WBETHUSDT Explodes: Unpacking the Monumental Bullish Breakout in Ethereum’s Staking Token

Welcome to our comprehensive market overview, where we dissect the electrifying performance of **Wrapped Beacon ETH (WBETHUSDT)**. On July 24, 2025, this prominent Ethereum staking token delivered a truly remarkable display of bullish strength, capturing the attention of traders and investors alike. Understanding these pivotal market movements is crucial for anyone navigating the dynamic world of digital assets.

WBETHUSDT’s Remarkable Surge: A Deep Dive into Price Action

The past 24 hours have been nothing short of extraordinary for **WBETHUSDT**. Opening at $3877.32 on July 23 and closing robustly at $4002.91 by July 24, the token showcased significant upward momentum. The price soared from $3877 to $4003 within a 24-hour window, particularly noticeable on the 15-minute chart data, which painted a clear picture of a developing bullish breakout pattern.

- 24-Hour Range: WBETHUSDT reached a high of $4047.00 and touched a low of $3804.47, demonstrating substantial intraday volatility.

- Total Volume: A healthy 554.19 WBETH was traded, indicating active participation.

- Notional Turnover: The approximate turnover of $2,048,293.40 underscores the significant capital flowing into this asset.

Unpacking the Bullish Breakout: Key Formations and Structures

The 15-minute chart provided compelling evidence of a strong bullish bias. A key development was the decisive breakout from a descending channel in the early morning hours, signaling a shift in market sentiment. This was reinforced by a large bullish engulfing pattern that emerged around 05:30 ET, pushing the price from $3846.04 to $3865.40. Following this initial surge, **WBETHUSDT** entered a consolidation phase, building energy for a final powerful upward thrust in the last three hours of the trading window.

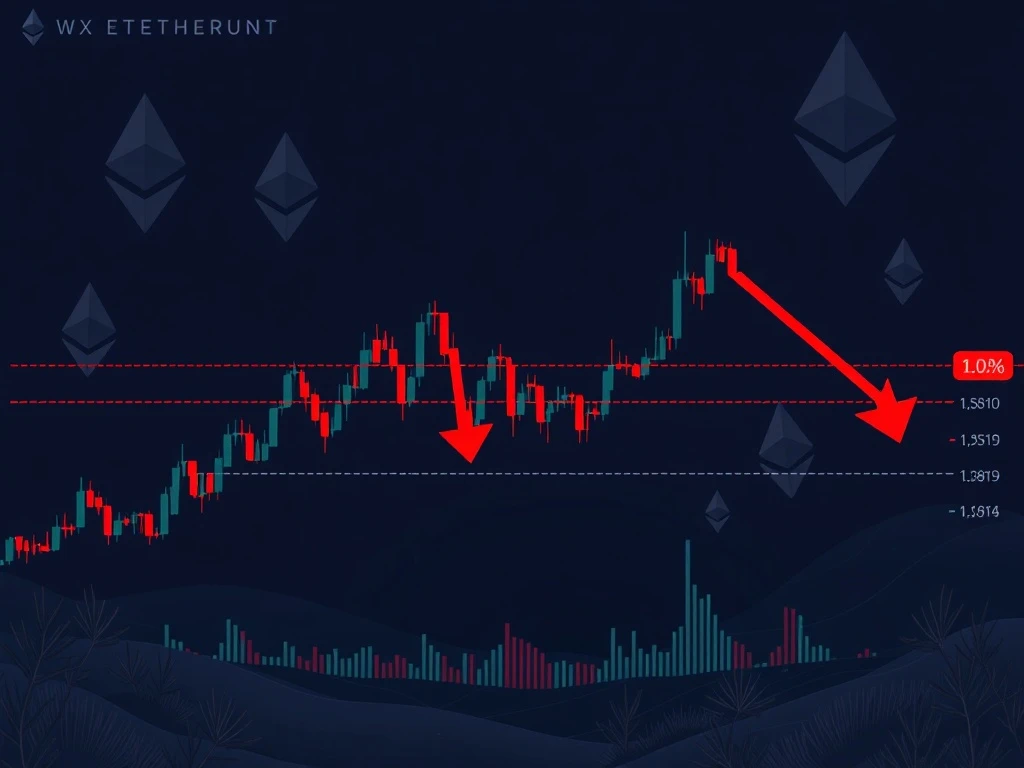

However, it’s worth noting the appearance of a bearish doji near the high at $4045.61 (15:15 ET). While momentum was strong, this formation often hints at short-term exhaustion and could precede a period of consolidation or a minor pullback.

Key Indicators in Crypto Market Analysis: Moving Averages and MACD

To gain a deeper understanding of WBETHUSDT’s trajectory, let’s look at what the leading technical indicators are telling us:

Moving Averages: A Confirmation of Strength

On the 15-minute chart, both the 20-period and 50-period moving averages demonstrated a clear upward trend, with the 20-period MA rising from approximately $3880 to $3910. The price consistently traded above both, which is a classic sign of robust short-term upward momentum. Zooming out to the daily chart, the 50-period MA at around $3890 and the 200-period MA near $3840 further confirm that **Wrapped Beacon ETH** is trading significantly above its key medium-term and long-term benchmarks, indicating sustained underlying strength.

MACD: Fueling the Upward Drive

The Moving Average Convergence Divergence (MACD) indicator provided a clear bullish signal. The MACD line crossed above the signal line in the early morning, a classic bullish crossover. The histogram subsequently expanded positively above the zero line, reinforcing the upward momentum and confirming that buying pressure was firmly in control throughout the period.

Navigating Overbought Territory: Technical Analysis Insights from RSI and Bollinger Bands

While the rally was impressive, some indicators suggest caution is warranted.

RSI: Overextended Rally?

The Relative Strength Index (RSI) climbed into overbought territory (above 70) around 15:00 ET and remained there until the close. An RSI reading consistently above 70 indicates that the asset may be overextended in the short term, increasing the likelihood of a pullback or sideways consolidation as buyers take a breather and profit-takers emerge. This is a crucial insight for any **technical analysis** enthusiast.

Bollinger Bands: Volatility on the Rise

Initially, the Bollinger Bands were in a state of contraction, signaling a period of low volatility and consolidation. However, in the final three hours of the 24-hour window, the bands expanded sharply, coinciding perfectly with the rapid price rally. The price closed near the upper band at $4002.91, which signifies strong volatility and a continuation of bullish momentum. Despite this, the expansion often precedes a retest of the middle or lower band, with the lower band currently around $3900, which could serve as a near-term support level.

Volume Speaks Volumes: Sustained Buying Pressure for Ethereum Staking Token

Volume is often considered the fuel for price movements, and in the case of this **Ethereum staking token**, it tells a compelling story. Volume increased steadily throughout the 24-hour period, culminating in an astonishing 270x surge in the final 15-minute candle compared to earlier hours. This final candle, recorded at 16:00 ET, showed a volume of 5.14 WBETH but an impressive turnover of $20,595. This dramatic increase in volume, especially during the final upward push, suggests strong conviction among buyers, validating the rally. Crucially, there was no significant divergence between price and volume, indicating that the rally is well-supported by genuine buying pressure rather than a speculative pump.

Fibonacci Retracements: Identifying Key Support Levels for WBETHUSDT

Applying Fibonacci retracement levels to the recent swing from the low of $3804.47 to the high of $4047.00 offers valuable insights into potential support and resistance zones.

- 61.8% Retracement: This critical level sits approximately at $3918–$3920. Notably, this zone has already acted as support earlier in the 24-hour window, making it a key area to watch for potential bounces or consolidation.

- 38.2% Retracement: Around $3950, this level could also offer short-term resistance or act as a minor support if a pullback occurs.

The forward-looking view suggests that while **WBETHUSDT** may continue its upward trajectory if bullish momentum persists, a period of consolidation near the 61.8% Fibonacci level is a strong possibility. Given the RSI’s overbought status and the expanded Bollinger Bands indicating high volatility, a short-term pullback or sideways consolidation should be anticipated in the next 24 hours. Investors should exercise caution and monitor these key support levels closely for potential reversal signals or further confirmation of the trend.

Conclusion: Navigating the Waves of WBETHUSDT’s Momentum

The past 24 hours have been a testament to the robust bullish sentiment surrounding **Wrapped Beacon ETH**. From a decisive breakout and significant price surges backed by strong volume to key technical indicators confirming momentum, WBETHUSDT has certainly made its mark. However, the overbought RSI and expanding Bollinger Bands suggest that while the long-term outlook remains positive, a short-term breather or consolidation phase is likely. Staying informed and utilizing these **crypto market analysis** tools will be paramount for navigating the exciting path ahead for WBETHUSDT.

Frequently Asked Questions (FAQs)

What is Wrapped Beacon ETH (WBETHUSDT)?

Wrapped Beacon ETH (WBETHUSDT) is a liquid staking token representing staked Ethereum (ETH) on the Beacon Chain. It allows users to earn staking rewards while maintaining liquidity, as WBETH can be traded or used in DeFi protocols.

What does a ‘bullish breakout’ mean in crypto trading?

A bullish breakout occurs when the price of an asset moves above a significant resistance level or pattern (like a descending channel) with strong volume, signaling that buyers have taken control and the price is likely to continue rising.

Why is the RSI indicator important for WBETHUSDT analysis?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. When RSI enters ‘overbought’ territory (typically above 70), it suggests that the asset’s price has risen too quickly and may be due for a pullback or consolidation, indicating potential short-term risk.

How do Bollinger Bands help in understanding WBETHUSDT’s volatility?

Bollinger Bands measure market volatility. When the bands contract, it indicates low volatility and consolidation. When they expand sharply, as seen with WBETHUSDT, it signifies increasing volatility and often accompanies strong price movements, suggesting the current trend is robust but also highlights potential for larger price swings.

What are Fibonacci Retracement levels and how are they used for WBETHUSDT?

Fibonacci Retracement levels are horizontal lines that indicate potential support and resistance levels based on a percentage of a previous price move. For WBETHUSDT, levels like 61.8% ($3918-$3920) can act as crucial areas where the price might find support during a pullback or consolidate before continuing its trend.

What should investors watch out for after this WBETHUSDT rally?

After such a strong rally, investors should watch for potential short-term pullbacks due to the overbought RSI. Key support levels, particularly the 61.8% Fibonacci retracement at $3918-$3920, should be monitored for signs of a bounce or continued consolidation. Volume trends and the overall market sentiment for Ethereum staking tokens will also be crucial.