Spot Ether ETFs Face **Challenging** Outflows Amid Shifting **Institutional Confidence**

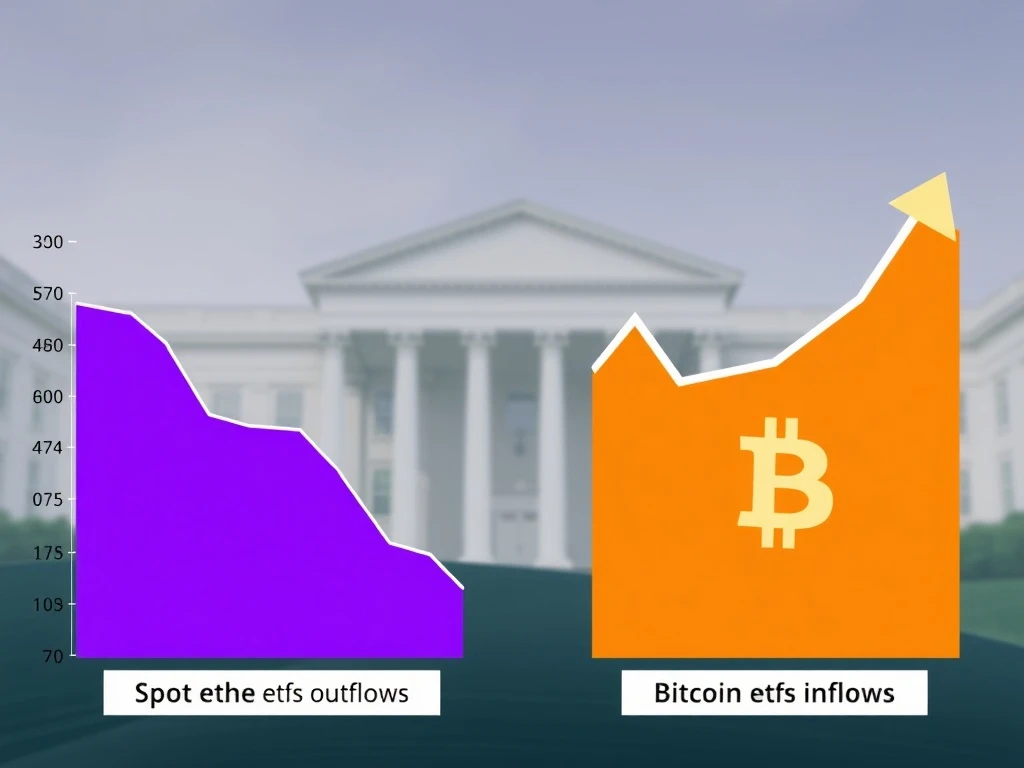

The cryptocurrency investment landscape currently presents a tale of two distinct trajectories. While Spot Ether ETFs have recently experienced a notable dip in investor interest, Bitcoin ETFs are simultaneously attracting substantial capital. This divergence signals a fascinating shift in institutional investor sentiment, prompting a closer look at prevailing crypto market trends. Understanding these movements becomes crucial for anyone tracking digital asset performance.

Spot Ether ETFs See Persistent Outflows Amid Cooling Demand

For the second consecutive week, Spot Ether ETFs have recorded significant net outflows. This trend suggests a period of “cooling demand” among investors who previously flocked to these products. Data from SoSoValue confirms this downturn. Ether products collectively posted $243.9 million in net redemptions for the week ending on Friday. This follows a substantial $311 million outflow from the previous week.

Overall, cumulative inflows across all Ether spot ETFs now stand at $14.35 billion. Total net assets currently total $26.39 billion. This figure represents approximately 5.55% of Ethereum’s total market capitalization. On Friday alone, these funds saw an additional $93.6 million in outflows. BlackRock’s ETHA ETF led these withdrawals, accounting for $100.99 million in outflows. Conversely, Grayscale’s ETHE and Bitwise’s ETHW experienced only minor inflows during this period. The sustained selling pressure highlights a cautious approach by many market participants.

[img]

Ether funds see outflows for second week. Source: SoSoValue

Bitcoin ETFs Attract Renewed Institutional Confidence

In stark contrast, Bitcoin ETFs have shown renewed strength this week. They recorded $446 million in net inflows. This surge indicates a return of institutional investors to the market, according to SoSoValue data. On Friday, these products added another $90.6 million. This brings cumulative inflows to an impressive $61.98 billion. Total net assets now stand at $149.96 billion, representing 6.78% of Bitcoin’s market cap.

Several key players drove these significant inflows. BlackRock’s iShares Bitcoin Trust (IBIT) led the charge with $32.68 million. Fidelity’s FBTC followed closely, adding $57.92 million. Both funds continue to dominate the Bitcoin ETF landscape. IBIT currently holds $89.17 billion in assets. FBTC manages $22.84 billion. This robust performance underscores a positive sentiment towards Bitcoin as a primary digital asset.

[img]

Bitcoin funds see inflows. Source: SoSoValue

Decoding Current Crypto Market Trends and Investor Sentiment

The diverging performance between Ether and Bitcoin ETFs offers crucial insights into current crypto market trends. Vincent Liu, chief investment officer at Kronos Research, provides valuable context. He notes that these ETF flows suggest a “strong rotation” into Bitcoin. Investors are doubling down on the “digital gold” and store-of-value narrative. This renewed confidence in Bitcoin often reflects broader market sentiment. It favors assets perceived as resilient during global uncertainty. Furthermore, anticipation of upcoming interest rate cuts contributes to this preference.

Conversely, Ethereum’s ongoing ETF outflows highlight cooling demand. Softer on-chain activity also plays a role. Institutional investors appear to be waiting for new catalysts. They require these before re-entering the Ethereum market with conviction. This strategic pause suggests a more selective approach within the digital asset space. Investors are clearly evaluating each asset’s unique value proposition.

What Awaits Ethereum Price? Potential Catalysts Ahead

The future trajectory of Ethereum price largely depends on several factors. A resurgence in network activity could provide a much-needed boost. Increased utility and adoption of the Ethereum blockchain would attract renewed interest. Additionally, the emergence of new, significant catalysts could reignite demand. These might include:

- Major technological upgrades: Further advancements in Ethereum’s scaling solutions.

- Increased institutional adoption: New partnerships or use cases for ETH in traditional finance.

- Broader market recovery: A general uptick in the cryptocurrency market.

Vincent Liu suggests that Ethereum and other altcoins could regain momentum only if network activity picks up. New catalysts are also essential for sustained growth. Until then, the cautious stance from institutional investors may persist.

Institutional Investors Reshape the Digital Asset Landscape

The contrasting ETF flows underscore the significant influence of institutional investors on the digital asset market. Their movements often dictate short-term price action and sentiment. As these large entities allocate capital, they reshape the landscape for both Bitcoin and Ethereum. Bitcoin’s current appeal as a macro hedge is undeniable. Its established position as “digital gold” attracts capital during uncertain times.

Looking ahead, Liu anticipates strong Bitcoin inflows to continue next week. Traders are positioning themselves for potential macro tailwinds from monetary easing. This expectation further solidifies Bitcoin’s current dominance in the institutional investment arena. Meanwhile, the focus for Ethereum remains on developing new narratives and demonstrating enhanced utility. Only then might the outflows reverse, attracting institutional investors back to the second-largest cryptocurrency.