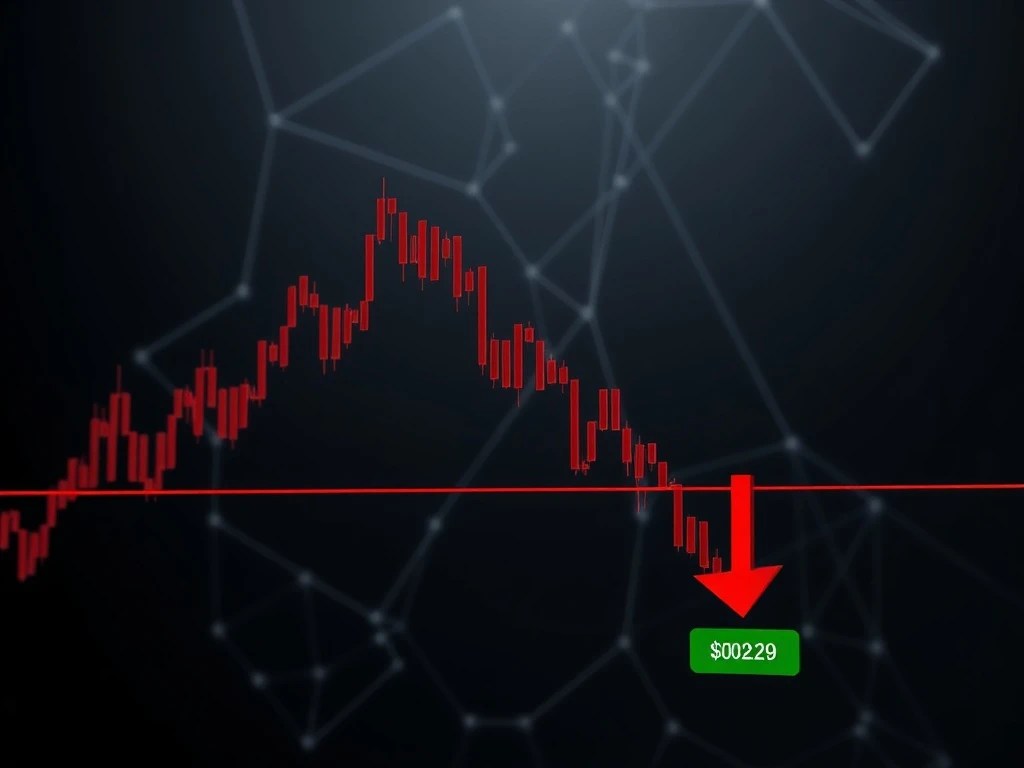

Origin Token (OGN) Faces Critical Test at $0.02229 Support as Bearish Pattern Signals Alarming Decline

Global cryptocurrency markets face renewed pressure as Origin Token (OGN) tests crucial technical support at $0.02229, with analysts identifying a concerning bearish pennant pattern that suggests potential further declines in the digital asset’s valuation. Market data from March 2025 indicates this technical formation typically precedes significant downward movements, raising questions about OGN’s near-term trajectory amid broader market uncertainty.

Origin Token OGN Technical Analysis Reveals Bearish Pennant Formation

The Origin Token has entered a critical technical phase according to market analysts. Currently trading at $0.02229, OGN approaches a support level that has held through multiple tests since late 2024. Technical chart patterns show clear consolidation within a symmetrical triangle formation, commonly known as a bearish pennant. This pattern typically develops after a sharp downward move and suggests continuation of the prevailing trend. Market technicians note the pattern’s completion could trigger additional selling pressure across cryptocurrency exchanges.

Historical data reveals similar patterns in OGN’s price history. For instance, in Q3 2023, a comparable formation preceded a 42% decline over six weeks. Current volume analysis shows decreasing trade activity during the pattern’s development, which technical analysts interpret as consolidation before potential breakout. The $0.02229 level represents more than psychological support; it aligns with the 78.6% Fibonacci retracement level from OGN’s 2024 highs, adding mathematical significance to this price point.

Cryptocurrency Market Context and Broader Implications

The Origin Token’s technical situation unfolds against a complex cryptocurrency market backdrop. Several factors contribute to current market conditions:

- Regulatory developments: Recent global cryptocurrency regulations have increased market uncertainty

- Institutional participation: Traditional financial institutions continue cautious cryptocurrency adoption

- Market correlation: OGN maintains high correlation with major cryptocurrencies like Bitcoin and Ethereum

- Platform developments: Origin Protocol’s ecosystem growth contrasts with token price performance

Comparative analysis shows OGN’s 30-day performance at -18.7%, underperforming against the broader cryptocurrency market index, which declined only 12.4% during the same period. This relative weakness suggests specific challenges for the Origin Token beyond general market conditions. The token’s trading volume has decreased approximately 34% month-over-month, indicating reduced market participation at current price levels.

Expert Technical Analysis and Market Interpretation

Financial analysts specializing in cryptocurrency markets provide detailed examination of OGN’s technical position. According to technical analysis principles established by renowned market technicians like John Bollinger and Charles Dow, the bearish pennant pattern represents a continuation signal within established downtrends. The pattern’s measured move projection, calculated from the flagpole’s height, suggests potential downside targets between $0.01650 and $0.01875 if the $0.02229 support fails.

Market data from leading cryptocurrency exchanges confirms the pattern’s validity. The 20-day moving average currently sits at $0.02415, providing dynamic resistance above current prices. Meanwhile, the Relative Strength Index (RSI) registers at 38.7, indicating neither oversold nor overbought conditions but leaning toward bearish momentum. Bollinger Band analysis shows price action testing the lower band, typically suggesting either support or breakdown potential.

Historical context reveals OGN has faced similar technical challenges previously. In November 2023, the token breached a comparable support level at $0.035, leading to a 28% decline over the following month. Current market structure shows similarities, though at different absolute price levels. The cryptocurrency’s market capitalization now stands at approximately $87 million, ranking it outside the top 200 digital assets by market value.

Fundamental Factors Influencing Origin Token Valuation

Beyond technical patterns, fundamental developments within the Origin Protocol ecosystem warrant examination. The platform continues development of its decentralized commerce infrastructure, with several partnerships announced throughout 2024. However, token utility and adoption metrics show mixed signals:

| Metric | Current Status | Year-over-Year Change |

|---|---|---|

| Active Platform Users | 42,500 | +18% |

| Transaction Volume | $3.2M monthly | -7% |

| Token Staking | 18% of circulating supply | +4% |

| Development Activity | High (GitHub commits) | +22% |

The divergence between platform development and token valuation presents an interesting market dynamic. While the Origin Protocol continues technical advancement and user growth, the OGN token faces separate market pressures. This separation highlights the complex relationship between blockchain platform utility and associated token economics in cryptocurrency markets.

Market Psychology and Trader Sentiment Analysis

Trader positioning data reveals shifting sentiment toward OGN. Futures market analysis shows increasing short interest, with the put/call ratio rising to 1.8, indicating bearish options positioning. Social media sentiment analysis across cryptocurrency forums shows neutral to negative discussion tone, with fear and uncertainty indexes elevated compared to historical averages. However, long-term holder metrics indicate continued accumulation at lower price levels, suggesting some investors view current prices as accumulation opportunities.

The $0.02229 support level represents more than technical significance. Psychologically, this price point marks a threshold where many investors entered positions throughout 2024. A breach could trigger stop-loss orders and forced liquidations, potentially accelerating downward momentum. Conversely, successful defense of this level might establish a foundation for price recovery, though technical analysts emphasize the bearish pattern suggests lower probabilities for immediate reversal.

Conclusion

Origin Token (OGN) faces a critical technical juncture at the $0.02229 support level as a bearish pennant pattern suggests potential further declines. Market analysts emphasize the importance of this technical formation within broader cryptocurrency market context. While fundamental developments within the Origin Protocol ecosystem continue positively, token valuation faces separate technical pressures. The coming trading sessions will determine whether OGN maintains crucial support or follows the bearish pattern’s typical trajectory toward lower price targets. Market participants should monitor volume confirmation of any breakout direction, as technical patterns require volume validation for reliable signals.

FAQs

Q1: What is a bearish pennant pattern in cryptocurrency trading?

A bearish pennant is a technical chart pattern characterized by a sharp decline (flagpole) followed by consolidation in a symmetrical triangle. This pattern typically signals continuation of the existing downtrend and often precedes further price declines.

Q2: Why is the $0.02229 level significant for Origin Token?

The $0.02229 price represents crucial technical support that has held through multiple tests. It aligns with Fibonacci retracement levels and serves as psychological support where many investors established positions, making it significant for both technical and market structure reasons.

Q3: How does OGN’s performance compare to broader cryptocurrency markets?

OGN has underperformed relative to broader cryptocurrency indices recently, declining 18.7% over 30 days compared to a 12.4% decline for the overall market. This suggests OGN faces specific challenges beyond general market conditions.

Q4: What fundamental factors support Origin Token’s long-term value?

Origin Protocol continues platform development with growing active users and development activity. The ecosystem expands through partnerships and platform enhancements, though these fundamental improvements haven’t prevented recent token price pressure.

Q5: What price levels might OGN reach if support breaks?

Technical analysis suggests potential downside targets between $0.01650 and $0.01875 if the $0.02229 support fails, based on measured move projections from the bearish pennant pattern’s dimensions and historical support/resistance levels.