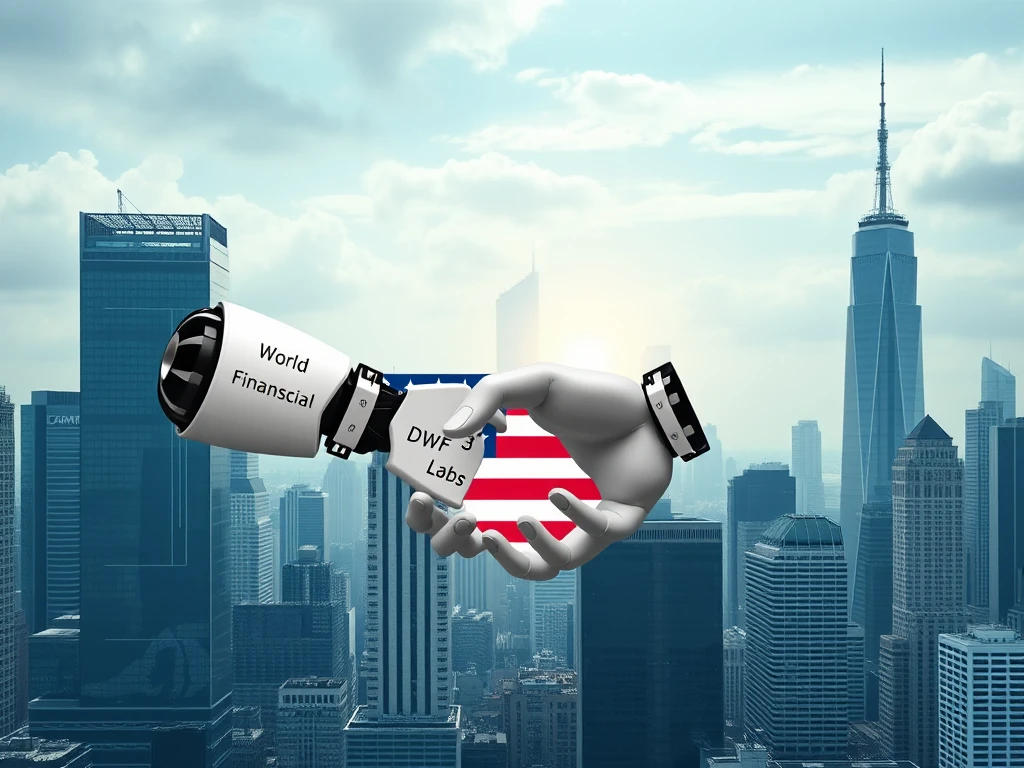

Unveiling $25M DWF Labs Investment in Trump Crypto Venture: A DeFi Boost?

In a stunning move that’s sending ripples through the crypto sphere, market maker giant DWF Labs has announced a substantial DWF Labs investment of $25 million into World Liberty Financial (WLFI). This DeFi project, linked to the Trump family, is making headlines not just for the funding but also for its ambitious plans in the US market. What does this mean for the future of DeFi, stablecoins, and the intersection of crypto and politics? Let’s dive into the details of this game-changing development.

Why is the DWF Labs Investment in World Liberty Financial Significant?

This isn’t just another crypto investment; it’s a strategic play on multiple fronts. Here’s why the DWF Labs investment in World Liberty Financial is turning heads:

- Political Connections: World Liberty Financial boasts ties to the Trump family, instantly bringing a unique dimension to the project. This connection, whether advantageous or controversial, undeniably amplifies its visibility.

- DeFi and Stablecoin Focus: WLFI is dedicated to decentralized finance and promoting the adoption of US dollar-pegged stablecoins, a sector ripe for growth and innovation.

- DWF Labs’ US Expansion: The investment coincides with DWF Labs establishing a New York office, signaling a serious commitment to the US market and closer engagement with American regulators.

- Liquidity Boost for USD1 Stablecoin: A crucial part of the collaboration is DWF Labs providing liquidity for WLFI’s stablecoin, USD1. This is vital for the stablecoin’s success and usability.

Decoding World Liberty Financial: What is Trump Crypto Venture All About?

Launched in September 2024, World Liberty Financial entered the crypto scene with a bold vision. The Trump family publicly endorsed the project, positioning it as a move towards the future of finance, away from traditional banking systems. Key aspects of Trump Crypto venture, World Liberty Financial include:

- DeFi Promotion: WLFI aims to champion decentralized finance, offering alternatives to traditional financial systems.

- USD1 Stablecoin: The project launched its stablecoin, USD1, pegged to the US dollar, aiming to provide a stable and accessible digital currency.

- Significant Funding: Even before the DWF Labs investment, WLFI had already raised a staggering $600 million, showcasing strong investor interest.

The Power of DeFi Investment: What Does $25M Mean for WLFI?

A $25 million DeFi investment is no small feat. For World Liberty Financial, this injection of capital from DWF Labs can translate into:

- Enhanced Liquidity: DWF Labs, as a market maker, will significantly boost the liquidity of WLFI tokens and the USD1 stablecoin, making trading smoother and more efficient.

- Ecosystem Growth: The funds can be used to further develop the WLFI ecosystem, expand its DeFi offerings, and attract more users and partners.

- Increased Credibility: Securing investment from a reputable firm like DWF Labs adds credibility and validation to the Trump Crypto project, potentially attracting more institutional and retail investors.

- Governance Participation: DWF Labs’ token purchase grants them voting rights in WLFI’s governance, meaning they will have a say in the project’s future direction.

Stablecoin USD1: Will DWF Labs Investment Make a Difference?

The success of any stablecoin hinges on its stability and liquidity. DWF Labs’ commitment to providing liquidity for USD1 is a critical factor. Here’s how this DeFi investment can bolster the USD1 stablecoin:

| Factor | Impact of DWF Labs Liquidity Provision |

|---|---|

| Price Stability | Market makers help maintain the peg to the US dollar by ensuring there’s always buying and selling pressure to balance out fluctuations. |

| Trading Volume | Increased liquidity attracts more traders, leading to higher trading volumes and making it easier for users to buy and sell USD1. |

| Adoption | A liquid and stable stablecoin is more likely to be adopted for various DeFi applications, payments, and as a safe haven asset within the crypto ecosystem. |

Navigating the Regulatory Landscape: US Expansion and DeFi

DWF Labs’ move into the US market, marked by their New York office, is strategically important, especially given the evolving regulatory landscape for crypto in the United States. This expansion suggests:

- Proactive Engagement: DWF Labs aims to proactively engage with US regulators, signaling a commitment to compliance and operating within legal frameworks.

- Institutional Partnerships: The US expansion is also geared towards strengthening partnerships with traditional financial institutions like banks and asset managers, bridging the gap between traditional finance and DeFi.

- Market Growth Potential: The US remains a crucial market for crypto adoption. A physical presence allows DWF Labs to tap into this market more effectively.

Conclusion: A Bold Move for DeFi and the Trump Crypto Narrative

The $25 million DWF Labs investment in World Liberty Financial is a significant development in the crypto world. It brings together a major market maker, a politically connected DeFi project, and ambitious stablecoin aspirations. Whether this DeFi investment will propel Trump Crypto venture, World Liberty Financial and its stablecoin USD1 to mainstream success remains to be seen. However, it undoubtedly injects fresh energy and intrigue into the ever-evolving crypto narrative. Keep watching this space – the intersection of DeFi, politics, and big money is sure to deliver more compelling stories.