Sui’s $500M Stablecoin Surge: How Crypto Treasuries Now Dominate Protocol Operations

January 27, 2026 – The Sui blockchain ecosystem has reached a significant milestone with its stablecoin market capitalization surpassing $500 million, according to on-chain data from late January 2026. This development signals a fundamental transformation in how cryptocurrency treasuries operate within blockchain networks. Rather than maintaining passive balance sheets, institutional holders now actively participate in protocol governance, liquidity provision, and yield generation. Consequently, this shift represents a maturation of crypto treasury management that could redefine institutional participation across decentralized ecosystems.

Sui’s Treasury Transformation: From Passive Holding to Active Protocol Management

Crypto treasury management has evolved dramatically since the early 2020s. Initially, companies like MicroStrategy and Metaplanet treated digital assets as static reserves, similar to gold holdings. However, the Sui ecosystem demonstrates a completely different approach today. Foundation-controlled wallets currently maintain the largest SUI positions, with treasury wallets tracked on blockchain explorers holding approximately 108 million SUI tokens. This represents roughly 3% of the circulating supply, indicating concentrated but strategically deployed ownership.

On-chain analytics reveal increasing holder concentration among top wallets throughout 2025 and early 2026. This concentration enables more coordinated protocol participation. Treasury entities now engage in multiple active roles:

- Governance participation: Voting on protocol upgrades and parameter changes

- Liquidity provision: Deploying capital across decentralized exchanges

- Yield generation: Earning returns through staking and lending protocols

- Ecosystem development: Funding grants and incentive programs

This active participation contrasts sharply with traditional treasury approaches that focused primarily on asset appreciation. The transition reflects broader institutional recognition that protocol influence often generates greater long-term value than passive holding alone.

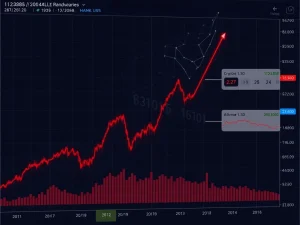

SUI Token Circulation: Controlled Expansion Despite Ongoing Unlocks

Sui’s token distribution follows a carefully managed schedule that prevents market disruption. As of late January 2026, the circulating supply reached approximately 3.79 billion SUI tokens. This represents 38% of the maximum 10 billion supply. The controlled unlock schedule follows a predefined vesting curve without abnormal distribution spikes. Consequently, supply growth has remained absorbed by strategic holders rather than flooding public markets.

The Sui Foundation and Mysten Labs retain substantial allocations for ecosystem development. These allocations support several long-term initiatives:

| Allocation Purpose | Percentage of Total Supply | Primary Function |

|---|---|---|

| Ecosystem Development | ~20% | Grants, partnerships, and infrastructure |

| Staking Incentives | ~10% | Network security and participation rewards |

| Team & Early Contributors | ~20% | Vested allocations with multi-year schedules |

| Community Reserve | ~12% | Future community programs and initiatives |

This distribution strategy mirrors Solana’s ecosystem bootstrapping approach more than Bitcoin’s pure scarcity model. According to CoinGecko data, institutional entities now hold over 110 million SUI tokens. This reinforces growth-focused, yield-enabled token usage rather than speculative trading patterns.

The Solana Comparison: Ecosystem Development vs. Pure Scarcity

Sui’s treasury strategy shares important similarities with Solana’s successful ecosystem development. Both networks prioritize liquidity depth and developer engagement over artificial scarcity. However, Sui implements more structured treasury deployment mechanisms. The network’s Move programming language enables sophisticated financial operations that traditional blockchains cannot easily replicate. This technical foundation supports complex treasury management strategies that generate sustainable ecosystem growth.

Stablecoin Growth and Active Treasury Convergence

The $500 million stablecoin market cap on Sui represents more than just liquidity growth. It reflects structural alignment between stablecoin adoption and active treasury management. USDC dominates this market with over 70% share, according to DeFiLlama data from January 2026. This stablecoin liquidity powers multiple DeFi applications including lending protocols, decentralized exchanges, and yield-generating strategies.

Treasury-linked entities increasingly deploy capital through stablecoins rather than native tokens. This approach provides several strategic advantages:

- Reduced sell pressure: Avoiding spot market exits that could depress token prices

- Fee generation: Earning transaction fees through liquidity provision

- Protocol influence: Shaping DeFi ecosystem development through capital allocation

- Risk management: Maintaining stable value positions while participating in governance

This convergence signals a broader transition from simple asset custody toward sophisticated protocol-level execution. Treasury managers now operate within the Sui economy rather than merely observing it from the sidelines.

Yield Dynamics: The Engine Driving Treasury Participation

Sui’s DeFi ecosystem offers compelling yield opportunities that attract institutional capital. In late January 2026, yields range from 3-10% on conservative strategies to over 50% on incentive-heavy liquidity pools. This yield dispersion reflects both deeper liquidity and improved capital efficiency across the network.

Major protocols demonstrate this yield potential clearly:

- NAVI Protocol: 5-7% APY on USDC lending positions

- Suilend: Competitive lending rates with flexible terms

- Cetus DEX: Over 70% APY through trading fee distribution

- FlowX Finance: Innovative yield aggregation strategies

These yield opportunities serve multiple purposes for treasury managers. First, they generate returns that traditional fixed-income markets cannot match. Second, they deepen liquidity across Sui’s DeFi ecosystem. Third, they reinforce the network’s position as an active, yield-driven environment for institutional capital.

The Institutional Yield Calculus: Risk-Adjusted Returns in DeFi

Institutional treasury managers evaluate DeFi yields through sophisticated risk frameworks. They consider multiple factors including smart contract security, counterparty risk, and market volatility. Sui’s Move programming language provides inherent security advantages for these calculations. The language’s resource-oriented design prevents common vulnerabilities like reentrancy attacks and overflow errors. Consequently, institutional participants can pursue higher yields with greater confidence in the underlying protocol security.

Governance Implications: From Token Holders to Protocol Operators

The most significant transformation involves governance participation. Treasury entities now exercise voting power proportional to their holdings. This influence extends across multiple protocol dimensions:

- Parameter adjustments: Modifying interest rates, collateral factors, and fee structures

- Protocol upgrades: Approving new features and security improvements

- Treasury allocations: Directing ecosystem development funds

- Partnership decisions: Shaping strategic ecosystem relationships

This governance participation creates a virtuous cycle. As treasuries become more active, they gain greater influence over protocol development. This influence enables them to shape ecosystems toward their strategic objectives. The result is more aligned, sustainable growth that benefits all network participants.

Conclusion

Sui’s $500 million stablecoin milestone represents far more than simple metric growth. It signals a fundamental transformation in how cryptocurrency treasuries interact with blockchain protocols. The transition from passive balance sheets to active protocol operators reflects institutional maturity within the digital asset space. Treasury managers now deploy capital strategically through governance participation, liquidity provision, and yield generation. This active management approach creates sustainable ecosystem growth while avoiding disruptive market exits. As stablecoin adoption continues expanding, treasury influence will likely increase across all major blockchain networks. The Sui ecosystem provides a compelling case study for this emerging paradigm of active treasury management in decentralized finance.

FAQs

Q1: What does Sui’s $500 million stablecoin market cap indicate about treasury management?

The milestone demonstrates that crypto treasuries have evolved from passive asset holders to active protocol participants. They now deploy capital through governance, liquidity provision, and yield generation rather than simply holding tokens for appreciation.

Q2: How does SUI token circulation remain stable despite ongoing unlocks?

Sui implements a carefully managed vesting schedule that prevents supply shocks. The circulating supply reached 3.79 billion tokens (38% of maximum) by January 2026, with allocations locked for ecosystem development, staking incentives, and long-term growth initiatives.

Q3: What advantages do stablecoins provide for treasury operations?

Stablecoins enable treasury managers to participate in DeFi ecosystems without creating sell pressure on native tokens. They can provide liquidity, generate fees, and influence protocol development while maintaining stable value positions.

Q4: How do yield opportunities on Sui compare to traditional investments?

Sui’s DeFi ecosystem offers yields ranging from 3-10% on conservative strategies to over 50% on incentive-heavy pools. These returns significantly exceed traditional fixed-income markets while providing protocol participation benefits.

Q5: What technical features make Sui suitable for sophisticated treasury management?

The Move programming language provides inherent security advantages that reduce smart contract risks. This enables complex financial operations and gives institutional participants greater confidence in deploying capital across Sui’s DeFi ecosystem.