Binance SAFU Fund Conducts Crucial Test Transfer, Signaling Major Bitcoin Reserve Strategy

In a significant move for cryptocurrency security, Binance has executed a test transaction to its Secure Asset Fund for Users (SAFU), providing tangible evidence of its strategic shift toward Bitcoin reserves. This development, observed through on-chain analysis, confirms the exchange’s commitment to enhancing its $1 billion user protection fund with the world’s leading cryptocurrency. The transaction represents more than just a technical test—it signals a fundamental evolution in how major exchanges approach risk management and asset protection in the volatile digital asset space.

Binance SAFU Fund Undergoes Strategic Bitcoin Transition

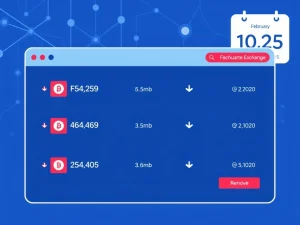

Blockchain analysts recently detected a 64.811 USDT test transfer from a Binance hot wallet to the official SAFU address. This transaction, identified by on-chain analyst ai_9684xtpa, serves as operational verification before larger asset movements. The test transfer follows Binance’s official announcement about restructuring SAFU’s asset composition. Consequently, the exchange plans to gradually convert its existing stablecoin holdings within the fund to Bitcoin. This strategic pivot reflects changing institutional attitudes toward reserve assets in the cryptocurrency industry.

The Secure Asset Fund for Users represents Binance’s self-insurance mechanism, established in 2018 following a major security incident. Originally funded through 10% of trading fees, the fund has grown to protect user assets against extreme scenarios. Moreover, the fund’s transparent on-chain address allows real-time verification by the community. The recent test transaction demonstrates Binance’s operational readiness for the asset conversion process. Industry observers view this move as part of a broader trend toward Bitcoin-denominated reserves among cryptocurrency custodians.

Understanding the Bitcoin Reserve Strategy

Binance’s decision to convert $1 billion in stablecoin holdings to Bitcoin represents a calculated risk management approach. Unlike stablecoins, which maintain parity with fiat currencies, Bitcoin offers potential appreciation alongside its store-of-value characteristics. However, this strategy introduces different volatility considerations. The conversion process will likely occur gradually to minimize market impact. This approach contrasts with traditional finance, where insurance funds typically maintain liquid, low-volatility assets.

The cryptocurrency industry has witnessed several high-profile collapses in recent years, including the FTX debacle in 2022. These events have increased scrutiny on exchange reserve practices. In response, Binance has emphasized transparency through its Proof of Reserves system. The SAFU fund conversion aligns with this transparency initiative. By holding Bitcoin rather than stablecoins, the fund may better preserve purchasing power during extended market cycles. This strategy acknowledges Bitcoin’s established position as digital gold within the cryptocurrency ecosystem.

Expert Analysis of Reserve Management Practices

Financial security experts note that cryptocurrency exchange insurance funds face unique challenges compared to traditional financial institutions. Traditional banks typically maintain deposit insurance through government-backed programs like the FDIC. Cryptocurrency exchanges, however, operate without such institutional safeguards. Therefore, they must develop innovative protection mechanisms. The SAFU fund represents one of the industry’s most substantial self-insurance initiatives.

Blockchain analysts emphasize the importance of on-chain verification for such funds. The test transaction provides observable evidence of operational procedures. Furthermore, the gradual conversion approach suggests careful planning to avoid market disruption. Industry observers will monitor the conversion timeline and its execution. Successful implementation could establish a new standard for exchange reserve management. This development occurs alongside increasing regulatory attention to cryptocurrency custody practices worldwide.

Historical Context and Industry Impact

Binance established the SAFU fund following a 2018 security breach that resulted in significant losses. The fund’s creation represented a proactive response to industry security challenges. Initially, the fund maintained a diversified portfolio including various cryptocurrencies and stablecoins. The shift toward Bitcoin dominance reflects evolving risk assessment models. Major exchanges now recognize Bitcoin’s unique position as both a liquid asset and a long-term store of value.

The cryptocurrency custody industry has matured significantly since 2018. Institutional adoption has increased demand for robust security frameworks. Consequently, reserve management practices have become more sophisticated. Binance’s move may influence other exchanges to reconsider their insurance fund compositions. The industry continues to develop standardized practices for user protection. This evolution addresses one of cryptocurrency’s persistent challenges: establishing trust in decentralized systems.

Technical Implementation and Security Considerations

The test transfer to the SAFU address involved specific technical protocols. Binance utilized a hot wallet for the transaction, indicating operational testing procedures. Hot wallets maintain connectivity to the internet for transaction processing. However, the SAFU fund itself reportedly employs cold storage solutions for most assets. This multi-layered security approach balances accessibility with protection.

Blockchain transparency allows independent verification of fund movements. Analysts can track addresses and monitor asset compositions. This transparency builds community trust in exchange operations. The test transaction’s modest size suggests careful protocol testing before larger movements. Such procedural diligence reflects institutional-grade operational standards. The cryptocurrency industry continues developing best practices for large-scale asset management.

Market Implications and Future Developments

The conversion of $1 billion from stablecoins to Bitcoin could influence market dynamics. While the gradual approach minimizes immediate impact, the long-term effect represents substantial Bitcoin accumulation. This movement signals institutional confidence in Bitcoin’s long-term value proposition. Additionally, it may encourage other institutional holders to consider similar reserve strategies. The cryptocurrency market continues evolving toward more sophisticated financial management practices.

Regulatory developments will likely influence future reserve management approaches. Global financial authorities increasingly focus on cryptocurrency exchange operations. Transparent reserve practices may facilitate regulatory compliance. Binance’s strategic shift demonstrates adaptability to changing market conditions. The exchange continues refining its risk management framework amid industry evolution. These developments contribute to cryptocurrency’s maturation as an asset class.

Conclusion

The Binance SAFU fund test transfer confirms the exchange’s strategic pivot toward Bitcoin reserves for its $1 billion user protection fund. This development represents more than a technical procedure—it signals evolving industry standards for cryptocurrency security and reserve management. The gradual conversion from stablecoins to Bitcoin reflects sophisticated risk assessment and long-term planning. As the cryptocurrency industry matures, such transparent, verifiable protection mechanisms become increasingly crucial for user confidence and institutional adoption. The Binance SAFU fund continues serving as a benchmark for exchange-operated insurance mechanisms in the digital asset space.

FAQs

Q1: What is the Binance SAFU fund?

The Secure Asset Fund for Users is Binance’s self-insurance mechanism, established in 2018 to protect user assets against extreme scenarios like exchange hacks or unexpected financial issues. The fund currently holds approximately $1 billion in assets.

Q2: Why is Binance converting SAFU assets to Bitcoin?

Binance aims to preserve the fund’s long-term purchasing power by holding Bitcoin, which the exchange views as a superior store of value compared to stablecoins. This strategy acknowledges Bitcoin’s established position as digital gold within the cryptocurrency ecosystem.

Q3: How was the test transfer detected?

On-chain analyst ai_9684xtpa identified a 64.811 USDT transaction from a Binance hot wallet to the official SAFU address. Blockchain transparency allows such transactions to be publicly verified by anyone with blockchain analysis tools.

Q4: Will this conversion affect Bitcoin’s price?

The gradual conversion of $1 billion is unlikely to cause immediate price disruption, but it represents significant long-term accumulation. Such institutional movements generally signal confidence in Bitcoin’s value proposition.

Q5: How does SAFU compare to traditional bank insurance?

Unlike government-backed deposit insurance (like FDIC coverage), SAFU represents private, exchange-funded protection. While traditional insurance has regulatory guarantees, cryptocurrency funds rely on transparent reserves and operational integrity.