Hyperliquid Stuns Market: Becomes World’s Most Liquid Crypto Price Discovery Venue – What’s Next for HYPE?

In a landmark development for decentralized finance, the Hyperliquid protocol has decisively claimed the title of the world’s most liquid venue for crypto price discovery, according to platform founder Jeff Yan. This pivotal shift, confirmed on January 27, 2026, represents a fundamental change in market structure, challenging the long-held dominance of centralized giants like Binance. The announcement triggered an immediate 24% surge in the platform’s native HYPE token, sparking intense analysis about the sustainability of its recovery and the broader implications for crypto market efficiency.

Hyperliquid’s Meteoric Rise in Perpetual Futures

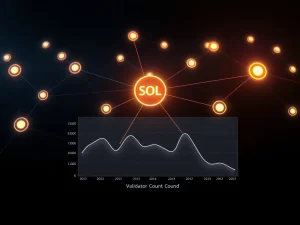

Hyperliquid’s ascent stems from remarkable traction across two key product lines. First, its crypto perpetual futures contracts have achieved unprecedented liquidity depth. Founder Jeff Yan stated the platform now shows “thicker order books than Binance,” a critical metric for institutional traders. Second, the protocol’s recently deployed equity perpetuals, known as HIP-3, have exploded in popularity. These instruments allow decentralized speculation on traditional stocks with leverage, crossing a staggering $1 billion in cumulative trading volume. Daily Open Interest (OI) across all markets neared a record $800 billion, signaling robust demand despite a broader crypto market lull.

This dual success highlights a strategic masterstroke. By capturing volume in both crypto and traditional equity derivatives, Hyperliquid diversifies its revenue streams and attracts a wider trader base. The platform’s architecture, built for high-throughput and low latency, provides the technical foundation for this liquidity. Consequently, market makers and arbitrageurs flock to the venue, creating a virtuous cycle where liquidity begets more liquidity. This environment fosters more accurate and efficient price discovery, a cornerstone of healthy financial markets.

The Mechanics of Superior Price Discovery

Price discovery refers to the process by which market prices are established through the interactions of buyers and sellers. A venue with superior liquidity, like Hyperliquid now claims to be, offers several concrete advantages. Tighter bid-ask spreads reduce trading costs for all participants. Deeper order books minimize slippage, allowing for larger trades without significantly moving the price. Furthermore, this robustness makes the platform more resilient to manipulation and wash trading, which can distort prices on less liquid exchanges. For the broader crypto ecosystem, a reliable, decentralized price discovery hub reduces reliance on a few centralized entities, enhancing market integrity.

Will HYPE Token Sustain Its 24% Recovery Rally?

Following the liquidity milestone announcement, the HYPE token price jumped from $22 to $28. However, technical analysis reveals a critical overhead resistance. The $28 price zone has acted as a key supply barrier since mid-December. A sustained break above this level, particularly one that pushes HYPE above $30, could open a clear path toward the $35 resistance area. Conversely, failure to hold this momentum may see the token retrace its recent gains. The rally occurs against a complex backdrop: HYPE remains 52% below its all-time high of $59, reached in September 2025.

Several on-chain and fundamental factors now influence the token’s trajectory. Analyst Ericonomic points to a significant easing of bearish catalysts. Most notably, the feared monthly token unlocks, which release 9.92 million HYPE, have transformed from a “cliff” to a “trickle.” Data shows only 10% of the unlocked supply was sold in the past two months, a 90% reduction in sell-side pressure. This suggests the market may have overestimated the impact of these scheduled releases. Additionally, persistent selling from known whale addresses, including Fasanara Capital and Continue Capital, has reportedly eased.

- Reduced Unlock Selling: Monthly sell-off pressure dropped 90%.

- Whale Accumulation: Top 10 buyers purchased ~$200M HYPE in 30 days.

- Leverage Reset: Wiped long positions create a cleaner structural setup.

However, analysts caution that one significant hurdle remains. Hyperliquid Strategies, the project’s treasury entity, is accumulating the team’s unlocked tokens. While this prevents immediate market dumping, it may also limit the treasury’s capacity to conduct aggressive spot market buybacks in the future. The ultimate driver for a sustained HYPE recovery, experts argue, must be a reversal in platform revenue growth to fund more substantial token buyback-and-burn mechanisms.

Broader Market Context and Future Implications

Hyperliquid’s achievement did not occur in a vacuum. It reflects a broader maturation within the DeFi derivatives sector, where protocols compete directly with CeFi on performance and liquidity. This milestone pressures other decentralized exchanges (DEXs) to innovate and could accelerate a migration of sophisticated trading volume from centralized to decentralized venues. For traders, the emergence of a highly liquid, non-custodial alternative enhances choice and reduces counterparty risk.

The platform’s success with equity perps (HIP-3) is particularly noteworthy. It demonstrates a growing appetite to trade traditional financial instruments in a decentralized manner, blurring the lines between TradFi and DeFi. If this trend continues, protocols like Hyperliquid could become the primary venues for price discovery across a hybrid asset universe, fundamentally reshaping global market infrastructure.

Conclusion

Hyperliquid has unequivocally established itself as the world’s most liquid venue for crypto price discovery, a claim backed by quantifiable on-chain depth and surging volumes in both crypto and equity perpetuals. This technical and market structure victory propelled the HYPE token to a 24% gain, though its path forward hinges on overcoming key technical resistance and translating platform traction into sustainable revenue. The easing of monthly unlock sell pressure and whale accumulation provide a supportive foundation. Ultimately, Hyperliquid’s rise signifies a pivotal moment where decentralized finance begins to outperform its centralized counterparts in core market functions, setting a new benchmark for the entire industry.

FAQs

Q1: What does “most liquid venue for crypto price discovery” mean?

It means Hyperliquid’s order books have greater depth and tighter spreads than any other exchange, including Binance. This allows for larger trades with less price impact, leading to more accurate and efficient market prices.

Q2: What are Hyperliquid’s equity perps (HIP-3)?

HIP-3 are perpetual futures contracts that allow traders to speculate on the price of traditional stocks (like Apple or Tesla) using leverage, all on a decentralized platform. They have surpassed $1 billion in trading volume.

Q3: Why did the HYPE token price jump 24%?

The price surged immediately after the announcement of Hyperliquid’s liquidity milestone. Reduced selling pressure from monthly token unlocks (down 90%) and accumulation by large buyers also supported the rally.

Q4: What is the main challenge for HYPE’s continued price recovery?

The key challenge is converting high platform usage into growing protocol revenue. Sustained revenue is needed to fund token buybacks and burns, which directly support the HYPE token’s value.

Q5: How does Hyperliquid’s liquidity benefit ordinary traders?

All traders benefit from lower costs (tighter spreads), the ability to execute larger orders without major price slippage, and a trading environment less prone to price manipulation due to the deep order books.