XRP Price Plunge: Crucial Factors Behind Today’s Drop

If you’re watching the markets, you’ve likely noticed the recent dip in the XRP price. Today, XRP is trading lower, leaving many investors asking: Why is XRP down? This article delves into the key factors contributing to this movement, providing a clearer picture of the current market sentiment surrounding Ripple XRP.

Understanding the Latest Dip in XRP Price

As of May 6, XRP price has seen a notable decline, falling by 3% over the past 24 hours to trade around $2.09. This price action is accompanied by a significant 25% increase in trading volume, suggesting strong selling pressure is at play. Several elements seem to be influencing this downward trend.

Ripple’s Strategic Shift and the XRP Market Report

One major point of discussion impacting Ripple XRP sentiment is the company’s decision to discontinue its quarterly XRP markets report. Announced on May 5, Ripple stated this change reflects a focus on institutional adoption and a need for more varied insights beyond the previous report’s scope. While Ripple views this as a strategic move, it has sparked debate among investors:

- **Transparency Concerns:** Some investors relied on these reports for data on XRP sales, escrow movements, and adoption trends, and worry about reduced transparency.

- **Strategic Pivot:** Others believe this is part of a larger strategy by Ripple to empower the broader ecosystem, including the XRPL Foundation, and focus on private, fast scaling for Web3.

This shift away from a long-standing source of market data has undeniably introduced a degree of uncertainty, potentially weighing on the XRP price.

What Low Open Interest Tells Us About XRP Sentiment

Another factor contributing to the current weakness is the declining open interest (OI) in XRP futures. Over the past seven days, XRP OI has dropped by 10% to $3.6 billion. A decrease in OI typically signals reduced confidence among traders and lower market liquidity, which can exacerbate price declines. This low OI suggests that conviction for bullish bets on XRP is currently weak.

Furthermore, the recent price drop triggered significant liquidations. In the last 24 hours, approximately $7.98 million in long positions (bets on price increase) were liquidated, compared to only $660,000 in short positions (bets on price decrease). This imbalance highlights the pressure on bullish traders, forcing them to sell and adding to the selling momentum. The 24-hour long/short ratio of 0.9131 confirms that bearish sentiment currently outweighs bullish sentiment for Ripple XRP.

XRP Technical Analysis Points to Continued Downtrend

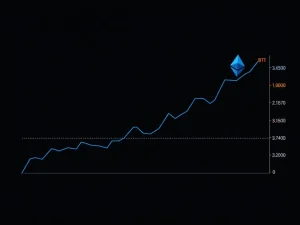

From a technical perspective, the XRP price is currently navigating a challenging structure. Examining the charts reveals that XRP remains confined within a descending triangle pattern. This pattern is characterized by a descending resistance line and a relatively flat support line, currently around the $2.00 level. This formation typically indicates a weakening technical setup and potential for further downside.

The Relative Strength Index (RSI), a momentum indicator used in XRP technical analysis, has also declined significantly, dropping from 60 to 43 since April 28. An RSI below 50 generally suggests increasing bearish momentum. If bears manage to push the price decisively below the $2.00 support line of the triangle, the technical target for the pattern points towards a potential drop to $1.92.

Conversely, a break and sustained close above the descending resistance line of the triangle would be a positive signal, suggesting bulls are regaining control. Such a move could see the pair test resistance levels, potentially targeting the 100-day Simple Moving Average (SMA) around $2.34. A move above this level would be crucial for any potential rally towards the significant $3.00 mark, where sellers are expected to step in.

Summary: Why is XRP Down Today?

In conclusion, the current dip in XRP price is influenced by a combination of factors. Ripple’s decision regarding the XRP market report has created uncertainty, while low open interest and significant long liquidations reflect weak trader confidence and selling pressure. Technically, the price is trapped in a bearish pattern, with indicators suggesting further downside if key support levels fail. While a rebound remains possible if resistance breaks, the immediate outlook for Ripple XRP is challenged by these prevailing conditions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Trading cryptocurrencies involves risk, and readers should conduct their own research.