Crypto Market Crash: Bitcoin Plunges Below $90K Amid Tariff Turmoil as Chainlink Unveils Revolutionary Equity Streams

Global cryptocurrency markets experienced a sharp corrective phase on January 22, 2026, as escalating geopolitical trade tensions triggered a broad sell-off. Consequently, Bitcoin (BTC) decisively broke below the psychologically significant $90,000 support level. Meanwhile, significant infrastructure developments continued unabated, highlighted by Chainlink’s landmark launch of real-time U.S. equity price feeds for blockchain networks. This juxtaposition of short-term price volatility against long-term technological progress defines the current state of the digital asset ecosystem.

Crypto Market Crash Analysis: Tariff Threats Trigger Sell-Off

Digital asset prices turned sharply negative during Tuesday’s trading session. The primary catalyst was a reaffirmation of tariff policies by U.S. Treasury Secretary Scott Bessent. He confirmed tariffs remain a core policy tool, specifically mentioning a potential 10% levy as early as February 2026. Markets interpreted this as a renewal of trade-driven inflation risks, prompting a flight to safety. Bitcoin, the market bellwether, slid below the $90,000 mark and was trading near $89,100 at press time. Technical analysis showed a steady sequence of lower highs on intraday charts, with brief bounce attempts failing to reclaim key resistance levels.

Ethereum (ETH) mirrored the downturn, slipping under the $3,000 threshold and posting a nearly 5% daily decline. Selling pressure was widespread across major altcoins. Solana (SOL) fell more than 2%, while Ripple’s XRP and Binance Coin (BNB) registered drops exceeding 2% and 4%, respectively. Secretary Bessent later attempted to downplay the direct impact of his statements on bond markets. He argued that rising global yields were partly driven by structural shifts in Japan’s bond market. Nevertheless, the immediate crypto market reaction underscored its continued sensitivity to traditional macroeconomic and geopolitical headlines.

Expert Context on Market Correlations

Historically, cryptocurrency markets have demonstrated periods of both correlation and decoupling from traditional risk assets like equities. The 2026 reaction to tariff threats highlights a persistent linkage to macro sentiment. Analysts note that while crypto operates on a 24/7 basis, its valuation remains influenced by policy announcements from major economies during their business hours. This event reinforces the understanding that digital assets are not yet a complete safe haven. They often act as a high-beta version of traditional risk appetite, amplifying moves based on global liquidity and investor sentiment.

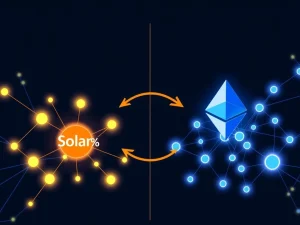

Chainlink’s Groundbreaking U.S. Equities Streams: Bridging TradFi and DeFi

Amid the market turmoil, Chainlink (LINK) executed a pivotal upgrade to its decentralized oracle network. The team rolled out “24/5 U.S. Equities Streams,” an enhancement to its Data Streams product. This innovation delivers real-time pricing data for U.S. stocks and Exchange-Traded Funds (ETFs) directly onto blockchains. Crucially, it provides continuous data feeds even outside standard New York Stock Exchange (NYSE) trading hours (9:30 AM – 4:00 PM ET). This development aims to unlock the roughly $80 trillion U.S. equities market for decentralized finance (DeFi) applications.

The new streams are live across more than 40 supported blockchains. They are specifically engineered to power sophisticated on-chain financial products. These include:

- Equity Perpetuals (Perps): Derivatives contracts for stocks that never expire.

- Prediction Markets: Platforms for speculating on real-world events.

- Advanced Trading Tools: Any application requiring reliable, verifiable price data.

Prior to this launch, most on-chain equity feeds relied on a single daily price update. This created significant pricing blind spots and increased risk for protocols operating 24/7. Chainlink’s solution converts traditional market data into continuous, cryptographically verified feeds. Several leading protocols, including BitMEX, ApeX, Orderly Network, and HelloTrade, have already integrated the product.

Solana Mobile Distributes SRK Airdrop to Seeker Ecosystem

Separately, Solana Mobile progressed its web3 mobile initiative by initiating an airdrop of its native SRK token. The distribution targets users of the Chapter 2 “Seeker” smartphone and active ecosystem builders. This move grants participants a direct stake in Solana’s mobile-focused blockchain strategy. Over 100,000 eligible participants can claim tokens through the Seeker’s built-in wallet. The claim window lasts for 90 days; unclaimed allocations will recycle back into the airdrop pool for future distribution.

The airdrop also rewards developers who launched high-quality applications on the Solana dApp Store during its inaugural season. The SRK token has a fixed total supply of 10 billion. The distribution allocates 30% of the supply to these initial airdrops and unlocks. The tokenomics feature an inflationary model starting at 10% annually. This inflation rate decreases by 25% each year until it stabilizes at a 2% annual rate. New token inflation events occur every 48 hours, a mechanism designed to consistently reward network participants.

Trump Media Announces Date for Digital Token Distribution

Trump Media and Technology Group (TMTG) finalized plans for its much-anticipated digital token distribution. The company announced it will issue tokens to shareholders holding at least one full share of DJT stock as of February 2, 2026. Crypto.com will handle the on-chain issuance and custody of the tokens until delivery to eligible investors. The company explicitly stated these tokens are not equity securities. They cannot be traded, transferred, or redeemed for cash. Instead, TMTG positions them as utility-based rewards.

These tokens grant shareholders access to non-financial benefits across TMTG’s product suite. This includes the Truth Social platform, the Truth+ streaming service, and an upcoming prediction market product named Truth Predict. This model represents a growing trend of using tokens for shareholder engagement and loyalty beyond pure financial speculation.

The Rise of Token-Based Engagement Models

The announcements from Solana Mobile and Trump Media coincide with a broader industry shift. Projects increasingly use tokens to align incentives, reward early users, and foster community ownership. For instance, Pump.fun recently unveiled the “Pump Fund,” a $3 million investment arm backing early-stage teams based on public traction and community engagement. This “build in public” model makes funding decisions transparently. It underscores a maturation in token utility, moving beyond mere speculative assets to tools for governance, access, and ecosystem growth.

Conclusion

The events of January 22, 2026, present a classic dichotomy in the cryptocurrency space. A sudden crypto market crash driven by macroeconomic fears pushed Bitcoin below $90,000 and rattled investor sentiment. Simultaneously, foundational builders like Chainlink advanced critical infrastructure, bridging trillion-dollar traditional markets with decentralized networks. Meanwhile, Solana Mobile and Trump Media showcased evolving token distribution models focused on utility and community. This day underscores that while prices fluctuate in the short term, the underlying innovation and integration of blockchain technology continue to accelerate, setting the stage for the next phase of adoption.

FAQs

Q1: What caused the crypto market crash on January 22, 2026?

A1: The primary trigger was U.S. Treasury Secretary Scott Bessent reaffirming the use of tariffs as a core policy tool, including a potential 10% levy in February. This renewed fears of trade-driven inflation, causing a risk-off sentiment that hit Bitcoin and other cryptocurrencies.

Q2: What are Chainlink’s U.S. Equities Streams?

A2: They are a decentralized oracle product that provides real-time, cryptographically verified price data for U.S. stocks and ETFs directly to blockchains. They operate 24 hours a day during the market week (24/5), enabling DeFi applications to build products like equity derivatives and prediction markets.

Q3: Who is eligible for the Solana Mobile SRK airdrop?

A3: Eligibility extends to users of the Solana Mobile “Seeker” smartphone and developers who launched high-quality apps on the Solana dApp Store during its first season. Over 100,000 participants can claim tokens through the device’s built-in wallet.

Q4: Can Trump Media’s DJT tokens be traded or sold?

A4: No. Trump Media has explicitly stated these digital tokens are not equity and have no cash value. They are non-transferable utility tokens designed to provide shareholders with access to specific platform benefits and cannot be traded on exchanges.

Q5: How does the current market volatility affect long-term blockchain development?

A5: Historically, core development and infrastructure building in the crypto space often continue independently of price cycles. The simultaneous launch of major products like Chainlink’s Equity Streams during a market downturn demonstrates that technological progress is a separate, ongoing track focused on long-term utility and adoption.