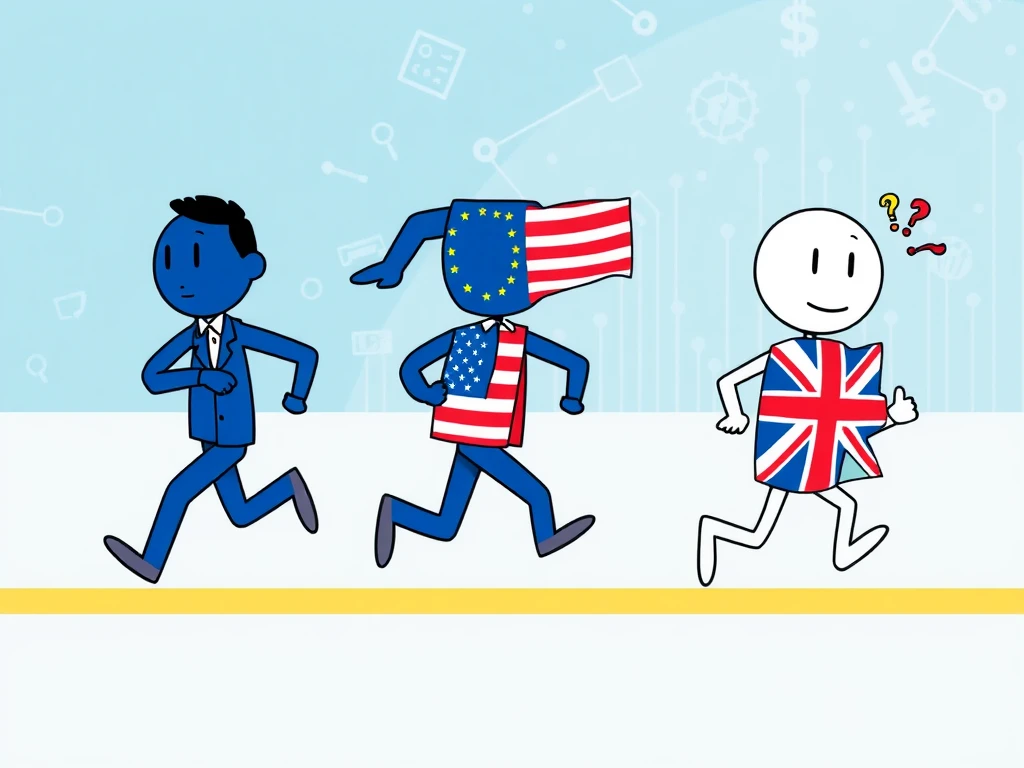

UK Crypto Regulation: Why is Britain Dangerously Lagging Behind EU and US?

Are you interested in the future of digital finance and where the UK stands? Recent warnings suggest that the UK is falling behind in the global race for effective UK crypto regulation, potentially jeopardizing its position as a financial hub. This is a crucial topic for anyone involved in or watching the cryptocurrency space.

Understanding the Concerns About UK Crypto Regulation

A new report from the Official Monetary and Financial Institutions Forum (OMFIF), an independent think tank, raises serious concerns about the UK’s approach to digital assets. Experts John Orchard and Lewis McLellan argue that the UK has squandered its initial lead in the digital asset space. They point to what they call ‘policy procrastination’ as a key reason the nation is trailing competitors like the EU and the US.

Key points from their analysis include:

- The UK, once expected to be a leader in post-Brexit crypto rules, continues to speak vaguely about future regulation.

- The Financial Conduct Authority (FCA) lacks a clear start date for its planned crypto regime, with suggestions pointing to sometime after 2026 – a date seen as far too distant by many.

- This lack of a concrete framework hinders the UK’s ability to adapt as finance increasingly moves ‘onchain’.

Comparing EU Crypto Regulation (MiCA) and US Crypto Regulation (GENIUS Act)

While the UK hesitates, other major jurisdictions are moving forward decisively. The contrast with the EU crypto regulation and US crypto regulation is stark:

- European Union: The Markets in Crypto-Assets (MiCA) framework is already implemented. This provides a comprehensive regulatory structure across member states for various crypto assets and service providers.

-

United States: While federal regulation is still evolving, significant steps are being taken. The Senate recently passed the GENIUS Act, specifically designed to establish federal rules and guardrails for stablecoins. This treats stablecoins distinctly as payment tools.

This clear progress in the EU and US highlights the delays in the UK’s approach.

The Impact of Crypto Regulation Delays on Digital Assets UK

The delays and unclear stance have a tangible impact on the development and adoption of digital assets UK. One specific area of criticism is the UK’s treatment of stablecoins.

- Unlike the US, which views stablecoins as payment instruments under the GENIUS Act, UK regulators initially grouped them with crypto investment assets.

- The Bank of England’s initial draft rules requiring systemic stablecoins to be fully backed by central bank money were seen as commercially unviable by the industry.

- While the Bank is softening its stance, a workable model is still missing.

This uncertainty makes it difficult for businesses dealing with stablecoins and other digital assets to operate and innovate effectively within the UK.

Looking Beyond the UK: Other Jurisdictions Making Strides

The OMFIF report also points to other parts of the world that are actively developing their digital asset frameworks:

- Hong Kong: Passed a stablecoin bill in May and is actively fostering tokenization through initiatives like Project Ensemble.

- United Arab Emirates (UAE): The Virtual Assets Regulatory Authority (VARA) is highlighted as a dedicated regulator for digital assets, offering a focused approach unlike the UK’s method of adapting existing institutions.

These examples underscore that rapid, focused regulatory action is possible and is happening elsewhere, potentially drawing talent and investment away from the UK.

What Do These Crypto Regulation Delays Mean for the UK?

The UK benefits from existing strengths like its time zone, language, and legal system, which have historically supported its role as a financial center. However, the report warns that these advantages are not guaranteed forever. The lack of clarity and the significant crypto regulation delays compared to peers could erode its competitive edge.

The experts urge swift action from UK regulators to avoid missing out on the transformative potential of digital finance. Without a clear, timely framework, the UK risks being left behind in the global shift towards a more digital financial ecosystem.

Conclusion: Time for Action on UK Crypto Regulation?

The message from experts is clear: the UK’s ‘policy procrastination’ on crypto regulation is causing it to fall behind the proactive steps taken by the EU and US. With MiCA in effect and the GENIUS Act advancing, these regions are establishing clear rules of the road for digital assets, while the UK’s roadmap remains unclear and distant. To maintain its position as a leading financial center, the UK government and regulators face increasing pressure to provide timely, clear, and workable UK crypto regulation before its early advantage is completely lost.