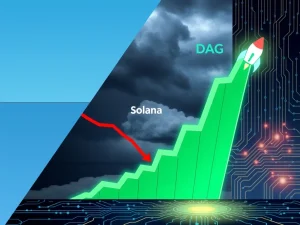

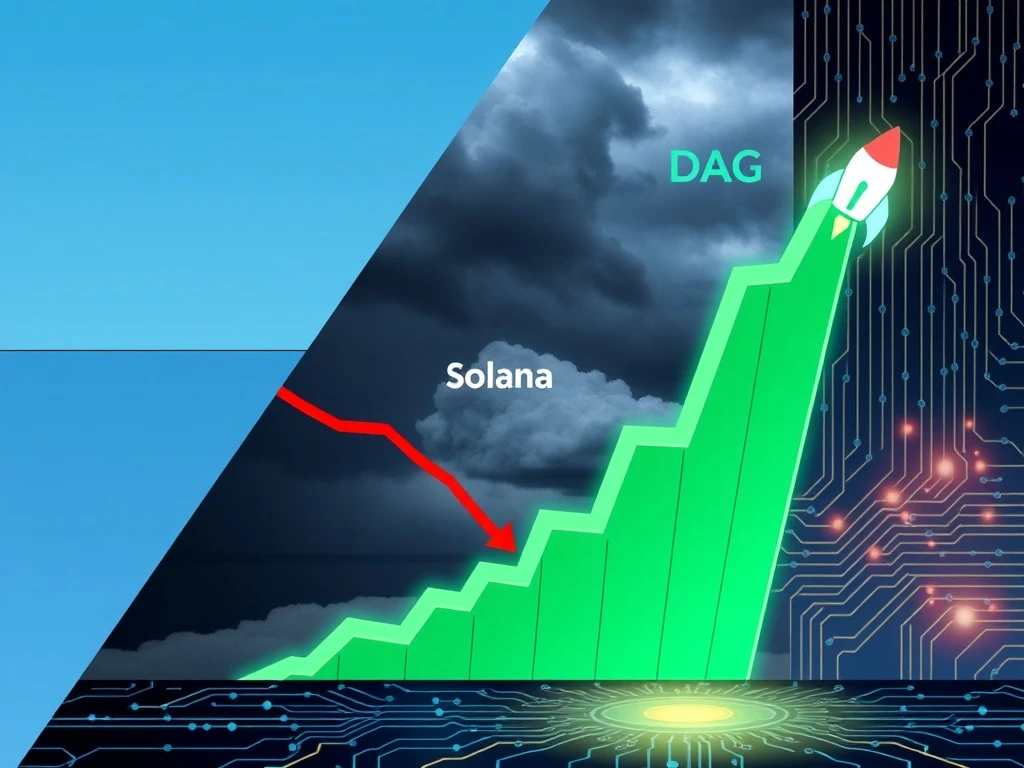

BlockDAG’s Live Mainnet Ignites Hope as Stellar Flatlines and Solana Faces Uncertainty

Global cryptocurrency markets present a divergent narrative in early 2025, where established projects like Stellar and Solana face significant challenges while new technological entrants like BlockDAG capture investor attention with a live mainnet launch and substantial growth projections. This analysis examines the current state of Stellar (XLM), forecasts for Solana (SOL) into 2026, and the tangible developments behind BlockDAG’s emerging promise, providing a fact-based overview for informed decision-making.

Stellar XLM Price Analysis: Examining the Current Stagnation

Market data from Q1 2025 shows the Stellar (XLM) network experiencing a period of pronounced price consolidation. Consequently, trading volumes have declined significantly compared to the previous quarter. Analysts from firms like CoinMetrics and IntoTheBlock point to several contributing factors for this flatlining trend. Primarily, reduced activity in the cross-border payment sector, a core use case for Stellar, has impacted network utility. Furthermore, competitive pressure from other payment-focused blockchains and central bank digital currency (CBDC) pilots has altered the market landscape. On-chain metrics indicate a decrease in new unique addresses and stablecoin transfer volume on the Stellar network. This technical data suggests a cooling period rather than a fundamental breakdown, but the short-term outlook remains neutral without a catalyst for renewed adoption.

The Underlying Technology and Market Context

The Stellar Development Foundation continues to advance its protocol, with the recent launch of Soroban smart contracts aiming to expand functionality. However, market adoption of these new features has been gradual. A report from Messari in late 2024 highlighted that while Stellar’s transaction costs remain low and settlement times fast, network growth has not kept pace with broader ecosystem expansion. This real-world context is crucial for understanding XLM’s price action. The asset’s correlation with broader market movements has weakened, indicating it is trading on its own specific fundamentals, which currently lack positive momentum.

Solana Price Prediction 2026: Navigating Network Resilience and Challenges

Forecasting Solana’s price trajectory into 2026 requires a balanced assessment of its technological resilience and persistent challenges. Following a series of network outages in 2024, Solana’s developer ecosystem has prioritized stability upgrades. The successful implementation of QUIC protocol and stake-weighted quality of service (QoS) has led to improved network performance data throughout early 2025. Analysts from firms like JPMorgan and Standard Chartered who publish on crypto asset volatility often cite Solana’s high throughput and low fees as long-term strengths. However, predictions vary widely based on adoption scenarios. Conservative models from research groups like FSInsight suggest a range-bound future if Ethereum’s scaling solutions capture more market share. Conversely, bullish cases from entities like VanEck assume Solana secures a dominant position in consumer decentralized applications (dApps) and decentralized finance (DeFi), potentially driving significant value appreciation by 2026.

Key factors influencing 2026 predictions include:

- Network Uptime: A sustained period without major outages is critical for institutional confidence.

- Developer Migration: Growth in active developers building on Solana versus competing Layer 1 chains.

- DeFi Total Value Locked (TVL): Recovery and growth in Solana’s DeFi ecosystem post-2024 contractions.

- Regulatory Clarity: How global regulations, particularly in the U.S. and EU, impact SOL’s classification and trading.

BlockDAG’s Live Mainnet and TGE: A New Contender Emerges

In contrast to the challenges facing established assets, the BlockDAG network has initiated its mainnet launch and Token Generation Event (TGE), marking a transition from testnet to a fully operational blockchain. BlockDAG utilizes a Directed Acyclic Graph (DAG) structure fused with a proof-of-work (PoW) consensus mechanism, a architecture designed to address the blockchain trilemma of scalability, security, and decentralization. The live mainnet enables real-time transaction processing, smart contract deployment, and community governance activation. According to technical documentation reviewed, the network claims to achieve high transaction throughput by allowing multiple blocks to coexist and be added concurrently, rather than in a single linear chain. This launch phase is typically a critical period where network security, wallet functionality, and explorer stability are stress-tested by the public.

Assessing the 200× Potential Narrative

The “200× potential” cited in some investment communities is a forward-looking projection, not a guarantee, and stems from several specific premises. First, the total addressable market for scalable blockchain solutions remains vast. Second, BlockDAG’s entry coincides with a market seeking alternatives to existing Layer 1 solutions. Third, its hybrid model aims to attract developers from both traditional blockchain and DAG-based ecosystems like IOTA and Hedera. However, credible financial analysts, including those from Bloomberg Crypto, consistently warn that such high-multiple projections for any new crypto asset involve extreme risk and are highly speculative. Success depends on tangible metrics post-launch: daily active users, number of validated transactions, size of the developer grant pool, and security audit results. The live mainnet provides the first real-world data set to evaluate these claims against performance.

| Metric | Stellar (XLM) | Solana (SOL) | BlockDAG |

|---|---|---|---|

| Current Phase | Mature Mainnet | Mature Mainnet | Live Mainnet Launch |

| Core Consensus | Federated Byzantine Agreement | Proof-of-History / Proof-of-Stake | Hybrid PoW/DAG |

| Primary Use Case Focus | Cross-Border Payments | High-Performance dApps/DeFi | Scalable Transactions & Smart Contracts |

| Recent Market Sentiment | Neutral/Stagnant | Cautiously Optimistic | Speculative/High Growth Potential |

| Key 2025 Challenge | Adoption Competition | Network Stability & Scaling | Proving Technology at Scale |

Why Mainnet Launches Are Critical Inflection Points

A live mainnet launch represents a fundamental milestone in any blockchain project’s lifecycle. It signifies the shift from theoretical design and controlled testing to open, permissionless, and value-bearing operation. For investors and developers, this is the point where the protocol’s claims meet reality. Metrics such as time-to-finality, average transaction cost under load, and network participation decentralization become publicly verifiable. Historically, successful mainnet launches that demonstrate stability and attract initial use cases—like Ethereum’s in 2015 or Avalanche’s in 2020—have created foundational value. Conversely, launches plagued by bugs, low participation, or security flaws have led to rapid loss of confidence. BlockDAG’s entry into this phase places it under the scrutiny of the entire crypto community, providing the evidence needed to evaluate its long-term viability beyond whitepaper promises.

Conclusion

The cryptocurrency landscape in 2025 showcases a tale of maturation and new entry. Stellar XLM faces headwinds in its core payment niche, leading to price stagnation. Solana’s path to 2026 hinges on proving sustained network resilience and capturing developer mindshare. Meanwhile, BlockDAG’s live mainnet and TGE introduce a new architectural proposition into the market, carrying high-growth expectations that must now be validated by operational performance and ecosystem adoption. Informed participants will monitor on-chain data, developer activity, and real-world utility metrics across all these projects, rather than price speculation alone, to understand the evolving story of blockchain technology.

FAQs

Q1: What does “Stellar flatlining” mean in practical terms?

It refers to a period of low volatility and minimal price movement for Stellar (XLM), often accompanied by declining trading volume and on-chain activity, indicating a lack of strong buying or selling pressure.

Q2: What is the most important factor for Solana’s price recovery by 2026?

Most analysts point to consistent, uninterrupted network uptime and growth in its decentralized application (dApp) ecosystem, particularly in decentralized finance (DeFi) and consumer applications, as the primary factors needed for a sustained positive trend.

Q3: What is a Token Generation Event (TGE)?

A Token Generation Event is the process by which a new cryptocurrency is officially created and distributed on its native blockchain, often marking the transition from a test network to a live, value-bearing mainnet.

Q4: How is BlockDAG’s technology different from Bitcoin or Ethereum?

BlockDAG proposes a hybrid model using a Directed Acyclic Graph (DAG) structure for organizing transactions, which allows for parallel processing, combined with a proof-of-work (PoW) mechanism for security. This contrasts with Bitcoin’s linear blockchain and Ethereum’s current proof-of-stake chain.

Q5: Are projections of 200× potential for new cryptocurrencies reliable?

No, such projections are highly speculative and represent optimistic, best-case scenarios. They should not be considered financial forecasts. All cryptocurrency investments carry significant risk, and potential returns are never guaranteed.