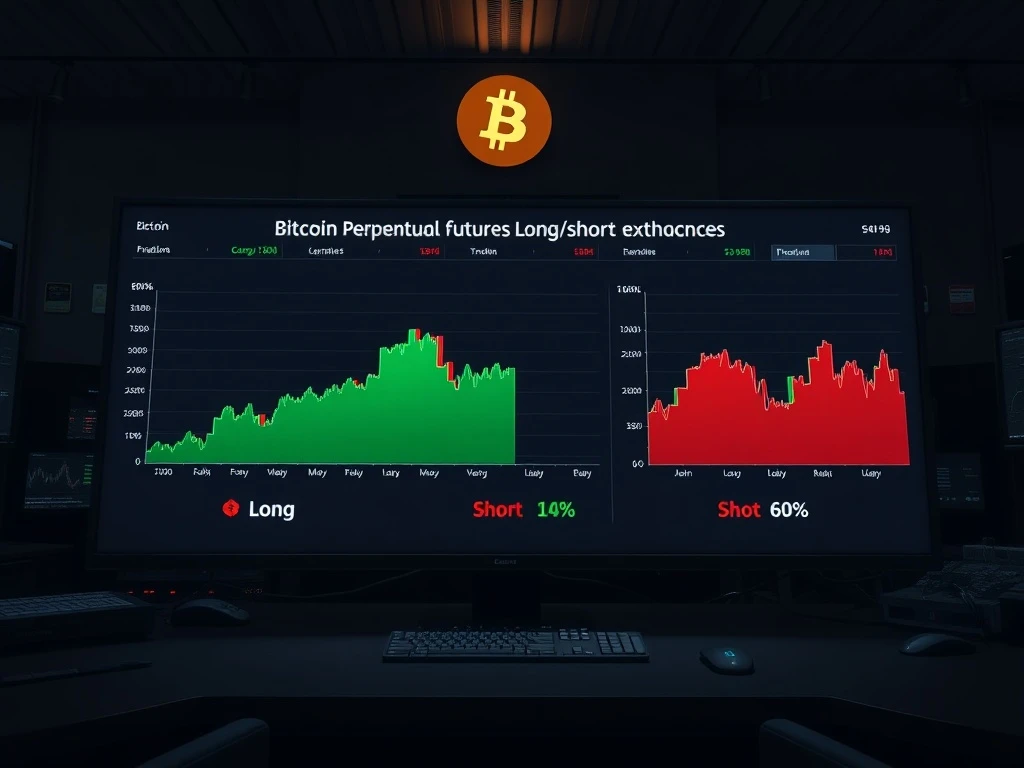

BTC Perpetual Futures Long-Short Ratio Reveals Critical Market Equilibrium Across Major Exchanges

Global cryptocurrency markets observed a remarkably balanced BTC perpetual futures long-short ratio across major exchanges during the past 24 hours, revealing sophisticated institutional positioning and retail trader behavior patterns that signal cautious market equilibrium. According to comprehensive data from the world’s three largest crypto futures exchanges by open interest, the aggregate positioning shows traders maintaining nearly equal long and short exposure, with subtle variations between platforms offering crucial insights into market microstructure and sentiment divergence. This detailed analysis examines the 49.49% long versus 50.51% short overall ratio through multiple analytical lenses, providing traders and investors with actionable intelligence about derivative market dynamics and potential price direction indicators.

BTC Perpetual Futures Market Structure Analysis

Perpetual futures contracts represent one of cryptocurrency’s most innovative financial instruments, combining traditional futures mechanics with unique funding rate mechanisms that maintain contract prices near underlying spot prices. Unlike traditional futures with expiration dates, perpetual contracts continue indefinitely, requiring sophisticated position management strategies from institutional and retail participants. The long-short ratio specifically measures the percentage of open positions expecting price increases versus those anticipating declines, serving as a crucial sentiment indicator when analyzed alongside volume, open interest, and funding rates.

Market analysts consistently monitor these ratios because they often precede significant price movements when extreme positioning develops. However, the current data reveals balanced positioning that suggests neither bulls nor bears have established clear dominance. This equilibrium typically indicates consolidation periods where traders await clearer fundamental or technical signals before committing to directional bets. Furthermore, the subtle differences between exchange ratios demonstrate how platform-specific user demographics, leverage options, and trading interfaces influence collective positioning decisions across global markets.

Exchange-Specific Positioning Variations

Detailed examination of individual exchange data reveals meaningful variations in trader behavior. Binance, the world’s largest cryptocurrency exchange by volume, shows 49.75% long positions versus 50.25% short positions, indicating nearly perfect balance with a slight bearish tilt. This minimal divergence suggests Binance’s diverse user base—spanning retail traders, algorithmic trading firms, and institutional participants—has reached consensus about near-term uncertainty. The exchange’s deep liquidity and sophisticated trading tools typically attract more professional traders who employ hedging strategies that might explain this balanced positioning.

OKX displays the most pronounced bearish skew among major platforms, with 48.25% long positions against 51.75% short positions. This 3.5 percentage point difference represents the most significant directional bias in the dataset and may reflect regional trading patterns, as OKX maintains strong presence in Asian markets where regulatory developments or local economic factors could influence sentiment. Alternatively, this positioning might indicate more aggressive short-selling by professional traders anticipating specific technical breakdowns or responding to macroeconomic indicators affecting Asian trading sessions.

Bybit presents the only bullish tilt among the three exchanges, with 50.32% long positions versus 49.68% short positions. This slight majority of long positions suggests Bybit’s user base maintains marginally more optimistic near-term expectations, possibly influenced by the platform’s retail-focused interface and educational resources that might attract different trader psychology. The exchange has gained significant market share in perpetual futures trading through user-friendly features and competitive fee structures that appeal to both novice and experienced derivatives traders.

Historical Context and Market Implications

Current positioning data gains significance when analyzed against historical patterns and broader market conditions. During previous market cycles, extreme long-short ratios often preceded trend reversals as overcrowded trades became vulnerable to liquidation cascades. For instance, when long ratios exceeded 70% during 2021’s bull market peaks, subsequent corrections frequently followed as over-leveraged long positions faced mass liquidations. Conversely, extreme short ratios below 30% sometimes preceded sharp rallies that forced short sellers to cover positions aggressively.

The present balanced ratios suggest markets have entered a consolidation phase following recent volatility, with traders unwilling to commit strongly to either direction without additional catalysts. This positioning aligns with typical behavior during periods of macroeconomic uncertainty, where traders reduce directional exposure while awaiting clarity on interest rate policies, regulatory developments, or institutional adoption milestones. Market technicians note that such balanced ratios often precede significant breakout movements once new information enters the market, as accumulated positioning on one side can accelerate price movements when trends establish.

Professional trading desks typically interpret these ratios alongside other metrics including funding rates, open interest changes, and volume patterns. When balanced long-short ratios coincide with neutral or slightly negative funding rates—as currently observed—they often indicate healthy market conditions without excessive speculation. However, traders remain vigilant for divergences between exchange ratios that might signal impending volatility, as different platform user bases sometimes react to news events at varying speeds based on geographic distribution and trading sophistication.

Institutional Perspective on Derivatives Data

Institutional analysts emphasize that exchange-level positioning differences provide valuable insights into market microstructure and participant behavior segmentation. According to derivatives market specialists, platform-specific ratios reflect how different trader cohorts interpret identical market information through varying risk frameworks and investment horizons. The current data suggests professional traders might be employing more sophisticated strategies like basis trading or volatility arbitrage that don’t appear as simple directional bets in long-short ratios, potentially explaining some of the balanced positioning.

Risk management departments at crypto-native hedge funds monitor these metrics daily to assess market sentiment extremes and potential liquidation risks. The balanced ratios currently observed reduce concerns about imminent long or short squeezes that can create violent price movements when highly leveraged positions face margin calls. However, experienced portfolio managers caution that balanced sentiment can shift rapidly with news events or technical breakouts, requiring continuous monitoring rather than static analysis of single data points.

Regulatory developments also influence derivatives positioning, as traders adjust strategies based on jurisdictional clarity and compliance requirements. Major exchanges operate under different regulatory frameworks that affect available leverage, product offerings, and user verification processes—all factors that indirectly influence collective positioning patterns. The current data might reflect how traders are positioning ahead of anticipated regulatory announcements or responding to recent enforcement actions in various jurisdictions.

Technical Analysis Integration

Combining long-short ratio analysis with technical indicators provides more comprehensive market understanding. Currently, Bitcoin’s price action shows consolidation within a defined range, with derivatives data confirming the lack of strong directional conviction among traders. Key resistance and support levels identified through technical analysis align with the balanced sentiment, as neither bulls nor bears have demonstrated sufficient strength to break established price boundaries. This convergence of technical and derivatives data strengthens analysis reliability.

Volume analysis reveals whether current positioning changes accompany significant trading activity or represent gradual adjustments. Recent volume patterns show moderate activity rather than explosive moves, supporting the interpretation that traders are maintaining rather than aggressively building positions. Open interest—the total number of outstanding contracts—provides additional context about whether new capital enters derivatives markets or existing positions simply roll over. Current open interest levels suggest stable participation without dramatic capital inflows or outflows.

Seasoned chart analysts note that balanced long-short ratios during consolidation phases often precede substantial moves once technical breakouts occur. The lack of extreme positioning reduces the likelihood of violent reversals caused by liquidation cascades but doesn’t eliminate directional possibilities once fundamental catalysts emerge. Traders typically watch for ratio divergences that develop alongside technical patterns like ascending triangles or descending channels, as these convergences sometimes provide higher-probability trade setups.

Risk Management Considerations

Current market conditions warrant specific risk management approaches given the balanced sentiment readings. Position sizing becomes particularly important when neither direction shows clear dominance, as false breakouts and whipsaw price action frequently occur during such periods. Experienced traders often reduce leverage during balanced sentiment environments, recognizing that low-conviction markets can reverse direction unexpectedly without clear fundamental triggers. Stop-loss placement requires additional consideration to avoid premature exits during normal volatility.

Portfolio managers emphasize diversification across timeframes and strategies when long-short ratios show equilibrium. Some institutional players maintain delta-neutral positions through options strategies or futures spreads while waiting for clearer directional signals. Retail traders might consider reducing position sizes or implementing tighter risk parameters until ratios show more decisive skew toward either longs or shorts. All market participants benefit from monitoring funding rates alongside positioning data, as significant divergences can signal impending adjustments.

Exchange-specific risk factors also merit attention, as platform issues or liquidity constraints can affect positions differently across venues. The current data shows sufficient liquidity across all three major exchanges, but traders should remain aware of potential platform-specific events that could impact positions. Regulatory developments continue evolving across jurisdictions, potentially affecting derivatives availability or leverage limits that would influence future positioning patterns and market structure.

Comparative Analysis with Traditional Markets

Bitcoin’s derivatives market maturation shows increasing sophistication through metrics like long-short ratios that parallel traditional finance instruments. Equity index futures and commodity derivatives markets have utilized similar positioning data for decades to gauge institutional sentiment and identify potential turning points. The cryptocurrency derivatives ecosystem now provides comparable analytics, though with unique characteristics including 24/7 trading, global accessibility, and different participant demographics that create distinct behavioral patterns.

Traditional market analysts observe that crypto derivatives data often shows faster sentiment shifts than established markets, reflecting the asset class’s volatility and information processing speed. However, the current balanced ratios demonstrate growing maturity as participants incorporate more sophisticated analysis rather than reacting impulsively to short-term price movements. This development suggests institutional adoption and professional trading desk participation continues increasing, potentially leading to more stable long-term market structure.

Cross-market correlations provide additional context, as Bitcoin’s positioning sometimes reflects broader risk sentiment across traditional asset classes. Current global macroeconomic conditions involving interest rate policies, inflation concerns, and geopolitical tensions influence all risk assets, with crypto derivatives positioning potentially capturing some of these cross-asset sentiment flows. Analysts monitor whether crypto derivatives begin leading or lagging traditional market sentiment indicators as institutional participation deepens.

Conclusion

The BTC perpetual futures long-short ratio analysis reveals a cryptocurrency derivatives market in careful equilibrium, with nearly balanced positioning across major exchanges suggesting neither bulls nor bears have established decisive control. The subtle variations between Binance, OKX, and Bybit provide valuable insights into platform-specific trader behavior and potential regional sentiment differences. This balanced positioning typically indicates consolidation periods where traders await clearer directional signals before committing substantial capital, often preceding significant price movements once new information enters the market. Market participants should continue monitoring these ratios alongside other derivatives metrics, technical patterns, and fundamental developments to identify potential trend changes as the cryptocurrency ecosystem evolves through 2025’s dynamic market conditions.

FAQs

Q1: What does the BTC perpetual futures long-short ratio measure?

The ratio measures the percentage of open long positions versus short positions in Bitcoin perpetual futures contracts, serving as a sentiment indicator showing whether traders collectively expect price increases or decreases.

Q2: Why do long-short ratios differ between cryptocurrency exchanges?

Ratios vary because each exchange has different user demographics, geographic concentrations, available leverage options, and trading interfaces that influence how participants position themselves in response to market conditions.

Q3: How should traders interpret balanced long-short ratios like the current 49.49%/50.51% split?

Balanced ratios typically indicate market consolidation and uncertainty, suggesting neither bulls nor bears have strong conviction. This often precedes significant price movements once new information breaks the equilibrium.

Q4: What other metrics should traders analyze alongside long-short ratios?

Traders should examine funding rates, open interest changes, trading volume patterns, liquidation levels, and technical analysis alongside long-short ratios for comprehensive market understanding.

Q5: How do perpetual futures differ from traditional futures contracts?

Perpetual futures lack expiration dates and use funding rate mechanisms to maintain prices near spot levels, while traditional futures have set expiration dates and settle based on predetermined settlement procedures.