Axelar AXL Price: Decoding the Critical 19% Rally Within a Persistent Bearish Structure

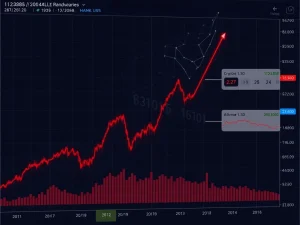

On January 26, 2026, the cryptocurrency market witnessed a significant yet complex move in Axelar (AXL), as the interoperability protocol’s token recorded a striking 19.8% single-day rally. This surge, however, unfolded against a backdrop of a broader bearish market structure, creating a pivotal moment for traders and analysts to assess. The price action highlights the ongoing tension between short-term bullish momentum and longer-term technical deterioration, a scenario familiar to seasoned market participants.

Axelar AXL Price: Volatility Meets Macro Headwinds

The weekend of January 25-26 delivered dramatic volatility for Axelar. Trading volume exploded by an astonishing 1,200%, propelling the AXL price from lower levels toward a local high of $0.083. This aggressive buying pressure initially suggested a potential shift in market sentiment. Concurrently, the broader digital asset market faced headwinds, primarily from Bitcoin’s retreat below the $88,000 level. Historically, such Bitcoin movements have a pronounced correlation effect on altcoins like AXL, often dictating the momentum on lower timeframes. Consequently, Axelar’s rally faced immediate resistance within a key overhead supply zone, failing to secure a daily close above it and signaling that the bearish structure established earlier in the month remained technically intact.

Technical Indicators Present a Mixed Picture

A deeper analysis of on-chain and market data reveals conflicting signals. The On-Balance Volume (OBV) indicator, which measures buying and selling pressure, painted a surprisingly bullish picture by reaching new highs, surpassing even levels from mid-December. This divergence often suggests accumulation despite falling prices. Furthermore, the 1-day Relative Strength Index (RSI) recovered and hovered above the neutral 50 level, indicating strengthening momentum. However, these positive signs were counterbalanced by the unbroken bearish price structure on the daily chart, confirmed by the breakdown below $0.066 on January 20th. The moving averages also failed to produce a bullish crossover, a classic signal for trend confirmation that remained absent. This technical dichotomy underscores the need for cautious, evidence-based analysis rather than reactionary trading.

Demand Zones and Fibonacci Levels Define the Battlefield

For active traders, specific price levels now carry heightened significance. Technical analysts have identified a critical demand zone between $0.065 and $0.072. This area is expected to act as a potential support region where buying interest may re-emerge. Applying Fibonacci retracement levels to the recent swing move higher provides further clarity. At the time of writing, the AXL price threatened to breach the 78.6% retracement level at $0.072. A sustained move below this level would significantly weaken the short-term bullish argument. On lower timeframes, the momentum has already waned, with the hourly RSI dipping below 50 and the price trading beneath its 50-period moving average. These factors collectively suggest that the path of least resistance in the immediate term could be downward, potentially leading to a retest of the lower boundary of the demand zone.

Key Technical Levels for Axelar (AXL):

- Immediate Resistance: $0.083 (Recent high & supply zone)

- Key Support: $0.072 (78.6% Fibonacci & demand zone top)

- Critical Support: $0.065 (Demand zone base)

- Bearish Continuation Trigger: Daily close below $0.065

Market Context and Strategic Implications for Traders

The recent price action cannot be viewed in isolation. The cryptocurrency market in early 2026 continues to exhibit high correlation, meaning Axelar’s trajectory is inextricably linked to Bitcoin’s performance. Analysts note that for a sustainable AXL recovery to take hold, Bitcoin must maintain stability above the $84,000 support region. The massive spike in Open Interest alongside the weekend rally, while indicative of heightened trader attention, also raises flags about sustainability. Such parabolic moves often necessitate a period of consolidation or a deeper retracement to establish a healthier foundation for the next leg up. Therefore, a strategic approach for swing traders involves patience, waiting for evidence of consolidation within the identified demand zone and a gradual, volume-supported recovery before considering new long positions.

The Role of Derivatives and Sentiment

The derivatives market provides crucial context for the spot price movement. The dramatic increase in Open Interest reflects new money entering the market, often amplifying volatility in both directions. While this can fuel powerful rallies, it also increases the risk of violent liquidations if the price reverses, as seen in broader market cycles. This environment demands rigorous risk management. The current analyst consensus, therefore, advocates for a sidelined stance in the immediate term, allowing the market to define its next clear direction. The primary bullish scenario hinges on AXL demonstrating a positive reaction and holding support at $0.072, coupled with a stabilizing Bitcoin market.

Conclusion

The Axelar AXL price action presents a classic study in market contradiction: powerful short-term bullish momentum clashing with a persistent bearish higher-timeframe structure. The 19% rally, fueled by a 1,200% volume spike, demonstrates significant trader interest but has so far failed to break the overarching downtrend. For market participants, the immediate focus rests on the $0.065-$0.072 demand zone. A successful defense of this area, particularly with a stabilizing Bitcoin, could set the stage for a more sustainable recovery. Conversely, a breakdown below $0.065 would signal a bearish continuation, invalidating the recent rally’s strength. In this complex environment, disciplined analysis of key levels, volume, and broader market correlation remains paramount for navigating the next phase of Axelar’s price discovery.

FAQs

Q1: What caused Axelar (AXL) to rally 19%?

The rally was driven by a massive 1,200% surge in daily trading volume, indicating a sudden influx of buying interest, though it occurred within a broader bearish market structure and faced rejection at a key supply zone.

Q2: Why is the market structure still considered bearish for AXL?

The bearish structure was confirmed by a daily close below $0.066 on January 20th. Despite the recent rally, the price failed to break above key resistance and the daily chart’s lower highs pattern remains unbroken.

Q3: What is the most important price level to watch for AXL?

The $0.065-$0.072 range is critical. It acts as a major demand zone. A hold above $0.072 could support recovery, while a break below $0.065 would signal a likely bearish continuation.

Q4: How does Bitcoin’s price affect Axelar (AXL)?

AXL, like most altcoins, exhibits a high correlation with Bitcoin. BTC’s stability above $84k is viewed as a necessary condition for a sustained AXL recovery, as bearish BTC momentum often spills over into the altcoin market.

Q5: What is a prudent trading strategy for AXL given the current analysis?

Analysts suggest a cautious, sidelined approach in the short term. The recommended strategy is to wait for evidence of consolidation and a gradual recovery within the $0.065-$0.072 zone before considering long positions, ensuring clearer directional momentum.