World Liberty Financial Stuns Market with 235 Million WLFI Transfer to Binance – What’s Next for the Volatile Altcoin?

In a move that sent shockwaves through cryptocurrency markets, World Liberty Financial executed a massive transfer of 235 million WLFI tokens to Binance on January 27, 2026, valued at approximately $40.63 million. This substantial movement represents the first major exchange deposit from the project’s team wallet since WLFI’s launch, immediately triggering significant price volatility and intense speculation among traders and analysts worldwide. The transfer occurred against a backdrop of recent price fluctuations, with WLFI experiencing both weekly gains and sudden daily declines, creating a complex market environment that demands careful examination.

World Liberty Financial Transfer Analysis and Market Context

The 235 million WLFI transfer represents a pivotal moment for World Liberty Financial’s market dynamics. According to verified on-chain data from Arkham Intelligence, this deposit marks a departure from the team’s previous holding patterns. Following this substantial movement, the project’s team wallet retains approximately $1.7 billion worth of WLFI tokens, indicating this transfer represents only a portion of their total holdings. Market analysts immediately began scrutinizing this action through multiple lenses, considering both technical implications and broader market psychology.

Historically, such significant transfers from project teams to exchanges generate immediate market reactions for several reasons. First, they increase the circulating supply available for trading on major platforms. Second, they often signal upcoming liquidity events or strategic repositioning. Third, they create psychological pressure on existing holders who may interpret such moves as bearish signals. The timing of this transfer proved particularly significant, occurring as WLFI attempted to stabilize after recent price movements between $0.15 and $0.18.

Technical Indicators and Market Response

Following the transfer announcement, World Liberty Financial experienced immediate technical deterioration across multiple metrics. The Relative Strength Index (RSI) dropped to 47, entering bearish territory after forming a concerning crossover pattern. Simultaneously, the Stochastic Momentum Index (SMI) declined dramatically from 13 to 4.4, indicating strengthening downward momentum. These technical developments coincided with increased selling pressure across exchanges, creating a challenging environment for WLFI’s price stability.

Market participants responded with heightened trading activity, as evidenced by shifting exchange flow metrics. The Spot Netflow metric turned significantly positive, reaching $5.18 million compared to previous negative readings. This shift suggests increased exchange deposits by traders, typically interpreted as preparation for selling activity. Furthermore, data from Nansen revealed that World Liberty Financial’s top holders increased their outflows to 254.9 million tokens while receiving only 240 million in inflows, resulting in a negative balance change of 14 million tokens.

Expert Perspectives on the WLFI Transfer

Cryptocurrency analysts have offered diverse interpretations of World Liberty Financial’s substantial transfer. Some experts, including noted analyst 0xShonkovich, suggest the movement could relate to planned airdrops for USD1 holders, potentially spanning a four-week distribution period. This perspective views the transfer as a necessary step for ecosystem development rather than a bearish signal. However, other market observers emphasize the immediate psychological impact, noting that such large transfers often trigger panic selling regardless of their underlying purpose.

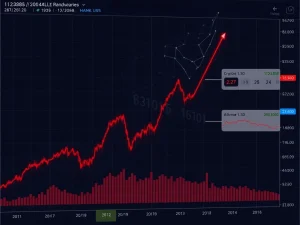

The transfer’s timing within WLFI’s broader price context adds complexity to its interpretation. Before the deposit, World Liberty Financial had demonstrated relative strength, gaining 2.56% on weekly charts despite recent volatility. The altcoin had rebounded from a low of $0.15 to reach $0.18 before retracing toward $0.16. This price action created what technical analysts describe as a “decision zone” where the transfer’s impact would prove particularly significant for determining future direction.

Comparative Analysis with Historical Precedents

Examining similar historical events provides valuable context for understanding World Liberty Financial’s current situation. Major token transfers from project teams to exchanges frequently precede periods of increased volatility across cryptocurrency markets. These events typically follow recognizable patterns: initial price decline, followed by either recovery or continued downward pressure depending on market conditions and project fundamentals. The scale of WLFI’s transfer places it among notable cryptocurrency movements that warrant careful monitoring.

Several factors distinguish this particular transfer from routine market activity. The team wallet’s historical inactivity regarding exchange deposits makes this movement particularly noteworthy. Additionally, the transfer’s size relative to WLFI’s market dynamics creates significant potential impact. Market makers and liquidity providers must now adjust their strategies accordingly, potentially affecting trading conditions across multiple platforms where WLFI maintains presence.

Market Structure and Future Implications

The World Liberty Financial transfer has fundamentally altered WLFI’s market structure in several measurable ways. Exchange order books show increased depth at lower price levels as market participants adjust their positioning. Trading volume patterns indicate heightened activity across both spot and derivative markets, suggesting professional traders are actively managing risk exposure. These structural changes will likely influence WLFI’s price discovery process in coming sessions.

Looking forward, several scenarios appear plausible for World Liberty Financial. If selling pressure continues unabated, technical analysis suggests potential support around $0.15, representing a key psychological level where previous buying interest emerged. Conversely, if market participants gradually absorb the transferred tokens without panic selling, WLFI could attempt to reclaim the $0.17 resistance level and potentially target $0.19 in subsequent sessions. The outcome will depend significantly on broader market conditions and any clarifying announcements from the World Liberty Financial team.

Risk Assessment and Trading Considerations

For market participants, the current environment surrounding World Liberty Financial requires careful risk management. The increased volatility following the transfer creates both opportunities and hazards for traders. Several factors warrant particular attention: monitoring exchange flow metrics for signs of stabilization, watching for any official communications from the project team, and observing how WLFI interacts with key technical levels during upcoming trading sessions.

Longer-term implications extend beyond immediate price action. The transfer may signal evolving token distribution strategies or changing liquidity requirements for World Liberty Financial. Market participants should consider how this event might influence WLFI’s position within the broader altcoin ecosystem, particularly regarding institutional interest and exchange relationships. These factors could prove significant for the project’s development trajectory beyond short-term price fluctuations.

Conclusion

World Liberty Financial’s transfer of 235 million WLFI tokens to Binance represents a defining moment for the altcoin’s market dynamics. The $40.63 million movement has triggered significant volatility, technical deterioration, and intense market scrutiny. While interpretations vary regarding the transfer’s purpose and implications, its immediate impact on WLFI’s price action and market structure remains undeniable. As the situation develops, market participants must balance technical analysis with broader contextual understanding, recognizing that such substantial transfers often create transitional periods that require patience and careful observation. The coming sessions will reveal whether World Liberty Financial can stabilize following this pivotal event or whether further volatility awaits this increasingly watched altcoin.

FAQs

Q1: What exactly did World Liberty Financial transfer to Binance?

World Liberty Financial transferred 235 million WLFI tokens to Binance on January 27, 2026, with an approximate value of $40.63 million at the time of transfer.

Q2: Why is this transfer significant for WLFI’s market dynamics?

This transfer marks the first major deposit from the project’s team wallet to an exchange since WLFI’s launch, potentially increasing circulating supply and triggering psychological reactions among traders and holders.

Q3: How did WLFI’s price react to the transfer announcement?

Following the transfer, WLFI declined approximately 6.2% to $0.1641, with increased volatility as market participants adjusted their positions in response to the news.

Q4: What are the main interpretations of why this transfer occurred?

Analysts offer varying interpretations, including potential preparations for market-making activities, liquidity provision, airdrop distributions, or strategic portfolio rebalancing by the project team.

Q5: What technical indicators suggest increased selling pressure for WLFI?

Key indicators showing selling pressure include: RSI dropping to 47 (bearish territory), SMI declining from 13 to 4.4, positive Spot Netflow of $5.18 million, and top holders showing negative balance changes through increased outflows.