Significant Trump Crypto Stake Cut: Family Company Reduces World Liberty Financial Holding

The intersection of high-profile political figures and the volatile world of digital assets often captures significant attention. A recent report reveals a notable shift involving the Trump family’s financial interests within the cryptocurrency sector, specifically concerning World Liberty Financial (WLF). This development raises questions and highlights the complex landscape surrounding political involvement in the crypto space.

Examining the Trump Crypto Connection and Stake Reduction

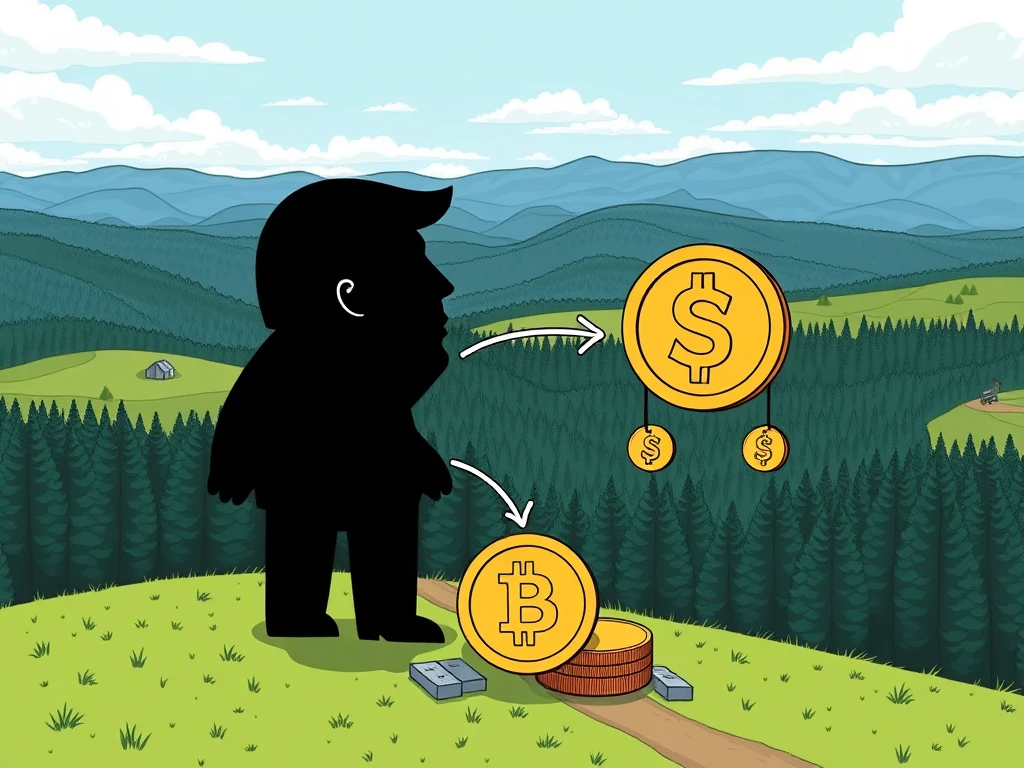

An umbrella company associated with the Trump family has reportedly reduced its significant holding in the cryptocurrency platform World Liberty Financial (WLF). According to a recent report, DT Marks DeFi LLC, a company controlled by former President Donald Trump and his family, has been systematically decreasing its stake in WLF since late 2024.

Here’s a breakdown of the reported stake changes:

- **December 2024:** DT Marks DeFi LLC held a reported 75% stake in World Liberty Financial.

- **January [Year]:** World Liberty Financial’s website indicated the company’s stake was approximately 60%.

- **Sometime After June 8 [Year]:** The stake was further reduced to 40%.

This represents a total reduction of 35 percentage points from the December 2024 figure, equating to nearly half of the initial holding being divested over this period. While the precise financial outcome for the Trump family is not explicitly stated, analysis suggests the proceeds from such a significant sale could potentially amount to millions of dollars.

World Liberty Financial and the Rise of its Stablecoin

World Liberty Financial (WLF) is a platform that has garnered attention, partly due to its association with the Trump family. The company has also ventured into the stablecoin market, launching its own USD1 stablecoin in March. Stablecoins are cryptocurrencies designed to maintain a stable value, often pegged to a fiat currency like the US dollar.

The launch of the USD1 stablecoin by World Liberty Financial coincides with increasing legislative focus on regulating these digital assets. The company has also been active in fundraising, reportedly raising around $550 million through public token sales. Furthermore, a notable instance of WLF’s growing presence was an announcement in May by an Abu Dhabi-based company planning to use the USD1 token for a substantial $2 billion investment settlement with Binance.

Navigating Crypto Regulation and Political Scrutiny

The timing of the Trump family’s stake reduction in World Liberty Financial is noteworthy, occurring amidst growing calls from US lawmakers for increased scrutiny into the connections between political figures and the crypto industry. These calls are fueled by potential conflicts of interest, particularly as Congress debates and advances legislation aimed at regulating digital assets.

A key piece of legislation is the GENIUS Act, which specifically targets the regulation of payment stablecoins in the United States. The bill recently passed the US Senate with bipartisan support. However, its path through the House of Representatives could face challenges, partly due to ongoing debates and concerns surrounding the Trump crypto ties and potential influence on policy.

Former President Trump himself has publicly urged the House to pass the GENIUS Act swiftly, highlighting the complex political dynamics at play. The involvement of figures like Trump in platforms issuing stablecoins like WLF’s USD1 inevitably brings political dimensions into the discussion around crypto regulation.

Why Does This Matter? Potential Implications

The reduction of the Trump family’s stake in World Liberty Financial could have several implications:

- **Financial Strategy:** It might indicate a strategic decision by DT Marks DeFi LLC to realize profits, diversify holdings, or respond to market conditions.

- **Political Pressure:** The divestment could be influenced by increasing political scrutiny and calls for transparency regarding potential conflicts of interest.

- **Market Perception:** Such moves by high-profile affiliates can impact market perception and investor confidence in platforms like WLF.

- **Regulatory Landscape:** The focus on WLF and its stablecoin amidst the divestment could further highlight the urgency and complexities of implementing effective crypto regulation.

Conclusion: A Shifting Landscape for Trump’s Crypto Ventures

The reported reduction in the Trump family company’s stake in World Liberty Financial underscores the dynamic nature of investments in the cryptocurrency sector, especially when intertwined with political figures. As the debate around crypto regulation continues to evolve, the financial activities and holdings of influential individuals and entities like those connected to the Trump family will likely remain under the spotlight. The future trajectory of World Liberty Financial and its USD1 stablecoin, as well as the broader landscape of US crypto policy, will be shaped by these converging financial, technological, and political forces.