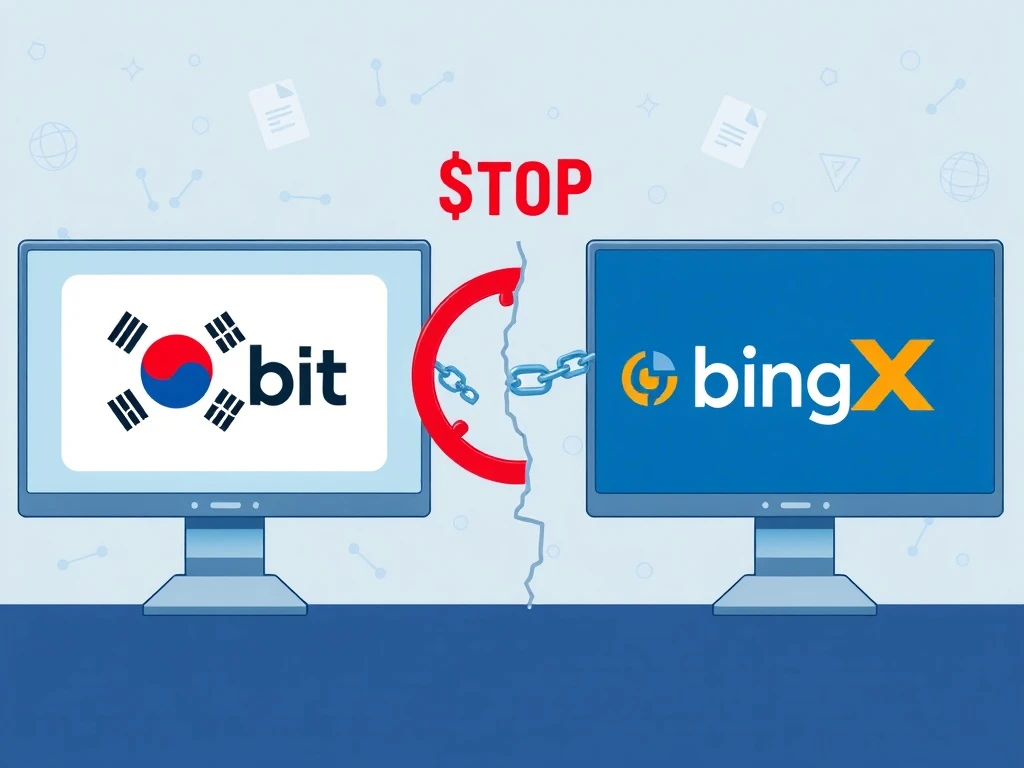

Upbit Halts BingX Transactions: Critical Compliance Move Shakes Crypto Markets

SEOUL, South Korea – March 2025 – In a significant regulatory compliance move, Upbit, South Korea’s largest cryptocurrency exchange, has announced the immediate suspension of all digital asset deposits and withdrawals with global trading platform BingX. This decisive action follows direct guidance from South Korean financial authorities and represents a critical development in the ongoing evolution of cryptocurrency exchange oversight. Consequently, the decision removes BingX from Upbit’s verified exchange list, fundamentally altering how traders move assets between these platforms.

Upbit BingX Suspension: Regulatory Compliance Takes Priority

Upbit officially confirmed the suspension through a public notice on its website and mobile application. The exchange stated clearly that the decision resulted from regulatory authority guidance regarding account holder identification verification standards. Specifically, the Financial Services Commission (FSC) and the Financial Intelligence Unit (FIU) provided updated compliance requirements that BingX apparently failed to meet. Therefore, Upbit removed BingX from its whitelist of verified external exchanges, effectively severing the direct transaction pathway between the two platforms.

This suspension impacts multiple cryptocurrency assets including Bitcoin, Ethereum, and various altcoins that traders previously moved between exchanges. Upbit emphasized that existing deposits from BingX made before the cutoff date will remain accessible in user accounts. However, the exchange strongly advised users to complete any pending transfers immediately before the suspension takes full effect. Meanwhile, BingX has acknowledged the situation through its official communication channels, stating it is working to address the compliance concerns raised by South Korean regulators.

South Korea’s Evolving Cryptocurrency Regulatory Landscape

South Korea has implemented increasingly stringent cryptocurrency regulations since the passage of the Virtual Asset User Protection Act in 2023. The Financial Services Commission now requires all exchanges operating in South Korea to maintain rigorous know-your-customer (KYC) and anti-money laundering (AML) protocols. Furthermore, exchanges must verify the compliance standards of any external platforms they connect with for deposits and withdrawals. This regulatory framework aims to prevent illicit financial activities and protect investors from potential fraud.

The specific compliance issues surrounding BingX likely relate to identification verification procedures. South Korean regulations mandate that exchanges verify the real-name accounts of all users through partnerships with local banks. Additionally, exchanges must maintain transaction monitoring systems that flag suspicious activities. Global exchanges like BingX sometimes struggle to meet these specific national requirements, particularly when their user verification standards differ from South Korea’s stringent protocols.

Expert Analysis: The Compliance Imperative

Financial regulation experts note that Upbit’s decision reflects broader trends in cryptocurrency oversight. “South Korea has established itself as a global leader in cryptocurrency regulation,” explains Dr. Min-ji Park, a fintech regulation researcher at Seoul National University. “The authorities are taking a proactive approach to ensure exchanges maintain the highest compliance standards. This suspension demonstrates that regulatory guidance directly impacts operational decisions, even for major exchanges like Upbit.”

Industry analysts point to several previous instances where South Korean exchanges suspended transactions with non-compliant platforms. In 2024, both Bithumb and Korbit implemented similar restrictions with other international exchanges. These actions consistently followed regulatory reviews that identified compliance deficiencies. The pattern suggests that South Korean authorities are systematically evaluating all connected exchanges and mandating suspensions where verification standards prove inadequate.

Immediate Impact on Cryptocurrency Traders and Markets

The suspension creates immediate practical challenges for traders who regularly move assets between Upbit and BingX. Users must now employ alternative methods for transferring cryptocurrencies, potentially involving additional steps and transaction fees. Some traders utilize multiple exchanges to access different trading pairs or take advantage of arbitrage opportunities. Consequently, the severed connection between these platforms may temporarily disrupt certain trading strategies until users establish new workflows.

Market data indicates minimal immediate price impact on major cryptocurrencies following the announcement. However, analysts monitor potential secondary effects on trading volumes and liquidity distribution. The suspension could influence how assets flow between South Korean and global markets, particularly for altcoins with significant trading activity on both platforms. Traders should remain aware of potential delays when moving assets through alternative channels during the adjustment period.

Key implications for users include:

- No new deposits from BingX to Upbit accounts

- No withdrawals from Upbit to BingX wallets

- Existing deposits remain accessible for trading

- Alternative transfer methods require additional verification

- Potential delays in asset movement between exchanges

Broader Implications for Global Cryptocurrency Exchanges

This development signals increasing regulatory scrutiny of cross-border cryptocurrency transactions. Global exchanges seeking to connect with South Korean platforms must now demonstrate compliance with specific national standards. The verification process involves multiple dimensions including user identification procedures, transaction monitoring capabilities, and reporting protocols. Exchanges that cannot meet these requirements risk losing access to South Korea’s substantial cryptocurrency market through direct connections with local platforms.

Other major cryptocurrency markets are observing South Korea’s regulatory approach with interest. Japan and Singapore have implemented similar but distinct regulatory frameworks for digital asset exchanges. The European Union’s Markets in Crypto-Assets (MiCA) regulations will establish comprehensive standards across member states. Consequently, global exchanges increasingly face a complex patchwork of national regulations that require tailored compliance approaches for each jurisdiction where they operate or connect with local platforms.

Historical Context: South Korea’s Regulatory Evolution

South Korea’s cryptocurrency regulation has evolved significantly since the initial boom of 2017. The government implemented real-name account requirements in 2018, forcing exchanges to partner with banks for user verification. Subsequent regulations addressed specific concerns including market manipulation, tax compliance, and investor protection. The Virtual Asset User Protection Act of 2023 established comprehensive legal frameworks that defined digital assets, set exchange obligations, and created investor protection mechanisms.

This regulatory evolution reflects South Korea’s balanced approach to cryptocurrency innovation and risk management. Authorities recognize the technological and economic potential of blockchain technology while implementing safeguards against its misuse. The Financial Services Commission regularly updates guidance based on market developments and emerging risks. This proactive regulatory stance has positioned South Korea as an influential voice in global cryptocurrency policy discussions while maintaining one of the world’s most active retail trading markets.

Technical Implementation and User Guidance

Upbit has implemented technical restrictions that prevent transaction initiation between the two platforms. The exchange’s interface now displays warning messages when users attempt to generate deposit addresses for BingX transfers. Similarly, withdrawal requests to BingX wallet addresses trigger automatic rejection by Upbit’s systems. These technical measures ensure compliance with the regulatory guidance while minimizing user confusion about transaction status.

Affected users should consider several alternative methods for moving assets between exchanges. Many traders utilize intermediary wallets or alternative compliant exchanges that maintain connections with both platforms. However, each additional step potentially increases transaction costs and processing time. Users must also ensure proper address verification at each transfer point to avoid asset loss. Upbit recommends consulting their official support channels for specific guidance based on individual circumstances and asset types.

Recommended steps for affected traders:

- Complete any pending transfers immediately

- Verify alternative exchange compliance status

- Use intermediary wallets with caution

- Double-check all wallet addresses before transfers

- Monitor transaction confirmations carefully

Future Outlook and Potential Resolutions

The suspension duration remains uncertain and depends on BingX’s ability to address the compliance concerns identified by South Korean regulators. Historical precedents suggest that similar suspensions have lasted from several weeks to multiple months. Resolution typically requires the non-compliant exchange to implement specific verification enhancements and undergo regulatory review. Once authorities confirm satisfactory improvements, Upbit could potentially reinstate the connection following another compliance assessment.

Industry observers note that global exchanges increasingly prioritize regulatory compliance as cryptocurrency markets mature. Many platforms are investing in enhanced verification systems and compliance teams to meet diverse international standards. This trend suggests that while temporary suspensions may occur, the long-term direction points toward greater standardization and interoperability between compliant exchanges across different jurisdictions.

Conclusion

Upbit’s suspension of BingX transactions represents a significant compliance action within South Korea’s evolving cryptocurrency regulatory framework. The decision directly results from regulatory guidance regarding account holder identification verification standards. This development impacts traders moving assets between the platforms while highlighting broader trends in cryptocurrency exchange oversight. Furthermore, the situation underscores the increasing importance of regulatory compliance as digital asset markets mature globally. The Upbit BingX suspension serves as a reminder that exchanges must prioritize verification standards to maintain connectivity in regulated markets.

FAQs

Q1: Why did Upbit suspend transactions with BingX?

Upbit suspended deposits and withdrawals with BingX following regulatory guidance from South Korean financial authorities. The decision resulted from compliance concerns regarding account holder identification verification standards.

Q2: Can I still access my existing deposits from BingX on Upbit?

Yes, existing deposits from BingX made before the suspension date remain accessible in your Upbit account. However, you cannot make new deposits from BingX or withdraw assets from Upbit to BingX.

Q3: How long will the suspension last?

The duration remains uncertain and depends on BingX’s ability to address the compliance concerns. Similar suspensions have lasted from several weeks to multiple months based on regulatory review timelines.

Q4: What alternatives exist for moving assets between exchanges?

Traders can use intermediary wallets or alternative compliant exchanges that maintain connections with both platforms. However, each additional step may increase transaction costs and processing time.

Q5: Does this affect all cryptocurrencies or specific assets?

The suspension applies to all digital asset deposits and withdrawals between Upbit and BingX. This includes Bitcoin, Ethereum, and various altcoins previously transferable between the platforms.