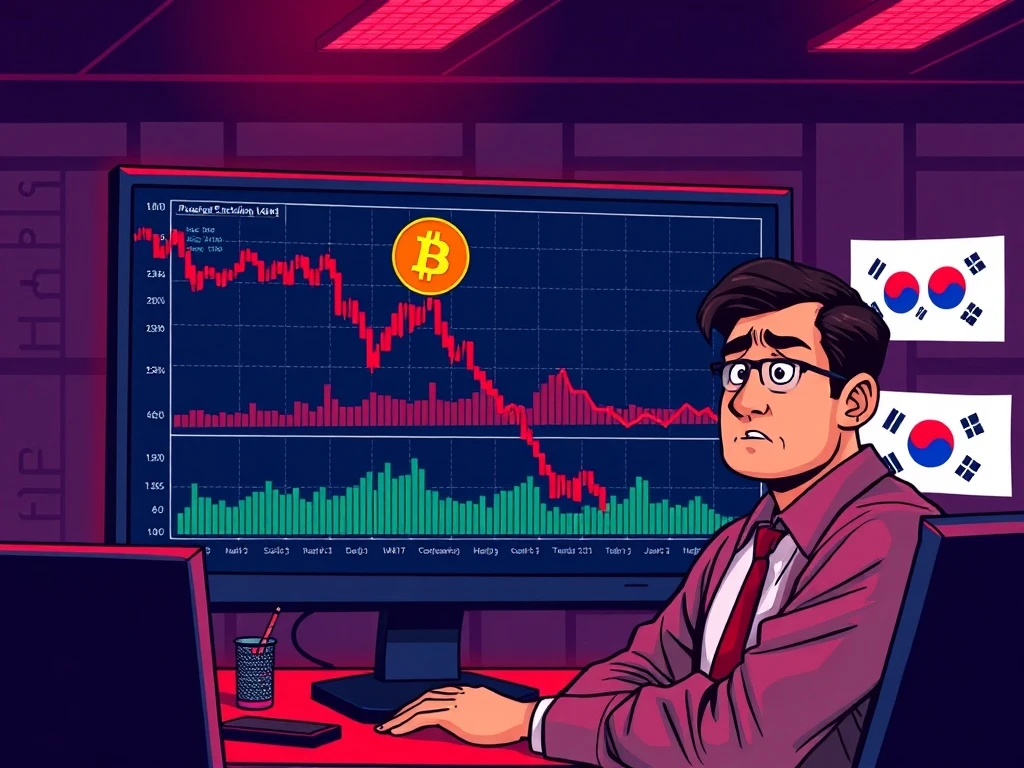

Bitcoin Price Plummets on Bithumb: Shocking Staff Error Transfers 2,000 BTC

In a startling development for the cryptocurrency market, the Bitcoin price on South Korea’s Bithumb exchange experienced a sharp and sudden plummet. This dramatic drop followed a significant operational error by exchange staff, who mistakenly transferred 2,000 BTC—worth approximately $140 million at the time—during an airdrop campaign. The incident, first flagged by blockchain analytics firm Lookonchain, sent immediate shockwaves through trading platforms and highlighted critical vulnerabilities in digital asset management procedures. Market analysts quickly noted the event’s potential to erode trader confidence and trigger broader volatility, underscoring the fragile interplay between human oversight and high-value crypto transactions.

Bitcoin Price Volatility Following the Bithumb Incident

The immediate aftermath of the erroneous transfer saw the Bitcoin price on Bithumb deviate significantly from global benchmarks. Typically, arbitrage bots work to keep prices aligned across exchanges. However, the sudden, unexpected movement of such a large volume of Bitcoin created a localized supply shock. Consequently, automated sell orders likely exacerbated the initial decline. This event provides a clear, real-time case study in how internal operational failures can directly impact market prices, even for an asset as large as Bitcoin. Furthermore, the incident occurred against a backdrop of heightened regulatory scrutiny on global cryptocurrency exchanges, adding another layer of context to its significance.

Blockchain data serves as the immutable ledger for this event. Analysts at Lookonchain tracked the movement of the 2,000 BTC from a Bithumb-controlled wallet to a series of external addresses. This transparency, while a hallmark of blockchain technology, also meant the error was publicly visible almost instantly. The speed of information dissemination in crypto markets amplified the price reaction. Traders and algorithms reacted to the data, interpreting the large outflow as a potential sign of distress or a major sell-off. This sequence demonstrates the powerful role real-time blockchain analytics now plays in modern financial markets.

Expert Analysis of Exchange Risk Management

Industry experts point to this event as a textbook example of operational risk. “While exchanges invest heavily in cybersecurity against external threats, internal process failures remain a potent risk,” noted a veteran blockchain security consultant. “A transfer of this magnitude should require multiple layers of verification, including time delays and multi-signature approvals.” The error reportedly occurred within the context of an airdrop campaign—a common marketing tactic where tokens are distributed to users. This suggests a possible breakdown in the procedure separating promotional token distributions from core exchange treasury management. Such incidents force a re-evaluation of internal controls at even the most established trading platforms.

Understanding the Impact on Market Structure and Trader Confidence

The repercussions of the Bithumb error extend beyond a temporary Bitcoin price dip. Market structure relies heavily on trust in the integrity and stability of major liquidity hubs like exchanges. When a leading platform demonstrates a critical flaw in its operational safeguards, it can lead to a migration of volume and assets to competitors perceived as more secure. In the days following the incident, analysts monitored withdrawal patterns from Bithumb for signs of eroding user confidence. Additionally, the event sparked immediate discussions among regulators in South Korea and other jurisdictions about mandating stricter operational protocols for crypto custodians.

The table below outlines key metrics related to the incident:

| Metric | Detail | Context |

|---|---|---|

| Amount Transferred | 2,000 BTC | Equivalent to ~$140M at time of event |

| Source | Bithumb Exchange Treasury | Internal operational error during airdrop |

| Data Source | Lookonchain Analytics | Public blockchain data confirmation |

| Primary Impact | Localized Bitcoin Price Plunge | Significant deviation from global average |

| Broader Risk Category | Operational/Internal Control Failure | Distinct from external hack or exploit |

For traders, the incident reinforced several critical lessons. First, it highlighted the risks of holding large balances on any single exchange, a principle often called “not your keys, not your coins.” Second, it demonstrated how non-market events—like administrative errors—can create profitable arbitrage opportunities but also substantial losses for those caught on the wrong side of the volatility. Finally, the market’s relatively quick recovery suggested that the error was recognized as isolated, preventing a full-blown contagion event. However, the psychological impact on market participants dealing with Bithumb may have longer-lasting effects.

The Role of Blockchain Transparency in Crisis Management

Paradoxically, the very feature that exposed the error—blockchain transparency—also aided in crisis containment. Because the transaction was publicly recorded, Bithumb could not conceal the mistake. This forced immediate acknowledgment and, presumably, corrective action. The transparent ledger allowed analysts and the community to track the mistakenly sent funds, reducing fear that the exchange had been hacked or was insolvent. In a traditional financial setting, such an internal error might remain obscured for much longer, potentially causing greater uncertainty. Therefore, this event serves as a dual lesson in both the pitfalls of human error and the stabilizing power of transparent accounting in decentralized systems.

In response, the exchange likely initiated a multi-step recovery process. Standard protocol involves attempting to contact the recipients of the erroneous transfer, though recovery is not guaranteed if sent to non-custodial wallets. Simultaneously, risk and compliance teams would audit internal procedures to identify the exact point of failure. Technically, exchanges often implement stricter controls like whitelisted addresses, withdrawal limits, and mandatory cooling-off periods for large transactions. The fact that this error bypassed such safeguards indicates a significant procedural breakdown, which will be the focus of internal and possibly external investigations.

Historical Context and Precedents

This is not the first time an exchange error has moved markets. Historical precedents include:

- Mt. Gox (2014): Catastrophic hack and operational failures led to collapse, different in scale and cause but foundational for exchange risk awareness.

- Coincheck (2018): A $534 million hack of NEM tokens highlighted inadequate security practices at a Japanese exchange.

- Binance (2021): An institutional client’s trading error caused a flash crash in Bitcoin’s price, showing how large orders can destabilize markets.

However, the Bithumb event is distinct as a clear-cut internal administrative mistake rather than a security breach or aggressive trading action. This distinction is crucial for regulators and insurers who categorize and price these risks differently. The incident adds a new data point to the growing understanding of operational risk in digital asset ecosystems.

Conclusion

The sudden plummet in the Bitcoin price on Bithumb following a staff error transferring 2,000 BTC is a significant event with layered implications. It underscores the persistent human element in digital finance, where a single procedural failure can trigger substantial market volatility. While blockchain transparency allowed for rapid verification and contained broader panic, the incident damages trust and will inevitably lead to stricter internal controls at exchanges globally. For the market, it is a reminder that cryptocurrency prices remain susceptible to technical and operational shocks, not just macroeconomic trends. As the industry matures, robust operational risk management will become just as important as cybersecurity in ensuring ecosystem stability and protecting investor assets.

FAQs

Q1: What exactly caused the Bitcoin price to drop on Bithumb?

A1: The price drop was directly triggered by a large, erroneous transfer of 2,000 BTC from the exchange’s treasury during an airdrop campaign. This created a localized supply shock and prompted automated selling, causing a sharp price decline on their platform.

Q2: Has Bithumb recovered the mistakenly sent 2,000 BTC?

A2: As of the latest reports, the recovery status of the funds is unclear. Exchanges typically attempt to contact recipients of erroneous transfers, but recovery depends on the recipients’ cooperation, as blockchain transactions are irreversible.

Q3: How does this staff error differ from a hack?

A3: This was an internal operational mistake, not an external security breach. A hack involves malicious actors bypassing security. This error involved employees incorrectly executing a legitimate process, falling under operational risk rather than cybersecurity failure.

Q4: Did this affect the global Bitcoin price?

A4: The impact was most severe on Bithumb’s order book, causing a significant deviation from the global average price. There was a minor ripple effect, but major global indices saw less volatility due to arbitrage activity balancing prices across exchanges.

Q5: What should traders learn from this incident?

A5: Traders should be reminded of the importance of using exchanges with robust internal controls, avoiding over-concentration of assets on any single platform, and understanding that non-market events can create sudden volatility.