ETH Price Prediction: Can It Break $3,000? Cardano Builds Momentum While APEMARS Emerges as the Next 100x Coin with 950+ Holders

Global cryptocurrency markets enter 2025 with renewed optimism as Ethereum approaches critical resistance levels, Cardano demonstrates sustained network growth, and emerging projects like APEMARS attract significant early interest from 950+ holders during presale phases. Market analysts closely monitor these developments across different blockchain ecosystems, providing valuable insights into potential market movements and investment opportunities. This comprehensive analysis examines current market conditions, technical indicators, and fundamental factors shaping these three distinct cryptocurrency narratives.

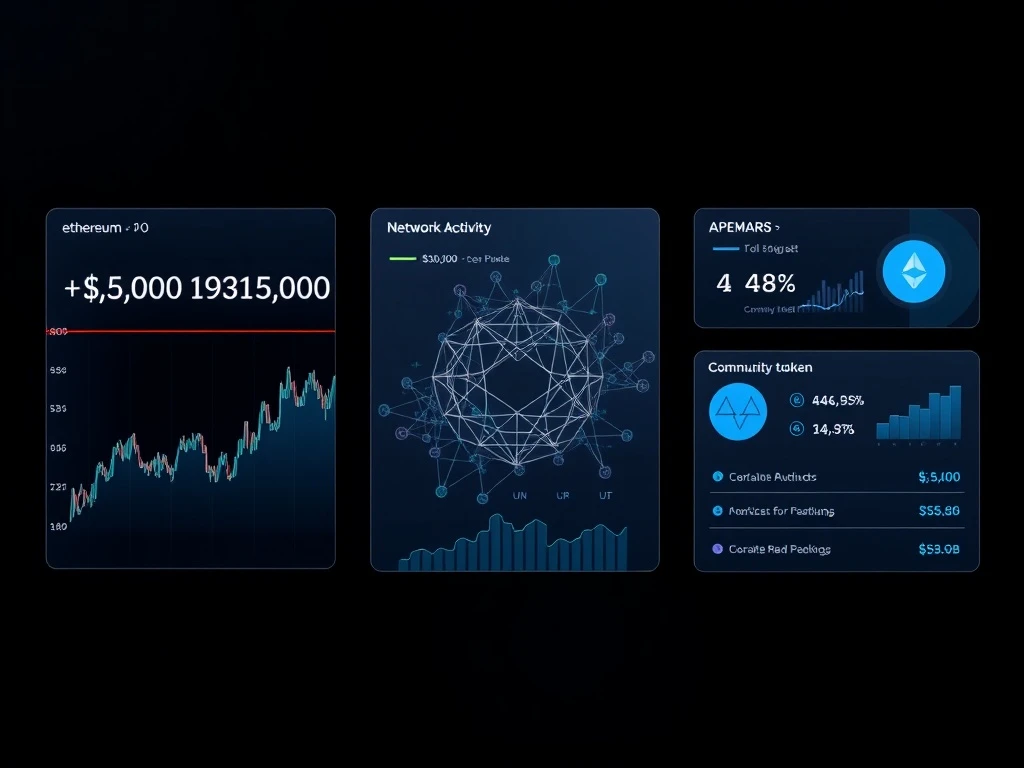

Ethereum’s Path to $3,000: Technical Analysis and Market Context

Ethereum currently trades within a crucial price range as market participants evaluate its potential to breach the $3,000 psychological barrier. Several technical indicators suggest increasing bullish momentum, while fundamental developments provide additional context for this ETH price prediction scenario. The Ethereum network recently completed significant protocol upgrades, including improvements to transaction efficiency and reduced gas fees during peak periods. These technical enhancements contribute to renewed developer activity and increased decentralized application deployment.

Market data from January 2025 shows Ethereum maintaining strong support above $2,600, with trading volume increasing approximately 18% compared to December 2024 levels. Institutional interest continues to grow, as evidenced by recent filings with regulatory authorities showing increased Ethereum exposure among traditional financial institutions. Network metrics reveal consistent growth in daily active addresses, which have increased by 22% year-over-year according to blockchain analytics platforms. This fundamental strength provides a solid foundation for potential price appreciation.

Key Resistance Levels and Market Sentiment

Technical analysts identify several critical resistance levels between $2,850 and $3,050 that Ethereum must overcome to establish a new bullish trend. The $3,000 level represents not only a psychological barrier but also a significant technical resistance zone where previous market cycles encountered selling pressure. Market sentiment indicators, including the Crypto Fear & Greed Index, currently show moderate optimism without reaching extreme levels that typically precede corrections. Derivatives market data reveals balanced positioning between call and put options at the $3,000 strike price for March 2025 expirations.

Historical patterns suggest that Ethereum typically experiences increased volatility when approaching round-number psychological barriers. Previous attempts to breach similar resistance levels in 2024 resulted in temporary pullbacks before eventual breakthroughs. Current market conditions differ significantly from previous cycles due to improved regulatory clarity in major jurisdictions and increased institutional participation. These structural changes may influence how Ethereum responds to the $3,000 resistance level in the coming weeks.

Cardano’s Building Momentum: Network Growth and Development Activity

While Ethereum approaches key resistance levels, Cardano demonstrates substantial momentum through measurable network growth and development activity. The Cardano blockchain has recorded consistent increases in several fundamental metrics throughout late 2024 and early 2025. Daily transaction volume has grown by approximately 35% compared to the same period last year, indicating increased utility and adoption. Developer activity on the platform remains robust, with GitHub commit frequency maintaining elevated levels since the implementation of recent protocol upgrades.

Cardano’s decentralized finance ecosystem continues to expand, with total value locked in DeFi applications increasing steadily across multiple consecutive quarters. This growth occurs despite broader market conditions that have challenged some competing blockchain platforms. The Cardano community actively participates in governance decisions through the Project Catalyst funding mechanism, which has allocated substantial resources to ecosystem development projects. These governance activities demonstrate the network’s maturation and community engagement.

Technical Developments and Strategic Partnerships

Recent technical developments on the Cardano network include improvements to smart contract execution efficiency and enhanced interoperability features. These upgrades address previous limitations while maintaining the platform’s security-first approach to blockchain architecture. Strategic partnerships with academic institutions and research organizations continue to advance Cardano’s scientific foundation, distinguishing it from many competing platforms. These collaborations focus on formal verification methods and security protocols that enhance network reliability.

Market analysts note that Cardano’s price action often correlates with major network upgrades and ecosystem milestones. The platform’s methodical development approach, characterized by peer-reviewed research and gradual implementation, creates predictable catalysts for market attention. Upcoming protocol improvements scheduled for 2025 include enhancements to transaction throughput and additional smart contract capabilities. These planned developments provide fundamental support for continued network growth and potential price appreciation.

APEMARS Presale Momentum: Analyzing Early Interest and Market Positioning

Emerging cryptocurrency project APEMARS has attracted significant attention during its presale phase, with blockchain data confirming participation from over 950 unique wallet addresses. This early interest demonstrates market appetite for innovative blockchain projects with distinct value propositions. The APEMARS project focuses on specific utility applications within the decentralized finance sector, though detailed technical documentation remains limited during early development phases. Presale participation metrics provide initial indicators of community interest and potential market reception.

Market analysts approach early-stage projects with appropriate caution, recognizing that presale momentum represents only initial interest rather than proven utility or adoption. Historical data shows that fewer than 15% of projects with similar early interest maintain sustainable development and adoption over multi-year periods. The APEMARS development team has released preliminary technical specifications outlining planned features and implementation timelines. These documents suggest integration with existing DeFi infrastructure and cross-chain compatibility features.

Evaluating Early-Stage Investment Opportunities

Professional investors typically evaluate early-stage cryptocurrency projects using multiple criteria beyond presale participation metrics. These evaluation frameworks consider technical innovation, team experience, market positioning, and realistic development timelines. The APEMARS project enters a competitive market segment with established alternatives, requiring clear differentiation to achieve sustainable adoption. Early documentation suggests focus on specific niche applications rather than broad platform ambitions, which may provide more achievable development targets.

Market participants considering early-stage opportunities should conduct thorough due diligence beyond presale metrics. This process includes examining team backgrounds, reviewing technical implementation plans, assessing tokenomics structures, and evaluating realistic market opportunities. Historical analysis indicates that projects with transparent development processes and realistic milestones demonstrate higher probabilities of long-term success. The cryptocurrency market’s evolution toward increased regulatory oversight and institutional participation creates additional considerations for emerging projects seeking sustainable growth.

Comparative Market Analysis: Established Platforms vs. Emerging Projects

The current cryptocurrency landscape presents distinct opportunities across market capitalization segments, from established platforms like Ethereum and Cardano to emerging projects like APEMARS. Each category offers different risk-reward profiles, development timelines, and market dynamics. Established platforms benefit from network effects, proven security models, and extensive developer ecosystems. Emerging projects offer potential for asymmetric returns but face significant challenges in achieving adoption and technical execution.

Market data reveals interesting correlations and divergences between different cryptocurrency segments. Ethereum and Cardano often demonstrate price correlation during broader market movements, though specific catalysts create periods of divergence. Emerging projects typically show lower correlation with major cryptocurrencies, reflecting their distinct market dynamics and development timelines. This diversification potential attracts certain investor profiles seeking exposure to different aspects of blockchain technology evolution.

Risk Management Considerations in Current Market Conditions

Professional portfolio managers emphasize appropriate risk management when allocating across cryptocurrency market segments. Established platforms typically receive larger allocations due to their proven track records and lower relative volatility. Emerging projects receive smaller allocations with clear exit strategies and ongoing evaluation criteria. This disciplined approach balances potential returns with appropriate risk management in a rapidly evolving market environment.

Current market conditions present both opportunities and challenges across cryptocurrency segments. Regulatory developments, technological innovations, and macroeconomic factors create complex dynamics requiring careful analysis. Market participants benefit from distinguishing between short-term price movements and long-term fundamental developments. This distinction informs investment decisions aligned with individual risk tolerance and investment horizons.

Conclusion

Cryptocurrency markets in early 2025 present a dynamic landscape with distinct narratives across different blockchain platforms and projects. Ethereum approaches the critical $3,000 resistance level with improving fundamentals and technical indicators. Cardano demonstrates sustained momentum through measurable network growth and development activity. The APEMARS project attracts early interest during its presale phase, though long-term success requires execution against development milestones. Market participants should consider these developments within broader market context, recognizing both opportunities and risks across cryptocurrency segments. Continued monitoring of technical developments, regulatory changes, and market dynamics will provide valuable insights for informed decision-making in evolving digital asset markets.

FAQs

Q1: What technical factors support Ethereum’s potential move above $3,000?

Several technical factors support this ETH price prediction scenario, including strong support above $2,600, increasing trading volume, and improved network fundamentals following recent protocol upgrades. Resistance levels between $2,850 and $3,050 represent key barriers that must be overcome through sustained buying pressure.

Q2: How does Cardano’s current momentum compare to previous growth periods?

Cardano’s current momentum demonstrates similarities to previous growth periods in terms of developer activity and network metrics, though current conditions benefit from a more mature ecosystem and established DeFi applications. Daily transaction growth of approximately 35% year-over-year exceeds some previous growth phases.

Q3: What due diligence should investors conduct regarding APEMARS and similar presale projects?

Investors should examine team backgrounds, review technical documentation, assess tokenomics structures, evaluate development timelines, and consider market positioning relative to established alternatives. Presale participation metrics provide only initial indicators requiring verification through ongoing development progress.

Q4: How do regulatory developments affect these different cryptocurrency segments?

Regulatory developments typically affect established platforms like Ethereum and Cardano through compliance requirements and institutional access. Emerging projects face additional regulatory considerations regarding token classification and offering structures. Clear regulatory frameworks generally benefit established platforms with greater resources for compliance.

Q5: What time horizon should investors consider for these different cryptocurrency opportunities?

Ethereum and Cardano typically suit medium to long-term investment horizons aligned with protocol development cycles and ecosystem growth. Emerging projects like APEMARS require shorter evaluation cycles with clear milestones, though successful projects may transition to longer-term holdings as they demonstrate execution against development plans.