Ethereum’s Alarming Activity Peak: How Record Network Growth Masks a Dangerous Security Crisis

January 2025 marked a paradoxical milestone for the Ethereum blockchain. While the network celebrated surpassing 1.29 million daily active addresses—a record that outperformed all major Layer 2 solutions—security researchers uncovered a disturbing truth. This apparent surge in Ethereum activity, driven by the successful Fusaka update, concealed sophisticated phishing campaigns exploiting the very improvements designed to democratize access. The resulting security crisis highlights a fundamental tension between technological scalability and user protection in decentralized ecosystems.

Ethereum’s Record Activity and the Illusion of Growth

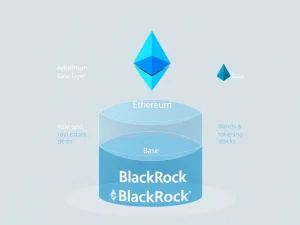

The Ethereum mainnet achieved unprecedented metrics in mid-January 2025. Data analytics platform Token Terminal confirmed that Layer 1 activity definitively exceeded all major Layer 2 networks, including Arbitrum, Base, and Optimism, in daily active addresses. This resurgence demonstrated Ethereum’s enduring role as the foundational settlement layer, the “gravitational well” for ultimate security, finality, and liquidity. The Fusaka update, deployed in early December 2024, served as the primary catalyst. By implementing proto-danksharding and other optimizations, the upgrade successfully reduced average transaction fees by approximately sixfold. Consequently, network vitality appeared to return to levels reminiscent of previous bull markets, attracting renewed institutional and retail interest.

The Hidden Mechanism of Artificial Activity

Beneath the triumphant headlines, blockchain researcher Andrey Sergeenkov identified anomalous patterns. His analysis revealed that 67% of the new addresses created during this period received initial transactions of less than one dollar in stablecoin value. This pattern is a hallmark of “dusting” or “dust poisoning,” a long-standing but increasingly sophisticated attack vector. The technique involves sending microscopic, traceable amounts of cryptocurrency to a large number of wallets. These transactions create a false history of interaction, which attackers can later use for social engineering, address poisoning, or to deanonymize wallet clusters. The lower transaction fees post-Fusaka made launching millions of these micro-transactions economically viable for malicious actors.

The Fusaka Update: A Double-Edged Sword

The Fusaka upgrade represented a significant technical achievement for Ethereum developers, directly addressing years of user complaints about high gas costs. Its core innovation, EIP-4844 or proto-danksharding, introduced “blob” transactions, temporarily storing data off-chain to dramatically reduce Layer 1 congestion and fees. The immediate effect was a surge in accessibility; weekly transactions jumped by 63% to over 17 million, and more than 2.7 million new addresses appeared in a single week. However, this very success inadvertently subsidized a spam economy. Sergeenkov’s research suggested that automated malicious contracts could generate up to 80% of the new transactional activity, flooding the network with micro-transfers designed not for utility but for exploitation.

Key Data Points from the January 2025 Activity Surge:

- Daily Active Addresses: 1.29 million (Ethereum L1 record)

- Estimated Fraudulent Activity: Up to 80% from automated spam contracts

- Stolen Funds via Dusting: $740,000, including $509,000 from a single compromised wallet

- New Addresses with Sub-$1 Initial Tx: 67%

- ETH Price at Period’s End: $2,958

The Mechanics and Impact of Dusting Attacks

Dusting attacks exploit human psychology and interface design flaws. After a wallet receives dust, the transaction appears in its history. Attackers then create fake addresses that closely mimic the dusted address (e.g., changing one character). A user intending to send funds to a legitimate contact might auto-complete or copy the wrong address from their history, inadvertently sending a large sum to the attacker’s spoofed address. The drastic reduction in fees enabled by Fusaka lowered the barrier for attackers to dust millions of addresses, increasing the attack’s scale and probability of success. This incident underscores a persistent Web3 paradox: systems designed to eliminate intermediaries place immense security responsibility on the end-user, who remains the most vulnerable link.

Ethereum’s Enduring Strengths Amidst the Crisis

Despite the security concerns, Ethereum’s fundamental position in the blockchain ecosystem remained robust. According to a contemporaneous ARK Invest report, Ethereum controlled between 60% and 66% of the real-world asset (RWA) tokenization market, cementing its role as the preferred institutional infrastructure. Corporate and institutional treasuries continued accumulating ETH, purchasing over 1.2 million ETH in Q4 2024 alone. This divergence between on-chain security threats and off-chain institutional confidence illustrates the complex, multi-layered nature of blockchain adoption. The network’s value for high-value settlement and as a trustless base layer was not diminished by the spam activity, but the episode exposed critical vulnerabilities in user-facing security protocols.

Broader Implications for Blockchain Security and Development

The January 2025 event forced a reevaluation of development priorities within the Ethereum ecosystem. Researchers, including those cited by The Defiant, criticized a potential trade-off where rapid innovation and fee reduction occurred without commensurate advancements in user security education and wallet safeguards. The situation presents a classic scaling trilemma challenge: how to simultaneously achieve scalability, security, and decentralization without compromising one for the others. Furthermore, the incident served as a stark reminder of future threats. Ethereum co-founder Vitalik Buterin had previously outlined the “quantum risk,” where advances in quantum computing could break the elliptic-curve cryptography securing wallets. While not an immediate threat in 2025, the dusting attacks highlighted the network’s ongoing vulnerability to evolving adversarial tactics.

Conclusion

Ethereum’s activity peak in early 2025 revealed a critical inflection point for the world’s leading smart contract platform. The successful Fusaka update achieved its goal of reducing fees and revitalizing mainnet use, but it also unlocked new vectors for large-scale, low-cost attacks. The resulting security crisis, centered on dusting campaigns, emphasized that technological progress must be paired with robust security frameworks and user education. As Ethereum continues to evolve, balancing innovation with protection will be paramount. The network’s dominant position in RWA tokenization and institutional finance proves its underlying strength, yet the January events underscore that sustainable growth requires vigilance against the hidden dangers that can lurk within apparent success.

FAQs

Q1: What is a dusting attack on the Ethereum network?

A dusting attack is a malicious technique where an attacker sends a tiny, traceable amount of cryptocurrency (“dust”) to a large number of wallets. The goal is to later identify wallet clusters for phishing, scam attempts, or to trick users into sending funds to spoofed addresses that appear in their transaction history.

Q2: How did the Fusaka update contribute to this security issue?

The Fusaka update, specifically EIP-4844 (proto-danksharding), successfully reduced Ethereum transaction fees by about six times. While this increased accessibility for legitimate users, it also made it economically feasible for attackers to send dust to millions of addresses, dramatically scaling the potential impact of dusting campaigns.

Q3: Did the fraudulent activity affect Ethereum’s price or institutional adoption?

Available data from Q4 2024 and early 2025 shows no immediate negative impact on ETH’s price or institutional sentiment. Major reports indicated Ethereum maintained over 60% market share in RWA tokenization, and institutional treasuries continued accumulating ETH, suggesting they viewed the spam activity as a separate layer from the network’s core settlement value.

Q4: What can users do to protect themselves from dusting attacks?

Users should never send funds to an address that appears unsolicited in their transaction history. They should always verify recipient addresses manually and use wallet features that allow labeling of trusted addresses. Furthermore, using wallets with robust security analytics that can flag potential dust transactions is advisable.

Q5: Are Layer 2 solutions like Arbitrum or Optimism safer from this type of attack?

Layer 2 networks are not inherently safer; they are potentially more vulnerable because their fees are already low. The primary reason the attack focused on Ethereum Layer 1 was the record-breaking attention and the specific success of the Fusaka update. The security model ultimately depends on user vigilance and wallet safeguards, not just the layer on which a transaction occurs.