Bitcoin Hashrate Plummets Below 1000 EH/s: A Critical 15% Drop Sparks Miner Exodus to AI

In a significant development for the world’s largest cryptocurrency, the Bitcoin network hashrate has plunged below the 1000 exahash per second threshold for the first time in four months. This notable decline, representing a substantial 15% drop from recent peaks, signals a potential strategic shift within the global mining industry as operators pursue more lucrative opportunities in artificial intelligence. The movement of computational power away from Bitcoin’s proof-of-work consensus mechanism raises important questions about network security and miner economics in the evolving digital landscape.

Bitcoin Hashrate Decline: Analyzing the Four-Month Low

According to comprehensive data from the Hashrate Index, the Bitcoin network’s seven-day average hashrate currently stands at 993 EH/s. This figure represents a meaningful departure from the 1157 EH/s peak recorded on October 19 of last year. The hashrate metric, which measures the total computational power dedicated to mining and processing transactions on the Bitcoin blockchain, serves as a crucial indicator of network security and miner participation. Historically, Bitcoin’s hashrate has demonstrated remarkable resilience and consistent growth, making this recent reversal particularly noteworthy for market observers and network participants.

The descent below 1000 EH/s marks the first breach of this psychological barrier since late 2023. Network analysts have documented similar declines following previous Bitcoin halving events, but the current drop appears more directly tied to external economic factors rather than scheduled protocol adjustments. This development coincides with increasing institutional interest in artificial intelligence infrastructure, creating competitive pressure on mining operations that traditionally dominated the high-performance computing sector.

Understanding Hashrate Fundamentals and Network Security

Bitcoin’s security model fundamentally depends on its distributed hashrate. The proof-of-work consensus mechanism requires miners to solve complex cryptographic puzzles, with the network’s total computational power determining the difficulty of these mathematical challenges. A higher hashrate generally corresponds to greater resistance against potential 51% attacks, where a malicious actor could theoretically control the majority of network power. Consequently, the recent 15% reduction warrants careful examination despite remaining well above levels that would compromise fundamental network integrity.

The relationship between hashrate and mining difficulty creates a self-regulating economic system. Bitcoin’s protocol automatically adjusts mining difficulty approximately every two weeks based on the total computational power dedicated to the network. This mechanism ensures consistent block production times regardless of miner participation levels. The current hashrate decline will trigger a corresponding difficulty adjustment in the coming weeks, potentially improving profitability for remaining miners through reduced competition for block rewards.

Historical Context and Comparative Analysis

Examining historical hashrate data reveals several previous instances of significant declines followed by robust recoveries. The most dramatic example occurred during China’s 2021 mining ban, when Bitcoin’s hashrate dropped approximately 50% before completely recovering within six months as operations relocated to North America and Central Asia. The current 15% decline appears less severe by comparison but reflects different underlying causes tied to economic optimization rather than regulatory intervention.

Comparative analysis with other proof-of-work cryptocurrencies shows varied responses to similar market conditions. Networks with smaller hashrates typically experience greater volatility during industry transitions, while Bitcoin’s substantial baseline provides relative stability despite percentage declines. This resilience stems from the network’s established infrastructure and the significant capital investment already deployed across global mining facilities.

The AI Investment Thesis: Why Miners Are Diversifying

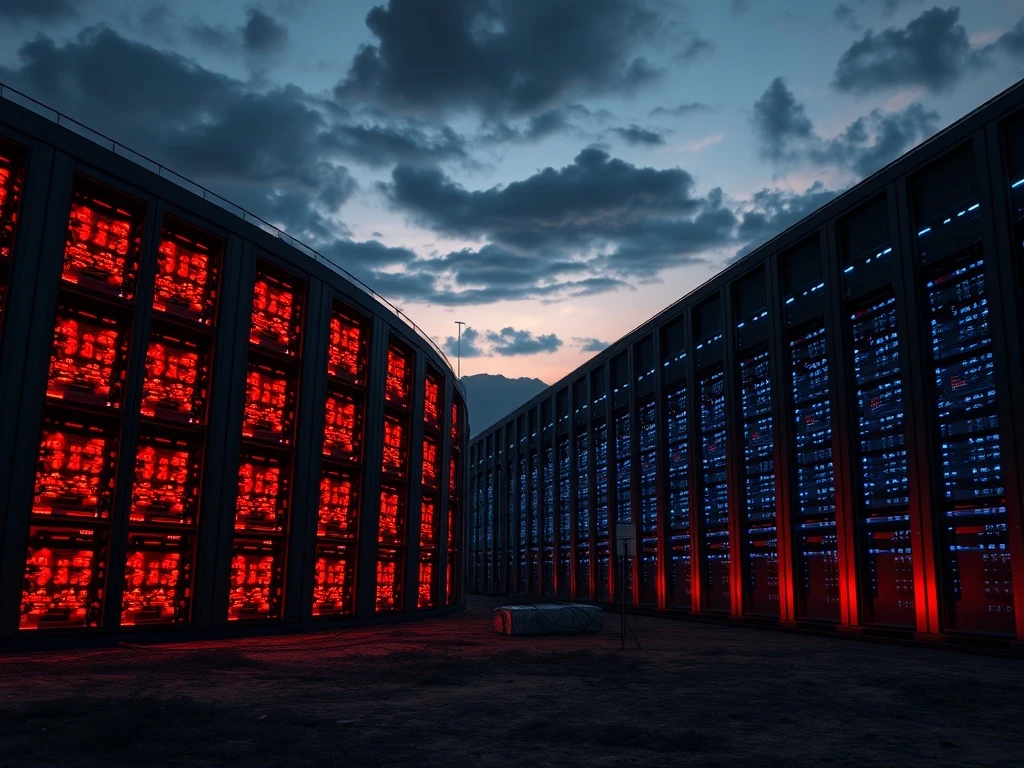

Industry analysts increasingly point toward artificial intelligence infrastructure as the primary catalyst for the hashrate decline. Bitcoin mining operations require specialized hardware optimized for cryptographic computations, particularly application-specific integrated circuits (ASICs). These powerful machines consume substantial electricity while generating intense heat, necessitating sophisticated cooling solutions and reliable power infrastructure. Interestingly, these same characteristics—high computational density, robust cooling requirements, and stable power access—make mining facilities potentially suitable for AI workload processing with appropriate hardware modifications.

The economic proposition driving this transition involves significantly higher potential returns from AI computation versus Bitcoin mining at current market conditions. Several factors contribute to this profitability differential:

- Revenue Stability: AI service contracts often provide more predictable income streams compared to Bitcoin’s volatile mining rewards

- Energy Efficiency: Some AI workloads can utilize existing infrastructure more efficiently than continuous mining operations

- Market Timing: The current AI boom coincides with compressed Bitcoin mining margins following the 2024 halving

- Hardware Flexibility: Next-generation mining facilities increasingly incorporate modular designs adaptable to multiple computational workloads

Major mining companies have publicly disclosed strategic initiatives to allocate portions of their computational resources to AI services. These announcements typically emphasize the complementary nature of both sectors rather than complete abandonment of Bitcoin mining. The hybrid approach allows operators to maintain Bitcoin network participation while capturing value from the rapidly expanding artificial intelligence market.

Infrastructure Adaptation and Technical Challenges

Transitioning from Bitcoin mining to AI computation involves substantial technical considerations beyond simple profitability calculations. Mining ASICs excel at performing the specific SHA-256 algorithm required for Bitcoin but lack the general-purpose processing capabilities needed for most AI workloads. Consequently, facilities pursuing AI opportunities typically require different hardware configurations, though they can leverage existing power contracts, cooling systems, and geographical advantages.

The most successful transitions involve purpose-built facilities designed from inception to support multiple computational paradigms. These next-generation data centers incorporate flexible rack designs, advanced liquid cooling solutions, and dynamic power management systems. Such infrastructure investments represent significant capital commitments but provide operational resilience against single-market volatility. The current hashrate decline partially reflects temporary disruptions as operators reconfigure facilities for diversified computational services.

Market Implications and Network Health Assessment

The Bitcoin hashrate reduction carries several immediate and longer-term implications for network participants and cryptocurrency investors. From a security perspective, the current level remains sufficiently high to maintain robust protection against coordinated attacks, though continued declines would warrant increased monitoring. The network’s decentralized nature and global distribution of mining power provide additional safeguards against localized disruptions affecting specific regions or operators.

Mining profitability metrics show interesting dynamics following the hashrate decline. With fewer participants competing for block rewards, individual miners may experience improved returns despite the overall reduction in network power. This economic rebalancing represents the proof-of-work mechanism functioning as designed, automatically adjusting difficulty to maintain equilibrium between participation and rewards. Historical patterns suggest such adjustments typically precede periods of renewed miner interest as profitability improves.

The broader cryptocurrency market often interprets hashrate movements as indicators of miner sentiment and network health. While short-term declines sometimes correlate with price weakness, the relationship remains complex with numerous intervening variables. The current situation differs meaningfully from previous hashrate reductions because it stems from attractive alternatives rather than fundamental problems with Bitcoin mining economics. This distinction suggests potential for rapid recovery should AI profitability moderate or Bitcoin mining conditions improve.

Geographical Considerations and Regulatory Environment

The hashrate decline exhibits notable geographical patterns reflecting regional differences in energy costs, regulatory frameworks, and AI infrastructure development. North American mining operations, particularly those in Texas and other deregulated energy markets, appear most active in pursuing AI diversification strategies. These regions combine competitive electricity pricing with robust technology sectors actively seeking computational resources for artificial intelligence development.

Conversely, mining operations in regions with less developed AI ecosystems or restrictive energy policies show greater continuity in Bitcoin-focused activities. This geographical variation contributes to the hashrate decline’s uneven impact across the global mining landscape. The resulting redistribution of computational power may gradually alter Bitcoin’s geographical decentralization, though the network’s inherent design mitigates concentration risks through its permissionless participation model.

Regulatory developments in both cryptocurrency and artificial intelligence sectors will significantly influence future hashrate trajectories. Clear regulatory frameworks for digital asset mining provide stability for long-term infrastructure investments, while AI computation faces evolving standards regarding data privacy, algorithmic transparency, and computational ethics. Mining operators navigating both regulatory environments must balance compliance requirements with operational flexibility across multiple technological domains.

Conclusion

The Bitcoin network hashrate decline below 1000 EH/s represents a meaningful development in cryptocurrency mining economics, primarily driven by attractive alternatives in artificial intelligence computation. This 15% reduction from recent peaks reflects strategic reallocation rather than fundamental weakness in Bitcoin’s value proposition or security model. The network’s adaptive difficulty mechanism will automatically rebalance mining economics, potentially improving profitability for remaining participants while maintaining robust security through distributed global infrastructure. As computational resources increasingly flow toward multiple high-value applications, Bitcoin mining operations demonstrate remarkable adaptability in optimizing returns across evolving technological landscapes. The current hashrate movement highlights the dynamic intersection of cryptocurrency, artificial intelligence, and global energy markets—a convergence that will likely define computational infrastructure development throughout the coming decade.

FAQs

Q1: What does Bitcoin hashrate measure and why is it important?

A1: Bitcoin hashrate measures the total computational power dedicated to mining new blocks and securing the network. It serves as a crucial security metric, with higher hashrate generally indicating greater resistance to potential attacks. The hashrate also influences mining difficulty and profitability for network participants.

Q2: How significant is a 15% hashrate decline for Bitcoin’s security?

A2: While notable, a 15% decline from recent peaks remains within historical norms and doesn’t compromise fundamental network security. Bitcoin’s hashrate has experienced larger percentage drops during previous market cycles without significant security incidents, thanks to the network’s decentralized architecture and substantial baseline computational power.

Q3: Can mining facilities easily switch between Bitcoin and AI computation?

A3: Transitioning requires substantial hardware changes since Bitcoin ASICs specialize in cryptographic computations while AI typically uses general-purpose GPUs. However, mining facilities can leverage existing power infrastructure, cooling systems, and geographical advantages when adding AI capabilities, often through hybrid configurations rather than complete conversions.

Q4: How does Bitcoin’s difficulty adjustment respond to hashrate changes?

A4: Bitcoin’s protocol automatically adjusts mining difficulty approximately every two weeks based on average block production times. A hashrate decline typically leads to reduced difficulty in subsequent adjustments, improving profitability for remaining miners by decreasing the computational effort required to mine new blocks.

Q5: Could the hashrate decline affect Bitcoin’s price or transaction processing?

A5: Hashrate changes don’t directly impact transaction processing speed or confirmation times, which the protocol maintains at consistent intervals. While hashrate movements sometimes correlate with price trends, the relationship involves numerous variables, and current declines appear driven by external opportunities rather than Bitcoin-specific concerns.