Hyperliquid EXPLODES Past Solana in Fees: Is the DeFi Hype Genuine?

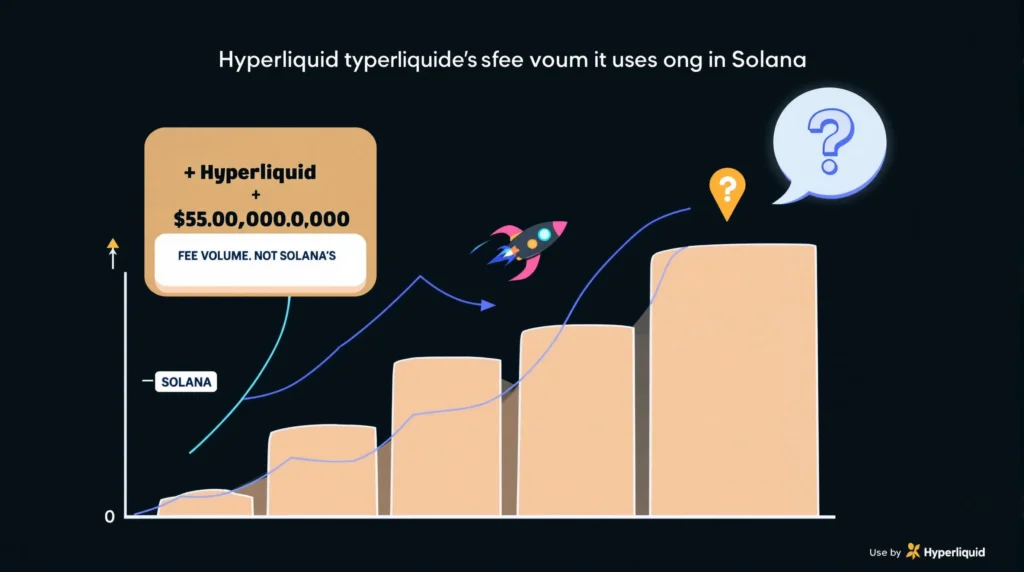

Hold onto your hats, crypto enthusiasts! A new contender has entered the DeFi arena and is making waves. Hyperliquid, a decentralized exchange (DEX), has sensationally flipped Solana in terms of generated fees. Yes, you read that right. This up-and-coming platform is now generating more fees than Solana, a blockchain known for its speed and scalability. But is this a fleeting moment of glory, or is there genuine substance behind the ‘HYPE’ surrounding Hyperliquid?

Hyperliquid vs. Solana: Decoding the DeFi Fee Flip

Let’s dive straight into the heart of the matter. Hyperliquid, despite being a relatively newer platform compared to the established giant Solana, has managed to outpace it in daily fee generation. This is a significant achievement, akin to a rookie team defeating a seasoned champion. But what exactly does this fee flip signify in the bustling world of decentralized finance?

To understand the magnitude, consider these points:

- Volume Surge: Hyperliquid has witnessed an impressive surge in trading volume, recently hitting a staggering $9 billion. This massive influx of trading activity directly translates to higher fees collected on the platform.

- Profitable Mechanisms: The architecture of Hyperliquid seems to be inherently designed for profitability. Its mechanisms, while perhaps complex under the hood, are clearly resonating with traders and generating substantial revenue.

- Solana’s Position: Solana, while still a major player in the crypto space, has seen fluctuations in its network activity and user engagement. This fee flip doesn’t necessarily indicate Solana’s downfall, but it certainly highlights a shift in momentum.

This isn’t just about bragging rights; it’s about understanding the evolving dynamics of the DeFi landscape. The fact that a platform like Hyperliquid can challenge and even surpass a blockchain as prominent as Solana in a key metric like fees is noteworthy.

Is the ‘HYPE’ Around Hyperliquid Justified? Unpacking the DEX Phenomenon

Now for the million-dollar question: Is all the buzz around Hyperliquid truly warranted? The crypto world is no stranger to fleeting trends and overhyped projects. So, let’s dissect the ‘HYPE’ and see if there’s solid ground beneath it.

Arguments for Justified Hype:

- Innovative Platform: Hyperliquid isn’t just another run-of-the-mill DEX. It brings fresh ideas and potentially more efficient trading mechanisms to the table. This innovation can attract users seeking advanced features and better trading experiences.

- Strong Volume Speaks Volumes: The sheer volume of $9 billion isn’t something to dismiss lightly. It suggests genuine user adoption and confidence in the platform. Traders are voting with their assets, and they’re choosing Hyperliquid.

- Fee Generation as Validation: In the crypto world, fees often equate to value accrual. High fees indicate strong demand for the platform’s services and its ability to capture economic activity. Hyperliquid’s fee dominance over Solana is a powerful validation signal.

- Potential for Growth: If Hyperliquid can maintain this momentum and continue to innovate, its growth trajectory could be significant. Early successes can create a positive feedback loop, attracting even more users and liquidity.

Points to Consider – Is it All Just ‘HYPE’?

- New Platform Volatility: Newer platforms can be more susceptible to volatility. Initial surges in popularity might be followed by periods of stagnation or decline. Sustained performance is key.

- Vampire Attacks and Liquidity: The content mentions “vampire attacks on liquidity.” This is a crucial point. While Hyperliquid currently boasts strong liquidity, attracting and retaining it in the long run is an ongoing challenge. Other platforms might try to siphon away liquidity with enticing incentives.

- Sustainability of Mechanisms: Are Hyperliquid’s profitable mechanisms sustainable in the long term? Market conditions change, and what works today might not work tomorrow. The platform needs to adapt and evolve to maintain its competitive edge.

- Competition in the DEX Space: The decentralized exchange landscape is fiercely competitive. Giants like Uniswap and PancakeSwap, along with numerous other emerging DEXs, are constantly vying for market share. Hyperliquid needs to navigate this crowded space effectively.

Delving Deeper: Understanding Hyperliquid’s Competitive Edge in the DEX Arena

What exactly is giving Hyperliquid this competitive edge that’s allowing it to challenge established players? While a full technical deep dive is beyond the scope here, we can highlight some potential factors contributing to its success as a crypto trading platform.

- Efficient Trading Engine: Hyperliquid likely employs a highly optimized trading engine capable of handling large volumes and high-frequency trading. This can attract sophisticated traders seeking speed and efficiency.

- User-Friendly Interface: While perhaps geared towards more experienced traders, a well-designed and intuitive user interface can significantly enhance user experience and attract a broader audience.

- Innovative Features: Hyperliquid might offer unique features or trading tools not readily available on other DEXs. This could include advanced order types, sophisticated analytics, or novel DeFi integrations.

- Community and Support: A strong and active community, coupled with responsive customer support, can be a major differentiator in the crypto space. Positive user experiences can fuel organic growth and word-of-mouth marketing.

The Broader Implications: What Does This Mean for the DeFi Landscape?

Hyperliquid’s rise and its fee flip of Solana have broader implications for the decentralized finance ecosystem. It signals a few key trends:

- Continued Innovation in DEXs: The DEX space is far from stagnant. Hyperliquid’s emergence demonstrates that there’s still ample room for innovation and disruption. New DEXs with novel approaches can capture significant market share.

- Shifting Liquidity Flows: Liquidity in DeFi is fluid and constantly seeking the most attractive opportunities. Hyperliquid’s success in attracting substantial liquidity underscores this dynamic. Platforms that offer better incentives and trading experiences will likely continue to draw in liquidity.

- Increased Competition for Solana: While Solana remains a powerful blockchain, the rise of platforms like Hyperliquid indicates increased competition. Solana needs to continue to innovate and adapt to maintain its position in the face of emerging rivals.

- Maturation of DeFi: The DeFi space is maturing. Users are becoming more discerning, and platforms are being held to higher standards of performance, efficiency, and user experience. Hyperliquid’s success reflects this maturation process.

Navigating the ‘HYPE’: Actionable Insights for Crypto Enthusiasts

So, what should you, as a crypto enthusiast or trader, take away from the Hyperliquid phenomenon? Here are some actionable insights:

- Explore Hyperliquid (with Caution): If you’re an experienced DeFi user, it might be worth exploring Hyperliquid. However, always exercise caution with new platforms. Start with small amounts and thoroughly research the platform’s risks and security.

- Monitor DEX Trends: Keep a close eye on the evolving DEX landscape. Hyperliquid’s success is a reminder that new and innovative platforms are constantly emerging. Staying informed about these trends can help you identify promising opportunities.

- Understand DeFi Fees: Pay attention to fee generation metrics in DeFi. Fees are a crucial indicator of platform usage and economic activity. Analyzing fee trends can provide valuable insights into the health and growth of different DeFi ecosystems.

- Diversify Your DeFi Portfolio: Don’t put all your eggs in one basket. Diversify your DeFi activities across multiple platforms and blockchains to mitigate risk and capitalize on different opportunities.

Conclusion: Is Hyperliquid a Flash in the Pan or the Future of DEXs?

Hyperliquid’s fee flip of Solana is undoubtedly a powerful statement. It showcases the dynamism and rapid evolution of the DeFi space. While it’s still early days, and the long-term sustainability of Hyperliquid’s ‘HYPE’ remains to be seen, its initial success is undeniable. The platform has captured significant trading volume, generated impressive fees, and sparked considerable interest within the crypto community.

Whether Hyperliquid will become a long-term dominant force in the DEX arena or a fleeting trend remains an open question. However, its emergence serves as a compelling reminder that innovation and disruption are constant forces in the world of decentralized finance. Keep watching this space – the DeFi revolution is far from over, and platforms like Hyperliquid are leading the charge into an exciting future.