Solana’s Pivotal Moment: Traders Bet Big on Imminent SOL Breakout

As of January 28, 2026, the cryptocurrency market watches with keen interest as Solana (SOL) consolidates near a historically significant price level. A confluence of technical, on-chain, and institutional factors suggests the digital asset may be on the cusp of a major directional move. This analysis delves into the data driving current trader sentiment and examines whether Solana’s long-anticipated breakout is finally materializing.

Solana Price Action at a Critical Historical Juncture

Solana currently trades at $124.50, reflecting a modest 1.55% gain over the past 24 hours. However, the most compelling narrative unfolds on the daily chart. The asset is testing the **$118 support level**, a zone that has proven remarkably resilient since April 2024. Market analysts note this level has been tested over ten times in the past two years, with each test preceding a significant price reversal.

This historical precedent forms the core of the current bullish thesis. If SOL maintains its position above this foundational support, technical patterns suggest a potential rally of approximately 16%. This would propel the price toward the **$146 resistance level**. The strength of this trend is partially confirmed by the Average Directional Index (ADX), which reads 31.26. A value above 25 typically indicates a strong directional trend is in place.

Conversely, a decisive break below $118 would invalidate this optimistic outlook. It is crucial to note that SOL’s price remains below its 50-day Exponential Moving Average (EMA), a reminder that the broader market structure for the asset is still corrective. This creates a tense equilibrium between short-term bullish potential and longer-term caution.

Institutional Confidence Grows Despite Market Uncertainty

Beyond the charts, fundamental data reveals a growing institutional conviction in Solana’s ecosystem. A key driver is the sustained capital inflow into U.S. spot Solana Exchange-Traded Funds (ETFs). Data from analytics platform SoSoValue shows consistent investments into these funds since mid-January 2026.

ETF inflows are a critical metric because they represent fresh, institutional capital entering the market. This activity signals confidence from Wall Street investors, who often take a longer-term view than retail traders. Their continued participation, even amid broader market volatility, provides a solid foundation for price stability and potential growth.

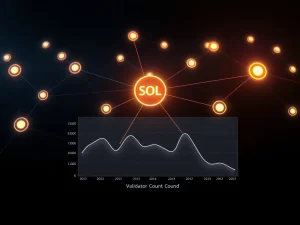

Furthermore, Solana’s on-chain health appears robust. According to DeFiLlama, the network’s Total Value Locked (TVL) has increased by 4.66% in a single day, reaching **$36.66 billion**. TVL measures the total value of assets deposited in Solana’s decentralized finance protocols. This rise indicates two positive developments:

- Increased Capital Inflows: More value is being deployed within the ecosystem.

- Strengthening Activity: Users are actively engaging with DeFi applications, suggesting utility and trust in the network.

Derivatives Data Reveals Trader Positioning

The derivatives market offers a real-time pulse of trader sentiment. Data from CoinGlass highlights specific price levels where leverage has concentrated. Currently, **$121.3** acts as a key support level in the futures market, while **$125.7** serves as immediate resistance.

More importantly, the balance of leveraged positions leans decisively bullish. Traders have built approximately **$157.18 million in long positions** compared to **$66.71 million in short positions** around these levels. This nearly 2.4:1 ratio in favor of longs demonstrates that active, intraday traders are aligning with the breakout hypothesis. They are betting that Solana will overcome resistance and move higher.

The Interplay of Volume, Sentiment, and Macro Context

While the signals are largely positive, one metric introduces a note of caution: trading volume. SOL’s 24-hour trading volume has declined by roughly 40% to $3.67 billion. Lower volume during a consolidation phase can signify investor indecision or a lack of aggressive selling pressure. However, for a decisive breakout to be validated, a significant surge in volume is typically required to confirm the move’s sustainability.

This scenario places Solana at a fascinating crossroads. The asset benefits from strong institutional backing via ETFs and healthy on-chain metrics. Simultaneously, it faces the technical challenge of overcoming a multi-month downtrend structure, a task that may require a catalyst or a shift in broader crypto market sentiment.

The current market behavior mirrors historical patterns where assets consolidate at key levels before making their next significant move. The sustained interest from both institutions and derivatives traders suggests the path of least resistance could be upward, provided the $118 support holds firm.

Conclusion

Solana stands at a technically and fundamentally pivotal point. The convergence of a historically strong support level, consistent institutional ETF inflows, rising on-chain TVL, and a bullish skew in derivatives positioning creates a compelling case for a potential SOL breakout. The immediate price targets for such a move reside near the $146 level. However, traders and investors must monitor the $118 support closely, as a breakdown would alter the bullish narrative. The coming days will be critical in determining if Solana can capitalize on this alignment of positive factors and begin a new leg of price appreciation.

FAQs

Q1: What is the key support level for Solana (SOL) mentioned in the analysis?

The critical support level is **$118**. This price zone has acted as major support since April 2024 and is considered a line in the sand for the current bullish thesis.

Q2: How do Solana ETF inflows affect the price?

Inflows into spot Solana ETFs indicate that institutional investors are deploying fresh capital to buy the underlying SOL tokens. This creates consistent buy-side demand, which can provide price support and contribute to upward momentum.

Q3: What does Total Value Locked (TVL) indicate for Solana?

Solana’s TVL, which has risen to $36.66 billion, measures the total capital deposited in its DeFi protocols. An increasing TVL suggests growing user adoption, trust in the network’s security, and vibrant ecosystem activity, all of which are positive fundamental indicators.

Q4: Why is the balance of long and short leveraged positions important?

The current data shows over $157 million in long-leveraged positions versus about $67 million in short positions. This imbalance reveals that a majority of active derivatives traders are betting on a price increase, reflecting short-term bullish market sentiment.

Q5: What would invalidate the potential 16% rally for SOL?

The bullish scenario would be invalidated if the price of Solana experiences a sustained break and closes decisively below the **$118 support level**. Such a move would signal a failure of the historical support and could lead to further downside.