Coinbase CEO’s Inevitable Vision: Why Even Crypto Critics Will Embrace Daily Digital Currency Use

In a significant statement from San Francisco this week, Coinbase CEO Brian Armstrong made a bold prediction about cryptocurrency’s future trajectory, suggesting that even the technology’s most vocal critics will eventually use digital assets daily, perhaps without even realizing it.

Coinbase CEO’s Vision for Universal Crypto Adoption

Brian Armstrong, who co-founded the United States’ largest cryptocurrency exchange in 2012, recently articulated his perspective on blockchain technology’s inevitable integration into everyday life. During a fintech conference discussion, Armstrong emphasized that cryptocurrency adoption will follow patterns established by previous technological revolutions. He specifically pointed to internet protocols and cloud computing as historical parallels. Initially, these technologies faced substantial skepticism from established institutions and public figures. However, they eventually became invisible infrastructure powering countless applications that people use without understanding the underlying technology.

Armstrong’s comments arrive during a period of significant maturation for the cryptocurrency sector. Regulatory frameworks continue to develop globally, while institutional investment in digital assets reaches new milestones. Major financial institutions now offer cryptocurrency custody services, and payment processors increasingly integrate blockchain settlement layers. This institutional embrace creates a foundation for broader consumer adoption through familiar interfaces and applications.

The Technological Foundation for Invisible Crypto Integration

Blockchain technology’s evolution enables Armstrong’s prediction through several key developments. Layer-2 scaling solutions dramatically increase transaction speeds while reducing costs, making micro-transactions feasible. Meanwhile, zero-knowledge proofs enhance privacy without sacrificing security. These technical advancements allow developers to build applications where blockchain functions as a backend utility rather than a user-facing feature.

Consider these current implementations where users already interact with blockchain technology unknowingly:

- Cross-border payments: Many remittance services use cryptocurrency rails for settlement while displaying traditional currency values to users.

- Loyalty programs: Major retailers tokenize reward points on private blockchains without requiring customer cryptocurrency knowledge.

- Digital identity: Verifiable credentials stored on decentralized networks enable secure logins across platforms.

- Supply chain tracking: Consumers access product origin data through QR codes powered by immutable ledgers.

These examples demonstrate Armstrong’s core argument: blockchain’s value proposition lies in solving specific problems efficiently, not in requiring users to understand cryptographic principles. As these solutions become more refined and integrated, the technology recedes into the background while delivering tangible benefits.

Historical Context and Expert Perspectives

Technology adoption curves provide relevant context for Armstrong’s prediction. Professor Everett Rogers’ Diffusion of Innovations theory identifies distinct adopter categories, from innovators to laggards. Cryptocurrency currently occupies the early adopter phase, with approximately 15-20% global adoption according to recent surveys from TripleA and the Cambridge Centre for Alternative Finance. Historical patterns suggest that once a technology reaches this penetration level, accelerated mainstream adoption typically follows within 5-7 years.

Financial technology experts echo aspects of Armstrong’s perspective. Dr. Merav Ozair, a blockchain researcher at Rutgers Business School, notes, “We’re witnessing the ‘productization’ of blockchain technology. Just as most internet users don’t understand TCP/IP protocols, future blockchain users won’t need to understand consensus mechanisms. The technology becomes a utility enabling specific functionalities within applications.”

This transition from technology-focused to solution-focused implementation represents a critical maturation phase. Early cryptocurrency applications required users to manage private keys and understand wallet addresses. Current developments abstract these complexities behind intuitive interfaces while maintaining the technology’s core benefits of transparency, security, and programmability.

Addressing Critic Concerns Through Technological Evolution

Cryptocurrency critics frequently cite several legitimate concerns that must be addressed for Armstrong’s prediction to materialize. These include volatility, regulatory uncertainty, environmental impact, and usability challenges. However, ongoing developments directly respond to each criticism, creating pathways toward seamless integration.

Stablecoins pegged to traditional assets address volatility concerns for transactional use cases. Regulatory clarity continues to improve through frameworks like the European Union’s Markets in Crypto-Assets (MiCA) regulation and ongoing legislative efforts in the United States. Environmental concerns diminish as proof-of-stake consensus mechanisms replace energy-intensive proof-of-work systems, with Ethereum’s 2022 Merge reducing network energy consumption by approximately 99.95% according to the Crypto Carbon Ratings Institute.

| Common Criticism | Technological/Regulatory Response | Current Implementation Examples |

|---|---|---|

| Price Volatility | Algorithmic and asset-backed stablecoins | USDC, DAI, PayPal USD |

| Transaction Speed | Layer-2 scaling solutions | Polygon, Arbitrum, Optimism |

| Energy Consumption | Proof-of-stake consensus | Ethereum 2.0, Cardano, Solana |

| Regulatory Uncertainty | Comprehensive frameworks | MiCA (EU), Travel Rule compliance |

| User Experience Complexity | Account abstraction, social recovery | ERC-4337 standard implementations |

These developments collectively create an environment where cryptocurrency’s benefits become accessible without requiring users to navigate its historical complexities. As Armstrong suggests, this evolution enables adoption even among those currently skeptical about the technology’s value proposition or usability.

The Path Toward Daily Crypto Integration

Several converging trends support Armstrong’s prediction of daily cryptocurrency use becoming commonplace. Central bank digital currencies (CBDCs) currently in development across 130 countries according to the Atlantic Council will familiarize populations with digital currency concepts. Tokenization of real-world assets, projected to become a $16 trillion market by 2030 according to consulting firm BCG, will create blockchain-based representations of traditional financial instruments.

Furthermore, decentralized identity solutions enable users to control personal data while accessing services, potentially replacing traditional login systems. Micropayment capabilities through improved scaling solutions could transform content monetization and in-app purchases. These applications share a common characteristic: they solve specific problems efficiently while keeping the underlying technology transparent to end-users.

Armstrong’s perspective aligns with broader industry observations about technology adoption patterns. Marc Andreessen’s seminal essay “Why Software Is Eating the World” described how software companies would disrupt traditional industries. A similar transformation now occurs with blockchain technology, which enables new approaches to trust, verification, and value transfer without requiring users to understand its implementation details.

Real-World Implementation Timeline

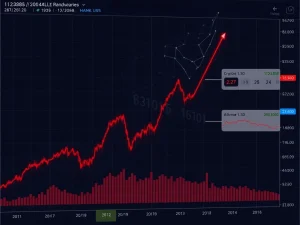

The transition toward daily cryptocurrency use follows a discernible timeline with measurable milestones. Between 2009 and 2017, cryptocurrency primarily served as an alternative investment asset and payment method for early adopters. From 2018 to 2023, institutional infrastructure development accelerated through custody solutions, derivatives markets, and regulatory frameworks. The current phase (2024 onward) focuses on integration with traditional financial systems and consumer applications.

Projecting forward, several indicators suggest Armstrong’s prediction could materialize within specific domains first. Cross-border remittances already demonstrate blockchain’s efficiency advantages, with settlement times reduced from days to minutes and costs lowered by 40-80% according to World Bank data. Gaming and virtual economies increasingly incorporate non-fungible tokens (NFTs) and cryptocurrency rewards. Digital identity applications using verifiable credentials on blockchain networks are being piloted by governments and corporations worldwide.

These implementations share a crucial characteristic identified by Armstrong: they deliver tangible benefits that address specific pain points. When technology solves genuine problems effectively, adoption follows regardless of initial skepticism. This pattern has repeated throughout technological history, from electricity to automobiles to the internet itself.

Conclusion

Coinbase CEO Brian Armstrong’s prediction about daily cryptocurrency use reflects blockchain technology’s evolution from speculative asset to practical infrastructure. As the technology matures and integrates with existing systems, its distinguishing characteristics become implementation details rather than user requirements. This transition enables adoption across demographic segments, including current critics who may eventually use cryptocurrency daily without recognizing the underlying technology. The path toward this future involves addressing legitimate concerns through technological innovation and regulatory development while focusing on solving real-world problems efficiently. Armstrong’s vision suggests cryptocurrency will follow the adoption pattern of previous transformative technologies: initial skepticism giving way to ubiquitous integration as the technology recedes into the background of daily life.

FAQs

Q1: What exactly did Coinbase CEO Brian Armstrong predict about cryptocurrency adoption?

Brian Armstrong predicted that even cryptocurrency’s strongest critics will eventually use digital assets daily, possibly without realizing they’re interacting with blockchain technology, as it becomes integrated into everyday applications and services.

Q2: How could someone use cryptocurrency without knowing it?

Blockchain technology can function as a backend infrastructure for applications while presenting familiar interfaces to users. Examples include cross-border payments settled via cryptocurrency rails, tokenized loyalty programs, verifiable digital credentials, and supply chain tracking systems.

Q3: What technological developments make Armstrong’s prediction feasible?

Key developments include layer-2 scaling solutions for faster transactions, proof-of-stake consensus reducing energy consumption, stablecoins minimizing volatility, account abstraction improving user experience, and regulatory frameworks providing clearer operating environments.

Q4: What historical parallels exist for this type of technology adoption?

Internet protocols, cloud computing, and encryption technologies followed similar adoption patterns where initially complex technologies became invisible infrastructure that users employed daily without understanding their technical implementation.

Q5: What are the main barriers to daily cryptocurrency adoption that need addressing?

Primary barriers include regulatory uncertainty, price volatility for non-stablecoin assets, user experience complexity, environmental concerns (for proof-of-work systems), and integration with traditional financial infrastructure, all of which are being actively addressed through ongoing developments.

Q6: Which applications might drive daily cryptocurrency use first?

Cross-border payments, gaming/virtual economies, digital identity systems, tokenized real-world assets, and micropayment-enabled content platforms represent likely early drivers of daily cryptocurrency integration that users might not explicitly recognize as blockchain-based.