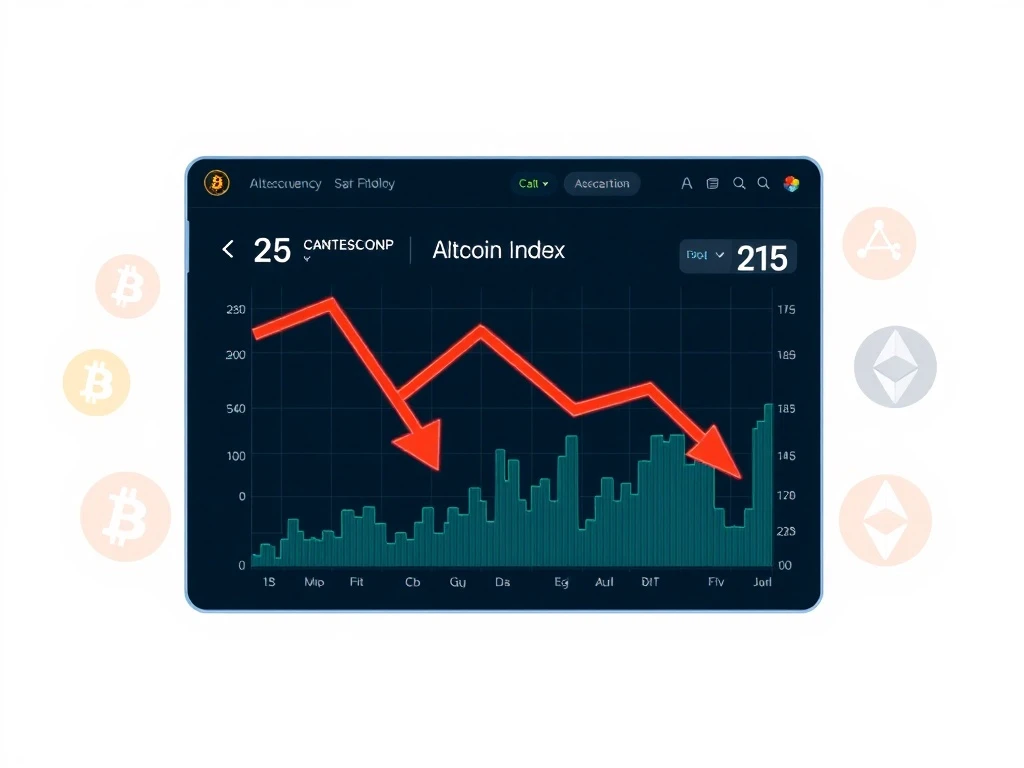

Altcoin Season Index Plummets to 25, Signaling a Critical Shift in Crypto Market Sentiment

Global cryptocurrency markets witnessed a significant shift in momentum on April 10, 2025, as CoinMarketCap’s widely-tracked Altcoin Season Index fell four points to a reading of 25. This notable decline moves the market further from the conditions that define a robust altcoin season, sparking analysis among traders and portfolio managers worldwide. The index serves as a crucial barometer for understanding capital rotation between Bitcoin and alternative cryptocurrencies.

Decoding the Altcoin Season Index Drop

CoinMarketCap’s Altcoin Season Index provides a quantitative measure of market structure. The platform calculates this metric by analyzing the performance of the top 100 cryptocurrencies by market capitalization over a rolling 90-day period. Crucially, the index excludes stablecoins and wrapped assets to focus purely on speculative performance. A score above 75 traditionally signals an ‘altcoin season,’ where at least 75% of these major altcoins outperform Bitcoin. Conversely, a score below 25 strongly indicates a ‘Bitcoin season,’ where the pioneer cryptocurrency leads the market. The drop to 25 places the market precisely at this critical threshold.

Market analysts immediately scrutinized the underlying data. The four-point decline did not occur in isolation; it reflects a sustained trend observed over several weeks. This trend suggests a consolidation of capital and investor preference. Historically, such shifts often precede periods of increased volatility or trend confirmation. The current reading implies that Bitcoin is matching or exceeding the performance of a significant majority of major altcoins, challenging the ‘risk-on’ sentiment that typically fuels altcoin rallies.

Historical Context and Market Cycle Analysis

Understanding the index’s movement requires examining past crypto market cycles. For instance, during the bull market of late 2020 into early 2021, the Altcoin Season Index repeatedly surged above 75, leading to explosive gains for projects across decentralized finance (DeFi) and non-fungible tokens (NFTs). Conversely, prolonged bear markets often see the index languish below 25 for months, highlighting Bitcoin’s relative resilience as a safe-haven asset within the digital asset class.

The transition between these phases rarely happens abruptly. Instead, it typically involves a gradual shift in liquidity. Investors often rotate profits from high-performing altcoins back into Bitcoin during times of uncertainty or macroeconomic stress. The current global financial landscape, characterized by evolving interest rate policies and geopolitical tensions, provides a plausible macro backdrop for such a rotation. This index movement offers a data point confirming that this rotational behavior is actively occurring within crypto markets.

Expert Insights on Capital Rotation

Seasoned market participants interpret the index through the lens of capital flow. ‘The Altcoin Season Index is essentially a gauge of speculative appetite,’ notes a veteran crypto fund manager, whose analysis is frequently cited in financial publications. ‘When it falls, it signals that investors are de-risking. They are moving capital from higher-beta, more experimental altcoins toward the established, institutional-grade narrative of Bitcoin, especially with the maturation of ETF products.’ This behavior mirrors traditional finance, where investors might shift from growth stocks to value or defensive assets.

This rotation has tangible effects on trading volumes and project development. Altcoin projects often see reduced trading volume and social engagement during Bitcoin-dominant phases. However, these periods can also foster healthier ecosystems by washing out excessive speculation and allowing fundamental development to continue away from the hype cycle’s glare. The index, therefore, is not just a trading signal but also an indicator of market maturity and focus.

Implications for Investor Portfolios and Strategy

The declining index reading carries direct implications for investment strategy. A low Altcoin Season Index suggests a different risk-reward profile for asset allocation. During Bitcoin seasons, diversified portfolios heavily weighted toward altcoins may underperform a simple Bitcoin holding strategy. Conversely, a low index can present accumulation opportunities for altcoins with strong fundamentals, as prices may be depressed relative to their long-term potential.

Investors should consider several key factors:

- Time Horizon: Short-term traders may view this as a signal to reduce altcoin exposure, while long-term holders might see a buying opportunity.

- Correlation Analysis: Not all altcoins move in lockstep. Some sectors, like decentralized physical infrastructure (DePIN) or real-world assets (RWA), may demonstrate lower correlation to the broader index.

- On-Chain Metrics: Smart investors combine the index with on-chain data, such as exchange flows and holder concentration, to build a more complete picture.

The table below summarizes typical market characteristics associated with different index ranges:

| Index Range | Market Phase | Typical Investor Sentiment | Common Strategy |

|---|---|---|---|

| > 75 | Altcoin Season | High risk appetite, ‘FOMO’ | Momentum trading, altcoin accumulation |

| 25 – 75 | Transition / Neutral | Cautious, selective | Core Bitcoin position with selective altcoin bets |

| < 25 | Bitcoin Season | Risk-off, defensive | Bitcoin dominance, stablecoin yield, altcoin accumulation for long-term holds |

The Road Ahead: Monitoring for a Trend Reversal

The critical question for the market is whether this drop to 25 represents a local bottom or the beginning of a prolonged Bitcoin-dominant phase. Monitoring the index over the coming weeks will be essential. A swift recovery back above 30 or 40 would indicate the altcoin market retains underlying strength and the dip was a temporary correction. However, a consolidation below 25, or a further decline, would strongly confirm the dominance of Bitcoin’s narrative.

Several catalysts could reignite altcoin momentum. These include breakthrough developments in blockchain scalability, a surge in new user adoption for a specific application, or a decisive shift toward a more dovish global monetary policy. Until such catalysts emerge, the weight of the evidence, as shown by the Altcoin Season Index, suggests a market environment favoring caution and a potential reassessment of altcoin allocations.

Conclusion

The Altcoin Season Index’s decline to 25 provides a clear, data-driven signal of changing market dynamics. This movement away from altcoin dominance underscores a current preference for Bitcoin’s relative stability and established market position. While not predictive of individual asset performance, the index offers invaluable context for understanding broader capital flows and sentiment within the volatile cryptocurrency landscape. Investors and analysts will watch the index closely for signs of stabilization or further decline, using it as one key tool among many to navigate the complex crypto market cycle.

FAQs

Q1: What does an Altcoin Season Index of 25 mean?

An index reading of 25 means the market is at the threshold of a ‘Bitcoin season.’ It indicates that Bitcoin is performing as well as or better than the vast majority of top altcoins over the past 90 days, suggesting capital is flowing towards Bitcoin and away from higher-risk altcoins.

Q2: How is the Altcoin Season Index calculated?

CoinMarketCap calculates the index by tracking the 90-day performance of the top 100 cryptocurrencies (excluding stablecoins and wrapped tokens) against Bitcoin’s performance. The score reflects the percentage of these altcoins outperforming Bitcoin. A score of 100 would mean all are outperforming.

Q3: Should I sell all my altcoins when the index is low?

Not necessarily. A low index is a macro indicator, not specific investment advice. It may suggest reducing aggressive altcoin allocations or rebalancing toward Bitcoin, but altcoins with strong fundamentals can still perform well. It often signals a time for selective, research-driven investing rather than broad speculation.

Q4: How often does the Altcoin Season Index update?

The index updates daily, reflecting the latest 90-day rolling performance data. This allows traders and investors to monitor gradual shifts in market momentum as they happen.

Q5: Has the index ever been wrong in predicting market phases?

The index is a descriptive metric, not a predictive one. It confirms what has already happened over a quarter. It can ‘lag’ behind sudden market turns. It is most powerful when used with other indicators like trading volume, on-chain data, and macroeconomic analysis to form a complete market view.