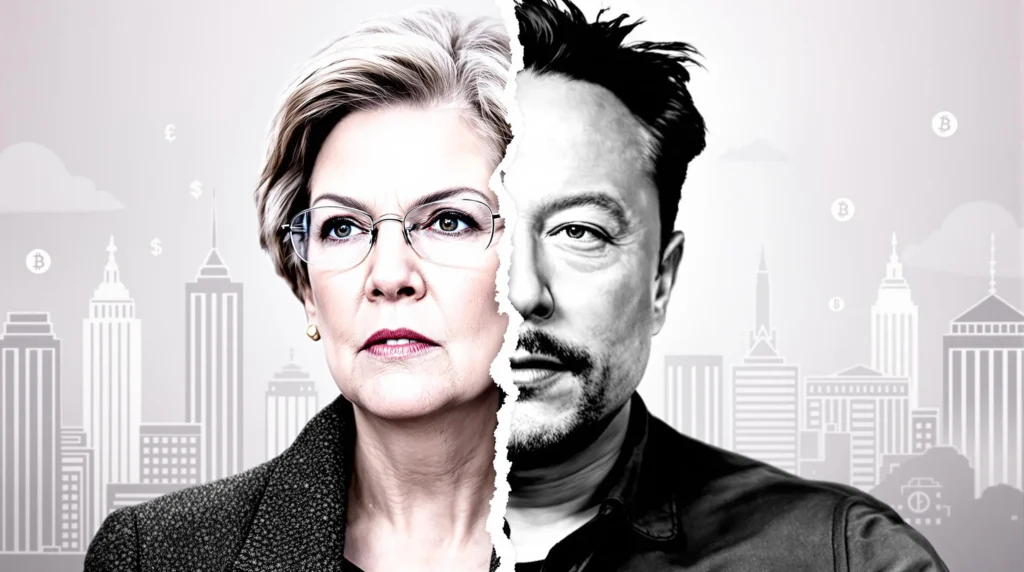

Explosive Accusation: Elizabeth Warren Brands Elon Musk a ‘Bank Robber’ Amidst Crypto Regulation Frenzy

The gloves are off in Washington as Senator Elizabeth Warren, a vocal critic of both traditional finance and the burgeoning crypto world, has launched a scathing attack against tech mogul Elon Musk. Warren didn’t mince words, directly labeling Musk a ‘bank robber’ in connection to the alleged dismantling of the Consumer Financial Protection Bureau (CFPB). This fiery accusation comes at a crucial juncture, as discussions around crypto regulation intensify and the financial landscape undergoes rapid transformation. Is this just political rhetoric, or does Warren’s accusation hold weight? Let’s delve into the details and uncover what’s fueling this explosive claim.

Why is Elizabeth Warren Calling Elon Musk a ‘Bank Robber’ Regarding the CFPB?

Senator Warren’s strong words stem from concerns about the perceived weakening of the CFPB, an agency established in the wake of the 2008 financial crisis to protect consumers from predatory financial practices. She alleges that both Elon Musk and former President Trump have played roles in undermining the CFPB, creating an environment ripe for financial exploitation. But what exactly are these accusations, and how do they relate to Elon Musk and the CFPB?

- The CFPB’s Mandate: The Consumer Financial Protection Bureau is designed to safeguard consumers in the financial marketplace. It enforces federal consumer financial laws and aims to ensure fairness and transparency in dealings with banks, lenders, and other financial institutions.

- Warren’s Allegations: Senator Warren contends that actions taken during the Trump administration, and potentially influenced by figures like Musk, have weakened the CFPB’s ability to effectively regulate and protect consumers. She suggests this dismantling is intentional, designed to benefit powerful financial interests.

- Musk’s Involvement (Indirect): While not directly linked to dismantling the CFPB, Warren’s accusation might stem from a broader perception of Musk and figures like him as representing a deregulatory approach that ultimately weakens consumer protections. The ‘bank robber’ label is likely metaphorical, highlighting what Warren sees as a robbery of consumer protection rather than literal bank robbery.

It’s crucial to understand that Warren’s statement is a strong political statement, framing the issue in stark terms to draw attention to her concerns about consumer protection and regulatory oversight. The timing of this accusation, amidst heightened crypto regulation debates, is also noteworthy.

The Crypto Regulation Debate Heats Up: Is This Connected?

The accusation against Elon Musk and the concerns around the CFPB are happening against a backdrop of intense discussions about how to regulate the cryptocurrency industry. The crypto market, known for its volatility and novel financial instruments, has attracted both excitement and scrutiny from regulators worldwide. Here’s how Warren’s accusations might tie into the broader crypto regulation conversation:

- Deregulation Concerns in Crypto: Similar to Warren’s concerns about the CFPB, there’s a broader debate about the level of regulation needed in the crypto space. Some argue for minimal regulation to foster innovation, while others, like Warren, advocate for stronger oversight to protect consumers and prevent financial instability.

- CFPB’s Potential Role in Crypto: While not explicitly focused on crypto, the CFPB’s mandate to protect consumers in financial markets could extend to certain aspects of the crypto industry. If the CFPB is weakened, as Warren alleges, it could impact its ability to address potential consumer protection issues within the crypto space.

- Political Messaging: Warren’s strong stance against Musk and the perceived weakening of the CFPB sends a clear message about her views on regulation. It signals a tougher stance on financial deregulation in general, which likely extends to her approach to crypto regulation.

The debate around crypto regulation is complex, involving questions about innovation, consumer protection, national security, and financial stability. Warren’s accusation adds a layer of political intensity to this already heated discussion.

Financial Control: Is That the Real Goal?

Warren’s accusation also points to a deeper concern: financial control. She suggests that dismantling the CFPB and, by extension, potentially resisting robust crypto regulation, is about consolidating financial control in the hands of a few powerful individuals and corporations. This raises critical questions about power, influence, and the future of finance.

Is the goal of weakening regulatory bodies truly about gaining financial control? Here are some perspectives to consider:

| Perspective | Description |

|---|---|

| Warren’s View: | She likely believes that deregulation efforts are driven by a desire to reduce oversight and increase the power of financial institutions and wealthy individuals, allowing them to operate with less accountability and potentially at the expense of consumers. |

| Pro-Deregulation Argument: | Proponents of deregulation often argue that it fosters innovation, reduces bureaucratic hurdles, and allows businesses to thrive, ultimately benefiting the economy. They may see regulations as stifling growth and hindering progress. |

| Neutral View: | The reality is likely complex. There are valid arguments on both sides of the regulation debate. Finding the right balance between fostering innovation and protecting consumers is a continuous challenge. |

The concept of financial control is central to this debate. Who gets to shape the financial landscape? Who benefits from the rules, or lack thereof? These are fundamental questions that underpin the discussions about both traditional financial regulation and the emerging world of cryptocurrencies.

Actionable Insights: What Does This Mean for Crypto Enthusiasts?

While the political sparring between Warren and figures like Elon Musk might seem distant, it has real implications for the crypto world. Here are some actionable insights for crypto enthusiasts to consider:

- Stay Informed about Regulation: Pay close attention to developments in crypto regulation. Warren’s stance reflects a growing sentiment in Washington for increased oversight of the crypto industry. Understanding these regulatory trends is crucial for navigating the evolving landscape.

- Engage in the Debate: Your voice matters. Participate in discussions about crypto regulation. Contact your representatives, engage in online forums, and contribute to shaping a balanced and informed regulatory framework.

- Prioritize Security and Compliance: As regulation tightens, prioritize platforms and projects that emphasize security, transparency, and compliance. Choose reputable exchanges and be aware of the regulatory requirements in your jurisdiction.

- Understand the Political Landscape: Recognize that crypto regulation is not just a technical issue; it’s deeply intertwined with politics. Understanding the political forces at play, like the views of figures like Elizabeth Warren, is essential for anticipating future trends.

Conclusion: A Battle for the Future of Finance

Elizabeth Warren’s fiery accusation against Elon Musk, branding him a ‘bank robber’ in the context of CFPB dismantling and crypto regulation, is more than just political theater. It’s a powerful statement in a larger battle for the future of finance. It highlights the ongoing tension between deregulation and consumer protection, between innovation and control, and between the established financial order and the disruptive potential of cryptocurrencies.

As the crypto regulation debate intensifies, and as figures like Warren continue to push for stronger oversight, the crypto community must remain vigilant, informed, and engaged. The future of crypto will be shaped not just by technological advancements, but also by the regulatory and political landscape that emerges in the years to come. The ‘bank robber’ accusation serves as a stark reminder of the high stakes involved and the passionate debates that are defining this pivotal moment in financial history.