Coinbase Premium Surges Dramatically – Is US Institutional Selling Pressure Finally Easing?

NEW YORK, March 2025 – The cryptocurrency market witnessed a significant development this week as Coinbase Premium, a crucial institutional sentiment indicator, recorded its most substantial positive jump in three months, potentially signaling a major shift in US institutional selling pressure that has dominated markets since early 2024.

Understanding the Coinbase Premium Surge

Coinbase Premium represents the price difference between Bitcoin on Coinbase Pro and other major exchanges, particularly Binance. This metric serves as a reliable gauge of US institutional activity because Coinbase maintains strong regulatory compliance and serves primarily American institutional investors. Consequently, a positive premium indicates stronger buying pressure from US institutions, while a negative premium suggests selling pressure.

The recent surge in Coinbase Premium reached 0.8% on Tuesday, marking the highest level since December 2024. This development follows months of predominantly negative premiums that reflected consistent institutional selling. Market analysts immediately noted this reversal, especially given its timing relative to broader market conditions.

Historical Context of US Institutional Pressure

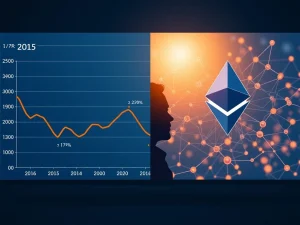

US institutional investors have exerted substantial selling pressure on cryptocurrency markets throughout 2024. Several factors contributed to this trend, including regulatory uncertainty, tax harvesting strategies, and portfolio rebalancing following the 2023 bull market. The sustained negative Coinbase Premium throughout most of 2024 reflected this institutional caution.

However, the current premium surge coincides with several important developments. First, clearer regulatory frameworks have emerged from recent SEC guidance. Second, major financial institutions have completed their quarterly rebalancing cycles. Third, macroeconomic conditions have shifted with changing interest rate expectations. These factors collectively created conditions for potential institutional re-entry.

Comparative Exchange Flow Analysis

Exchange flow data provides crucial context for understanding the Coinbase Premium movement. While Coinbase shows net inflows, other exchanges present mixed signals:

- Coinbase: Net inflow of 8,200 BTC over the past week

- Binance: Net outflow of 3,500 BTC during same period

- Kraken: Neutral flows with slight accumulation

- Gemini: Moderate inflows continuing previous trend

This divergence between exchanges suggests geographic and institutional segmentation in current market behavior. The US-focused exchanges show markedly different patterns than their international counterparts.

Taker Buy Sell Ratio Contradiction

Interestingly, the positive Coinbase Premium development contrasts with another key metric reported by CryptoNewsInsights. The Taker Buy Sell Ratio, which measures the volume of market buy orders versus market sell orders, dropped significantly one day before the premium surge. This indicator typically reflects retail trader sentiment rather than institutional activity.

The divergence between these two metrics reveals a crucial market dynamic. While retail traders may exhibit bearish sentiment, institutional investors appear to be taking contrarian positions. This separation between retail and institutional behavior often precedes significant market movements, as institutions typically lead retail in both accumulation and distribution phases.

Expert Analysis of Market Divergence

Market analysts provide important perspective on these conflicting signals. According to institutional trading desk reports, the Taker Buy Sell Ratio decline likely reflects retail reaction to short-term price volatility. Meanwhile, the Coinbase Premium surge indicates institutional response to longer-term fundamental developments.

This divergence creates potential opportunities for market participants who correctly interpret the signals. Historically, when institutional and retail sentiment diverge significantly, institutional positioning tends to predict future price movements more accurately. The current situation mirrors patterns observed in early 2023 before the institutional-led rally.

Technical and Fundamental Drivers

Several technical and fundamental factors support the interpretation of fading US selling pressure. On the technical side, Bitcoin has established strong support levels despite recent volatility. The $60,000 level has held through multiple tests, providing confidence to institutional buyers.

Fundamentally, several developments support institutional accumulation:

- Regulatory clarity: Recent SEC guidance provides clearer compliance pathways

- Institutional infrastructure: Improved custody and trading solutions

- Macroeconomic shifts: Changing interest rate expectations

- Adoption milestones: Continued institutional blockchain integration

These factors collectively reduce the perceived risk for institutional investors, potentially explaining the shift from selling to accumulation.

Market Impact and Future Implications

The potential fading of US institutional selling pressure carries significant implications for cryptocurrency markets. Historically, US institutional flows have served as leading indicators for broader market direction. Their accumulation phases typically precede retail FOMO and subsequent price appreciation.

If the current Coinbase Premium surge represents a sustained trend rather than a temporary anomaly, several outcomes become probable. First, reduced selling pressure would provide stronger price support. Second, institutional accumulation could absorb available supply more efficiently. Third, improved sentiment could attract additional institutional participants.

Risk Factors and Considerations

Despite the optimistic interpretation, several risk factors warrant consideration. The premium surge could represent temporary positioning rather than sustained accumulation. Additionally, macroeconomic developments could reverse recent gains. Regulatory developments remain unpredictable, and external market shocks could affect all risk assets.

Market participants should monitor several confirming indicators. Sustained positive premiums over multiple weeks would strengthen the fading pressure thesis. Increasing institutional custody balances would provide additional confirmation. Finally, derivatives market positioning should align with spot market flows for a coherent narrative.

Conclusion

The dramatic surge in Coinbase Premium represents a potentially significant development for cryptocurrency markets. While the Taker Buy Sell Ratio indicates continued retail bearishness, institutional indicators suggest shifting dynamics. The apparent fading of US institutional selling pressure, if sustained, could signal an important market inflection point. Market participants should monitor confirming indicators while recognizing that single data points require broader context for proper interpretation. The coming weeks will reveal whether this Coinbase Premium movement represents temporary positioning or a fundamental shift in institutional cryptocurrency strategy.

FAQs

Q1: What exactly is Coinbase Premium?

Coinbase Premium measures the price difference between Bitcoin on Coinbase Pro and other major exchanges like Binance. It serves as an indicator of US institutional sentiment because Coinbase primarily serves American institutional investors under strict regulatory compliance.

Q2: Why does Coinbase Premium matter for cryptocurrency markets?

The premium matters because US institutional investors significantly influence market direction. Their buying or selling pressure often precedes broader market movements, making Coinbase Premium a valuable leading indicator for institutional sentiment and potential price trends.

Q3: How does the Taker Buy Sell Ratio differ from Coinbase Premium?

The Taker Buy Sell Ratio measures the volume of immediate market buy orders versus sell orders, primarily reflecting retail trader sentiment. Coinbase Premium reflects institutional positioning through price differences between exchanges, making these complementary but distinct indicators.

Q4: What factors could reverse the fading selling pressure trend?

Several factors could reverse the trend, including negative regulatory developments, adverse macroeconomic shifts, unexpected institutional outflows, or broader risk asset selloffs. Sustained market volatility might also cause institutions to pause accumulation strategies.

Q5: How long should the premium remain positive to confirm the trend?

Market analysts typically look for sustained positive premiums over 2-3 weeks to confirm a genuine trend shift. Single-day movements can represent temporary positioning, while sustained patterns indicate more fundamental changes in institutional behavior and sentiment.