Ethereum Tokenization: BlackRock’s Crucial Infrastructure Bet Faces Rollup Reality Check

Institutional adoption of blockchain technology is entering a new, more nuanced phase, as highlighted by a pivotal January 2026 thematic report from asset management giant BlackRock. The analysis positions the Ethereum network not as a mere speculative cryptocurrency but as foundational tokenization infrastructure for global finance—a potential “toll road” for the digitization of trillions in real-world assets. However, this bullish framing arrives alongside a critical examination of how the network’s evolving architecture, particularly the dominance of rollups, is reshaping the fundamental economic link between platform activity and demand for its native asset, ETH. This development forces investors to move beyond simple adoption metrics and scrutinize settlement paths, fee capture, and the quality of on-chain data.

BlackRock’s Infrastructure Thesis: Ethereum as the Settlement Backbone

BlackRock’s 2026 Thematic Outlook represents a significant evolution in institutional crypto analysis. The report deliberately shifts focus away from ETH’s price volatility and instead assesses the Ethereum blockchain’s functional role. Analysts frame it as core financial infrastructure, analogous to a public utility or settlement network, where value accrues through fees generated from the issuance, transfer, and final settlement of tokenized assets like bonds, equities, and funds. According to the firm’s early January data, more than 65% of all tokenized assets by value currently reside on Ethereum, establishing it as the de facto leading base layer.

This infrastructure perspective is actively being operationalized. BlackRock’s own tokenized U.S. Treasury fund, BUIDL, launched in 2024, now operates across seven different blockchain networks. This multi-chain strategy, facilitated by cross-chain bridges like Wormhole, demonstrates a key institutional priority: distribution and accessibility. While Ethereum often serves as the primary issuance or final settlement layer, execution and user interaction frequently occur on other chains. Consequently, BlackRock’s report carefully avoids drawing a direct causal line between Ethereum’s market share in tokenization and near-term ETH price performance. The critical question for investors becomes not “if” assets are tokenized, but where the economic activity ultimately settles and which network captures the associated fees.

The Data Dilemma: Filtering Signal from Noise in Stablecoin Metrics

Accurate measurement is paramount to this analysis. BlackRock and payment processor Visa have both cast doubt on the reliability of raw, headline on-chain transfer volumes. They reference filtered data from analytics firms Coin Metrics and Allium, which attempts to strip out “inorganic activity”—such as automated bot transfers, exchange shuffling, and wash trading—to reveal genuine economic usage. The discrepancy is stark. Visa’s research showed that adjusting 30-day stablecoin transfer volume for this inorganic activity could reduce a headline figure of $3.9 trillion to approximately $817.5 billion.

This filtering is crucial for assessing the “toll road” model. If fee generation depends on organic settlement demand, then inflated metrics provide a misleading picture of economic throughput. For example, RWA.xyz, a leading tracker of tokenized real-world assets, showed Ethereum’s share at approximately 59.84%, representing $12.8 billion in value as of late January 2026—a figure that highlights how quickly data can shift based on reporting windows and methodology. This analytical rigor underscores a maturation in institutional crypto research, moving from tracking simple flows to evaluating economically meaningful usage.

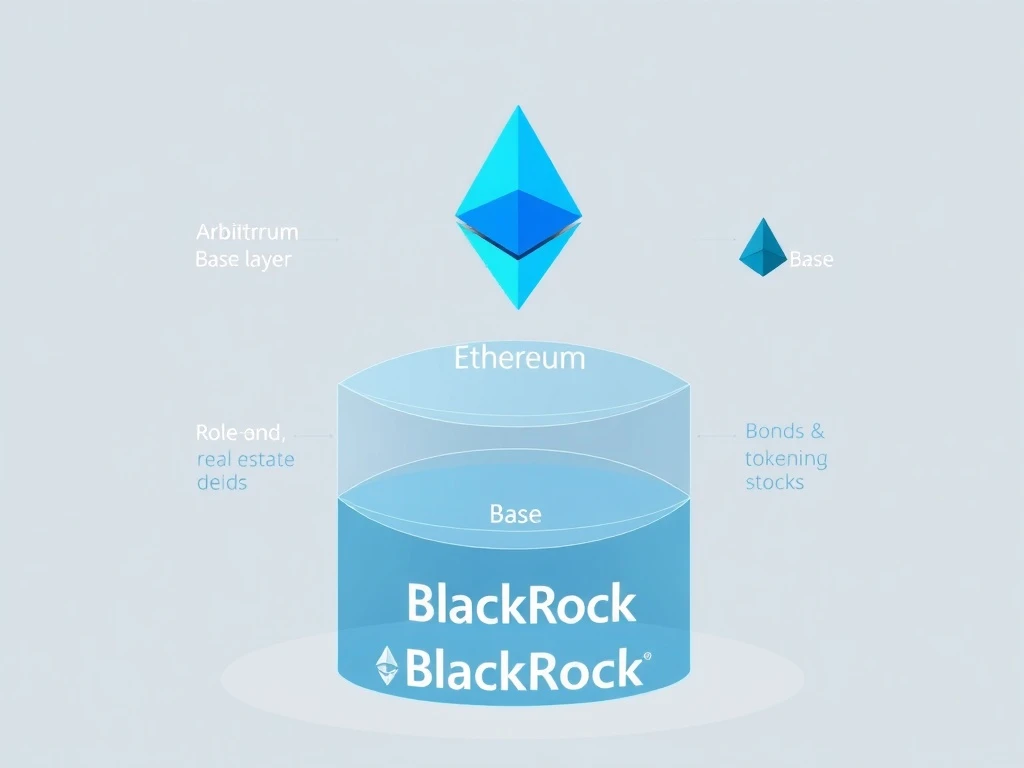

The Rollup Complication: Security vs. Revenue Capture

For ETH holders, the central investment thesis faces a structural challenge from layer-2 scaling solutions known as rollups. Networks like Arbitrum One, Base, and OP Mainnet now secure tens of billions in value and process the majority of user transactions, all while deriving their security from the Ethereum mainnet. This creates a complex decoupling:

- Security Inheritance: Rollups batch transactions and post cryptographic proofs to Ethereum L1, inheriting its decentralization and security.

- Execution Shift: Day-to-day user activity and gas fee payments occur primarily on the rollups themselves, not on Ethereum L1.

- Variable Fee Assets: While some fees may ultimately be settled in ETH, rollups can use their own tokens or stablecoins for transaction execution.

Data from L2BEAT in late January 2026 illustrates this scale: Arbitrum One secured about $17.52 billion, Base held $12.94 billion, and OP Mainnet contained $2.33 billion. This rollup-centric ecosystem fundamentally complicates the simple “toll road” analogy. Ethereum can remain the indispensable security and final settlement foundation—a role BlackRock emphasizes—even as direct fee-generating activity migrates upward. Consequently, growth in Total Value Locked (TVL) on rollups or growth in tokenized assets does not automatically translate into proportional demand for ETH block space or fee revenue on the base layer.

Projecting Future Volume: The Tokenized Cash Catalyst

Despite these complexities, the potential scale of tokenization presents a staggering opportunity. A separate 2025 report from global bank Citi projected that the issuance of tokenized deposits and stablecoins could reach between $1.9 trillion and $4.0 trillion by 2030. Assuming a conservative velocity of 50x, this could generate annual transaction activity between $100 trillion and $200 trillion. At this magnitude, even a small percentage of this volume settling directly on Ethereum L1, or requiring ETH for collateral and security, could have profound implications. The debate, therefore, shifts from raw adoption to settlement share and the mechanisms by which value accrues to the base asset across a multi-layered stack.

Multi-Chain Realities Reshape the Competitive Landscape

The future of institutional tokenization is decidedly multi-chain. BlackRock’s BUIDL fund exemplifies this, and discussions at the 2026 World Economic Forum meeting in Davos reinforced the trend. While some speculated about convergence onto a single ledger, official WEF materials highlighted the benefits of tokenization—fractional ownership, faster settlement, increased liquidity—without endorsing a winner-take-all platform view. This ecosystem approach means that while Ethereum may maintain an advantage in settlement credibility and security assurance, other blockchains will compete aggressively as distribution and execution layers.

This dynamic reshapes how investors must interpret the space. Key considerations now include:

- The spread of asset issuance across multiple Layer 1s and rollups.

- The importance of settlement location over raw transaction volume.

- How rollups alter the relationship between where fees are paid and where security resides.

- Major issuers like BlackRock actively hedging platform risk through multi-chain designs.

Conclusion

BlackRock’s 2026 report provides a sophisticated, infrastructure-driven framework for evaluating Ethereum tokenization, marking a departure from simplistic crypto investment narratives. By framing the network as a potential settlement backbone for a digitized global asset market, it validates the technology’s long-term utility. However, this validation comes with a critical caveat: the rise of rollups and multi-chain strategies is blurring the direct economic payoff for ETH. The path forward for investors requires deep analysis of settlement mechanics, filtered on-chain data, and the evolving relationship between security provision and revenue capture. The race is no longer just about adoption, but about defining and capturing value within a complex, layered tokenization infrastructure.

FAQs

Q1: What is BlackRock’s main argument about Ethereum in its 2026 report?

BlackRock argues that Ethereum should be viewed primarily as core financial infrastructure for tokenizing real-world assets (like bonds and funds), similar to a “toll road,” rather than just as a speculative cryptocurrency. The focus is on its potential to capture value through settlement and transaction fees.

Q2: How do rollups affect the value of ETH?

Rollups (like Arbitrum and Base) handle most user transactions and fees on their own layers, while using Ethereum for security. This means growth in tokenization activity on rollups does not automatically lead to higher direct fee revenue or demand for ETH on the main Ethereum chain, complicating the value accrual model.

Q3: Why is filtered stablecoin data important?

Raw on-chain transfer volumes can be inflated by bot activity and non-economic transfers. Firms like Visa and BlackRock use filtered data to remove this “noise,” providing a clearer picture of genuine economic usage, which is essential for accurately assessing the health and fee potential of a network.

Q4: What is BlackRock’s BUIDL fund, and why does it matter?

BUIDL is BlackRock’s tokenized U.S. Treasury fund. Its operation across seven different blockchains demonstrates that major institutions are adopting a multi-chain strategy from the start, reducing reliance on any single platform and making the settlement path more important than which chain hosts the asset.

Q5: Does Ethereum’s large share of tokenized assets guarantee its future dominance?

Not necessarily. While Ethereum holds a leading share (around 60-65% in early 2026), BlackRock’s report treats this as a snapshot. The multi-chain trend, the growth of rollups, and the focus on where economic value ultimately settles mean market share is fluid, and dominance in issuance does not guarantee dominance in fee capture.