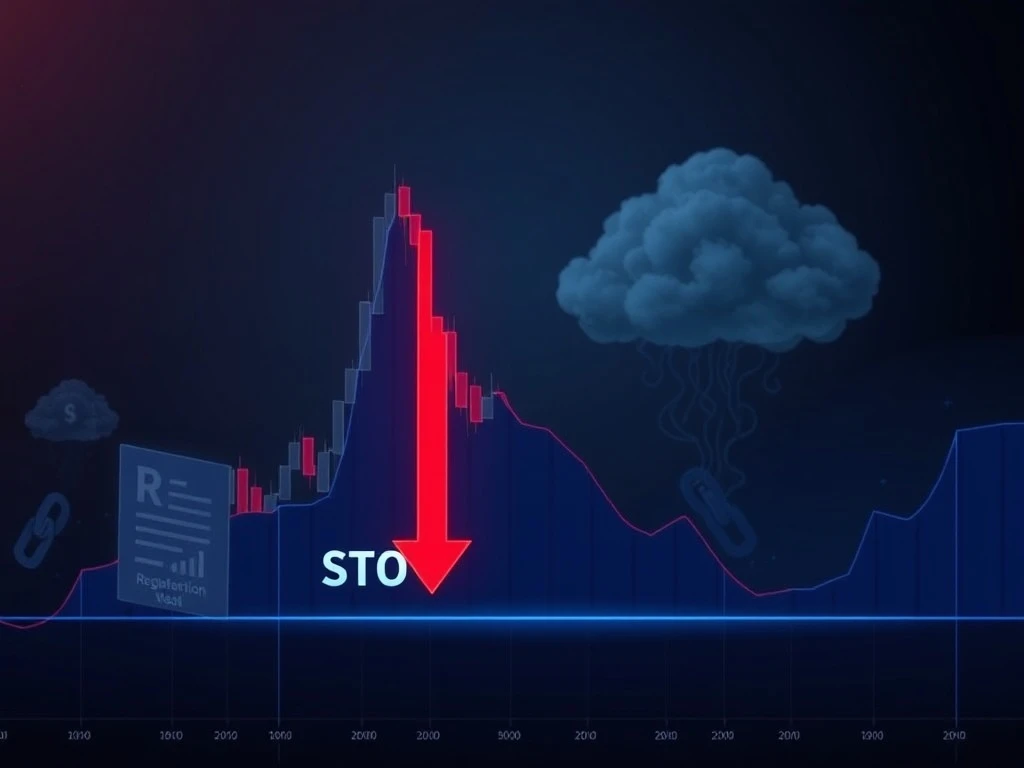

STO: Unpacking the Dramatic Plunge Amid Regulatory Uncertainty

The world of digital assets is no stranger to dramatic shifts, but the recent performance of **STO** has sent shockwaves through the market. Reporting an unprecedented 1108.01% reported decline within a mere 24 hours, this security token offering is grappling with intense **regulatory scrutiny** and the inherent unpredictability of **crypto volatility**. For anyone navigating the complex currents of cryptocurrency investments, understanding the forces behind such a significant event is paramount.

What’s Driving the STO’s Steep Decline?

The reported dramatic plunge of **STO** didn’t happen in a vacuum. It’s a confluence of escalating regulatory pressures and the asset’s own volatile nature, reflecting broader shifts in investor sentiment. While the exact mathematics of an ‘1108.01% drop’ may raise eyebrows, the underlying message is clear: a monumental loss of value that demands immediate attention.

Regulatory Storm Clouds Gather Over Security Tokens

Global authorities are increasingly tightening their grip on the digital asset space, and **security tokens** like STO are squarely in their sights. The distinction between utility tokens and true securities is becoming clearer, and with that clarity comes a demand for stricter compliance. Recent investigations have focused on:

- Transparency: Ensuring investors have full disclosure of the underlying assets and operational models.

- Investor Accreditation: Verifying that only eligible investors participate in offerings that carry higher risks.

- Compliance Practices: Scrutinizing how projects adhere to existing securities laws, which often differ significantly from traditional crypto regulations.

This intensified **regulatory scrutiny** creates an environment of heightened uncertainty, making both institutional and retail investors wary of potential enforcement actions or shifts in legal frameworks that could impact their holdings.

The Double-Edged Sword of Crypto Volatility

While the 24-hour drop is alarming, it’s crucial to contextualize it within STO’s recent history. The asset had previously seen an impressive 803.17% increase over seven days and a staggering 3208.85% surge in the last month. This extreme **crypto volatility** is characteristic of many digital assets, driven by:

- Speculative Trading: Short-term gains often fueled by hype and momentum, rather than fundamental value.

- Low Liquidity: Smaller markets can experience larger price swings with relatively minor buy or sell orders.

- Market Sentiment: News, social media trends, and macroeconomic factors can trigger rapid shifts in perception.

The recent plunge underscores that what goes up quickly can come down even faster, raising questions about the sustainability of such rapid gains and the true long-term value proposition of **STO**.

How Has Investor Behavior Shifted Amidst the Chaos?

The dramatic price movements have inevitably reshaped **investor caution** and behavior. Initial excitement, driven by the promise of high returns, has given way to a more guarded approach. This shift is visible across different investor demographics:

Institutional Investors: De-Risking and Re-evaluating

Large institutional players, typically more sensitive to risk and regulatory compliance, have reportedly begun reducing their exposure to **STO**. Their decisions are often influenced by:

- Regulatory Ambiguity: The lack of clear, consistent global frameworks makes long-term institutional commitment challenging.

- Risk Management: High volatility can quickly erode large capital allocations, prompting a focus on capital preservation.

- Fiduciary Duties: Institutions must act in the best interest of their clients, which often means avoiding highly speculative or uncertain assets.

Retail Investors: Divided Sentiments

Retail investors, on the other hand, show a more mixed reaction. Some, driven by a ‘buy the dip’ mentality, see the current low as a potential entry point, hoping for a rebound. Others, burned by the rapid decline, are exiting the market entirely, prioritizing capital preservation over potential future gains. This divergence highlights the varied risk appetites and investment philosophies within the retail segment, emphasizing the need for personal **investor caution**.

What’s the Long-Term Outlook for STO and Security Tokens?

The future trajectory of **STO** remains highly uncertain, deeply intertwined with the evolution of regulatory frameworks and its ability to demonstrate consistent, fundamental value creation. A 10.46% decline over the past year further illustrates the difficulty in maintaining stable investor confidence in this nascent sector.

While the broader potential of **security tokens** is still widely discussed—offering benefits like fractional ownership, increased liquidity for illiquid assets, and enhanced transparency through blockchain—the current environment presents significant hurdles. Without clearer legal and operational guidelines, widespread adoption and sustained growth may remain elusive. The market is increasingly demanding that projects demonstrate not just technological innovation, but also robust compliance and a tangible pathway to long-term value.

Navigating the Storm: Practical Advice for Investors

The recent 24-hour price drop of **STO** serves as a potent reminder of the inherent risks in the crypto market. For both seasoned and novice investors, embracing proactive risk management strategies is more critical than ever.

Consider these actionable insights:

- Do Your Due Diligence: Thoroughly research any security token offering. Understand its underlying assets, the team behind it, its whitepaper, and its compliance efforts.

- Understand Regulatory Risks: Stay informed about evolving regulations in your jurisdiction and globally. Regulatory shifts can significantly impact an asset’s viability.

- Diversify Your Portfolio: Never put all your capital into a single, highly volatile asset. Spread your investments across different asset classes and cryptocurrencies to mitigate risk.

- Set Stop-Loss Orders: Implement automated sell orders to limit potential losses if an asset’s price drops unexpectedly.

- Invest What You Can Afford to Lose: This golden rule of crypto investing is particularly relevant for high-volatility assets.

- Focus on Long-Term Fundamentals: While short-term gains can be tempting, prioritize projects with strong fundamentals, clear use cases, and a viable business model over purely speculative plays.

The broader market environment remains highly sensitive to both regulatory developments and macroeconomic factors. As a result, **STO**’s performance, and indeed the performance of many **security tokens**, is likely to remain influenced by these external conditions in the near term, emphasizing the need for continued **investor caution**.

Conclusion: A Crucial Wake-Up Call for the Security Token Market

The dramatic plunge of **STO** is a stark reminder of the complexities and risks inherent in the evolving world of **security tokens**. It underscores the powerful interplay between **regulatory scrutiny**, extreme **crypto volatility**, and shifting **investor caution**. While the potential of security tokens to revolutionize traditional finance remains compelling, this event highlights the critical need for clearer regulatory frameworks, enhanced transparency, and a greater focus on sustainable value creation. For investors, it’s a powerful lesson in risk management and the importance of thorough due diligence in a market that, while promising, remains fraught with uncertainty. The future of STO, and indeed the broader security token landscape, hinges on its ability to adapt to these challenges and build a foundation of trust and compliance.

Frequently Asked Questions (FAQs)

1. What is an STO (Security Token Offering)?

An STO, or Security Token Offering, is a type of fundraising method where investors are offered digital tokens that represent ownership in an underlying asset, such as real estate, company equity, or a share in a fund. Unlike utility tokens, security tokens are subject to securities regulations, offering investors legal rights similar to traditional securities like dividends or voting rights.

2. Why are security tokens facing increased regulatory scrutiny?

Security tokens are facing increased regulatory scrutiny because they blur the lines between traditional financial securities and cryptocurrencies. Regulators worldwide are working to establish clear frameworks to protect investors, prevent fraud, and ensure market integrity. This involves scrutinizing aspects like investor accreditation, transparency of offerings, and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

3. How does crypto volatility impact STOs?

Crypto volatility significantly impacts STOs by introducing rapid and unpredictable price swings. While STOs are backed by real-world assets and are generally expected to be less volatile than pure cryptocurrencies, they are still traded on crypto exchanges and can be affected by broader market sentiment, liquidity issues, and speculative trading. This volatility can lead to substantial gains or losses in short periods, as seen with STO’s recent performance.

4. What does ‘investor caution’ mean in the context of STOs?

‘Investor caution’ in the context of STOs means exercising a high degree of prudence and due diligence before investing. Given the regulatory uncertainties, market volatility, and the nascent nature of the security token market, investors are advised to thoroughly research projects, understand the associated risks, diversify their portfolios, and only invest capital they can afford to lose. It emphasizes a conservative approach to mitigate potential losses.

5. What is the long-term outlook for the security token market?

The long-term outlook for the security token market remains cautiously optimistic. While current challenges like regulatory ambiguity and market volatility persist, security tokens offer significant potential for democratizing investment, improving liquidity for illiquid assets, and enhancing transparency. Future growth will heavily depend on the development of clearer regulatory guidelines, increased institutional adoption, and the ability of projects to demonstrate consistent value creation and robust compliance.