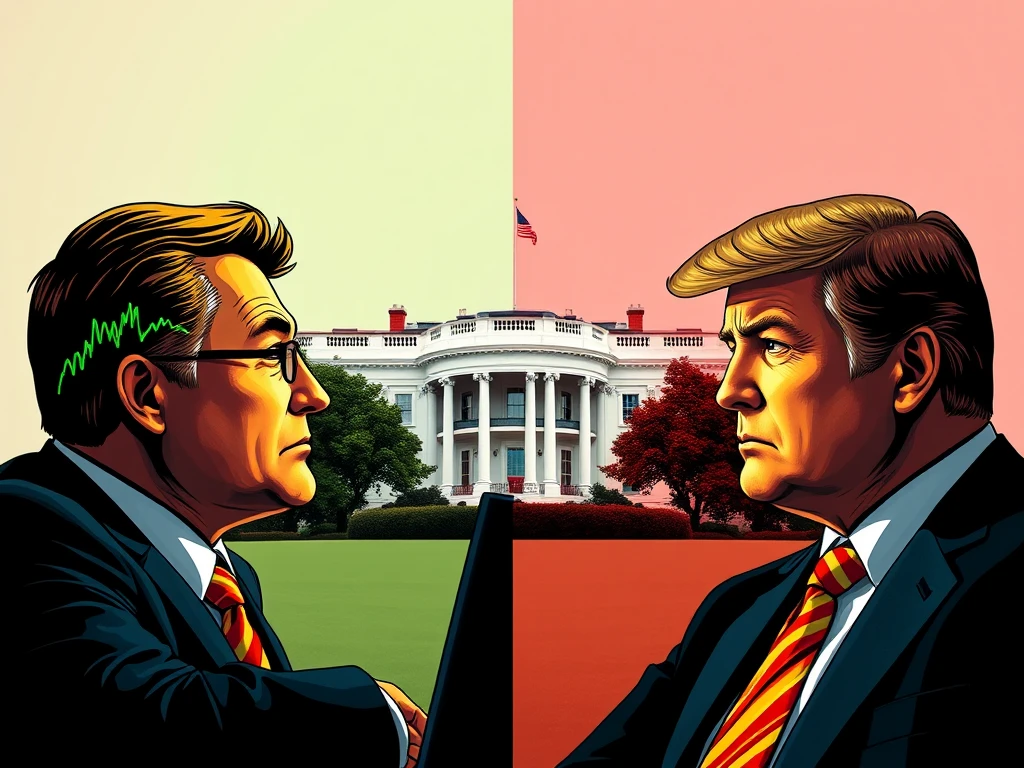

Fractured Reactions: Bitcoin Investors Divided After White House Crypto Summit

The recent White House Crypto Summit sparked a whirlwind of opinions within the Bitcoin investors community. Was it a landmark event, or just another day in the crypto world? Reactions are sharply divided, revealing a fascinating split between institutional optimism and retail skepticism. Let’s dive into the heart of the matter and explore what this summit truly means for the future of Bitcoin.

White House Crypto Summit: A Historic Moment or Underwhelming Event?

The White House Crypto Summit on March 7th was intended to signal a turning point in the U.S. government’s approach to cryptocurrencies. While some industry insiders hailed it as a ‘historic moment’, others in the Bitcoin investors space felt distinctly underwhelmed.

- Optimistic View: Crypto trader Miles Deutscher believes the summit was a “massive net positive” for Bitcoin, despite mixed initial reactions.

- Institutional Approval: Kyle Samani, managing partner at Multicoin Capital and a summit attendee, echoed this sentiment, calling it a “historic moment” for the crypto industry. This suggests that institutional Bitcoin investors are largely positive about the summit’s implications.

- Retail Skepticism: Coin Bureau founder Nic Puckrin’s reaction, “Just looking at the charts, I can assume that nothing groundbreaking came from the White House summit?” reflects the sentiment of many retail Bitcoin investors who were looking for more immediate and tangible outcomes.

This divergence in opinions highlights the different expectations and perspectives within the broader Bitcoin community. While institutional players might appreciate the symbolic importance of the summit and its potential for future policy shifts, retail Bitcoin investors often seek more immediate market signals and regulatory clarity.

Bitcoin Regulation: A Step Forward or Just More Talk?

One of the key takeaways from the summit was the discussion around Bitcoin regulation. The Trump administration’s approach appears to be a significant shift from previous stances, particularly with the executive order establishing a Bitcoin strategic reserve. However, the devil is in the details, and this is where much of the skepticism from Bitcoin investors arises.

Justin Bechler, a Bitcoin maximalist, voiced strong criticism, labeling the summit as a “gathering of rent-seeking lobbyists pushing state-approved surveillance tokens.” This perspective reflects concerns within the Bitcoin community about potential over-regulation that could stifle innovation and decentralization.

The executive order itself, while seemingly positive on the surface, contained caveats that tempered enthusiasm:

- Strategic Reserve via Asset Forfeiture: The US government is authorized to acquire BTC for the reserve, but only through asset forfeiture and budget-neutral strategies.

- No New Debt or Taxpayer Burden: The order explicitly states that acquisitions should not create additional debt, deficits, or burden taxpayers.

This condition disappointed some Bitcoin investors, particularly maximalists, who had hoped for direct government purchases of Bitcoin to bolster the reserve. The cautious approach to funding the reserve signals a more measured, rather than aggressive, adoption strategy.

Bitcoin Price Reaction: Sell-the-News Event or Market Correction?

The immediate market reaction to the White House Crypto Summit and the strategic reserve order was a decline in Bitcoin price. Bitcoin experienced a roughly 7.3% drop, widely interpreted as a ‘sell-the-news’ event. This price action further fueled the mixed reactions from Bitcoin investors, particularly those focused on short-term market movements.

Furthermore, Bitcoin ETFs saw significant outflows of $370 million following the announcement, indicating that traders viewed the executive order as less impactful than anticipated. This market behavior raises important questions about the short-term and long-term effects of such government initiatives on Bitcoin price.

Market Sentiment and Future Predictions:

| Prediction | Details |

|---|---|

| Short-term Correction | Many Bitcoin investors now anticipate a potential crash to the $70,000 level in March. |

| Mid-term Rebound | Despite the short-term bearish sentiment, a majority still predict Bitcoin will reclaim the $100,000 mark. |

| Long-term Uncertainty | The recent price action and executive order have sparked debate about whether Bitcoin has reached its cycle top or if it can still achieve new highs in 2025. |

The volatility in Bitcoin price following the summit underscores the sensitivity of the crypto market to regulatory news and government actions. Bitcoin investors are now closely watching market trends to gauge the true impact of the summit and the strategic reserve order.

Has Bitcoin Reached Its Cycle Top? What’s Next for Bitcoin Investors?

The question on many Bitcoin investors‘ minds is whether this recent dip signifies a cycle top for Bitcoin. The mixed reactions to the White House Crypto Summit, coupled with the sell-the-news event, have injected uncertainty into the market.

While some analysts like Benjamin Cowen predict a potential fall in Bitcoin dominance in 2025, the long-term trajectory of Bitcoin remains subject to numerous factors, including regulatory developments, macroeconomic conditions, and technological advancements.

Actionable Insights for Bitcoin Investors:

- Stay Informed: Keep abreast of regulatory news and government policies impacting Bitcoin and the crypto market.

- Diversify: Consider portfolio diversification to mitigate risks associated with Bitcoin’s volatility.

- Long-Term Perspective: Maintain a long-term investment horizon and avoid making impulsive decisions based on short-term market fluctuations.

- Due Diligence: Conduct thorough research before making any investment decisions in the crypto space.

Conclusion: Navigating the Post-Summit Crypto Landscape

The White House Crypto Summit has undoubtedly stirred the pot within the Bitcoin investors community. While institutional investors seem to view it as a positive step, retail traders and maximalists express more nuanced and often critical perspectives. The market reaction, characterized by a price dip and ETF outflows, highlights the immediate uncertainty. Moving forward, the true impact of the summit will unfold as we observe how Bitcoin regulation evolves and how the strategic reserve initiative is implemented. For Bitcoin investors, navigating this landscape requires a balanced approach of informed optimism and cautious analysis.