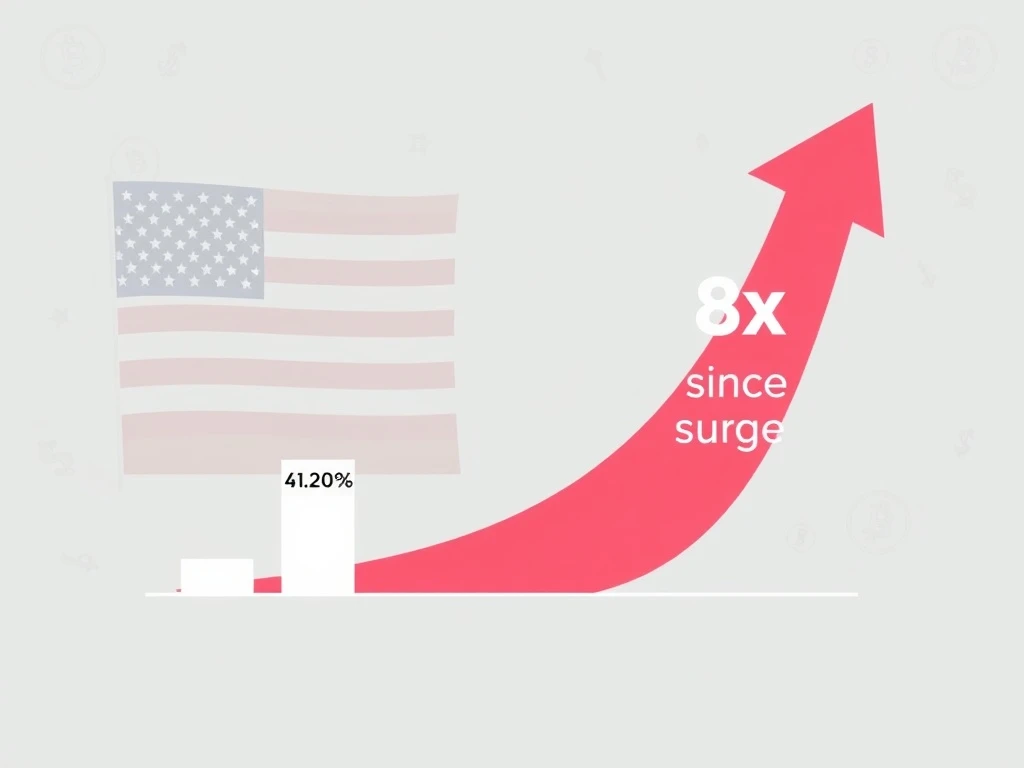

Shocking Truth: US Crypto Adoption Remains Low Despite 8x Surge, Gallup Survey Reveals

Are you one of the millions fascinated by the world of digital assets, perhaps even owning a piece of the future in Bitcoin or Ethereum? You might assume that with all the buzz, institutional interest, and market developments, US crypto adoption would be skyrocketing. However, a recent and revealing Gallup crypto survey paints a surprisingly different picture, highlighting a persistent hesitancy among American adults to fully embrace digital currencies. This article delves into the crucial findings of this survey, exploring why, despite an impressive 8x surge in ownership since 2018, cryptocurrency remains a niche investment for most Americans.

The Current State of US Crypto Adoption: A Niche Market?

The latest Gallup crypto survey on U.S. cryptocurrency ownership underscores a significant disconnect: while the crypto market continues to evolve at a rapid pace, mainstream consumer engagement lags. The data reveals that a surprisingly small percentage of American adults currently own cryptocurrency. While specific figures were left out of the initial snippet, the overarching message is clear: ownership is not as widespread as one might expect given the market’s trajectory.

Despite this low overall adoption, there’s an undeniable growth story. Since 2018, cryptocurrency ownership has seen an 8x increase. This surge indicates a growing curiosity and willingness among a segment of the population to explore digital assets. However, this growth often comes from a relatively small base, meaning that even significant percentage increases can still translate to modest overall penetration. It’s a classic case of ‘growth within a niche’ rather than ‘mass market embrace’.

Key findings from the survey indicate:

- Only a small percentage of Americans currently own crypto.

- Even fewer are actively planning to purchase digital currencies.

- A very limited number view crypto as the best long-term investment, preferring traditional assets.

This data challenges the perception that cryptocurrencies are on the cusp of widespread integration into everyday financial life, raising crucial questions about public perception, trust, and practical use cases.

Unpacking the Gallup Crypto Survey Insights: Who’s Investing?

So, who exactly is leading the charge in digital asset investment in the U.S.? The Gallup survey provides valuable demographic insights, painting a clearer picture of the typical crypto owner:

- Younger Men (18–49): This demographic consistently shows the highest rates of crypto ownership, aligning with global trends that suggest younger generations are more open to new technologies and alternative investments.

- Upper-Income Earners: Individuals with higher incomes are more likely to hold digital assets, possibly due to greater disposable income for speculative investments or better access to financial education.

- College Graduates: Higher education levels correlate with increased crypto ownership, suggesting that a better understanding of complex financial instruments might play a role.

Even among these key groups, however, adoption remains limited. Bitcoin and Ethereum continue to dominate ownership patterns, reflecting their established market presence and liquidity. Yet, the survey clearly shows that for most investors, even those dabbling in crypto, traditional assets like stocks and real estate remain the preferred long-term investment vehicles.

A significant barrier highlighted by the survey is skepticism, particularly among older adults and lower-income households. A staggering 60% of respondents perceive crypto as high-risk, a sentiment consistent with previous Gallup findings from 2024. This perception of risk, coupled with market volatility, acts as a powerful deterrent for potential investors.

Understanding Barriers to Widespread Cryptocurrency Ownership

Why, despite the hype and the 8x growth, does cryptocurrency ownership remain stubbornly low for the majority of Americans? The Gallup survey points to several critical factors:

- Knowledge Gap: While familiarity with crypto is widespread, practical understanding lags significantly. Only 35% of Americans claim to truly understand how cryptocurrencies work. This lack of fundamental knowledge creates a barrier to entry, as people are hesitant to invest in something they don’t comprehend.

- Market Volatility: The inherent price swings of cryptocurrencies are a major concern. The potential for rapid gains is often overshadowed by the risk of substantial losses, deterring risk-averse individuals and those seeking stable long-term investments.

- Regulatory Uncertainty: The evolving and often unclear regulatory landscape in the U.S. adds another layer of risk. Investors are wary of potential future regulations that could impact their holdings or the legality of certain activities.

- Lack of Tangible Applications: Beyond speculative trading, the everyday utility of cryptocurrencies remains limited for the average consumer. Unlike traditional currencies, crypto isn’t widely used for purchasing goods and services, making it less appealing for practical use cases.

As Coincu’s research team notes, these findings underscore the urgent need for regulatory clarity and robust educational efforts to foster trust and stability within the U.S. crypto sector. Without a clear framework and better public understanding, bridging the gap between awareness and adoption will remain a challenge.

Navigating Digital Asset Investment Preferences: Traditional vs. Crypto

The survey clearly indicates a strong preference for conventional investments. A significant 60% of Americans either opt for traditional financial instruments or reject crypto outright. This preference is deeply rooted in familiarity, perceived stability, and historical performance of assets like stocks, bonds, and real estate. For many, these traditional options represent a safer, more predictable path to wealth accumulation compared to the volatile nature of digital asset investment.

Macroeconomic factors also play a role. Inflation and interest rates can influence investment decisions, potentially pushing individuals towards assets perceived as hedges against economic uncertainty, or towards interest-bearing accounts that offer guaranteed returns. When faced with these choices, the speculative nature of crypto often takes a backseat for the majority of the population.

Even among the segment open to digital assets, the 4% of Americans planning to buy crypto represents a niche pursuit. This suggests that while a small, dedicated group sees potential, the broader population remains unconvinced or unmotivated to dive in. This sentiment has profound implications for the evolving crypto market trends and the strategies of financial institutions and fintech companies.

Future Crypto Market Trends and The Path to Mainstream Success

The findings from the Gallup survey provide critical insights that will likely shape future crypto market trends and strategies. For the industry, the message is clear: focusing solely on speculative hype will not achieve mainstream adoption. Instead, the emphasis must shift towards:

- Education: Simplifying complex concepts and demonstrating practical applications of crypto beyond trading.

- Risk Mitigation: Developing clearer regulatory frameworks and consumer protection measures to build trust and reduce perceived risk.

- Practical Applications: Innovating to create more tangible, everyday use cases for cryptocurrencies, making them more than just an investment vehicle.

Policymakers, on their part, face the delicate task of balancing innovation with consumer protection. The potential for crypto to enhance financial inclusion and offer new economic opportunities is immense, but it must not be overshadowed by the risks associated with an unregulated or poorly understood market. Achieving regulatory alignment is crucial to providing the stability and clarity needed for broader acceptance.

For now, the Gallup survey reinforces that cryptocurrency remains a niche asset in the U.S. Bridging the gap between institutional adoption (which is growing) and public trust (which is still low) is critical for its mainstream success. The journey from a speculative asset to an integrated part of the financial system will require concerted efforts from all stakeholders to educate, regulate responsibly, and innovate for practical utility.

Conclusion: A Long Road Ahead for US Crypto Adoption

The latest Gallup survey offers a sobering yet realistic view of US crypto adoption. While the 8x surge in ownership since 2018 is impressive on paper, it primarily reflects growth within a niche, rather than a true mainstream embrace. Persistent hesitancy, driven by a significant knowledge gap, high-risk perception, regulatory uncertainty, and a lack of tangible use cases, continues to deter the average American from fully engaging with digital assets. The preference for traditional investments remains strong, underscoring the challenges ahead for the crypto industry. For cryptocurrencies to truly move beyond their niche status and achieve widespread acceptance, a concerted effort focusing on education, robust regulatory frameworks, and the development of practical, everyday applications will be essential. The future of digital asset investment in the U.S. hinges on building trust and demonstrating value beyond mere speculation.

Frequently Asked Questions (FAQs)

1. What did the latest Gallup survey reveal about US crypto adoption?

The latest Gallup survey indicated that despite an 8x surge in cryptocurrency ownership since 2018, overall US crypto adoption remains surprisingly low. A significant portion of Americans still view crypto as high-risk, and only a minority truly understand how it works or considers it a long-term investment.

2. Why is cryptocurrency ownership still low in the U.S. despite growth?

Several factors contribute to low cryptocurrency ownership, including a widespread knowledge gap (only 35% understand crypto), high market volatility, ongoing regulatory uncertainty, and a lack of tangible, everyday use cases beyond speculative trading. Many Americans also prefer traditional investments due to perceived lower risk and greater familiarity.

3. Which demographics are most likely to own cryptocurrency in the U.S.?

According to the Gallup survey, cryptocurrency ownership is most prevalent among younger men (18–49), upper-income earners, and college graduates. However, even within these groups, adoption rates are still limited compared to traditional investment vehicles.

4. What are the main barriers to mainstream digital asset investment?

The primary barriers to mainstream digital asset investment include the perception of high risk (60% of respondents), a significant knowledge gap among the general public, the highly volatile nature of the crypto market, and the lack of clear and consistent regulatory frameworks in the U.S. Additionally, limited practical applications for everyday transactions deter wider adoption.

5. How can the crypto industry increase US crypto adoption?

To increase US crypto adoption, the industry needs to prioritize comprehensive educational efforts to bridge the knowledge gap, work towards clearer regulatory alignment to foster trust and stability, and develop more practical, tangible applications for cryptocurrencies beyond speculative trading. Focusing on real-world utility and consumer protection will be key.

6. Are traditional investments still preferred over digital assets in the U.S.?

Yes, the Gallup survey highlights that a strong majority of Americans (60%) continue to prefer conventional investments like stocks, real estate, or other traditional assets over cryptocurrencies. This preference is driven by factors such as perceived stability, historical performance, and familiarity, reinforcing that digital assets remain a niche investment for now.