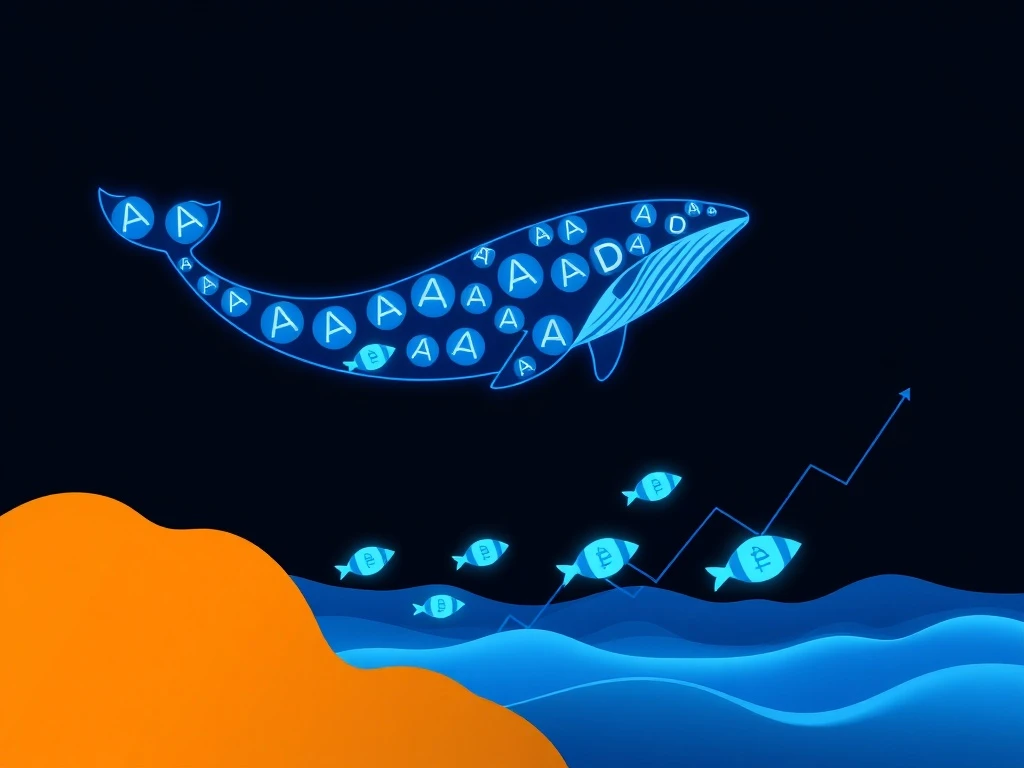

Cardano Whales Defiantly Accumulate 455 Million ADA, Signaling Potential Market Rebound

In a significant development for the cryptocurrency market, blockchain analytics firm Santiment reveals that Cardano whales have accumulated a staggering 455 million ADA tokens over the past two months, creating what analysts describe as ideal conditions for a potential market rebound. This substantial accumulation by addresses holding between 100,000 and 100 million ADA coincides with retail investor selling, establishing a classic accumulation pattern that historically precedes price recoveries.

Cardano Whales Demonstrate Strategic Accumulation Pattern

Santiment’s on-chain data, collected from transparent blockchain records, shows consistent buying activity among large ADA holders throughout the monitoring period. These whale addresses, representing some of the most sophisticated investors in the cryptocurrency space, have steadily increased their positions despite market volatility. The 455 million ADA accumulation represents approximately 1.2% of Cardano’s total circulating supply, valued at hundreds of millions of dollars at current market prices.

This accumulation pattern follows established market principles where informed institutional or large-scale investors accumulate assets during periods of retail pessimism. Historical cryptocurrency cycles frequently demonstrate that whale accumulation during market downturns often precedes significant price recoveries. The current Cardano whale activity mirrors patterns observed before previous bull markets, though past performance never guarantees future results.

Understanding Whale Wallet Classifications

Cryptocurrency analysts typically categorize wallet sizes based on their holdings:

- Retail Investors: Addresses holding less than 100,000 ADA

- Whales: Addresses holding between 100,000 and 100 million ADA

- Mega Whales/Institutions: Addresses holding over 100 million ADA

The Santiment report specifically focuses on the whale category, which represents sophisticated investors with substantial resources and market influence. These entities typically conduct extensive research before making investment decisions, making their collective actions particularly noteworthy for market analysts.

Market Dynamics: Whales Buying While Retail Sells

Santiment’s analysis highlights a crucial market dynamic where whale accumulation coincides with retail investor distribution. This divergence creates what market technicians call “accumulation phases,” where assets transfer from weak hands to strong hands. The firm explicitly states that this scenario creates ideal conditions for a cryptocurrency market rebound, based on historical precedent and market structure principles.

Several factors may explain this behavioral divergence. Retail investors often react emotionally to short-term price movements, while institutional and whale investors typically employ longer-term strategic thinking. Additionally, whales generally possess better access to market intelligence, research resources, and risk management tools. This informational asymmetry frequently results in whales accumulating during market pessimism when assets become undervalued relative to their long-term potential.

| Cryptocurrency | Time Period | Whale Accumulation | Market Outcome |

|---|---|---|---|

| Cardano (ADA) | Past 2 months | 455 million ADA | To be determined |

| Bitcoin (BTC) | Q4 2022 | 240,000 BTC | 157% price increase |

| Ethereum (ETH) | Q2 2023 | 3.2 million ETH | 84% price increase |

The Psychology Behind Market Rebounds

Market rebounds typically require several conditions, including oversold technical indicators, improving fundamentals, and shifting sentiment. Whale accumulation addresses the sentiment component by demonstrating confidence from sophisticated market participants. When whales accumulate while retail sells, it suggests the market may be approaching a sentiment extreme where pessimism has become excessive relative to underlying value.

This psychological dynamic creates potential buying opportunities, as assets may become undervalued due to emotional selling rather than deteriorating fundamentals. However, investors should note that whale accumulation alone doesn’t guarantee immediate price appreciation. Market rebounds require multiple factors aligning, including broader cryptocurrency adoption, technological developments, and favorable regulatory environments.

Cardano’s Fundamental Developments and Ecosystem Growth

Beyond whale accumulation, Cardano’s ecosystem continues developing through several important initiatives. The blockchain platform, founded by Ethereum co-founder Charles Hoskinson, has implemented numerous technical upgrades throughout 2024 and early 2025. These developments include scalability improvements, enhanced smart contract capabilities, and governance mechanism refinements.

Cardano’s development approach emphasizes peer-reviewed research and methodical implementation, distinguishing it from many cryptocurrency projects. This scientific philosophy appeals to institutional investors seeking blockchain platforms with rigorous development methodologies. The platform’s growing decentralized application ecosystem and increasing real-world use cases provide fundamental support for long-term value propositions.

Several key metrics demonstrate Cardano’s ecosystem growth:

- Increasing daily active addresses and transaction volumes

- Growing total value locked in decentralized applications

- Expanding developer activity and GitHub contributions

- Strengthening network security and decentralization metrics

Expert Perspectives on Whale Activity

Cryptocurrency analysts emphasize that whale accumulation should be considered alongside other market indicators. While significant, it represents just one data point in comprehensive market analysis. Technical analysts typically examine price charts, trading volumes, and momentum indicators alongside on-chain data. Fundamental analysts evaluate technological developments, adoption metrics, and competitive positioning.

Market observers note that whale accumulation often precedes institutional investment, as sophisticated investors typically enter markets before traditional financial institutions. This pattern has repeated throughout cryptocurrency history, with whale accumulation frequently signaling upcoming institutional interest. The current Cardano whale activity may indicate growing institutional awareness of the platform’s technological advancements and ecosystem development.

Historical Context and Previous Accumulation Cycles

Previous cryptocurrency cycles provide context for understanding current whale accumulation patterns. During the 2018-2019 bear market, Bitcoin whales accumulated approximately 1.2 million BTC before the 2020-2021 bull market. Similarly, Ethereum whales accumulated substantial positions before major price appreciations in 2017 and 2021. These historical patterns demonstrate that whale accumulation during market downturns frequently correlates with subsequent price recoveries.

However, correlation doesn’t imply causation, and multiple factors influence cryptocurrency prices. Regulatory developments, macroeconomic conditions, technological breakthroughs, and market sentiment all interact to determine price trajectories. Whale accumulation represents confidence from sophisticated investors but doesn’t override other market forces. Investors should consider whale activity as one component of comprehensive market analysis rather than a standalone predictor.

The current accumulation period for Cardano coincides with broader cryptocurrency market developments, including evolving regulatory frameworks and increasing institutional adoption. These macro factors may influence whale investment decisions alongside Cardano-specific developments. The convergence of positive ecosystem growth and whale accumulation creates an interesting scenario for market observers monitoring potential inflection points.

Risk Considerations and Market Volatility

Despite promising indicators, cryptocurrency markets remain inherently volatile and unpredictable. Whale accumulation patterns can reverse quickly if market conditions change or new information emerges. Additionally, past accumulation cycles don’t guarantee identical outcomes in current market conditions, which feature different regulatory environments, institutional participation levels, and technological maturity.

Investors should approach cryptocurrency markets with appropriate risk management strategies, including position sizing, diversification, and long-term perspectives. While whale accumulation provides valuable market intelligence, it shouldn’t replace thorough due diligence and risk assessment. The cryptocurrency market’s relative youth and evolving nature mean historical patterns may not repeat exactly, requiring continuous monitoring and analysis.

Conclusion

The accumulation of 455 million ADA by Cardano whales over two months represents a significant market development with potential implications for cryptocurrency investors. This substantial buying activity, occurring alongside retail selling, creates conditions that historically precede market rebounds according to Santiment’s analysis. While whale accumulation alone doesn’t guarantee price appreciation, it demonstrates confidence from sophisticated investors in Cardano’s long-term prospects. Market participants should monitor this development alongside Cardano’s technological progress, ecosystem growth, and broader cryptocurrency market trends to make informed investment decisions. The divergence between whale accumulation and retail distribution highlights the importance of distinguishing between short-term sentiment and long-term value in volatile cryptocurrency markets.

FAQs

Q1: What exactly does “whale accumulation” mean in cryptocurrency markets?

Whale accumulation refers to large-scale investors, typically holding between 100,000 and 100 million ADA in Cardano’s case, increasing their cryptocurrency holdings over a specific period. These entities are called “whales” due to their substantial market influence and ability to move prices with their trading activity.

Q2: Why is whale accumulation considered bullish for cryptocurrency prices?

Whale accumulation is considered bullish because it demonstrates confidence from sophisticated, well-resourced investors. These entities typically conduct extensive research before making investment decisions. Their buying activity during market downturns suggests they believe assets are undervalued, potentially signaling upcoming price recoveries based on historical patterns.

Q3: How does Santiment track whale accumulation data?

Santiment analyzes transparent blockchain data to track wallet movements and holdings. Since most cryptocurrency transactions are recorded on public ledgers, analytics firms can monitor address balances and transaction patterns. They categorize addresses by size and track changes in holdings across different investor groups over time.

Q4: Does whale accumulation guarantee that Cardano’s price will increase?

No, whale accumulation doesn’t guarantee price increases. While historically correlated with subsequent price appreciation, multiple factors influence cryptocurrency prices including regulatory developments, technological progress, market sentiment, and macroeconomic conditions. Whale activity should be considered alongside other indicators in comprehensive market analysis.

Q5: How can retail investors respond to whale accumulation patterns?

Retail investors can monitor whale activity as one data point among many in their investment research. Rather than blindly following whale movements, investors should consider how accumulation patterns align with fundamental analysis, technical indicators, and their own investment objectives. Professional investors emphasize diversification and risk management regardless of whale activity patterns.