Federal Reserve Signals Cautious Optimism: Powell Highlights Emerging Employment Stability

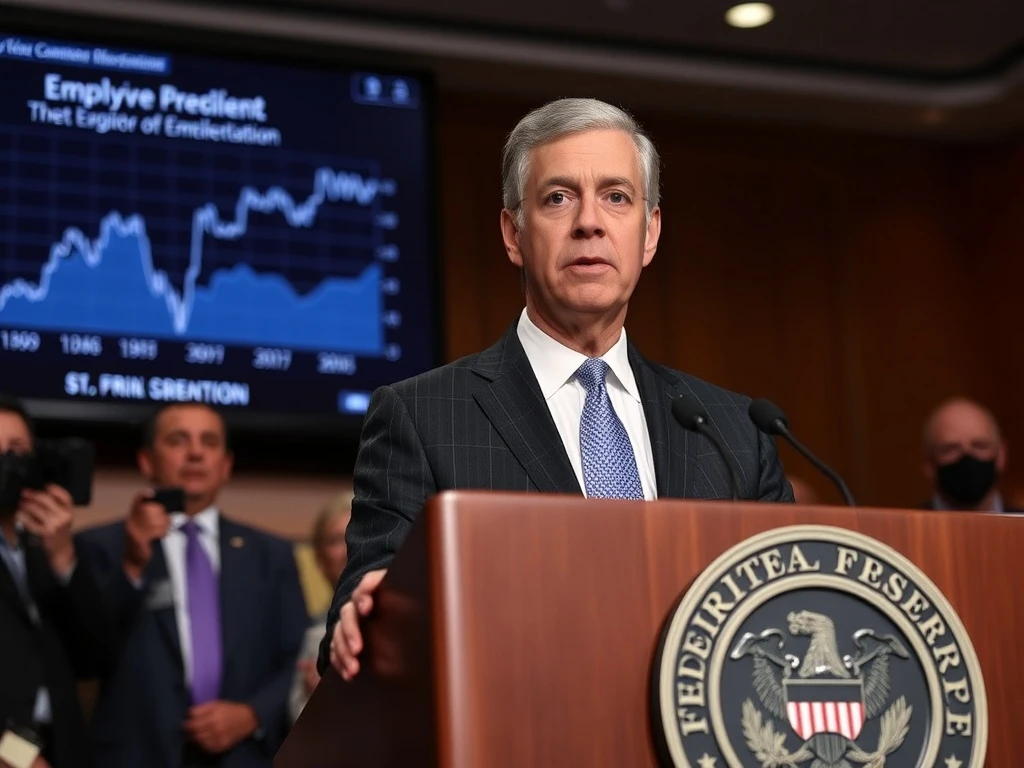

WASHINGTON, D.C. — Federal Reserve Chair Jerome Powell delivered measured optimism about the labor market’s trajectory in March 2025, revealing that policymakers removed specific cautionary language about employment risks from their latest statement. This subtle but significant shift indicates the central bank perceives initial signs of stabilization following years of post-pandemic volatility. However, Powell immediately tempered this observation with a clear warning against over-interpreting these early signals, emphasizing the complex and data-dependent nature of current monetary policy decisions.

Federal Reserve Adjusts Language on Employment Risks

The Federal Open Market Committee’s March 2025 policy statement underwent a critical revision. Officials explicitly removed previous phrasing that highlighted “downside risks” to the employment sector. This technical change represents a deliberate communication shift from the world’s most influential central bank. Historically, the Fed maintains such language during periods of perceived labor market fragility or economic uncertainty. Consequently, its removal signals a collective, albeit preliminary, judgment that the worst employment pressures have potentially subsided.

During his subsequent press conference, Chair Powell provided the rationale. He stated the committee observed “some signs of stability” across various labor market indicators. These indicators likely include jobless claims, hiring rates, and wage growth metrics. Powell consistently stressed, however, that this does not constitute a declaration of victory. The labor market remains a primary focus for the Fed’s dual mandate, which targets maximum employment and price stability.

The Data Behind the Decision

Analysts point to several recent data points that may have informed the Fed’s nuanced stance. The February 2025 jobs report showed nonfarm payroll growth aligning with long-term trends, while the unemployment rate held steady at 4.0%. Furthermore, job openings have gradually retreated from record highs toward pre-pandemic levels, suggesting a better balance between labor supply and demand. Wage growth, a key inflation input, has also shown signs of moderating. This combination of factors provides a factual basis for the committee’s adjusted outlook, though Powell warned the data remains “noisy” and subject to revision.

Understanding Powell’s Cautious Tone on Labor Markets

Jerome Powell’s immediate caution following the statement revision is a hallmark of his communication style. It serves multiple strategic purposes. First, it prevents financial markets from prematurely pricing in a more aggressive policy pivot, which could loosen financial conditions counter to the Fed’s goals. Second, it acknowledges the inherent lag in economic data; today’s stability does not guarantee tomorrow’s performance. Finally, it maintains optionality for the committee, allowing future meetings to respond to new information without appearing inconsistent.

This approach reflects lessons from recent economic history. For instance, in 2021, policymakers initially described inflation as “transitory,” a characterization they later walked back as price pressures proved more persistent. The Fed now prioritizes clear, evidence-based, and humble communication to manage public and market expectations effectively. Powell’s balanced message—acknowledging progress while underscoring uncertainty—exemplifies this refined strategy.

Key reasons for the Fed’s caution include:

- Data Revisions: Initial employment reports are often revised significantly in subsequent months.

- Geopolitical Risks: Global events can swiftly disrupt domestic labor markets.

- Sectoral Imbalances: Stability in aggregate may mask weakness in specific industries.

- Productivity Puzzles: The relationship between employment, wages, and output remains complex.

Historical Context of Fed Policy and Employment Language

The evolution of the Fed’s statement language provides a narrative of its economic assessment. During the 2020 pandemic crisis, the committee emphasized “considerable risks” to the employment outlook. As recovery took hold in 2022-2023, the language softened but retained references to “uncertainty.” The complete removal of the “downside risks” phrase in 2025, therefore, marks a notable milestone. It suggests the committee believes the probability of a sudden, severe labor market downturn has diminished sufficiently to alter its formal guidance.

This decision does not occur in a vacuum. It follows nearly two years of restrictive monetary policy aimed at cooling inflation, which inherently raised recession risks. The Fed’s current challenge is navigating a “soft landing”—reducing inflation without triggering significant job losses. Powell’s comments indicate cautious confidence that this narrow path remains achievable, but he refuses to declare success prematurely. Other central banks, like the European Central Bank and Bank of England, are watching closely, as their policy cycles often correlate with the Fed’s.

Expert Analysis and Market Implications

Economists from major financial institutions have weighed in on the policy shift. Dr. Michelle Chen, Chief Economist at the Brookings Institution, noted, “The language change is incremental, not revolutionary. It reflects a data-dependent Fed moving carefully from a crisis mindset to a normalization phase.” Market reactions were relatively muted, with Treasury yields and equity indices showing limited movement. This suggests investors correctly interpreted Powell’s message as one of continuity, not a pivot. The table below summarizes key labor market indicators the Fed monitors:

| Indicator | Recent Trend (2025) | Fed’s Implied Assessment |

|---|---|---|

| Unemployment Rate | Stable at ~4.0% | Consistent with maximum employment |

| Nonfarm Payrolls | Moderate monthly gains | Growth is sustainable, not overheating |

| Labor Force Participation | Gradual recovery | Positive but incomplete |

| Wage Growth (Avg. Hourly Earnings) | Moderating from peaks | Reducing inflationary pressures |

| Job Openings (JOLTS) | Declining from highs | Moving toward better balance |

The Path Forward for Monetary Policy in 2025

The acknowledgment of employment stability directly influences the Fed’s policy trajectory. With the labor market showing resilience, the committee can theoretically maintain a focus on returning inflation to its 2% target. However, Powell avoided directly linking this statement change to future interest rate decisions. The Fed’s next moves will depend on the totality of incoming data, including inflation reports, consumer spending, and global economic conditions.

Most analysts expect the Fed to proceed with caution. The central bank will likely keep policy restrictive until it sees convincing evidence that inflation is sustainably returning to target. Any future rate cuts will be gradual and carefully communicated. Powell’s management of expectations is therefore crucial. By neither overhyping the good news nor ignoring it, he seeks to guide the economy toward a stable equilibrium without triggering destabilizing market swings.

Conclusion

Federal Reserve Chair Jerome Powell’s latest commentary reveals a central bank in a delicate transition. The removal of language citing downside risks to employment marks a recognition of emerging labor market stability, a positive development for the broader economy. However, Powell’s emphatic caution against over-interpretation underscores the Fed’s commitment to data-dependent, patient, and prudent policymaking. For businesses, investors, and households, the message is clear: the worst employment fears may be receding, but the path to full economic normalization remains long and requires vigilant monitoring. The Federal Reserve’s careful communication on employment stability will continue to be a critical signal for the economic outlook throughout 2025.

FAQs

Q1: What specific language did the Federal Reserve remove from its policy statement?

The Federal Open Market Committee removed previous phrasing that explicitly highlighted “downside risks” to the employment situation. This is a technical but meaningful change in its official communication.

Q2: Why is Jerome Powell cautioning against over-interpreting signs of employment stability?

Powell is emphasizing that economic data is preliminary and subject to revision. He aims to prevent financial markets from prematurely anticipating aggressive policy changes, which could undermine the Fed’s efforts to control inflation.

Q3: How does employment stability affect the Fed’s interest rate decisions?

A stable labor market gives the Federal Reserve more flexibility to focus on its inflation mandate. It reduces the immediate pressure to cut rates to support jobs, allowing policymakers to keep policy restrictive longer if needed to ensure inflation returns to 2%.

Q4: What are the main indicators the Fed watches to assess labor market health?

Key indicators include the unemployment rate, nonfarm payroll growth, labor force participation rate, wage growth (Average Hourly Earnings), and job openings data from the JOLTS report.

Q5: Does this change in language mean a recession is less likely in 2025?

While a more stable labor market reduces one major recession risk, the Fed’s statement does not guarantee avoidance of a downturn. Other factors, including consumer spending, business investment, and global events, will also determine the economic trajectory.