Bitcoin Price Analysis: Bitwise CIO Reveals Why Market Turmoil May Not Signal Another Crypto Collapse

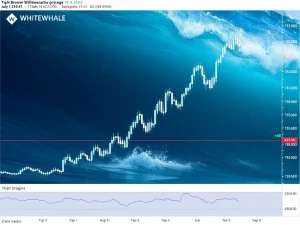

Institutional cryptocurrency investors received crucial market insights this week as Bitwise Chief Investment Officer Matt Hougan delivered a comprehensive analysis of Bitcoin’s current position, suggesting that while further price declines remain possible, the underlying market structure differs fundamentally from previous crypto crises. According to exclusive reporting from The Block, Hougan’s assessment comes during a period of significant market volatility that has seen Bitcoin experience substantial price fluctuations amid broader financial uncertainty.

Bitcoin Price Analysis: Understanding Current Market Dynamics

Matt Hougan’s analysis provides institutional investors with critical context for understanding recent cryptocurrency market movements. The Bitwise CIO explained that multiple factors contributed to the recent sell-off, creating a complex market environment that requires careful interpretation. Hougan identified three primary drivers behind the current market conditions, each representing different aspects of financial market behavior.

First, cyclical selling patterns emerged as investors adjusted their portfolios according to established market rhythms. Second, leverage effects amplified price movements as overextended positions faced liquidation pressure. Third, broader macro risk-off sentiment influenced investor behavior across multiple asset classes. This comprehensive perspective helps explain why cryptocurrency markets experienced simultaneous pressure with traditional assets.

Comparative Asset Performance During Recent Volatility

Recent market data reveals parallel movements across different asset classes, supporting Hougan’s analysis of interconnected financial markets. Gold experienced a 6.2% decline during the same period as Bitcoin’s sell-off, while silver dropped 8.7% over three trading sessions. Major U.S. stock indices faced similar pressures, with technology stocks particularly affected by uncertainty surrounding interest rate policies and corporate capital expenditure plans.

| Asset | Percentage Change | Time Period | Primary Driver |

|---|---|---|---|

| Bitcoin | -12.4% | 7 days | Leverage unwinding |

| Gold | -6.2% | 7 days | Interest rate expectations |

| Silver | -8.7% | 7 days | Industrial demand concerns |

| NASDAQ Composite | -4.8% | 7 days | Growth stock valuation pressure |

Structural Differences Between Current Market and 2022 Crypto Crisis

Hougan emphasized crucial distinctions between current market conditions and the 2022 cryptocurrency crisis, providing investors with important analytical frameworks. The 2022 market collapse featured specific characteristics that created systemic risk throughout the cryptocurrency ecosystem. Several major platforms experienced liquidity crises during that period, leading to cascading failures across the industry.

Key differences include:

- Infrastructure stability: Current market infrastructure shows no signs of systemic stress or imminent collapse

- Regulatory environment: Enhanced regulatory clarity has reduced uncertainty for institutional participants

- Institutional participation: More diversified investor base reduces concentrated risk exposure

- Market maturity: Bitcoin’s established track record provides historical context for current volatility

Capital Flow Analysis and Market Implications

While acknowledging significant capital outflows from cryptocurrency markets, Hougan contextualized these movements within broader financial trends. The current outflow patterns differ substantially from 2022, when withdrawals often signaled fundamental problems with specific platforms or protocols. Today’s capital movements primarily reflect portfolio rebalancing and risk management strategies rather than emergency withdrawals from failing institutions.

Market data indicates that exchange reserves have remained relatively stable despite price volatility, suggesting that long-term holders continue maintaining their positions. This behavior contrasts sharply with 2022 patterns, when exchange outflows frequently preceded platform failures. The stability of major cryptocurrency custodians and trading venues provides additional evidence of improved market infrastructure resilience.

Bitcoin Market Maturation and Institutional Perspective

Bitcoin’s evolution as an asset class has fundamentally changed how institutional investors approach cryptocurrency markets. Hougan highlighted several maturation indicators that distinguish current market conditions from previous cycles. Increased regulatory clarity, particularly regarding spot Bitcoin ETF approvals, has created more structured pathways for institutional participation.

Furthermore, enhanced market surveillance and reporting requirements have improved transparency across cryptocurrency trading venues. These developments enable more sophisticated risk assessment and portfolio management strategies. Institutional investors now access better tools for analyzing cryptocurrency market dynamics, including improved data feeds and analytical frameworks specifically designed for digital assets.

Risk Assessment Framework for Current Market Conditions

Professional investors employ specific frameworks when evaluating cryptocurrency market risks during volatile periods. Hougan’s analysis suggests that current conditions warrant careful distinction between cyclical volatility and structural problems. Several indicators help differentiate between normal market corrections and more serious systemic issues.

Market participants monitor exchange stability, derivative market positioning, and on-chain metrics to assess underlying market health. Recent data shows that while leverage positions required adjustment, core blockchain infrastructure continued operating normally throughout the volatility period. This operational stability provides important context for evaluating the severity of current market conditions.

Potential Price Trajectories and Market Scenarios

While acknowledging possible further Bitcoin price declines, Hougan’s analysis suggests limited probability of a 2022-style market collapse. Several factors support this assessment, including Bitcoin’s established market position and improved institutional infrastructure. The cryptocurrency now functions within a more developed ecosystem featuring better risk management tools and more sophisticated market participants.

Historical analysis reveals that Bitcoin has experienced similar volatility periods throughout its history, with recovery patterns showing increasing stability over time. Each market cycle has featured distinct characteristics, with current conditions reflecting both cryptocurrency-specific factors and broader financial market dynamics. This interconnectedness represents both a challenge and an opportunity for cryptocurrency investors.

Macroeconomic Context and Cryptocurrency Correlation

Recent market movements highlight increasing correlation between cryptocurrency assets and traditional financial markets. This development reflects Bitcoin’s growing integration into broader investment portfolios and institutional frameworks. While cryptocurrency markets maintain unique characteristics, they increasingly respond to similar macroeconomic factors that influence traditional assets.

Interest rate expectations, inflation data, and growth projections now affect cryptocurrency valuations alongside traditional risk assets. This correlation represents an important evolution in how markets perceive and price digital assets. Investors must now consider both cryptocurrency-specific factors and broader financial market conditions when making allocation decisions.

Conclusion

Matt Hougan’s Bitcoin price analysis provides institutional investors with crucial perspective during a period of significant market uncertainty. The Bitwise CIO’s assessment suggests that while further volatility remains possible, current conditions differ fundamentally from previous cryptocurrency crises. Bitcoin’s market maturation, improved infrastructure, and institutional integration create a more resilient ecosystem capable of withstanding normal market corrections. Investors should carefully distinguish between cyclical volatility and structural problems when evaluating current cryptocurrency market conditions.

FAQs

Q1: What does Matt Hougan mean by “bad news is priced in” for Bitcoin?

Hougan suggests that current Bitcoin prices already reflect known negative information, meaning market participants have adjusted their valuations based on available data. This concept implies that future price movements will depend on new information rather than existing market knowledge.

Q2: How does the current cryptocurrency market differ from the 2022 crash?

The current market features more stable infrastructure, better regulatory clarity, and more diversified institutional participation. Unlike 2022, there are no signs of systemic platform failures or liquidity crises affecting major cryptocurrency service providers.

Q3: What factors could cause further Bitcoin price declines according to Hougan’s analysis?

Potential factors include continued macroeconomic uncertainty, unexpected regulatory developments, or shifts in institutional investor sentiment. However, Hougan suggests these would represent normal market adjustments rather than systemic failures.

Q4: How has Bitcoin’s market maturation affected its price stability?

Bitcoin’s established track record, improved market infrastructure, and institutional participation have increased its resilience during volatile periods. While price fluctuations still occur, they increasingly reflect broader financial market dynamics rather than cryptocurrency-specific issues.

Q5: What should investors monitor to assess Bitcoin market health?

Key indicators include exchange stability, derivative market positioning, on-chain transaction metrics, institutional flow data, and regulatory developments. These factors provide comprehensive insight into underlying market conditions beyond simple price movements.