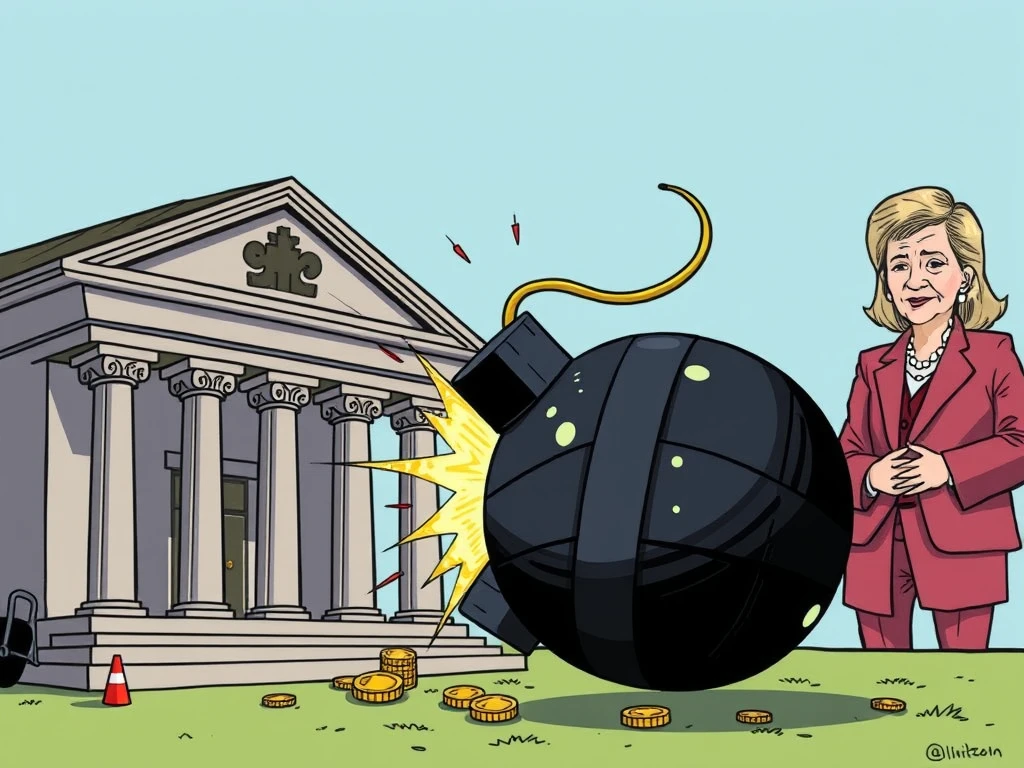

Alarming Stablecoin Threat: US Senator Gillibrand Warns of Banking Collapse

Are yield-bearing stablecoins the silent assassins poised to dismantle traditional banking? US Senator Kirsten Gillibrand has sounded the alarm, suggesting these digital assets could critically undermine the existing financial framework. Let’s dive into why this New York lawmaker believes the rise of stablecoins could spell trouble for your local bank and the broader financial system.

Senator Gillibrand’s Stark Warning: Stablecoins vs. Banking

Speaking at the 2025 DC Blockchain Summit, Senator Gillibrand didn’t mince words. She voiced a significant concern: allowing stablecoin issuers to offer interest could be the death knell for traditional banks. Her argument is straightforward and impactful:

- The Lure of Yield: Yield-bearing stablecoins offer users a return on their holdings, much like a savings account, but potentially with higher interest rates in the crypto space.

- Bank Competition: If stablecoins become attractive alternatives for savings due to these yields, why would individuals keep their money in traditional banks that often offer minimal interest?

- Impact on Lending: This shift could drain deposits from banks, crippling their ability to provide essential services like home mortgages and small business loans – the very backbone of the financial system.

Gillibrand emphasized that stablecoin issuers should not benefit from Federal Deposit Insurance Corporation (FDIC) protection because they operate outside the traditional banking model. She champions robust regulation, drawing inspiration from New York’s stringent financial rules, advocating for their broader adoption across all financial service sectors, including the burgeoning crypto landscape.

Why This Matters: The Ripple Effect on the Financial System

Senator Gillibrand’s apprehension isn’t just about protecting banks; it’s about safeguarding the entire financial system. Here’s a breakdown of the potential domino effect she foresees:

- Deposit Drain: As users flock to yield-bearing stablecoins, traditional banks could experience a significant outflow of deposits.

- Mortgage and Loan Crunch: With fewer deposits, banks have less capital to lend. This could lead to:

- Higher interest rates for mortgages and loans.

- Stricter lending criteria, making it harder for individuals and small businesses to secure funding.

- A potential slowdown in economic activity due to reduced credit availability.

In essence, Gillibrand fears a scenario where the rise of unregulated or lightly regulated yield-bearing stablecoins could destabilize the established banking infrastructure, impacting everyday consumers and businesses reliant on traditional financial services.

The GENIUS Act: A Regulatory Framework for Stablecoins?

Senator Gillibrand is not just raising concerns; she’s actively involved in shaping regulation. She is a co-sponsor of the GENIUS Act, a bill aiming to establish a comprehensive regulatory framework for digital fiat tokens like stablecoins. This legislation, spearheaded by Senator Bill Hagerty, seeks to bring clarity and control to the stablecoin market.

Key aspects of the GENIUS Act include:

- Anti-Money Laundering (AML) Provisions: Stricter measures to prevent illicit activities using stablecoins.

- Know Your Customer (KYC) Requirements: Enhanced identity verification for stablecoin users to combat financial crime.

- Financial Transparency Regulations: Rules to ensure stablecoin issuers are transparent about their reserves and operations.

- Consumer Protection Controls: Safeguards to protect users from potential risks associated with stablecoins.

The GENIUS Act has made significant progress, advancing through the Senate Banking Committee. However, it still needs to clear votes in both chambers of Congress before potentially becoming law. Its passage could mark a turning point in how stablecoins are governed in the United States, directly impacting their role within the broader financial system.

The Counter-Argument: Centralization and Control?

While the GENIUS Act aims to bring regulation and stability, it faces criticism from some corners of the crypto community. Critics argue that such legislation could pave the way for a central bank digital currency (CBDC) through the backdoor. Jean Rausis, co-founder of Smardex, highlights concerns about centralized stablecoins enabling:

- Financial Censorship: Governments potentially gaining the power to restrict or control access to funds.

- State Surveillance: Increased monitoring of financial transactions, eroding financial privacy.

- Centralized Control: The risk of governments or centralized entities having the ability to freeze accounts or exclude individuals from the financial system.

This perspective underscores the inherent tension within the crypto space: the desire for decentralized, permissionless finance versus the need for regulation to protect consumers and maintain financial system stability. The debate around stablecoins and their regulation is far from settled, and Senator Gillibrand’s warnings highlight the critical stakes involved.

Conclusion: Navigating the Future of Finance

Senator Gillibrand’s concerns paint a vivid picture of a potential clash between the burgeoning world of yield-bearing stablecoins and the established banking order. Her call for robust regulation, exemplified by her support for the GENIUS Act, reflects a growing urgency to define the rules of engagement for these digital assets. Whether stablecoins become a disruptive force that undermines traditional banking or a regulated innovation integrated into the existing financial system remains to be seen. One thing is clear: the decisions made regarding stablecoin regulation will have profound implications for the future of finance and the very structure of our economic landscape.