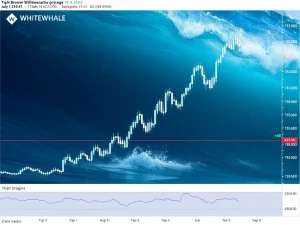

Bitcoin Mining Cost Crisis: Miners’ Average $67.7K Production Price Threatens Massive Sell-Off in Q3 2025

October 2025 – The Bitcoin mining industry faces a critical profitability threshold as new data reveals production costs have surged to unprecedented levels, potentially triggering significant market volatility. According to Marathon Digital Holdings’ Q3 2025 financial report, the average cost to mine a single Bitcoin has reached approximately $67,704, creating what analysts describe as a precarious economic environment for the entire mining sector. This development comes amid fluctuating Bitcoin prices that have struggled to maintain consistent levels above this crucial production benchmark.

Bitcoin Mining Economics Reach Critical Juncture

The cryptocurrency mining industry operates on razor-thin margins where electricity costs, hardware efficiency, and Bitcoin’s market price determine profitability. Consequently, mining operations constantly balance these factors to remain viable. The $67,704 average production cost represents a significant increase from previous quarters, reflecting several converging economic pressures.

Multiple factors contribute to this elevated cost structure. First, the Bitcoin network’s mining difficulty has increased substantially throughout 2025. Second, energy prices in key mining regions have remained volatile. Third, newer mining equipment requires significant capital investment. Finally, operational expenses have grown across the sector.

Industry analysts monitor these production costs closely because they establish fundamental price floors. When Bitcoin trades below production costs for extended periods, miners face difficult decisions. They must either operate at a loss or reduce operations. Both scenarios potentially impact Bitcoin’s network security and market dynamics.

Expert Analysis Points to Mounting Pressure

CryptoQuant CEO Ju Ki-young highlighted the concerning data on social media platform X, drawing attention to Marathon Digital’s quarterly figures. Meanwhile, CryptoQuant Senior Analyst Julio Moreno provided additional context about the current market situation. He explained that at prevailing price levels, many Bitcoin miners likely operate at a financial loss.

Moreno further noted that sustained prices below production costs typically increase selling pressure from miners. This occurs because mining operations must cover ongoing expenses. They often sell newly mined Bitcoin to fund electricity bills, hardware maintenance, and expansion costs. When profitability disappears, miners may liquidate larger portions of their Bitcoin reserves.

The relationship between mining costs and market prices follows predictable economic patterns. Historically, extended periods below production costs have preceded significant market adjustments. Sometimes these adjustments involve price recoveries that restore miner profitability. Other times they involve miner capitulation that reduces network hash rate before equilibrium returns.

Historical Context and Market Cycles

Bitcoin mining economics have evolved dramatically since the cryptocurrency’s inception. Early miners used basic computer processors with negligible costs. Today, industrial-scale operations consume energy comparable to small nations. This professionalization has made production costs increasingly relevant to market analysis.

Previous mining cost crises occurred during major market cycles. The 2018-2019 bear market saw similar pressures when prices fell below production costs for many miners. That period triggered significant industry consolidation. Similarly, mid-2022 presented challenges when energy prices spiked following geopolitical events.

The current situation differs because mining has become more institutionalized. Publicly traded companies like Marathon Digital now dominate significant portions of network hash rate. These entities face quarterly reporting requirements and shareholder expectations. Consequently, their financial decisions create more immediate market impacts than earlier decentralized mining operations.

Marathon Digital’s Q3 2025 Report Details

As one of the largest publicly traded Bitcoin mining companies, Marathon Digital Holdings serves as an industry bellwether. Their quarterly financial reports provide valuable insights into sector-wide economics. The Q3 2025 disclosure revealed several key metrics beyond the headline $67,704 average cost figure.

The company reported its total hash rate capacity and Bitcoin production for the quarter. It also detailed energy consumption patterns and efficiency improvements. Operational expenses broke down into several categories including electricity, hosting fees, and personnel costs. Capital expenditures reflected ongoing investments in next-generation mining equipment.

Marathon’s geographical distribution of mining operations affects its average costs. The company utilizes facilities across multiple jurisdictions with varying energy prices and regulatory environments. Some locations benefit from lower-cost renewable energy sources. Others face higher traditional energy costs or regulatory complexities.

Key metrics from Marathon’s Q3 2025 report include:

- Average cost per Bitcoin mined: $67,704

- Total Bitcoin produced during quarter: [Data from report]

- Hash rate capacity: [Data from report]

- Energy consumption: [Data from report]

- Operational efficiency metrics

Potential Market Impacts and Scenarios

Sustained mining unprofitability typically triggers several market responses. First, less efficient miners gradually reduce operations or shut down completely. This decreases network hash rate temporarily until difficulty adjustments occur. Second, miners increase Bitcoin sales from reserves to cover operational deficits. Third, mining equipment values may decline as demand decreases.

These dynamics create potential feedback loops. Increased selling pressure from miners can suppress prices further. Lower prices then exacerbate mining unprofitability. This cycle continues until either prices recover sufficiently or enough miners exit to reduce supply pressure. Historically, such periods have represented accumulation opportunities for long-term investors despite short-term volatility.

The current situation’s severity depends on Bitcoin’s price trajectory in coming weeks. Prices significantly above $67,704 would alleviate immediate pressure. Prices moderately below this level would sustain gradual selling pressure. Prices substantially below this threshold could accelerate miner capitulation and potentially trigger more pronounced market movements.

Network Security Considerations

Bitcoin’s security model relies on economic incentives for miners. When mining becomes unprofitable, network security potentially decreases as hash rate declines. However, Bitcoin’s difficulty adjustment algorithm automatically responds to hash rate changes. This mechanism maintains consistent block times regardless of mining participation.

Previous mining profitability crises have demonstrated the network’s resilience. Difficulty adjustments eventually restore equilibrium between mining costs and rewards. The process typically involves several adjustment periods over weeks or months. During this transition, transaction confirmation times may experience temporary variations before stabilizing.

Long-term network security depends on sustainable mining economics. The current high production costs highlight ongoing debates about Bitcoin’s energy consumption and environmental impact. Some analysts argue that higher efficiency standards will eventually reduce production costs. Others believe energy market dynamics will continue determining mining economics regardless of technological improvements.

Industry Responses and Adaptation Strategies

Bitcoin mining companies employ various strategies during profitability challenges. Many operations have hedged energy costs through long-term contracts. Some utilize flexible mining approaches that adjust operations based on electricity prices. Others diversify revenue streams through additional services like high-performance computing.

Geographical diversification represents another common strategy. Miners increasingly locate operations where renewable energy sources provide cost advantages. Some jurisdictions offer regulatory stability alongside competitive energy markets. These strategic decisions help mitigate risks during periods of compressed margins.

Technological innovation continues driving efficiency improvements. Newer mining hardware delivers better performance per watt of electricity. Cooling systems and facility designs optimize energy utilization. Software solutions dynamically manage mining operations based on real-time economic conditions. These advancements gradually reduce production costs across the industry.

Broader Cryptocurrency Market Implications

Bitcoin mining economics influence the broader digital asset ecosystem. As the largest cryptocurrency by market capitalization, Bitcoin often sets trends for other digital assets. Mining profitability affects investor sentiment and institutional participation. It also impacts related industries like mining equipment manufacturing and hosting services.

The current mining cost situation arrives during a period of significant cryptocurrency market development. Regulatory frameworks continue evolving in major jurisdictions. Institutional adoption progresses through various financial products and services. Technological advancements like the Lightning Network expand Bitcoin’s utility beyond store-of-value applications.

These developments create a complex backdrop for mining economics. While production costs represent immediate concerns, longer-term trends suggest continued Bitcoin integration into global financial systems. Mining profitability cycles have historically occurred within broader adoption trends. Many analysts view current challenges as temporary within Bitcoin’s multi-decade development trajectory.

Conclusion

The Bitcoin mining industry faces significant economic challenges as Q3 2025 data reveals average production costs reaching approximately $67,704 per Bitcoin. This development creates potential sell-off risk if prices remain below this critical threshold. CryptoQuant analysts highlight the precarious situation facing miners operating at potential losses. Historical patterns suggest such periods typically resolve through market adjustments that restore mining profitability. The coming weeks will determine whether Bitcoin prices recover sufficiently to support miners or whether increased selling pressure triggers broader market movements. Regardless of short-term volatility, Bitcoin’s fundamental economics continue evolving alongside technological improvements and growing institutional adoption.

FAQs

Q1: What does “average cost to mine Bitcoin” actually include?

The average mining cost incorporates all expenses required to produce one Bitcoin including electricity consumption, hardware depreciation, facility costs, personnel expenses, and overhead. Different mining operations calculate this figure slightly differently based on their accounting methods.

Q2: How quickly do miners typically respond to unprofitability?

Mining operations usually respond within weeks to sustained unprofitability. Publicly traded companies may act more quickly due to quarterly reporting pressures. Smaller operations might persist longer hoping for price recovery. The complete adjustment cycle often takes several difficulty adjustment periods.

Q3: Does mining unprofitability affect Bitcoin transaction speeds?

Potentially yes, but usually temporarily. As miners reduce operations, network hash rate decreases. Bitcoin’s difficulty adjustment eventually compensates, but during transition periods, block times may slightly increase. The network has historically maintained functionality throughout such periods.

Q4: How do mining costs vary geographically?

Mining costs differ significantly by region due to electricity prices, climate conditions affecting cooling needs, regulatory environments, and infrastructure quality. Some regions benefit from abundant renewable energy while others rely on more expensive traditional sources.

Q5: What happens to mining equipment during profitability crises?

Mining equipment values typically decline during extended unprofitability periods as demand decreases. Some equipment gets relocated to lower-cost regions. Older, less efficient hardware may be permanently retired. Equipment markets often become more active as miners optimize their operations.