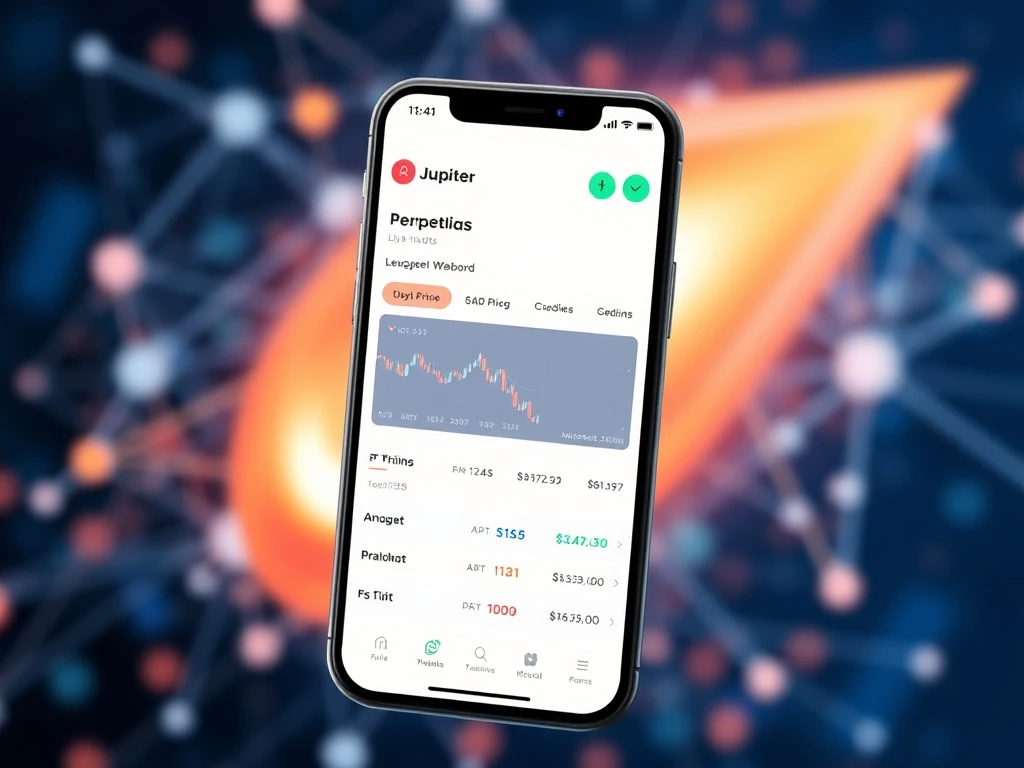

Jupiter Perpetual Trading Unleashes Professional Mobile DeFi for 1M+ Solana Users

In a landmark move for decentralized finance, the Jupiter aggregator has officially launched its native perpetual trading platform directly within the Jupiter V3 mobile application. This strategic deployment, confirmed on March 21, 2025, fundamentally transforms mobile cryptocurrency trading for its expansive user base exceeding one million. Consequently, it delivers institutional-grade perpetual futures contracts to the palm of a user’s hand, marking a pivotal evolution for the Solana ecosystem.

Jupiter Perpetual Trading Ushers in a New Mobile Era

The integration of Jupiter Native Perps represents a significant technical and market milestone. Previously, advanced perpetual trading on decentralized exchanges often required desktop interfaces or connections to separate protocols. Now, Jupiter consolidates this functionality natively. This development directly addresses the growing demand for sophisticated financial instruments in mobile-centric markets. Industry analysts note that mobile trading volume has surged by over 300% since 2023, according to data from analytics firm CryptoRank. Therefore, Jupiter’s move is both timely and strategically aligned with user behavior trends.

Functionally, the new platform allows traders to speculate on asset prices using leverage without an expiry date. It supports major Solana-based assets like SOL, JUP, and popular meme coins. The system utilizes a virtual automated market maker (vAMM) model for price discovery, isolating liquidity pools to manage risk effectively. Moreover, it integrates directly with Jupiter’s existing swap and limit order infrastructure. This creates a seamless, all-in-one trading environment that was previously unavailable on mobile DeFi applications.

The Technical Architecture Behind the Launch

Building a low-latency perpetual trading engine for mobile required substantial backend innovation. Jupiter’s engineering team optimized the vAMM smart contracts for speed and cost-efficiency on Solana. They prioritized reducing transaction fees and minimizing confirmation times. The architecture also incorporates real-time price oracles from Pyth Network and Switchboard. These provide the critical off-chain data needed for accurate mark prices and funding rate calculations. Security audits were conducted by leading firms OtterSec and Kudelski Security prior to the mainnet launch. Their reports confirm the robustness of the liquidation engine and collateral management system.

Impact on the Solana DeFi Landscape and Mobile Traders

The launch immediately alters the competitive dynamics within Solana’s decentralized finance sector. Jupiter, already the dominant liquidity aggregator, now directly challenges standalone perpetual protocols. This expansion could significantly increase total value locked (TVL) and trading volume across the ecosystem. Data from DeFiLlama shows Solana’s DeFi TVL consistently holding above $15 billion in Q1 2025. Jupiter’s move is poised to capture a larger share of this activity, particularly from retail traders who prefer mobile access.

For the end-user, the benefits are multifaceted. Traders gain access to professional tools like up to 20x leverage, real-time charting, and advanced order types directly from their smartphones. The user interface is designed for clarity, displaying key metrics such as funding rates, open interest, and liquidation prices prominently. This democratizes access to complex strategies that were once the domain of desktop or institutional traders. Furthermore, it enhances financial inclusion in regions where mobile phones are the primary, or only, gateway to digital assets.

- Unified Experience: Swap, limit orders, and perpetuals in one app.

- Reduced Friction: No need to bridge assets or connect to external dApps.

- Enhanced Security: Native integration reduces phishing risks from connecting to unknown sites.

- Speed Advantage: Leverages Solana’s sub-second block times for rapid execution.

Expert Analysis and Market Context

DeFi researchers highlight this launch as part of a broader industry shift toward integrated, app-chain experiences. “The future of retail crypto is mobile-first and aggregation-heavy,” stated Maria Chen, a lead analyst at Blockworks Research, in a recent market report. “Jupiter’s strategy of bundling core trading verticals—aggregation, spot, and now derivatives—creates powerful network effects and user lock-in. It’s a logical step to capture more of the trading lifecycle value.” This perspective is echoed by developers who note that simplifying the user journey is critical for mainstream adoption.

The timeline for this product began with Jupiter’s LFG Launchpad success in early 2024, which funded further protocol development. Following extensive testnet phases throughout Q4 2024, the team gathered feedback from over 50,000 beta testers. This iterative process focused on optimizing the mobile experience for both novice and experienced traders. The public launch follows this rigorous development cycle, ensuring stability at scale.

Future Roadmap and Protocol Evolution

Looking ahead, the Jupiter roadmap indicates plans for cross-margin accounts and additional asset support. The team has also hinted at integrating decentralized identity for compliant leverage tiers in specific jurisdictions. These features would further bridge the gap between traditional finance and DeFi. The success of the perpetuals platform will likely influence Jupiter’s governance token, JUP, as fee revenue from perps could be directed to stakers or used for buybacks. This creates a direct value-accrual mechanism for the ecosystem’s stakeholders.

Comparatively, while other mobile wallets offer dApp browsers, few offer a native, integrated perpetual trading product of this caliber. This gives Jupiter a distinct first-mover advantage in the Solana mobile ecosystem. The focus remains on maintaining a neutral, factual analysis of the protocol’s capabilities and market position without speculative praise.

Conclusion

The launch of Jupiter perpetual trading on its V3 mobile app marks a definitive step toward mature, accessible decentralized finance. By bringing professional-grade perpetual contracts to over a million mobile users, Jupiter significantly elevates the standard for mobile trading experiences on Solana. This development underscores the critical trends of aggregation, mobile-first design, and user experience simplification driving the next phase of DeFi growth. The integration’s success will be measured by its security, adoption, and its ability to onboard the next wave of users into advanced crypto financial products.

FAQs

Q1: What are Jupiter Native Perps?

Jupiter Native Perps are a perpetual futures trading platform built directly into the Jupiter Mobile application. They allow users to trade with leverage on Solana-based assets without a contract expiry date, using a virtual Automated Market Maker model.

Q2: How does this differ from using a perpetual protocol through a dApp browser?

The native integration offers a seamless, secure, and optimized experience. It eliminates the need to connect a wallet to an external website, reduces phishing risks, and provides a unified interface with Jupiter’s swap and limit order features, all designed specifically for mobile use.

Q3: What assets can I trade with Jupiter Perpetual Trading?

Initially, the platform supports major Solana ecosystem assets like SOL (Solana), JUP (Jupiter), and several high-liquidity meme coins. The team plans to expand this list based on governance proposals and market demand.

Q4: Is perpetual trading on mobile safe?

While Jupiter’s contracts have undergone professional security audits, perpetual trading itself is a high-risk activity involving leverage, which can lead to rapid liquidation and loss of funds. Users should fully understand the risks of leverage, funding rates, and market volatility before trading.

Q5: What are the potential impacts on the JUP token?

The JUP token governs the Jupiter ecosystem. Successful perpetual trading will generate protocol fees. Future governance votes may decide to distribute a portion of these fees to JUP stakers or use them for token buybacks, potentially creating new utility and value accrual for the token.