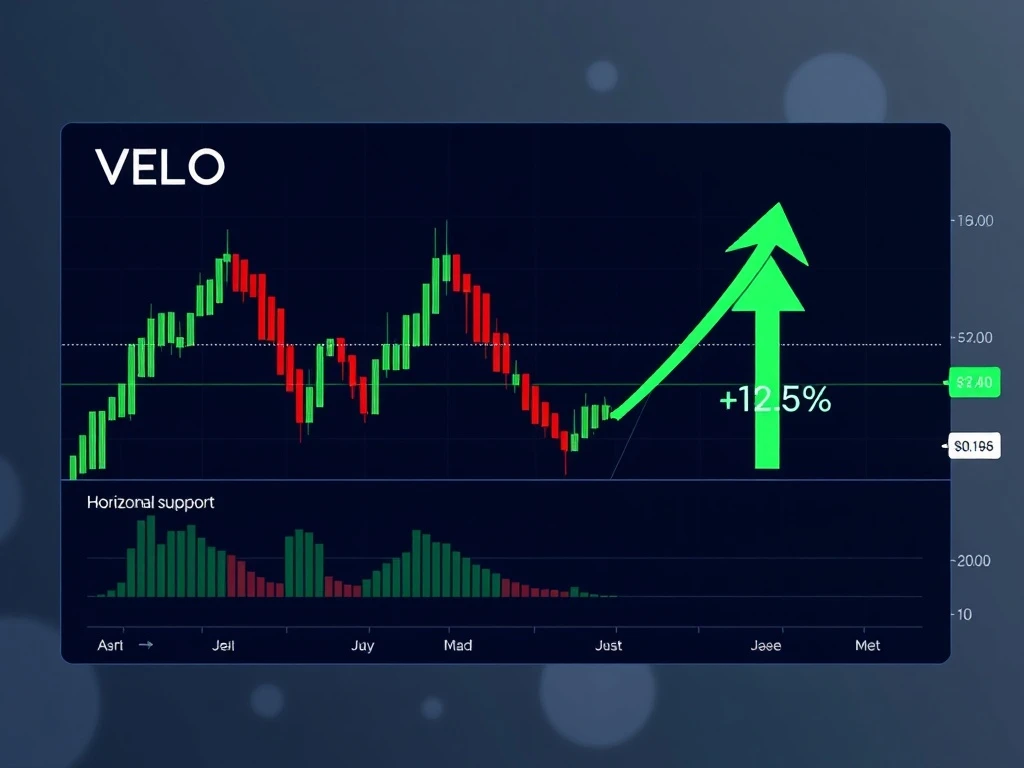

VELO Price: Crucial Consolidation Hints at Explosive 12.5% Rally

The world of digital assets is always buzzing with activity, and right now, all eyes are turning to VELO. This altcoin has been making headlines, demonstrating remarkable resilience as it consolidates above a critical support level. Could this be the calm before a storm of bullish activity? For anyone involved in crypto trading, understanding these consolidation phases is key, and VELO’s current posture suggests a significant move might be on the horizon. Let’s dive deep into what’s happening with VELO and what it could mean for its future.

VELO’s Resilient Stand: A New Chapter in Price Action

After a period of volatility, VELO has found its footing, firmly establishing a base above the $0.016 support level. This consolidation is a pivotal moment, as it suggests a potential shift from a long-term downtrend into a more defined trading range. Despite a slight 0.91% decline in the last 24 hours, VELO quickly rebounded from a low of $0.0155, settling at $0.01635. This quick recovery indicates that buyers are actively stepping in, absorbing selling pressure around the $0.0155 mark. Such price action is often a precursor to a significant move, as the asset builds momentum and finds a new equilibrium.

The transition from a prolonged downtrend to a clear consolidation range between $0.015 and $0.016 is a structural shift that smart traders watch closely. While the market has seen some volatility, VELO’s ability to hold this crucial support hints at underlying strength. A breakout above this consolidation range has already been observed, signaling a potential reversal in the broader trend and opening the door for a fresh uptrend.

Decoding the Charts: What Technical Indicators Tell Us About VELO

For a comprehensive market analysis, we must look beyond just price action and delve into technical indicators. These tools provide deeper insights into market sentiment and potential future movements. For VELO, two key indicators offer a neutral yet cautiously optimistic outlook:

- Relative Strength Index (RSI): Currently standing at 51.30, the RSI indicates a neutral stance. This means VELO is neither overbought (suggesting a pullback) nor oversold (suggesting a bounce). A neutral RSI gives traders room to consider both bullish and bearish scenarios, but in the context of consolidation, it often precedes a directional move once momentum builds.

- Moving Average Convergence Divergence (MACD): The MACD remains near zero, reflecting subdued volatility. Low MACD readings during a consolidation phase can be interpreted as the market gathering strength before a significant price swing. It suggests that the market is not experiencing aggressive buying or selling pressure, allowing for a more organic build-up of momentum.

These indicators collectively suggest that while the market isn’t aggressively bullish or bearish, it’s poised for a clearer directional bias. Immediate resistance levels for VELO are identified between $0.0166 and $0.0170. A successful and sustained breach above this zone could pave the way for a rally targeting higher levels, potentially between $0.018 and $0.020, representing a significant upside from current prices.

Beyond the Price: Key Market Metrics for This Cryptocurrency

Understanding the broader market metrics is essential for any serious investor looking at a cryptocurrency like VELO. These figures provide context for its current valuation and potential growth:

- Trading Volume: In the last 24 hours, VELO’s trading volume reached $38.4 million. While this represents an 11% decline, reduced volume during a consolidation phase is not necessarily negative. It can indicate that selling pressure is easing, and fewer traders are willing to sell at current prices, setting the stage for a stronger move once volume returns on a breakout.

- Market Capitalization: VELO’s total market capitalization stands at $120.87 million. This metric reflects the total value of all VELO tokens in circulation and positions it within the broader altcoin landscape.

- Fully Diluted Valuation (FDV): The FDV is currently $392.16 million. This figure represents the market cap if all tokens were in circulation, offering a perspective on the project’s long-term potential and future supply dynamics.

- Circulating Supply: There are 7.39 billion VELO tokens in circulation, which accounts for 30.8% of the 24-billion maximum supply. The relatively low circulating supply percentage suggests that a significant portion of tokens are yet to enter the market, which could impact future price action depending on the release schedule.

These metrics provide a snapshot of VELO’s current standing and highlight its potential within the dynamic crypto market. They are crucial for informed decision-making.

Community Confidence and the Path Forward for VELO

Community sentiment often acts as a powerful catalyst in the crypto market. For VELO, sentiment remains overwhelmingly positive, with a staggering 91% of respondents expressing bullishness. This high level of confidence underscores the belief in the token’s ability to maintain its position above the critical $0.016 support. Strong community backing can provide a psychological buffer against downward pressure and fuel upward momentum during breakouts.

The structural shift in VELO’s price action—from a prolonged downtrend to a defined range—indicates a potential inflection point for the asset. If the $0.016 support continues to hold firm, it could serve as a robust foundation for further upside. The key lies in VELO’s ability to sustain a breakout above the $0.0166 resistance level. Such a move would confirm the bullish sentiment and attract more buyers, potentially accelerating its ascent.

Navigating the Risks: What Could Derail VELO’s Price Prediction?

While the outlook for VELO appears promising, it’s crucial to acknowledge the potential risks. No price prediction in the volatile crypto market comes without caveats. Analysts caution that a breakdown below the $0.0155 support level could reignite selling pressure and negate the recent consolidation efforts. If this crucial support fails, VELO could see a return to its previous downtrend, with lower price targets becoming a possibility.

For traders and investors, monitoring the $0.0155 level is paramount. A decisive close below this point, especially on high volume, would be a strong bearish signal. Therefore, while the potential for a 12.5% rally is exciting, a balanced approach that considers both upside potential and downside risk is essential for effective crypto trading. The market is dynamic, and staying informed about key support and resistance levels is critical.

Conclusion: VELO’s Moment of Truth

VELO stands at a fascinating juncture. Its consolidation above the $0.016 support, coupled with neutral technical indicators and strong community sentiment, paints a picture of an asset gearing up for a significant move. The potential for a 12.5% rally on a successful breakout above $0.0166 is a compelling prospect for traders and investors. However, vigilance is key, as a breakdown below $0.0155 could quickly shift the narrative.

As the crypto market continues to evolve, VELO’s performance in the coming sessions will be closely watched. A sustained rally towards $0.018 or even $0.020 would represent a significant milestone, confirming the shift in market dynamics and potentially ushering in a new era for the token. Keep an eye on trading volume and sentiment metrics, as these will be crucial indicators for the path VELO chooses to take.

Frequently Asked Questions (FAQs)

What is VELO?

VELO is a cryptocurrency token that has recently garnered attention due to its price action and market consolidation. It’s part of the broader digital asset ecosystem, and its performance is often analyzed by traders and investors.

Why is the $0.016 level important for VELO?

The $0.016 level acts as a critical support zone for VELO. Its ability to consolidate and hold above this price indicates strong buying interest and a potential shift from a downtrend to a more stable, possibly bullish, trading range. Maintaining this level is crucial for further upside.

What do the technical indicators (RSI, MACD) suggest for VELO?

The Relative Strength Index (RSI) at 51.30 suggests a neutral market, meaning VELO is neither overbought nor oversold. The Moving Average Convergence Divergence (MACD) near zero indicates subdued volatility. Together, these suggest the market is in a phase of accumulation or indecision, often preceding a significant directional move once momentum builds.

What are the potential upside targets for VELO if it breaks out?

If VELO successfully breaches immediate resistance between $0.0166 and $0.0170, technical analysis suggests potential upside targets between $0.018 and $0.020. A move to these levels would represent a significant rally from its current position.

What are the risks for VELO’s price action?

The primary risk for VELO is a breakdown below the $0.0155 support level. If this support fails, it could negate the recent consolidation and reignite selling pressure, potentially leading to a continuation of its previous downtrend.

How does community sentiment affect VELO’s price?

Community sentiment plays a significant role in cryptocurrency markets. With 91% of respondents expressing bullishness on VELO, this strong positive sentiment can provide a psychological boost, encouraging buying activity and helping to sustain price levels, especially during consolidation phases and potential breakouts.