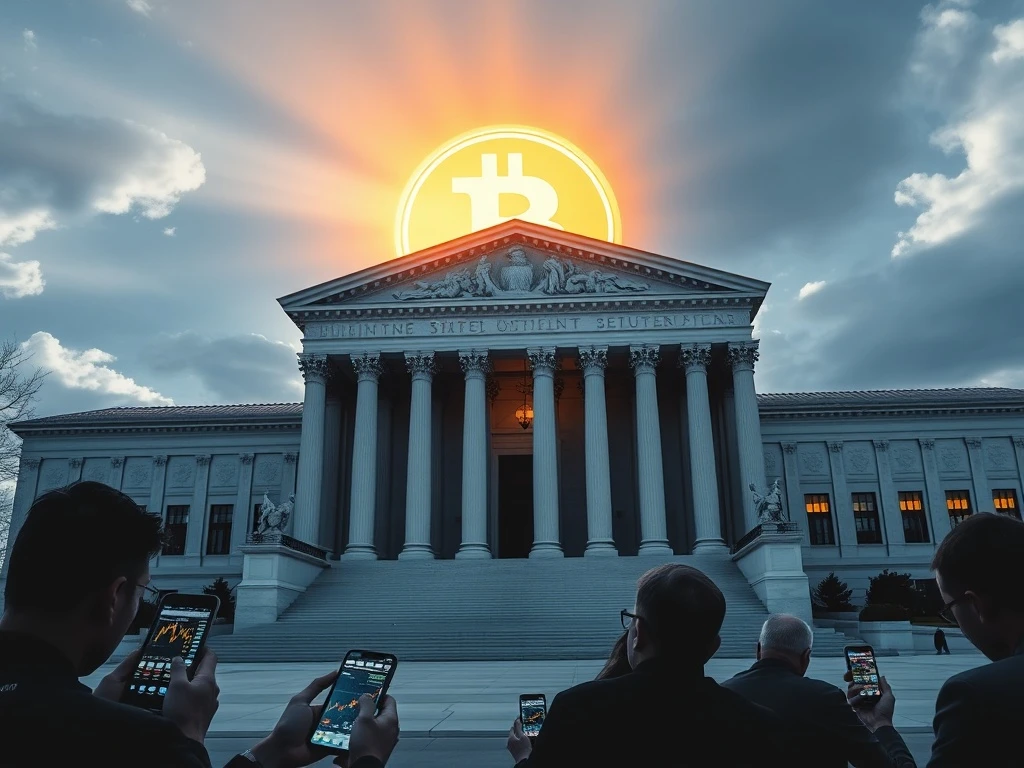

Bitcoin Braces for Impact: The Supreme Court’s Looming Verdict Threatens Crypto Markets

As Bitcoin consolidates near the $90,000 mark in early 2025, a formidable external force threatens to shatter its fragile stability: an impending decision from the United States Supreme Court. The highest court’s ruling on former President Donald Trump’s tariff policies has emerged as a critical catalyst with the potential to inject severe volatility into global cryptocurrency markets, demonstrating the digital asset’s deepening entanglement with traditional macroeconomic and legal frameworks.

Bitcoin’s Technical Stalemate and Trader Hesitation

For approximately two months, Bitcoin has exhibited uncharacteristic indecision, trading within a tight corridor between $88,000 and $92,000. This prolonged consolidation phase reflects a market in waiting. Typically, such a narrow range for a major asset signals a buildup of energy preceding a significant directional move. However, the current stagnation stems not from technical patterns alone but from a profound caution among institutional and retail traders. Analysts observe a notable decline in active engagement. Prominent crypto trader @DaanCryptoTrades recently encapsulated the sentiment on social media platform X, stating a clear disinterest in trading minor fluctuations until a decisive breakout occurs. This collective pause highlights a market prioritizing risk management over speculation, awaiting a fundamental signal strong enough to justify a major position.

The psychological barriers at $88,000 (support) and $92,000 (resistance) have become self-reinforcing. Without a fresh narrative or influx of capital, buy and sell orders continue to neutralize each other. Consequently, Bitcoin’s price action resembles a coiled spring, with its eventual release dependent on an external trigger. This scenario underscores a mature market reality: in the absence of clear information, inactivity often proves wiser than reactionary trading based on noise.

The Supreme Court as a Global Volatility Catalyst

The awaited external trigger now has a name and a date: the United States Supreme Court. The court is poised to rule on the legality of tariffs implemented during the Trump administration, a case with far-reaching implications for international trade policy. While seemingly distant from blockchain technology, the verdict’s impact on global risk assets is direct and potentially severe. Prediction markets, including platforms like Polymarket, currently assign roughly a 74% probability that the Court will deem the tariffs illegal, according to data shared by The Kobeissi Letter.

A ruling against the tariffs could spur a risk-on rally across equities and commodities, potentially benefiting Bitcoin as a correlated risk asset. Conversely, an unexpected affirmation could reignite trade war fears, strengthening the US dollar and prompting a flight from speculative holdings. The crypto analysis firm CoinBureau has highlighted that this decision will “reshape trade policy and cause waves in global markets, including crypto.” The direct link between a Washington legal proceeding and Bitcoin’s valuation powerfully illustrates that cryptocurrency markets no longer operate in a vacuum. They are deeply integrated into the fabric of global finance and geopolitics.

Macroeconomic Headwinds Compound Uncertainty

The Supreme Court case arrives amidst a challenging macroeconomic backdrop that has already tempered bullish enthusiasm for Bitcoin. Recent US economic data has provided little fuel for a sustained rally. December 2024 job creation figures fell short of expectations, and the Federal Reserve has signaled a pause in its interest rate cut cycle. As capital flows toward traditional safe-haven assets and away from risk, Bitcoin faces a liquidity drought. This macroeconomic pressure helps explain why even positive geopolitical developments, like the recent Venezuela-Maduro episode that attracted crypto community attention, failed to propel BTC to new sustainable highs. The asset finds itself caught between competing forces: long-term adoption narratives and short-term macroeconomic friction.

Key Market Indicators as of January 2025:

- BTC Price: ~$90,465, indicating fragile stability within a defined range.

- Critical Zone: $88,000 – $92,000 acting as primary support and resistance.

- Primary Catalyst: Imminent US Supreme Court decision on tariff legality.

- Capital Flows: Relative decline in institutional inflows, slowing bullish momentum.

- Investor Sentiment: Measured caution, with some rotation observed toward traditional assets.

Historical Precedents and Market Psychology

This is not the first time regulatory or legal uncertainty has induced a holding pattern in crypto markets. Historically, events like the SEC’s deliberations on Bitcoin ETF approvals or congressional hearings on digital asset frameworks have led to similar periods of compression and low volatility. These phases often conclude with explosive moves once clarity is achieved. The market’s current behavior suggests it is treating the Supreme Court verdict with comparable gravity. Traders are effectively pricing in a binary outcome, resulting in suppressed volatility until the decision is public. This behavior aligns with traditional market responses to major event risk, such as central bank announcements or election results.

Broader Implications for Crypto Regulation

Beyond immediate price impact, the Supreme Court’s involvement in a matter affecting cryptocurrency markets carries symbolic weight. It reinforces the notion that the legal and regulatory environment for digital assets in the United States remains a dominant factor for global prices. A ruling that influences macroeconomic stability will inevitably influence crypto. Furthermore, this event may set a precedent for how other high-stakes legal decisions—potentially including future cases directly concerning crypto regulation—are perceived by the market. The episode serves as a stark reminder to investors that fundamental analysis of Bitcoin must now routinely incorporate legal and political risk assessments alongside technical and on-chain metrics.

Conclusion

Bitcoin’s current price pressure and consolidation around $90,000 are symptomatic of a market in anticipatory mode, held captive by a macro-legal event. The impending US Supreme Court verdict on Trump-era tariffs represents a potent volatility catalyst that could dictate the cryptocurrency’s trajectory for the coming quarter. This situation highlights Bitcoin’s maturation from a niche digital experiment to a global financial asset deeply sensitive to traditional economic and judicial currents. While technical levels provide a framework, the ultimate direction for Bitcoin will likely be determined not by chart patterns, but by the gavel of the highest court in the United States. Investors and traders are advised to monitor this development closely, as its ramifications will extend far beyond the courtroom.

FAQs

Q1: How could a Supreme Court ruling on tariffs possibly affect Bitcoin?

A1: The ruling will influence global trade policy, economic sentiment, and the US dollar’s strength. Since Bitcoin trades as a risk asset, any decision that sparks risk-on or risk-off movements in traditional markets will directly impact crypto capital flows and volatility.

Q2: What is the expected timeframe for the Supreme Court’s decision?

A2: While the Court’s schedule is not publicized far in advance, legal analysts suggest a ruling could be issued within the current term, making it an imminent event for Q1 or early Q2 of 2025 that the market is actively pricing in.

Q3: Why hasn’t Bitcoin broken out of its current price range on its own?

A3: A combination of factors is causing the stalemate: cautious trader sentiment, a slowdown in institutional capital inflows, and a wait-and-see approach regarding major macroeconomic and legal catalysts like the Supreme Court case.

Q4: Does this mean Bitcoin is now completely tied to traditional finance?

A4: Not completely, but correlation has increased significantly. Bitcoin maintains unique value drivers like adoption and halving cycles, but as institutional investment grows, its short-to-medium-term price action becomes more reactive to broad financial market conditions and geopolitical events.

Q5: What should a crypto investor do in this uncertain environment?

A5: Prudent strategies include practicing robust risk management, avoiding over-leveraged positions ahead of high-volatility events, and focusing on long-term fundamentals rather than attempting to predict the short-term market reaction to the legal ruling.