DeFi Regulation Showdown: Anti-DeFi Group’s Urgent Ad Campaign Targets US Crypto Bill Provisions

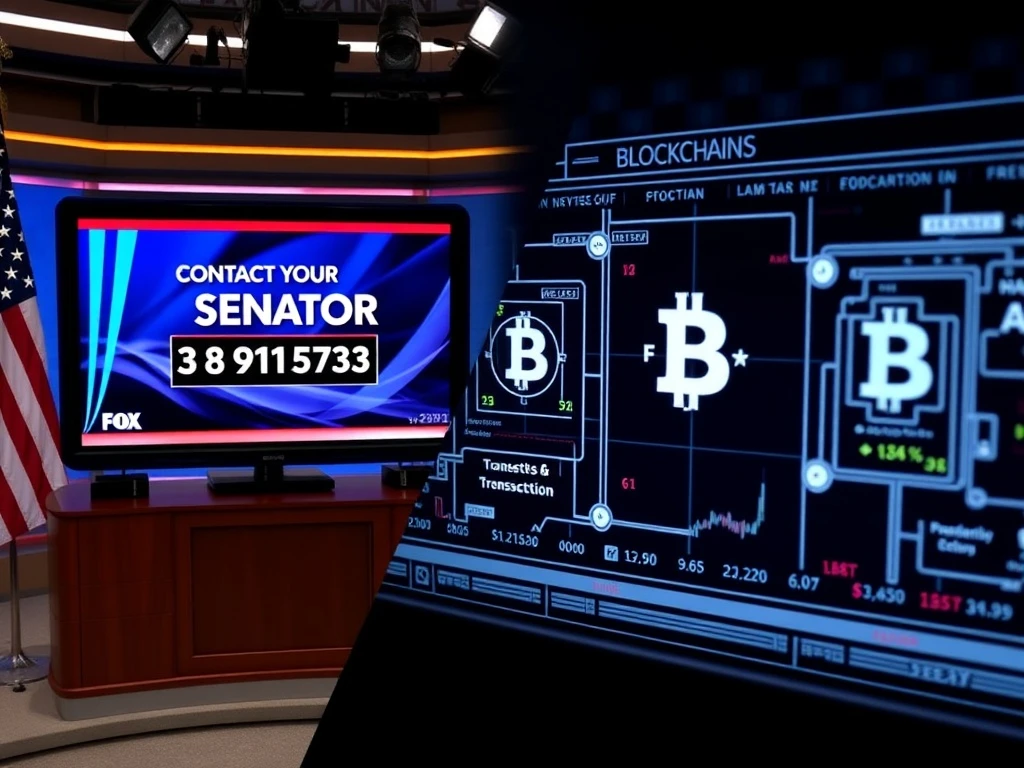

WASHINGTON D.C., March 2025 – A dramatic escalation in the battle over decentralized finance regulation unfolded this week as an organized opposition group launched a targeted advertising campaign on national television, directly urging the removal of DeFi-related provisions from pending cryptocurrency legislation. The Investors For Transparency group purchased airtime on Fox News to broadcast their message, creating immediate ripples through both political and financial circles. This development represents a critical moment for the future of digital asset regulation in the United States, potentially shaping how innovative financial technologies integrate with traditional systems.

DeFi Regulation Faces Organized Opposition in Washington

The advertisement campaign specifically targets the Crypto-Asset Market Structure and Investor Protection Act, commonly referred to as the CLARITY Act. This comprehensive legislation represents years of bipartisan effort to create regulatory frameworks for digital assets. However, the DeFi provisions within the bill have become a flashpoint for controversy. The television advertisement urges viewers to contact their U.S. Senate representatives immediately, providing a dedicated hotline number for this purpose. The ad’s core argument maintains that DeFi regulations could inadvertently stifle financial innovation rather than protect consumers.

According to legislative analysts, the CLARITY Act contains several provisions specifically addressing decentralized finance platforms. These include requirements for protocol governance transparency, liability frameworks for developers, and compliance mechanisms for automated protocols. The legislation attempts to balance innovation with consumer protection, a challenging task given DeFi’s fundamental differences from traditional financial systems. The advertisement campaign represents the most visible public opposition to these specific provisions since the bill’s introduction.

Banking Sector Concerns Drive Opposition Movement

Financial industry observers note that the advertisement campaign reflects deeper concerns within the traditional banking sector. Analysis from Crypto News Insights suggests banking institutions worry about potential deposit outflows if stablecoin interest products gain regulatory approval and mainstream adoption. Stablecoins, which are cryptocurrencies pegged to stable assets like the U.S. dollar, have grown exponentially in recent years. Many DeFi platforms offer interest-bearing opportunities for these digital assets, creating competition for traditional savings accounts.

The banking industry’s apprehension stems from several factors:

- Interest Rate Competition: DeFi platforms often offer higher yields than traditional banks

- Capital Mobility: Digital assets can move between platforms instantly

- Regulatory Arbitrage: Differing regulatory standards between jurisdictions

- Technological Disruption: Automated protocols operating without traditional intermediaries

These concerns have manifested in increased lobbying efforts throughout 2024 and early 2025. Banking associations have submitted multiple comment letters to regulatory agencies and congressional committees, arguing for cautious approaches to DeFi regulation. The television advertisement represents a new phase in this advocacy, moving from private meetings to public persuasion.

DeFi Community Responds to Political Pressure

The advertisement campaign prompted immediate responses from prominent figures within the cryptocurrency ecosystem. Hayden Adams, founder of the Uniswap decentralized exchange protocol, publicly criticized the effort through social media channels. Adams characterized the campaign as an “attack on DeFi” by unidentified interests seeking to protect traditional financial monopolies. His response highlighted the ongoing tension between established financial institutions and emerging decentralized technologies.

Uniswap represents one of the largest and most influential DeFi protocols, facilitating billions of dollars in monthly trading volume without traditional intermediaries. The protocol’s governance token, UNI, has become a benchmark for decentralized finance valuation. Adams’ response reflects broader concerns within the DeFi community that regulatory frameworks might impose traditional financial structures on fundamentally different technological systems.

Several blockchain advocacy organizations have mobilized counter-efforts, emphasizing DeFi’s potential benefits:

| Potential Benefit | Current Implementation | Regulatory Challenge |

|---|---|---|

| Financial Inclusion | Global access without geographic restrictions | Cross-border compliance requirements |

| Transparency | Public blockchain transaction records | Privacy and data protection concerns |

| Innovation Speed | Rapid protocol development and deployment | Traditional regulatory review timelines |

| Reduced Intermediation | Automated smart contract execution | Liability and accountability frameworks |

Legislative Timeline and Political Dynamics

The CLARITY Act has progressed through multiple congressional committees since its initial introduction. The legislation represents a compromise between various stakeholders, including cryptocurrency exchanges, traditional financial institutions, consumer protection advocates, and technology innovators. The Senate Banking Committee held extensive hearings throughout 2024, gathering testimony from diverse experts about appropriate regulatory approaches.

Key provisions currently under debate include:

- Classification standards for various digital assets

- Registration requirements for trading platforms

- Consumer protection mechanisms for retail investors

- DeFi-specific regulatory frameworks

- Stablecoin issuance and reserve requirements

Political analysts note that the advertisement campaign’s timing coincides with critical legislative negotiations. The Senate plans to consider the bill during the current session, with potential amendments expected from multiple committees. The public campaign aims to influence these amendment processes, particularly regarding DeFi-related sections. Congressional staffers report increased constituent contacts following the advertisement’s airing, indicating effective mobilization of concerned viewers.

Historical Context of Financial Technology Regulation

This regulatory debate follows historical patterns of technological innovation outpacing legal frameworks. Similar tensions emerged during the early internet era, e-commerce development, and peer-to-peer lending platforms. Regulatory systems typically evolve through iterative processes, balancing innovation encouragement with risk mitigation. The current DeFi regulation debate represents the latest chapter in this ongoing adaptation.

Previous financial technology innovations faced comparable regulatory challenges:

- Online Banking (1990s): Initial security concerns followed by widespread adoption

- Peer-to-Peer Lending (2000s): Regulatory classification debates and investor protection frameworks

- Mobile Payments (2010s): Interoperability standards and financial inclusion initiatives

- Cryptocurrency Exchanges (2020s): Registration requirements and compliance mechanisms

Each technological advancement required regulatory adaptation, often following initial resistance from established institutions. The current DeFi regulation debate continues this pattern, with traditional financial entities expressing concerns about disruptive technologies while innovators advocate for flexible frameworks that accommodate novel approaches.

International Regulatory Comparisons

The United States regulatory approach contrasts with developments in other jurisdictions. The European Union recently implemented comprehensive cryptocurrency regulations through its Markets in Crypto-Assets (MiCA) framework. Asian financial centers like Singapore and Hong Kong have developed progressive regulatory sandboxes for testing innovative financial technologies. These international approaches provide comparative perspectives for U.S. policymakers considering appropriate regulatory balances.

Key differences in international approaches include:

- EU MiCA Framework: Comprehensive classification system with tiered requirements

- UK Regulatory Sandbox: Controlled testing environments for innovative products

- Singapore’s Progressive Licensing: Graduated compliance requirements based on scale

- Switzerland’s Principle-Based Regulation: Technology-neutral regulatory principles

These international models inform the U.S. legislative debate, with different stakeholders advocating for various approaches. The advertisement campaign represents one perspective in this global conversation about appropriate financial technology regulation.

Economic Implications and Market Reactions

Financial markets have shown sensitivity to regulatory developments throughout the cryptocurrency sector. Previous regulatory announcements have triggered significant price movements and trading volume changes. Market analysts monitor legislative developments closely, recognizing that regulatory clarity often precedes institutional adoption. The current advertisement campaign and legislative debate occur against this backdrop of market sensitivity.

Several economic factors influence this regulatory debate:

- Capital Formation: Regulatory uncertainty may limit investment in innovative projects

- Competitive Positioning: Different regulatory approaches affect jurisdictional competitiveness

- Consumer Protection: Appropriate safeguards balance innovation with risk management

- Systemic Stability: Interconnections between traditional and decentralized systems

Financial institutions increasingly recognize blockchain technology’s transformative potential while advocating for risk-appropriate regulatory frameworks. This balanced perspective acknowledges both innovation opportunities and potential systemic risks, particularly as traditional and decentralized systems become more interconnected.

Technological Innovation and Regulatory Adaptation

DeFi protocols represent significant technological advancements beyond simple cryptocurrency trading. Automated market makers, liquidity pools, and algorithmic lending protocols introduce novel financial mechanisms without traditional intermediaries. These innovations challenge existing regulatory paradigms developed for centralized financial institutions. The legislative debate reflects this fundamental tension between innovative technologies and established regulatory frameworks.

Technological characteristics complicating regulatory approaches include:

- Decentralized Governance: Protocol decisions through token holder voting

- Automated Execution: Smart contracts operating without human intervention

- Global Accessibility: Borderless protocol access and participation

- Transparent Yet Pseudonymous: Public transaction records with privacy features

These characteristics require regulatory frameworks that accommodate technological realities while maintaining appropriate safeguards. The advertisement campaign highlights concerns that proposed regulations might not achieve this balance, potentially hindering beneficial innovation.

Conclusion

The advertisement campaign urging removal of DeFi provisions from the CLARITY Act represents a significant development in the ongoing cryptocurrency regulation debate. This public advocacy effort reflects deeper concerns within traditional financial sectors about competitive disruptions from decentralized technologies. The campaign’s timing coincides with critical legislative negotiations, potentially influencing amendment processes and final legislation. As the Senate considers comprehensive cryptocurrency regulation, balancing innovation encouragement with appropriate safeguards remains a central challenge. The outcome will shape not only DeFi’s future development but also the broader relationship between traditional financial systems and emerging technological innovations. Market participants, policymakers, and technology developers continue monitoring these developments, recognizing their potential long-term implications for financial systems and economic structures.

FAQs

Q1: What is the CLARITY Act and why is it important?

The Crypto-Asset Market Structure and Investor Protection Act (CLARITY Act) represents comprehensive U.S. legislation aimed at creating regulatory frameworks for digital assets. Its importance stems from providing legal clarity for cryptocurrency businesses, establishing consumer protections, and defining regulatory jurisdictions among federal agencies.

Q2: Why are banking institutions concerned about DeFi regulation?

Traditional banks express concerns about potential deposit outflows if regulated stablecoin interest products compete with traditional savings accounts. They also worry about regulatory arbitrage if DeFi platforms operate under different standards, potentially creating uneven competitive landscapes.

Q3: How does DeFi differ from traditional financial systems?

Decentralized finance operates through automated protocols on blockchain networks without traditional intermediaries like banks or brokers. Transactions execute through smart contracts, governance occurs through token holder voting, and systems remain accessible globally without geographic restrictions.

Q4: What are the main arguments for and against DeFi regulation?

Pro-regulation arguments emphasize consumer protection, financial stability, and prevention of illicit activities. Anti-regulation arguments focus on innovation preservation, technological neutrality, and concerns about imposing traditional structures on fundamentally different systems.

Q5: How might this regulatory debate affect cryptocurrency markets?

Regulatory clarity typically reduces uncertainty, potentially encouraging institutional adoption and investment. However, restrictive regulations might limit innovation or drive development to more favorable jurisdictions. Market reactions often reflect perceptions of balanced versus restrictive approaches.