Can XRP Price Break New Highs as Whales Exit Exchanges?

[ad_1]

Ripple’s (XRP) price has surged back to $0.60 for the first time in 10 days, recording a 7.74% gain in the last 24 hours. This rally aligns with a broader market recovery, making XRP the top gainer among the top 10 cryptocurrencies.

Starting the week with this positive momentum is promising, but the key question remains whether XRP can maintain this trend and end the week even stronger.

Demand for Ripple Jumps as Whales Take the Bull by the Horn

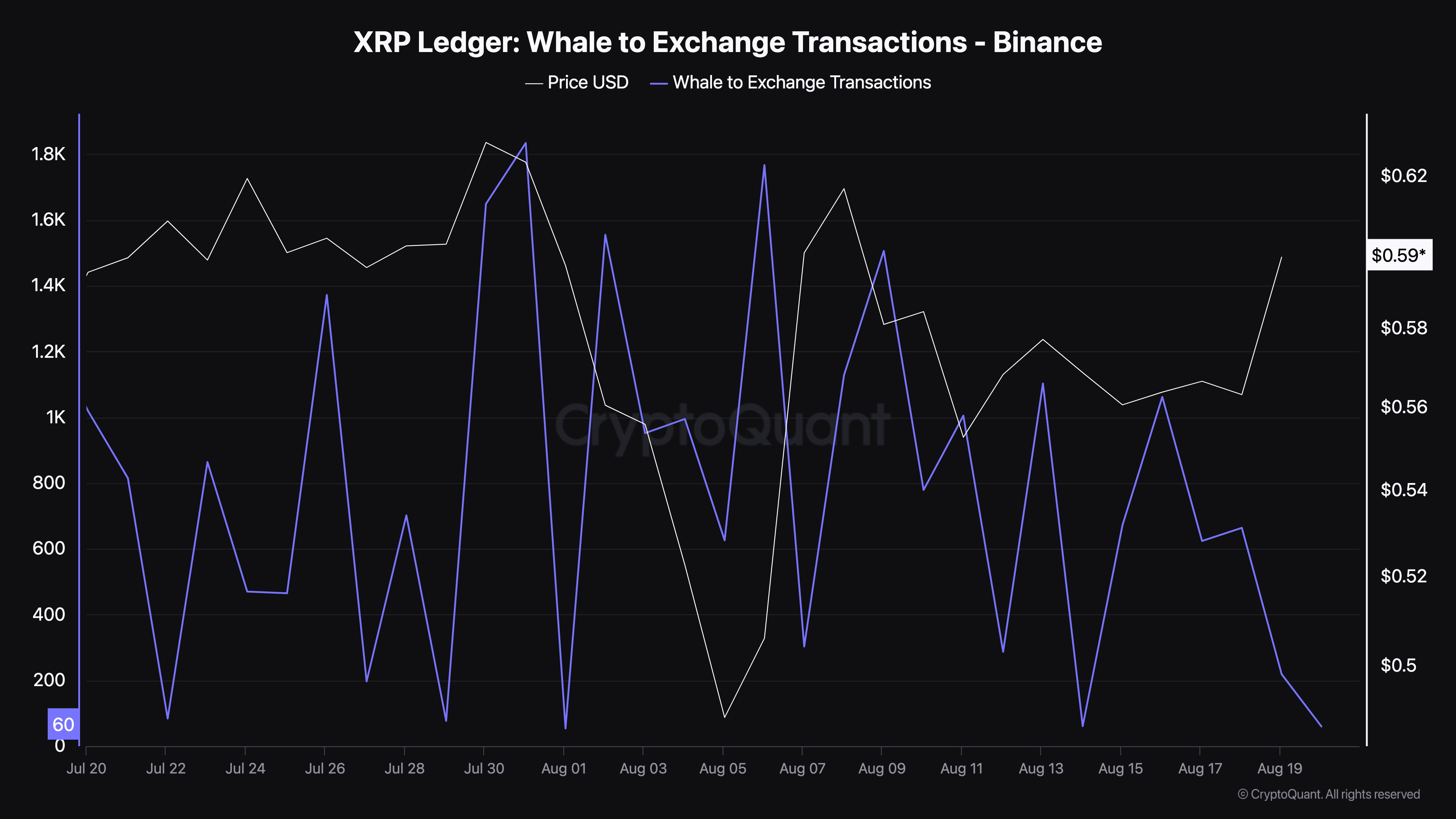

According to CryptoQuant, the Whale-to-Exchange Transactions obtained from the XRP Ledger have fallen tenfold since August 18. This metric measures how active cryptos move between whales and exchanges — in this instance, Binance.

Typically, an increase in transactions suggests that whales are willing to offload some tokens. A decrease points to withdrawals from the platform, which is a bullish sign.

On Sunday, there were about 664 transactions. But as of this writing, there are 60, indicating that most whales do not plan to sell their XRP anytime soon. Furthermore, it appears that this lack of selling pressure was crucial to the cryptocurrency’s rebound.

Read more: XRP ETF Explained: What It Is and How It Works

If sustained, XRP’s price will likely trade above $0.60 in the coming days. However, it is important to mention that the transactions in the above context are related to centralized exchanges (CEXes).

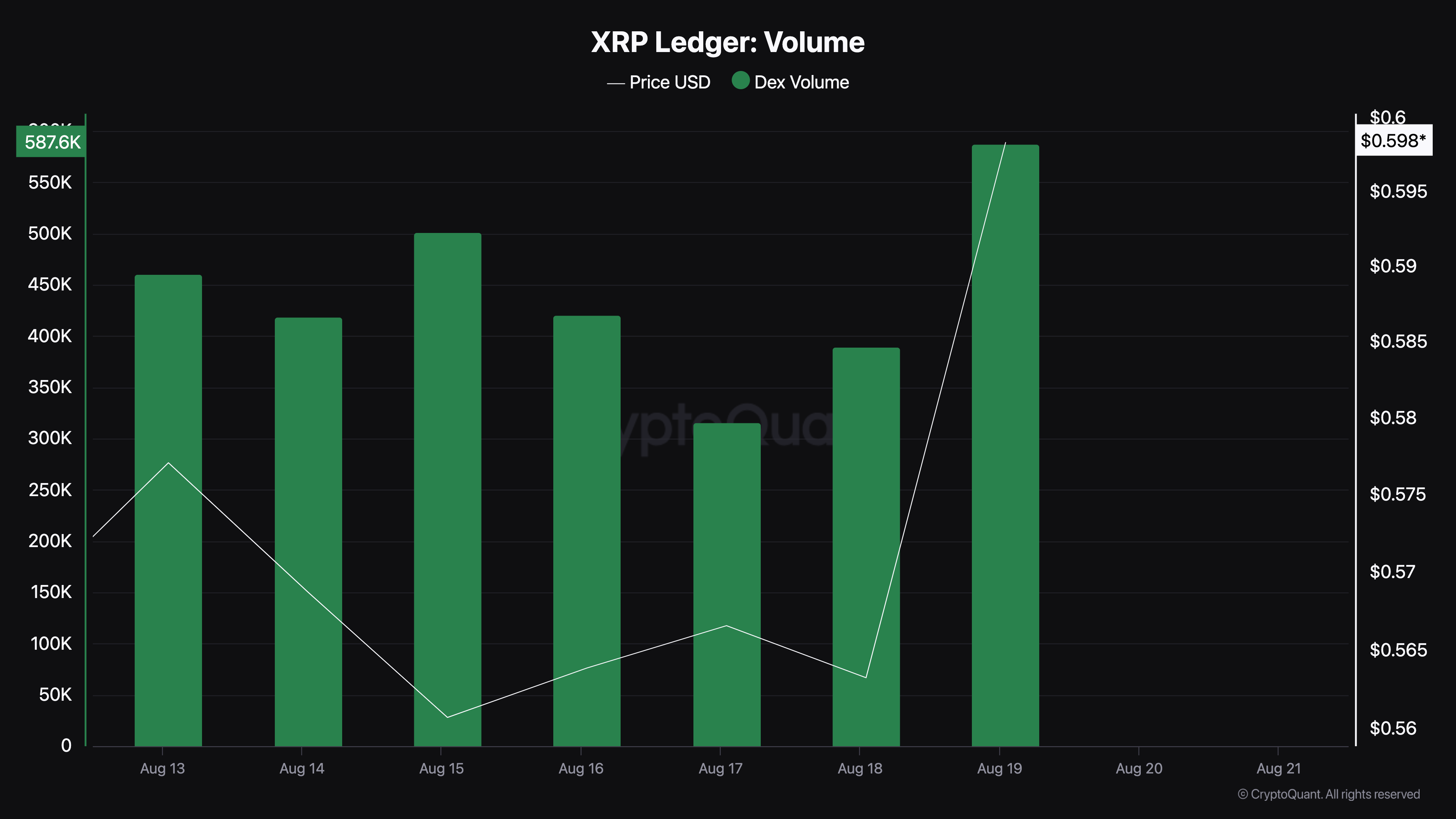

While large transactions on CEXes dropped, the volume of transactions on Decentralized Exchanges (DEXes) jumped by 28% in the last 24 hours. This increase suggests that demand for XRP increased on-chain.

Likewise, the high volume concentration is likely a byproduct of active user engagement on the XRP Ledger. DEX volume is an important metric that measures liquidity in the market.

If the volume falls, there is a high chance that the price of the token involved may not be stable, possibly undergoing a downtrend. Therefore, the surging volume is a bullish sign for the token, and if the increase continues, so will XRP’s price.

XRP Price Prediction: This Crypto Wants $0.65 Again

Moving on, XRP’s price upswing may remain intact according to signals from the Parabolic Stop And Reverse (SAR) indicator. The Parabolic SAR is a technical indicator that works well in detecting trends and reversal.

For context, if the dotted lines of the indicator are above the price, the uptrend is weak, and a downturn could be next. However, for Ripple’s native token, the indicator is below the price, suggesting that the upswing may continue.

Apart from this, XRP price trades above the 20 (blue) and 50 (yellow) EMAs. This indicator, which stands for Exponential Moving Average, measures trend direction. Since the token’s price is above it, the trend is bullish.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

If it were below the indicators, then the trend would have been deemed bearish. Meanwhile, a look at the Fibonacci retracement indicators shows that if the rally continues, XRP’s price could hit $0.65.

However, if demand for the token drops or whales begin to transfer their assets to CEXes, this optimistic thesis might be invalidated. Should this be the case, the price could drop to $0.59. In a highly bearish scenario, XRP could slide to $0.55.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link