Weaker Dollar Fails to Boost Bitcoin: Startling Analysis Reveals 2025’s Risk-Averse Reality

In a surprising development for cryptocurrency investors, a significant weakening of the US dollar throughout early 2025 has failed to provide its traditional catalyst for Bitcoin price appreciation, according to detailed on-chain analysis. This counterintuitive market behavior challenges conventional wisdom about cryptocurrency’s role as an inflation hedge. Market analysts now point toward a complex macroeconomic environment characterized by extreme risk aversion as the primary driver of this decoupling.

Weaker Dollar Bitcoin Correlation Breaks Down

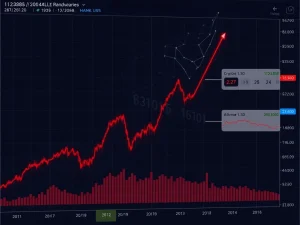

Historically, cryptocurrency markets have demonstrated an inverse relationship with US dollar strength. Consequently, analysts frequently monitor dollar index movements for Bitcoin price signals. However, recent data from CryptoQuant and independent analysts reveals a stark deviation from this pattern. The US Dollar Index (DXY) declined approximately 4.2% in the first quarter of 2025, yet Bitcoin’s price remained range-bound between $58,000 and $62,000 during the same period.

This breakdown suggests that simple currency devaluation no longer guarantees cryptocurrency inflows. Market participants now require specific macroeconomic conditions to trigger a rally. GugaOnChain, a noted CryptoQuant contributor, emphasizes this point in recent analysis. The analyst explains that dollar weakness must coincide with high inflation expectations and abundant market liquidity to benefit Bitcoin meaningfully.

Macroeconomic Conditions Dictate Crypto Response

The current financial landscape presents unique challenges for digital assets. Widespread fear dominates investor psychology, creating a strong “risk-off” sentiment across global markets. In such environments, capital typically flees volatile assets and seeks established safe havens. This flight to quality explains the recent outperformance of traditional stores of value.

- Gold’s Resurgence: Gold prices surged to record highs above $2,800 per ounce in March 2025, attracting substantial institutional investment.

- Treasury Demand: US government bond yields fell as demand for perceived safety increased dramatically.

- Cryptocurrency Stagnation: Major digital assets like Bitcoin and Ethereum showed low volatility and muted trading volumes.

This preference hierarchy demonstrates that during genuine economic uncertainty, investors prioritize assets with centuries of established trust over newer digital alternatives. The psychological comfort of tangible assets becomes paramount when confidence in financial systems wavers.

Expert Analysis: The Catalyst Framework

GugaOnChain’s framework provides crucial insight into current market mechanics. The analyst identifies two distinct scenarios for dollar devaluation and their differing impacts on cryptocurrency markets. First, a dollar decline driven by expansive monetary policy and high inflation often benefits Bitcoin as investors seek alternative stores of value. Second, a dollar weakness stemming from a crisis of confidence and extreme risk aversion typically harms cryptocurrencies alongside traditional risk assets.

The 2025 environment clearly falls into the second category. Banking sector stresses in several regions and geopolitical tensions have amplified systemic fears. Consequently, investors treat cryptocurrencies as risk assets rather than safe havens during this specific phase. This classification leads to correlated declines with stock markets during sell-offs, despite a weakening dollar.

Historical Context and Market Evolution

Understanding this shift requires examining Bitcoin’s evolving market role. During its early years, Bitcoin often moved independently from traditional financial markets, earning its “digital gold” moniker. However, increasing institutional adoption since 2020 has gradually increased its correlation with technology stocks and broader risk sentiment.

| Period | DXY Change | Bitcoin Change | Primary Market Driver |

|---|---|---|---|

| 2020-2021 | -6.8% | +425% | Monetary Expansion & Inflation Fears |

| 2023 Q4 | -3.1% | +52% | ETF Approval Expectations |

| 2025 Q1 | -4.2% | +2.3% | Risk-Off Sentiment & Safe-Haven Flows |

This comparison reveals how identical dollar movements produce dramatically different cryptocurrency outcomes based on underlying market psychology. The 2025 data indicates that dollar strength alone has become a poor predictor of Bitcoin performance without considering the fundamental reasons behind currency movements.

Implications for Cryptocurrency Investment Strategy

This analysis carries significant implications for both retail and institutional investors. Portfolio managers must now analyze the root causes of dollar movements rather than simply tracking the currency’s direction. A weakening dollar amid economic optimism and loose monetary policy might still benefit cryptocurrencies. Conversely, dollar weakness during financial stress likely signals caution for digital asset allocations.

Furthermore, this environment tests Bitcoin’s long-term value proposition. Proponents argue that true decentralization should provide insulation from traditional market panics. However, current price action suggests that market participants still categorize cryptocurrencies within the broader risk asset universe during extreme stress. This perception may evolve as the asset class matures and achieves greater mainstream adoption.

The Gold Comparison and Store-of-Value Debate

The simultaneous dollar weakness and gold strength create an intriguing comparison for Bitcoin. Gold’s performance reinforces its status as the ultimate crisis hedge, a role Bitcoin has aspired to claim. Several factors contribute to gold’s advantage in the current climate:

- Regulatory Clarity: Gold markets operate under established global frameworks.

- Institutional Comfort: Pension funds and central banks have centuries of experience with gold allocation.

- Physical Tangibility: The psychological comfort of physical possession during uncertainty.

- Zero Counterparty Risk: Gold bullion carries no dependency on digital infrastructure or exchanges.

These factors don’t diminish Bitcoin’s technological advantages but highlight the challenges of establishing monetary trust during crisis periods. Market analysts suggest that Bitcoin may need to demonstrate independence during several economic cycles before achieving comparable safe-haven status.

Conclusion

The startling revelation that a weaker dollar is not helping Bitcoin in 2025’s first quarter provides crucial lessons for cryptocurrency investors. Macroeconomic context now outweighs simple currency movements in determining digital asset performance. The current risk-off environment has temporarily severed the traditional inverse relationship between the dollar and Bitcoin, favoring established safe havens like gold instead. This analysis underscores the cryptocurrency market’s ongoing maturation and its complex integration with global financial systems. Investors must now consider deeper macroeconomic drivers rather than relying on historical correlations that may no longer apply in evolving market conditions.

FAQs

Q1: Why isn’t Bitcoin rising when the US dollar weakens?

A1: Bitcoin typically benefits from dollar weakness only during specific conditions like high inflation and abundant liquidity. The current risk-off sentiment causes investors to prefer traditional safe havens like gold instead.

Q2: What macroeconomic conditions help Bitcoin when the dollar declines?

A2: Expansionary monetary policy, rising inflation expectations, and strong market liquidity create an environment where dollar weakness often drives capital into cryptocurrencies as alternative stores of value.

Q3: How does risk-off sentiment affect cryptocurrency markets?

A3: During risk-off periods, investors reduce exposure to volatile assets. Cryptocurrencies often correlate with stock markets in these environments, declining alongside traditional risk assets despite a weakening dollar.

Q4: Why is gold outperforming Bitcoin during current dollar weakness?

A4: Gold has millennia of established trust as a crisis hedge. During genuine economic uncertainty, institutional and retail investors prioritize this proven safe haven over newer digital alternatives.

Q5: Could Bitcoin eventually decouple from risk assets during dollar declines?

A5: As the cryptocurrency market matures and achieves broader adoption, Bitcoin may demonstrate stronger decoupling during crises. However, this requires establishing deeper trust through multiple economic cycles.