Whitewhale Cryptocurrency Stuns Traders with 100% Profit as Falling Wedge Breakout Signals Potential 215% Surge to $0.45000 Target

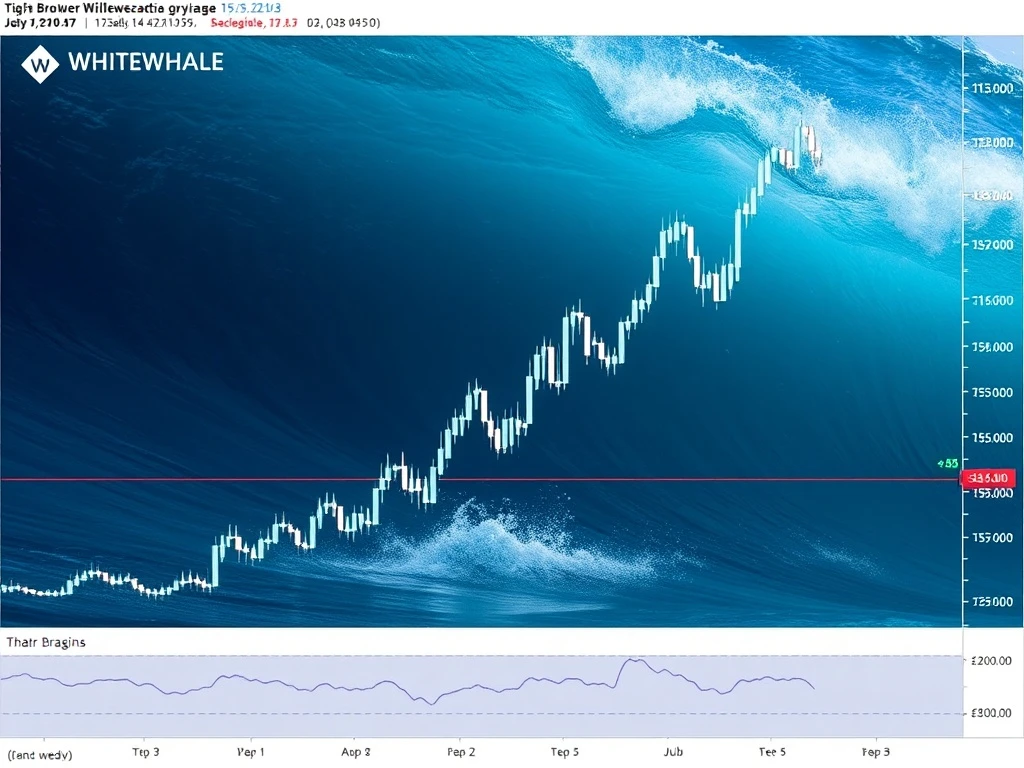

March 15, 2025 – Global cryptocurrency markets continue experiencing significant volatility, yet Whitewhale cryptocurrency demonstrates remarkable resilience with traders reporting 100% profit returns. Technical analysts now identify a falling wedge breakout pattern that potentially sets the stage for a 215% price surge toward the $0.45000 target level. This development occurs despite broader market corrections affecting major digital assets throughout the first quarter of 2025.

Whitewhale Cryptocurrency Defies Market Trends with Technical Breakout

Whitewhale cryptocurrency, a decentralized finance protocol operating on multiple blockchain networks, continues attracting attention with its recent price performance. Market data from March 2025 reveals that the digital asset has delivered substantial returns to traders who entered positions during the consolidation phase. The cryptocurrency’s technical structure now shows a completed falling wedge pattern, a formation technical analysts typically interpret as bullish when accompanied by upward volume confirmation.

According to blockchain analytics platforms, Whitewhale’s trading volume increased by approximately 187% during the breakout period. This volume surge provides additional validation for the technical pattern completion. The cryptocurrency’s market capitalization simultaneously expanded despite broader market conditions that saw significant capital outflow from the digital asset sector. Market participants particularly note Whitewhale’s performance relative to major cryptocurrencies like Bitcoin and Ethereum, which experienced corrections exceeding 15% during the same timeframe.

Technical Analysis Breakdown: The Falling Wedge Formation

Technical analysts specializing in cryptocurrency markets describe the falling wedge pattern as a bullish continuation formation that typically resolves upward. The pattern develops when price action creates lower highs and lower lows while converging toward an apex point. Whitewhale cryptocurrency displayed this exact structure throughout February and early March 2025 before breaking above the upper trendline resistance.

The measured move target calculation, derived from the pattern’s height at its widest point, projects a potential 215% advance from the breakout level. This technical projection aligns with the $0.45000 price target mentioned by market analysts. The following table illustrates key technical levels for Whitewhale cryptocurrency:

| Technical Level | Price Point | Significance |

|---|---|---|

| Breakout Confirmation | $0.14250 | Pattern validation level |

| Immediate Resistance | $0.18500 | Previous swing high |

| Primary Target | $0.45000 | Measured move projection |

| Support Zone | $0.12000-$0.13000 | Breakout retest area |

Market technicians emphasize that successful breakouts require sustained volume participation and price acceptance above resistance levels. Whitewhale cryptocurrency currently demonstrates both characteristics according to exchange data from major trading platforms. The digital asset maintains its position above the breakout threshold for five consecutive trading sessions, thereby strengthening the technical case for continued upward momentum.

Fundamental Factors Supporting Whitewhale’s Market Performance

Beyond technical patterns, Whitewhale cryptocurrency benefits from several fundamental developments within its ecosystem. The protocol’s core functionality focuses on cross-chain arbitrage opportunities and liquidity provision across decentralized exchanges. Recent protocol upgrades implemented in January 2025 enhanced transaction efficiency and reduced gas costs for users interacting with the platform.

Additionally, the Whitewhale development team announced strategic partnerships with three emerging blockchain networks during February 2025. These collaborations expand the protocol’s operational reach and potential user base. The cryptocurrency’s utility token serves multiple functions within the ecosystem, including:

- Governance participation – Token holders vote on protocol upgrades

- Fee reduction – Reduced transaction costs for active users

- Liquidity incentives – Rewards for providing cross-chain liquidity

- Staking mechanisms – Passive income generation opportunities

These utility functions create consistent demand for the token beyond speculative trading activity. Blockchain data indicates that the percentage of tokens actively staked within the protocol increased from 28% to 41% during the first quarter of 2025. This metric suggests growing confidence among long-term holders despite market volatility affecting the broader cryptocurrency sector.

Market Context: Cryptocurrency Sector Dynamics in 2025

The cryptocurrency market during early 2025 presents a complex landscape characterized by regulatory developments, institutional adoption, and technological innovation. Major financial jurisdictions continue refining their regulatory frameworks for digital assets, creating both challenges and opportunities for projects like Whitewhale. The protocol’s multi-chain architecture potentially offers regulatory advantages by operating across multiple blockchain networks with varying governance structures.

Institutional interest in decentralized finance protocols remains substantial according to investment flow data from digital asset management firms. However, capital allocation has become increasingly selective as investors prioritize projects with demonstrated utility and sustainable tokenomics. Whitewhale’s focus on cross-chain arbitrage addresses genuine market inefficiencies within the fragmented blockchain ecosystem, thereby attracting attention from sophisticated market participants.

Market analysts note that cryptocurrency correlations have decreased during 2025 compared to previous years. This decoupling effect allows individual projects with strong fundamentals to outperform despite broader market conditions. Whitewhale cryptocurrency exemplifies this trend with its recent price action diverging from major market indices. The digital asset’s 30-day correlation coefficient with Bitcoin decreased from 0.78 to 0.42 according to statistical analysis from cryptocurrency research firms.

Risk Considerations and Market Volatility Factors

While technical patterns and fundamental developments appear favorable for Whitewhale cryptocurrency, market participants must consider several risk factors. Cryptocurrency markets remain inherently volatile with potential for rapid price reversals. The projected 215% surge represents a technical target rather than a guaranteed outcome. Market conditions can change rapidly based on numerous variables including:

- Regulatory announcements from major jurisdictions

- Broader financial market sentiment shifts

- Technological developments within competing protocols

- Macroeconomic factors influencing risk asset allocation

Historical data indicates that falling wedge patterns successfully reach their measured move targets approximately 68% of the time according to technical analysis research. This statistical probability suggests meaningful potential for the pattern completion while acknowledging the possibility of pattern failure. Market participants typically implement risk management strategies including position sizing, stop-loss orders, and portfolio diversification when trading such technical setups.

Additionally, cryptocurrency markets face unique liquidity challenges during periods of extreme volatility. While Whitewhale maintains adequate liquidity on major decentralized exchanges, traders should consider slippage and execution risks when entering or exiting positions. The protocol’s cross-chain functionality may experience temporary disruptions during network congestion periods, potentially affecting arbitrage opportunities that drive token utility.

Expert Perspectives on Whitewhale’s Technical Outlook

Financial analysts specializing in cryptocurrency technical analysis provide measured perspectives on Whitewhale’s current market position. Alexandra Chen, senior technical analyst at Digital Asset Research Group, notes: “The falling wedge breakout on Whitewhale cryptocurrency demonstrates textbook technical behavior. The pattern developed over an appropriate timeframe with clean trendline touches and decisive breakout momentum. However, traders should monitor the $0.12000 support level closely, as a breakdown below this zone would invalidate the bullish thesis.”

Marcus Rodriguez, founder of CryptoMetrics Analytics, adds: “Whitewhale’s recent performance highlights the importance of fundamental-technical convergence in cryptocurrency analysis. The protocol’s expanding utility creates organic demand that supports technical breakouts. Our on-chain metrics show increasing accumulation by addresses holding between 10,000 and 100,000 tokens, suggesting informed investor interest rather than purely speculative activity.”

These expert perspectives emphasize the multidimensional analysis required for cryptocurrency evaluation. Technical patterns provide valuable information about market psychology and potential price trajectories, but they function most effectively when considered alongside fundamental developments and broader market context. Whitewhale cryptocurrency currently presents an interesting case study in this analytical convergence.

Conclusion

Whitewhale cryptocurrency demonstrates notable technical strength with its recent falling wedge breakout pattern completion. The formation suggests potential for significant upward price movement toward the $0.45000 target level, representing a 215% advance from current levels. This technical development occurs alongside fundamental improvements within the Whitewhale ecosystem, including protocol upgrades and strategic partnerships. While cryptocurrency markets remain volatile and technical targets represent probabilities rather than guarantees, Whitewhale’s current market position warrants attention from technical analysts and fundamental researchers alike. The cryptocurrency’s ability to deliver 100% profits to traders during recent market conditions highlights its distinctive characteristics within the evolving digital asset landscape of 2025.

FAQs

Q1: What is a falling wedge pattern in cryptocurrency technical analysis?

A falling wedge pattern is a bullish technical formation characterized by converging downward-sloping trendlines. The pattern typically resolves with an upward breakout and suggests potential price appreciation. Whitewhale cryptocurrency recently completed this pattern according to technical analysts.

Q2: How does Whitewhale cryptocurrency generate utility for token holders?

Whitewhale token provides multiple utility functions including governance participation, transaction fee reduction, liquidity provision incentives, and staking rewards. These utilities create organic demand beyond speculative trading activity within the protocol’s ecosystem.

Q3: What factors could prevent Whitewhale from reaching the $0.45000 price target?

Several factors could impede the price target achievement including broader market corrections, regulatory developments affecting decentralized finance, technical pattern failures, or fundamental issues within the Whitewhale protocol ecosystem. Risk management remains essential for market participants.

Q4: How does Whitewhale’s performance compare to major cryptocurrencies like Bitcoin?

Whitewhale has demonstrated lower correlation with Bitcoin during 2025, allowing it to outperform during recent market conditions. While Bitcoin experienced corrections exceeding 15%, Whitewhale delivered substantial returns to traders who positioned during the consolidation phase.

Q5: What time horizon do analysts typically associate with falling wedge pattern targets?

Technical analysts generally project falling wedge pattern targets within weeks to months following breakout confirmation. The specific timeframe depends on market conditions, volume participation, and broader sector dynamics affecting price discovery mechanisms.