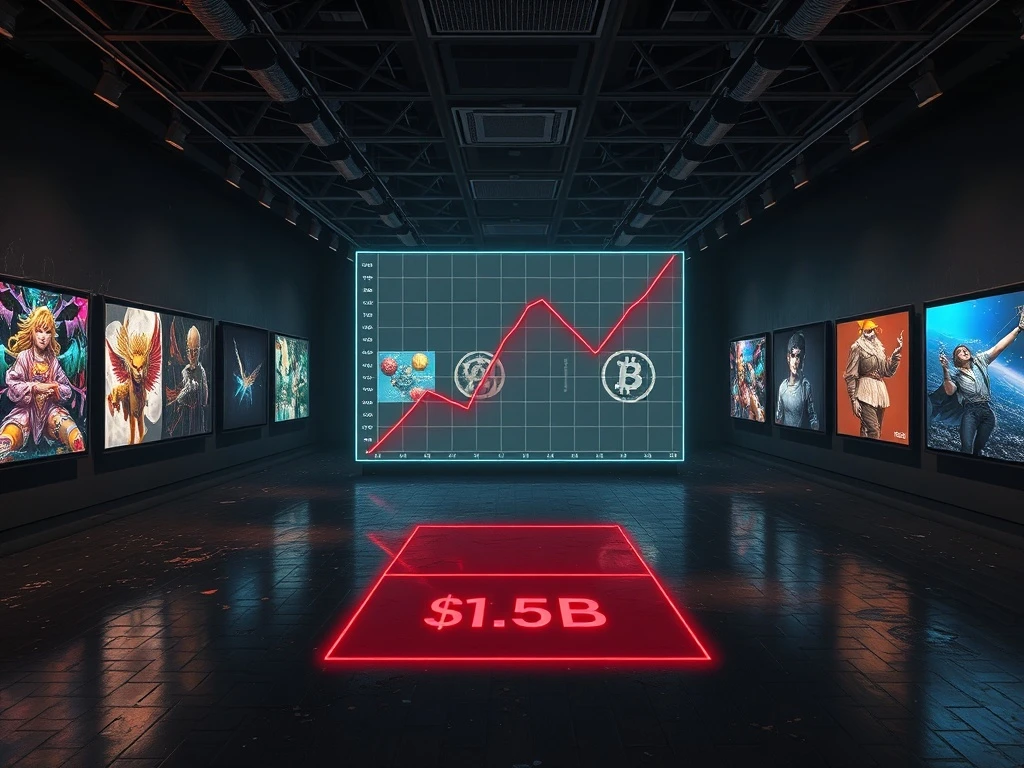

NFT Market Cap Crashes to $1.5B, Erasing 2021 Hype in Stark 2025 Reset

In a dramatic reversal for the digital collectibles sector, the global NFT market capitalization has collapsed to approximately $1.5 billion, a level not seen since before the explosive hype of 2021, according to data from CoinGecko. This stark reset, unfolding in late January 2025, coincides with a broader cryptocurrency market downturn and reveals a fundamental imbalance: a relentless surge in new token creation is colliding with rapidly evaporating buyer demand.

NFT Market Cap Plummets Amid Broader Crypto Winter

The decline in the non-fungible token sector is not an isolated event. Consequently, it mirrors a significant contraction across the entire digital asset landscape. Over a turbulent two-week period beginning January 23, 2025, the total cryptocurrency market capitalization fell sharply from around $3.1 trillion to $2.2 trillion. Major blockchain networks, which form the foundation for most NFT trading, experienced severe price corrections.

Bitcoin (BTC), the leading cryptocurrency, retreated from nearly $89,000 to about $65,000. Simultaneously, Ethereum (ETH), the primary network for NFT smart contracts, saw its value drop from $3,000 to near $1,800. This correlation is critical because, according to data aggregator CryptoSlam, Bitcoin and Ethereum remain the top two networks for NFT trading volume. Therefore, weakness in these foundational assets directly pressures the valuation of assets built upon them.

The Core Imbalance: Soaring Supply Meets Falling Demand

The market cap retracement stems from a powerful and worsening economic imbalance within the NFT ecosystem. Analysis of CryptoSlam data reveals a troubling divergence between supply and demand metrics throughout 2024 and into 2025.

- Supply Expansion: The total number of NFTs in circulation surged to nearly 1.3 billion in 2025, marking a 25% increase from the previous year.

- Demand Contraction: In stark contrast, total NFT sales volume fell 37% year-over-year to $5.6 billion.

- Price Erosion: The average sale price for an NFT slipped below $100, indicating a race to the bottom.

This data paints a clear picture of a high-volume, low-price environment. Essentially, minting new NFTs became increasingly accessible and cheap, but buyer interest and capital allocation failed to keep pace. The result is a market flooded with assets chasing a shrinking pool of capital.

Expert Analysis: A Market Maturation or a Bubble Deflating?

Market analysts interpret this data as a sign of sector maturation and correction, rather than mere failure. The 2021-2022 period was characterized by speculative frenzy and celebrity-driven hype, inflating valuations far beyond sustainable levels. The current reset strips away that speculation, potentially leaving a foundation built on utility and genuine cultural value. However, the rapid expansion of supply suggests many creators viewed NFT issuance as a low-cost experiment, further diluting the market’s attention and value concentration.

Corporate Retreats Signal Sector Contraction

The declining market metrics are reflected in the strategic decisions of major corporations and platforms. A series of high-profile exits and closures has accelerated, mirroring the market’s downward trajectory and reducing infrastructure support for the sector.

In early January 2025, sportswear giant Nike quietly divested RTFKT, the digital collectibles studio it acquired at the peak of the NFT boom. This sale followed operational shutdowns and an investor lawsuit, signaling a retreat from a once-high-profile web3 ambition. Furthermore, established marketplaces are winding down operations. Nifty Gateway, a pioneer in the curated NFT space owned by Gemini, announced it will cease operations on February 23, 2025, citing a “prolonged market downturn.”

Similarly, the social NFT platform Rodeo stated it would shut down in March 2025 after failing to achieve sustainable scale. These closures reduce critical avenues for discovery, trading, and community engagement, creating a negative feedback loop that further depresses market activity and confidence.

Historical Context and the Path Forward

The return to a $1.5 billion market cap effectively resets the NFT sector to its pre-bubble valuation. This presents a crucial juncture. The era of easy speculation appears over, placing greater emphasis on projects that demonstrate clear utility, strong community governance, and integration with broader digital experiences like gaming or virtual worlds. The market’s future health may depend on its ability to transition from a model of pure collectibility to one of functional application.

Regulatory clarity, particularly regarding intellectual property and securities law, will also play a defining role in shaping the next phase of growth. The current downturn, while severe, follows a familiar pattern in technological adoption cycles—a peak of inflated expectations followed by a trough of disillusionment, potentially leading to a slope of enlightenment built on more stable fundamentals.

Conclusion

The NFT market cap crash to $1.5 billion marks a definitive end to the speculative mania of 2021. Driven by a perfect storm of broader crypto weakness, a massive supply overhang, and collapsing demand, the sector is undergoing a severe contraction. High-profile corporate exits underscore the challenging environment. Ultimately, this reset may serve as a necessary cleansing phase, separating fleeting hype from enduring innovation and setting the stage for a more mature and sustainable digital assets ecosystem built on utility rather than speculation.

FAQs

Q1: What is the current NFT market capitalization and why is it significant?

The total NFT market cap has fallen to approximately $1.5 billion as of early 2025. This is significant because it returns the sector’s total valuation to levels last seen in early 2021, before the massive speculative bubble, effectively erasing years of paper gains and highlighting a major market correction.

Q2: What are the main factors causing the NFT market crash?

Three primary factors are converging: a broader downturn in the cryptocurrency market affecting Bitcoin and Ethereum; a massive increase in NFT supply (up 25% in 2025); and a sharp decline in buyer demand and sales volume (down 37%). This creates a severe supply-demand imbalance.

Q3: How are major companies reacting to the NFT market downturn?

Several high-profile exits are occurring. Nike sold its RTFKT studio, while platforms like Nifty Gateway and Rodeo have announced imminent shutdowns. These moves reflect a loss of corporate confidence and a reduction in the sector’s supporting infrastructure.

Q4: Does the low average NFT sale price indicate a problem?

Yes, the average sale price falling below $100 indicates a market flooded with assets where scarcity value has diminished. It suggests a race to the bottom in pricing as too many tokens chase too few interested buyers with significant capital.

Q5: Could this market crash be a positive development long-term?

Potentially. Analysts suggest this harsh reset could wash out speculative excess and low-quality projects, allowing the market to refocus on NFTs with genuine utility, strong communities, and sustainable models. It may represent a painful but necessary transition from hype-driven growth to value-driven maturation.