Crypto News Today: Critical Developments Shake Global Markets with New Tax Policies and Legal Resolutions

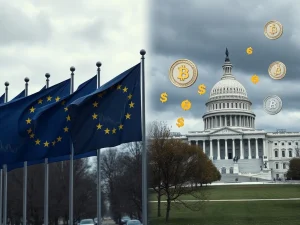

Global cryptocurrency markets face significant regulatory developments today as three major stories emerge simultaneously, potentially reshaping investment landscapes and security protocols for digital asset holders worldwide. The Netherlands proposes a groundbreaking tax on unrealized gains, the US Securities and Exchange Commission dismisses its high-profile case against Gemini, and French authorities launch investigations into a serious data breach affecting thousands of crypto investors. These developments collectively highlight the evolving intersection of cryptocurrency regulation, investor protection, and international policy coordination.

Crypto News Today: Netherlands Proposes Controversial Unrealized Gains Tax

The Dutch government has sparked international debate with its proposal to tax unrealized capital gains on investments including stocks, bonds, and cryptocurrencies. This significant policy shift emerged from parliamentary discussions this week, where caretaker State Secretary for Taxation Eugène Heijnen faced extensive questioning from lawmakers. The proposed changes to the Box 3 asset tax regime would require investors to pay annual taxes on both realized and unrealized gains, fundamentally altering traditional taxation principles that typically only apply when assets are sold.

This proposal follows multiple court rulings that invalidated the Netherlands’ previous taxation system for relying on assumed rather than actual returns. Parliamentary records indicate that despite acknowledging potential flaws in the implementation, a majority of lawmakers appear ready to support the measure. Their position stems primarily from financial considerations, with estimates suggesting delayed implementation could cost the government approximately 2.3 billion euros ($2.7 billion) annually in lost revenue.

Potential Market Impacts and International Reactions

Financial analysts immediately raised concerns about potential capital flight from Dutch markets. The taxation of paper gains represents a substantial departure from international norms and could significantly impact investment strategies. Comparative analysis reveals how this approach differs from other major economies:

| Country | Cryptocurrency Taxation Approach | Unrealized Gains Tax |

|---|---|---|

| Netherlands (Proposed) | Annual tax on unrealized gains | Yes |

| United States | Tax upon realization events | No |

| Germany | Tax-free after one year holding period | No |

| United Kingdom | Capital gains tax upon disposal | No |

Market observers note that this policy could create several immediate effects:

- Portfolio rebalancing: Investors may shift assets to jurisdictions with more favorable tax treatment

- Liquidity concerns: Forced selling to cover tax liabilities on paper gains

- Administrative complexity: Valuation challenges for illiquid crypto assets

- Precedent setting: Potential influence on other EU member states’ tax policies

SEC Dismisses Gemini Lawsuit with Prejudice

In a major legal development, the United States Securities and Exchange Commission has dismissed its civil lawsuit against Gemini Trust Company and Genesis Global Capital with prejudice. Court documents filed in the US District Court for the Southern District of New York reveal that both parties submitted a joint stipulation to dismiss the action on Friday. This dismissal effectively concludes the SEC’s claims regarding Gemini’s crypto lending program with Genesis, marking a significant resolution to litigation that began in January 2023.

The case dismissal follows approximately nine months after the SEC initially paused the civil action in April 2024. Regulatory documents indicate that the SEC agreed to dismissal based on several key factors. First, Gemini Earn investors received a 100% in-kind return of their crypto assets through the Genesis bankruptcy proceedings in mid-2024. Second, Gemini committed to contributing up to $40 million to facilitate the complete return of those assets. Additionally, Genesis previously settled with the SEC by agreeing to pay a $21 million civil penalty.

Regulatory Context and Industry Implications

This case originated during a period of intensified regulatory scrutiny of cryptocurrency platforms under the Biden administration. The SEC’s initial complaint alleged that Gemini’s Earn program constituted an unregistered securities offering. The resolution through dismissal rather than settlement or judgment provides important insights into current regulatory approaches.

Legal experts highlight several significant aspects of this development:

- Precedent value: Demonstrates regulatory flexibility when investor restitution occurs

- Enforcement priorities: Suggests focus on investor protection over punitive measures

- Industry signaling: May influence how other platforms approach regulatory engagement

- Procedural significance: Dismissal with prejudice prevents future litigation on same claims

The resolution timeline provides important context for understanding regulatory processes:

- January 2023: SEC files lawsuit against Gemini and Genesis

- April 2024: SEC pauses civil action under acting chairman Mark Uyeda

- Mid-2024: Genesis bankruptcy enables asset returns to Earn investors

- This week: Joint stipulation filed for dismissal with prejudice

French Authorities Investigate Crypto Tax Platform Data Breach

French cybersecurity authorities have initiated a preliminary investigation into a significant data breach at cryptocurrency tax platform Waltio. According to official notices from the Paris Public Prosecutor’s Office and France’s National Cyber Unit, the breach potentially compromised personal data of approximately 50,000 users, predominantly based in France. The investigation aims to determine the nature of stolen data and identify affected Waltio users, with particular concern about potential follow-on criminal activities targeting cryptocurrency holders.

Reports from French media indicate that hacker group Shiny Hunters conducted the attack and subsequently issued a ransom demand to Waltio. This incident highlights growing security challenges facing cryptocurrency service providers, particularly those handling sensitive financial and personal information. The official notice specifically warned that affected users could face targeted attempts to transfer their digital assets under false pretenses of legitimate security concerns.

Security Implications and User Protection Measures

The Waltio breach represents a concerning escalation in cryptocurrency-related cyber threats. Authorities specifically warned about potential “wrench attacks”—a colloquial term describing situations where criminals use physical threats or violence to coerce cryptocurrency transfers. These attacks typically follow data breaches that reveal both asset holdings and personal location information.

Security experts recommend several protective measures for cryptocurrency users:

- Enhanced privacy practices: Limit sharing of cryptocurrency holdings information

- Security protocols: Implement multi-signature wallets and cold storage solutions

- Monitoring services: Utilize blockchain analytics to detect unusual activity

- Educational resources: Stay informed about emerging threat vectors

This incident follows similar attacks reported in multiple countries, indicating a global pattern of cryptocurrency-targeted crimes. French authorities have documented previous cases where criminals obtained personal data through breaches and subsequently targeted individuals or their relatives. The investigation continues as authorities work to assess the full scope of compromised data and identify potentially vulnerable users.

Global Regulatory Landscape and Market Implications

Today’s developments collectively illustrate the complex, evolving regulatory environment for cryptocurrency markets. The Netherlands’ tax proposal represents a potentially transformative approach to digital asset taxation within the European Union. Meanwhile, the SEC’s dismissal of the Gemini case suggests evolving enforcement strategies in the United States. Simultaneously, the French investigation into Waltio underscores persistent security challenges in the cryptocurrency ecosystem.

Market analysts observe several interconnected implications from these simultaneous developments:

- Regulatory divergence: Different jurisdictions continue developing distinct approaches

- Investor considerations: Taxation and security become increasingly important factors

- Industry adaptation: Service providers must navigate complex compliance requirements

- Policy coordination: International discussions likely to intensify around these issues

The cryptocurrency industry continues maturing amid these regulatory developments. Market participants now face a landscape where taxation policies, legal precedents, and security protocols increasingly influence investment decisions and operational strategies. These developments occur against a backdrop of broader technological innovation and market evolution, creating both challenges and opportunities for stakeholders across the ecosystem.

Conclusion

Today’s crypto news highlights critical developments across taxation, regulation, and security that collectively shape the global digital asset landscape. The Netherlands’ proposed unrealized gains tax represents a potentially significant shift in investment taxation principles, while the SEC’s dismissal of the Gemini case provides important insights into US regulatory approaches. Simultaneously, the French investigation into the Waltio data breach underscores ongoing security challenges facing cryptocurrency users. These developments demonstrate the continued evolution of cryptocurrency markets amid increasing regulatory scrutiny and technological complexity, with implications for investors, service providers, and policymakers worldwide. As the industry matures, such developments will likely continue influencing market dynamics and regulatory frameworks across jurisdictions.

FAQs

Q1: What does “unrealized gains tax” mean for cryptocurrency investors?

An unrealized gains tax requires investors to pay taxes on investment appreciation annually, even if they haven’t sold the assets. This differs from traditional capital gains taxes that only apply upon asset sale, potentially creating liquidity challenges for cryptocurrency holders facing tax liabilities without actual proceeds from sales.

Q2: Why did the SEC dismiss its case against Gemini?

The SEC dismissed the case primarily because Gemini Earn investors received full restitution of their assets through the Genesis bankruptcy process, and Gemini agreed to contribute additional funds to ensure complete recovery. The agency determined that investor protection goals had been achieved through these mechanisms.

Q3: What risks do cryptocurrency users face from data breaches like Waltio’s?

Data breaches exposing cryptocurrency holdings and personal information create risks of targeted attacks, including phishing attempts, social engineering, and potentially physical threats. Criminals may use stolen data to identify high-value targets for extortion or theft attempts.

Q4: How might the Netherlands’ tax proposal affect international cryptocurrency markets?

The proposal could influence investment flows as investors potentially relocate assets to jurisdictions with more favorable tax treatment. It may also establish precedents that other countries consider, particularly within the European Union where tax policy coordination often occurs.

Q5: What protective measures should cryptocurrency investors take following security breaches?

Investors should enhance privacy practices, implement robust security protocols like multi-signature wallets and cold storage, monitor accounts for unusual activity, and stay informed about emerging threats. Using separate addresses for different purposes and limiting public disclosure of holdings can also reduce risks.