WLFI Governance Vote Sparks Outrage Amid Restricted Voting and Controversial Profit Allocation

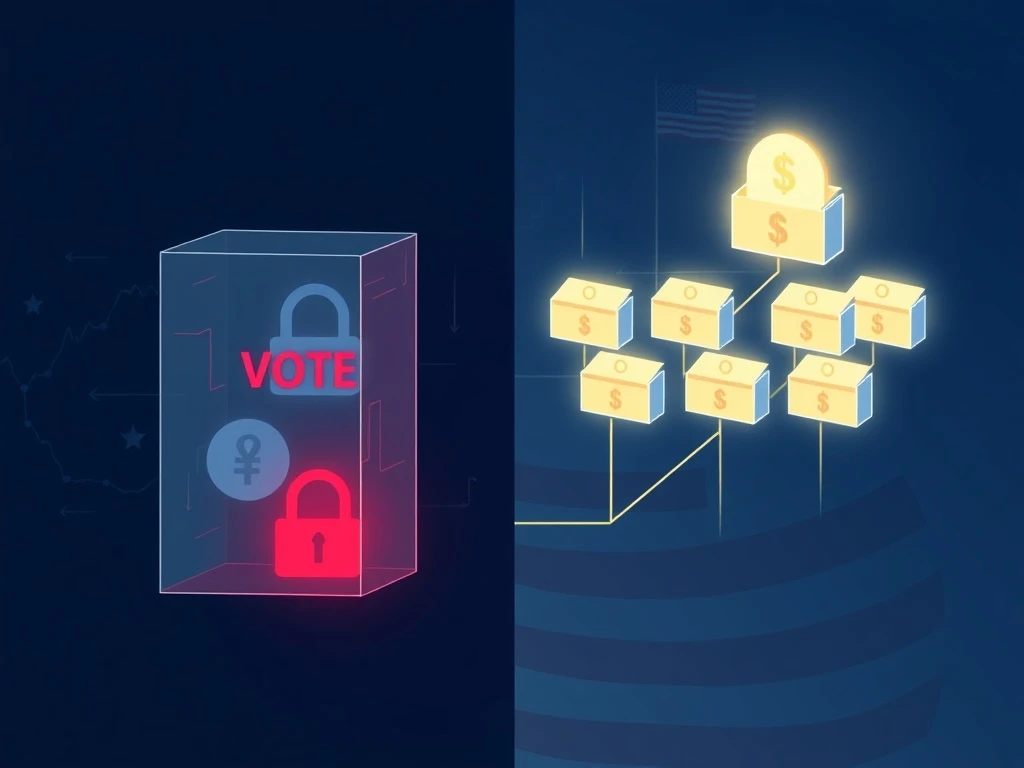

World Liberty Financial (WLFI) ignited significant controversy this week after passing a crucial governance proposal for its USD1 stablecoin while restricting voting access for holders of locked tokens. This contentious WLFI governance vote has raised fundamental questions about decentralization, token holder rights, and corporate governance within the rapidly evolving stablecoin sector. According to reports from Crypto News Insights, the project’s top nine addresses, all associated with the WLFI team, exercised approximately 59% of the total voting power during the decisive ballot. Furthermore, the project’s documentation reveals that 75% of net profits will flow to an entity linked to the Trump family, with the remaining 25% directed to an entity connected to the Witkoff family, while token holders receive no protocol revenue.

WLFI Governance Vote Details and Voting Restrictions

The recent WLFI governance vote centered on a proposal directly affecting the operational framework of its USD1 stablecoin. However, the voting process immediately drew scrutiny due to its restrictive parameters. Specifically, holders of locked WLFI tokens found themselves unable to participate in the democratic process. This restriction effectively silenced a substantial portion of the token holder base. Consequently, the voting power concentrated dramatically among a small group of addresses. Data from the blockchain reveals that just nine wallets, all publicly associated with the WLFI development team and early backers, controlled nearly 60% of the voting influence. This concentration of power contradicts the decentralized ethos championed by many blockchain projects. Moreover, it establishes a precedent where key decisions rest with insiders rather than the broader community.

Governance mechanisms represent the cornerstone of decentralized finance (DeFi). They allow token holders to steer a project’s direction. Typically, projects employ a one-token, one-vote model or a delegated system. The WLFI approach, however, introduced a significant barrier. The team cited technical and security rationale for locking certain tokens, perhaps for vesting schedules or staking requirements. Nevertheless, the timing of the vote, which occurred while these tokens remained inaccessible, has fueled accusations of manipulation. Industry analysts note that this situation creates a clear conflict of interest. The team could theoretically pass proposals favorable to themselves without meaningful opposition from the locked token cohort. This scenario undermines trust and could potentially affect the stablecoin’s adoption by risk-averse institutions.

Comparative Analysis of Stablecoin Governance Models

To understand the WLFI controversy, examining other major stablecoin governance frameworks proves instructive. The table below contrasts key features:

| Stablecoin Project | Governance Model | Voter Eligibility | Profit Distribution |

|---|---|---|---|

| WLFI (USD1) | Token-based with restrictions | Excludes locked token holders | 75% Trump entity, 25% Witkoff entity, 0% to token holders |

| Maker (DAI) | Decentralized (MKR token holders) | All MKR holders can vote | Fees accrue to protocol surplus, used for stability and buybacks |

| Circle (USDC) | Centralized corporate governance | No public voting | Profits to Circle and Coinbase shareholders |

| Frax Finance (FRAX) | Hybrid (veFXS model) | Locking FXS grants boosted voting power | Protocol revenue distributed to veFXS lockers |

This comparison highlights the unique and contentious structure of the WLFI model. Unlike MakerDAO’s community-driven approach or Frax’s incentive-aligned locking system, WLFI’s governance actively excludes a segment of its holders. Furthermore, its profit allocation model diverges sharply from standard DeFi practice, where revenue often flows back to token holders or the protocol treasury.

Profit Allocation and Whitepaper Provisions

The WLFI whitepaper contains provisions that have amplified the controversy surrounding the governance vote. A critical section explicitly states that holders of the WLFI token possess no entitlement to protocol revenue. This stands in stark contrast to numerous DeFi projects where governance tokens also function as value-accrual assets. Instead, the document allocates 100% of net profits to two private entities. A dominant 75% share is designated for an organization linked to the Trump family. The remaining 25% is allocated to an entity connected to the Witkoff family, known for real estate development. This structure essentially positions the WLFI token as a pure governance instrument with no claim on the financial success of the USD1 stablecoin.

This profit allocation model raises several important questions about long-term incentives. Why would token holders actively participate in governance if they do not share in the project’s economic upside? Experts suggest this could lead to voter apathy, further cementing control with the initial nine addresses. Additionally, the prominent political connection introduces a layer of regulatory and reputational scrutiny. Stablecoins already operate under intense regulatory observation globally. Tethering a stablecoin’s profitability directly to figures with significant political profiles may attract additional attention from lawmakers and financial watchdogs. The WLFI team has previously applied for a banking license to manage the issuance, custody, and exchange of USD1. Regulators reviewing this application will undoubtedly examine these governance and profit-sharing structures with extreme care.

The Banking License Ambition and Regulatory Context

WLFI’s pursuit of a banking license represents a strategic move toward legitimacy and integration with traditional finance. A license would allow the entity to legally manage fiat reserves, conduct custody services, and operate exchanges. However, the ongoing governance controversy complicates this ambition. Banking regulators prioritize stability, transparency, and fair treatment of all stakeholders. A governance model that excludes locked token holders and concentrates power might be viewed as insufficiently robust or potentially unfair. Furthermore, the opaque nature of the profit allocation to private entities, rather than to a transparent corporate or foundation structure, could raise “know your customer” (KYC) and anti-money laundering (AML) concerns. The regulatory path for a politically-linked, controversially-governed stablecoin will likely be arduous and could influence the entire project’s viability.

Broader Implications for DeFi and Stablecoin Governance

The WLFI governance vote controversy extends beyond a single project. It serves as a critical case study for the entire decentralized finance ecosystem. First, it tests the boundaries of what participants will accept as “decentralized” governance. The incident highlights the tension between founder control and community ownership, a recurring theme in crypto. Second, it underscores the importance of clear, fair, and immutable governance rules established before token distribution. Changing rules mid-stream, or holding votes under restrictive conditions, erodes trust—a fragile commodity in finance. Third, the situation demonstrates how real-world political and business connections are increasingly intersecting with blockchain protocols, creating new complexities.

The response from the broader crypto community will be telling. Will exchanges reconsider listing the WLFI token or the USD1 stablecoin? Will decentralized autonomous organizations (DAOs) cite this as an example of poor governance to avoid? The answers to these questions will shape standards for years to come. Furthermore, the event provides ammunition for critics who argue that many “decentralized” projects are, in reality, highly centralized. This could influence upcoming regulatory frameworks in the United States, European Union, and other major jurisdictions seeking to govern digital assets. Lawmakers may point to cases like WLFI to justify stricter rules on governance transparency and token holder rights.

Conclusion

The WLFI governance vote has unveiled significant challenges within the project’s structure, centering on restricted voting access and a highly unconventional profit allocation model. By excluding locked token holders and concentrating 59% of voting power among nine team-associated addresses, the vote has sparked a vital debate about decentralization in practice. Coupled with a whitepaper that directs all net profits to entities linked to the Trump and Witkoff families while offering token holders no revenue share, WLFI has positioned itself at the center of a controversy with far-reaching implications. As the project continues its pursuit of a banking license for the USD1 stablecoin, these governance decisions will face intense scrutiny from both the crypto community and financial regulators. The outcome will serve as a pivotal reference point for the evolution of governance, transparency, and accountability in the stablecoin sector.

FAQs

Q1: What was the main controversy in the WLFI governance vote?

The primary controversy stems from the fact that holders of locked WLFI tokens were restricted from voting, while the top nine team-associated addresses controlled approximately 59% of the voting power, leading to accusations of centralized control and an unfair process.

Q2: How does WLFI’s profit distribution work?

According to its whitepaper, WLFI allocates 75% of net profits to an entity linked to the Trump family and 25% to an entity connected to the Witkoff family. Token holders are explicitly not entitled to any share of the protocol revenue.

Q3: What is the USD1 stablecoin?

USD1 is the stablecoin issued by World Liberty Financial (WLFI). It is designed to maintain a 1:1 peg with the US dollar. The project has applied for a banking license to manage its issuance, custody, and exchange.

Q4: Why is the voting restriction for locked tokens significant?

This restriction is significant because it disenfranchises a portion of the token holder base, potentially allowing insiders to pass proposals without the full consent of the community. This contradicts the decentralized governance principles that many blockchain projects advocate.

Q5: What are the potential regulatory implications for WLFI?

WLFI’s governance model and its political profit allocations could attract heightened scrutiny from financial regulators, especially regarding its banking license application. Regulators may examine the structure for fairness, transparency, and compliance with KYC/AML standards.