Bitcoin Defies Market Turbulence: Institutional Investors See Compelling Value in Current Correction

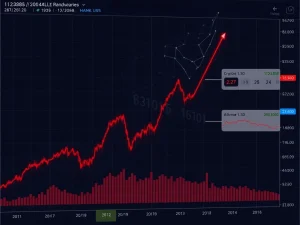

January 2026 – Global cryptocurrency markets continue navigating significant volatility, yet Bitcoin demonstrates remarkable resilience as institutional investors identify compelling value opportunities. According to recent data from Coinbase, approximately 71% of surveyed institutional investors consider Bitcoin undervalued within the $85,000 to $95,000 trading range. This perspective emerges despite Bitcoin experiencing approximately 30% correction from its October 2025 peak. The digital asset’s fundamental narrative appears intact, particularly among professional investment desks analyzing longer-term horizons.

Bitcoin Institutional Sentiment Analysis Reveals Value Perception

Coinbase’s comprehensive survey, conducted between December 10, 2025 and January 12, 2026, provides crucial insights into professional investor psychology. The research encompassed 148 participants, including 75 institutional investors and 73 independent investors. Significantly, nearly three-quarters of institutional respondents characterized Bitcoin as undervalued at current levels. Only a minority expressed concerns about overvaluation. This data point becomes particularly noteworthy when contrasted against recent market performance. Bitcoin has faced substantial selling pressure throughout late 2025, with significant liquidation events affecting market structure. However, institutional perspectives suggest this correction represents a potential buying opportunity rather than fundamental deterioration.

Methodology and Sample Significance

The survey’s sample size, while not exhaustive, provides meaningful directional data about professional sentiment. Institutional investors typically employ sophisticated valuation frameworks beyond simple price chart analysis. Their assessment incorporates multiple dimensions including scarcity metrics, adoption curves, liquidity profiles, and macroeconomic correlations. Many institutions compare current Bitcoin prices against their previous entry points, adjusting for risk parameters and portfolio allocation strategies. This disciplined approach contrasts with retail investor behavior, which often reacts more emotionally to short-term price movements. The consistency of institutional responses across the survey period suggests genuine conviction rather than temporary optimism.

Institutional Holding Patterns During Market Stress

Perhaps more revealing than valuation assessments are actual behavioral patterns during market declines. Coinbase data indicates that 80% of institutional investors would maintain or increase their positions following an additional 10% market decline. This “hold or buy” mentality represents a significant psychological support level for Bitcoin markets. Furthermore, over 60% of institutions have maintained or increased their cryptocurrency exposure since October 2025’s market peak. These behavioral indicators suggest institutional investors view current market conditions as a consolidation phase rather than a fundamental breakdown. The data reveals a strategic patience uncommon during previous cryptocurrency market cycles.

Portfolio Discipline Versus Market Sentiment

Institutional investment committees typically operate with strict portfolio management protocols. Their reported willingness to maintain positions during volatility reflects calculated risk assessment rather than speculative gambling. Many professional investors employ dollar-cost averaging strategies during corrections, systematically accumulating positions at perceived value levels. This approach contrasts sharply with momentum chasing during bull markets. The current institutional behavior suggests Bitcoin is transitioning from speculative asset to strategic portfolio component. This evolution carries significant implications for long-term price discovery and market stability.

Macroeconomic Context for 2026 Cryptocurrency Markets

Bitcoin’s performance never occurs in isolation from broader financial conditions. Coinbase’s analysis references several macroeconomic factors influencing institutional perspectives. The Federal Reserve’s potential interest rate policy represents a crucial variable. Market expectations currently anticipate two rate cuts during 2026, which typically supports risk assets including cryptocurrencies. Additionally, December 2025 inflation data registered approximately 2.7%, while GDPNow models project robust fourth-quarter economic growth. These conditions create a complex backdrop where traditional safe-haven assets compete with digital alternatives. Bitcoin’s narrative as “digital gold” gains particular relevance during periods of monetary policy transition.

Comparative Analysis with Traditional Assets

| Asset Class | 2025 Performance | Institutional Allocation Trend | Volatility Profile |

|---|---|---|---|

| Bitcoin | +45% YTD (pre-correction) | Increasing | High |

| Gold | +12% YTD | Stable | Low-Moderate |

| S&P 500 | +18% YTD | Decreasing | Moderate |

| 10-Year Treasury | -3% YTD | Decreasing | Low |

The comparative analysis reveals Bitcoin’s unique position within institutional portfolios. Despite higher volatility, its performance characteristics and non-correlation benefits maintain appeal. Many investment committees now view cryptocurrency allocations similarly to early-stage venture capital positions – higher risk but potentially asymmetric returns. This framework explains institutional tolerance for periodic corrections.

Risk Factors and Market Vulnerabilities

While institutional sentiment appears constructive, multiple risk factors warrant consideration. Coinbase’s report explicitly identifies several potential disruptors:

- Geopolitical tensions: International conflicts affecting energy markets and global trade

- Energy price shocks: Sudden commodity price movements impacting mining economics

- Regulatory developments: Evolving global cryptocurrency frameworks

- Political uncertainties: Election cycles and policy shifts

- Technological risks: Network security and protocol developments

These variables create what analysts term “comet tail risks” – low probability but high impact events that could dramatically alter market trajectories. Institutional investors typically hedge against such scenarios through position sizing and diversification rather than complete avoidance.

The Liquidation Cascade Dynamics

Recent market corrections have featured significant liquidation events across cryptocurrency derivatives markets. These cascades occur when leveraged positions face margin calls, forcing sales that depress prices further. However, institutional investors generally avoid excessive leverage, particularly with core Bitcoin holdings. Their longer time horizons and cash-based positions provide stability during volatility spikes. This behavioral distinction helps explain why institutional sentiment remains constructive despite dramatic price swings. Their investment theses typically extend across multiple market cycles rather than quarterly performance periods.

Valuation Methodologies and Price Discovery

The concept of “undervaluation” requires examination, as institutions employ diverse valuation frameworks:

- Stock-to-flow models: Comparing Bitcoin’s programmed scarcity to traditional commodities

- Network value metrics: Analyzing active addresses, transaction volumes, and hash rate

- Comparative store-of-value: Evaluating Bitcoin against gold’s market capitalization

- Adoption curve analysis: Projecting user growth against technology adoption patterns

- Macro hedge ratios: Calculating optimal portfolio allocations during currency debasement scenarios

These methodologies produce varying price targets but generally converge around current levels representing reasonable entry points. The diversity of approaches actually strengthens the undervaluation argument, as different analytical frameworks reach similar conclusions.

Historical Context and Market Cycle Analysis

Bitcoin has experienced multiple 30%+ corrections throughout its history, often within broader bull markets. Previous cycles demonstrate that institutional accumulation frequently accelerates during such periods. The current correction’s magnitude remains within historical norms for Bitcoin volatility. However, the market context differs significantly from previous cycles due to increased institutional participation. Professional investors typically exhibit different behavioral patterns than retail participants, potentially smoothing extreme volatility over time. This evolution represents Bitcoin’s maturation as an asset class.

Previous Correction Comparisons

Historical analysis reveals consistent patterns:

- 2017 bull market: Multiple 30-40% corrections within broader uptrend

- 2020-2021 cycle: Several 20-30% pullbacks during accumulation phase

- Current cycle: Similar magnitude corrections with higher institutional participation

The key distinction involves institutional response patterns. Previous corrections primarily reflected retail investor psychology, while current movements increasingly incorporate institutional rebalancing and strategic positioning.

Conclusion

Bitcoin continues demonstrating resilience amid challenging market conditions, with institutional investors identifying compelling value at current levels. The Coinbase survey reveals sophisticated market participants maintaining or increasing exposure despite significant price corrections. This behavior suggests professional investors view recent volatility as a consolidation phase rather than fundamental deterioration. Multiple valuation methodologies converge around current prices representing reasonable entry points for long-term allocations. While risks persist across geopolitical, regulatory, and macroeconomic dimensions, institutional commitment provides psychological and structural support for Bitcoin markets. The digital asset’s evolution from speculative instrument to strategic portfolio component appears increasingly evident through professional investor behavior during market stress.

FAQs

Q1: What percentage of institutional investors consider Bitcoin undervalued?

Approximately 71% of institutional investors surveyed by Coinbase consider Bitcoin undervalued when trading between $85,000 and $95,000, according to research conducted between December 2025 and January 2026.

Q2: How have institutional investors behaved during recent market declines?

Over 60% of institutions have maintained or increased their cryptocurrency exposure since October 2025’s market peak, with 80% indicating they would hold or buy more following an additional 10% decline.

Q3: What macroeconomic factors support Bitcoin’s institutional appeal?

Potential Federal Reserve rate cuts in 2026, manageable inflation around 2.7%, and robust economic growth projections create conditions where Bitcoin’s non-correlation and store-of-value characteristics gain relevance.

Q4: What risks could disrupt current institutional sentiment?

Geopolitical tensions, energy price shocks, regulatory developments, political uncertainties, and technological risks represent potential disruptors that could alter market trajectories despite constructive institutional perspectives.

Q5: How do institutional valuation methods differ from retail approaches?

Institutions typically employ sophisticated frameworks including stock-to-flow models, network value metrics, comparative store-of-value analysis, adoption curve projections, and macro hedge ratios rather than simple price chart analysis.