Urgent Warning: Solana User Activity Plummets Amidst Memecoin Rug Pull Crisis

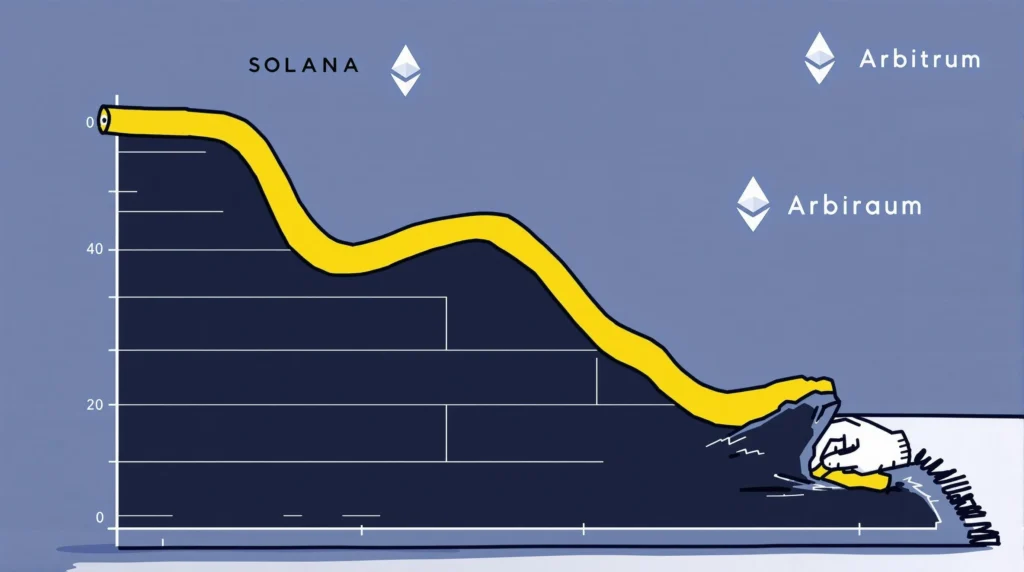

Hold onto your hats, crypto enthusiasts! The Solana blockchain, once a vibrant hub of activity, is experiencing a noticeable chill. Why? Because a wave of memecoin rug pulls is shaking user confidence, leading to a significant decline in user activity. Investors are understandably spooked, and capital is flowing out towards seemingly safer havens like Ethereum and Arbitrum. But is this all doom and gloom for Solana? Some analysts are suggesting that this turbulence might actually pave the way for a stronger, more sustainable future. Let’s dive deep into what’s happening and what it means for the Solana ecosystem and you, the crypto investor.

What’s Driving the Decline in Solana User Activity?

The crypto world thrives on excitement and quick gains, and memecoins often embody this spirit. Solana, with its fast transaction speeds and lower fees, became a breeding ground for these playful, community-driven tokens. However, this fertile ground also attracted bad actors. The recent surge in memecoin rug pulls has become a major pain point, directly impacting Solana’s user activity. Let’s break down the key factors:

- Rug Pulls Taint the Ecosystem: Imagine building trust in a marketplace only to have vendors suddenly disappear with your money. That’s essentially what a rug pull is in the crypto context. Developers of these memecoins vanish after raising funds, leaving investors with worthless tokens. This erodes trust in the entire Solana ecosystem, not just the specific memecoins involved.

- Fear and Uncertainty: Nobody wants to be the next victim. The increasing reports of memecoin rug pulls on Solana create a climate of fear and uncertainty. Users become hesitant to engage with new projects, fearing they might be scams. This naturally leads to reduced user activity across the board.

- Capital Flight to Perceived Safe Havens: When trust diminishes, investors seek safer options. Ethereum and Arbitrum, with their more established ecosystems and perceived lower risk (though not immune to scams themselves), become attractive alternatives. This capital outflow further contributes to the decline in Solana’s on-chain metrics.

The Anatomy of a Memecoin Rug Pull: How Trust is Broken

To truly understand the impact on Solana, it’s crucial to grasp how memecoin rug pulls function and why they are so damaging. These scams often follow a predictable pattern:

- Hype Generation: Scammers create a new memecoin, often with catchy names and viral marketing tactics on social media. They promise massive gains and build artificial hype to attract investors quickly.

- Pump and Dump Mechanics: Initially, the price of the memecoin is artificially inflated through coordinated buying, creating a ‘pump’. Early investors might see quick profits, further fueling FOMO (Fear Of Missing Out) and attracting more buyers.

- The Rug Pull: Once the price is sufficiently high and enough investors are lured in, the scammers suddenly remove liquidity from decentralized exchanges (DEXs). This means there’s no way to sell the tokens, and the price crashes to zero, leaving investors holding worthless assets – the ‘rug is pulled’.

- Vanishing Act: The developers, often anonymous or using fake profiles, disappear with the stolen funds, making it extremely difficult, if not impossible, for victims to recover their losses.

The frequency of these memecoin rug pulls on Solana has created a toxic environment, damaging the platform’s reputation and driving away legitimate users and developers.

Solana vs. Ethereum and Arbitrum: Why the Capital Shift?

The outflow of capital from Solana to Ethereum and Arbitrum isn’t just random. It reflects a strategic move by investors seeking stability and perceived security. Here’s a comparative look:

| Feature | Solana | Ethereum | Arbitrum |

|---|---|---|---|

| Ecosystem Maturity | Relatively Newer, Faster Growth, Higher Risk | Mature, Established, Slower Growth, Lower Perceived Risk | Layer-2 Solution, Growing Rapidly, Moderate Risk |

| Transaction Fees | Very Low | High (Mainnet), Lower (Layer-2) | Low (Layer-2) |

| Transaction Speed | Very Fast | Slower (Mainnet), Faster (Layer-2) | Fast (Layer-2) |

| Memecoin Activity | High, Prone to Rug Pulls | Moderate, Less Rug Pull Focused | Growing, Moderate Rug Pull Risk |

| Developer Community | Growing, Vibrant, but still developing robust security practices | Large, Mature, Strong Security Focus | Expanding, Leveraging Ethereum Security |

As you can see, while Solana offers speed and low fees, the current climate of memecoin rug pulls overshadows these advantages for many. Ethereum, despite higher fees, is seen as a more secure and established platform. Arbitrum, as an Ethereum Layer-2 scaling solution, provides a middle ground – faster and cheaper transactions than mainnet Ethereum, while still benefiting from Ethereum‘s security and ecosystem.

Long-Term Benefits for Solana? A Silver Lining?

It might seem counterintuitive, but some analysts believe that this period of declining user activity and memecoin rug pulls could actually be beneficial for Solana in the long-term. How so?

- Ecosystem Cleansing: The current situation is forcing a much-needed ‘cleansing’ of the Solana ecosystem. The exodus of users primarily driven by quick memecoin gains can pave the way for a more sustainable and quality-focused community.

- Focus on Genuine Projects: With the memecoin frenzy cooling down, developers and investors are likely to shift their attention towards more serious and utility-driven projects on Solana. This could lead to the development of more robust and valuable applications in the long run.

- Enhanced Security Measures: The prevalence of memecoin rug pulls will undoubtedly push the Solana community and developers to prioritize security and user protection. This could lead to the implementation of better vetting processes for projects, improved security audits, and educational initiatives to empower users to identify and avoid scams.

- Stronger Foundation for Future Growth: By weeding out the unsustainable elements and focusing on building a more secure and reliable platform, Solana can lay a stronger foundation for future growth and attract a more discerning and long-term oriented user base.

Navigating the Solana Ecosystem: What Should Users Do?

While the long-term outlook might be positive, the present situation demands caution. If you are currently involved in the Solana ecosystem or considering getting involved, here are some actionable insights:

- Exercise Extreme Caution with Memecoins: The golden rule is – if it sounds too good to be true, it probably is. Be highly skeptical of new memecoins promising overnight riches. Do thorough research, and understand the risks involved.

- Focus on Established Projects: Instead of chasing hype, consider exploring more established and reputable projects on Solana with proven utility and strong teams.

- Due Diligence is Key: Before investing in any crypto project, especially on a platform experiencing increased scam activity, conduct thorough due diligence. Research the team, the project’s fundamentals, tokenomics, and community sentiment.

- Risk Management: Never invest more than you can afford to lose. Diversify your portfolio and don’t put all your eggs in one basket, especially in the volatile world of cryptocurrencies.

- Stay Informed: Keep yourself updated on the latest developments in the Solana ecosystem and the broader crypto market. Knowledge is your best defense against scams and market volatility.

Conclusion: A Period of Turbulence, A Path to Resilience?

Solana is currently navigating a challenging period. The surge in memecoin rug pulls has undoubtedly shaken user activity and eroded trust. The capital outflow to Ethereum and Arbitrum is a clear indicator of investor apprehension. However, within this turbulence lies a potential opportunity. This ‘cleansing’ phase could force Solana to mature, prioritize security, and foster a more sustainable ecosystem focused on genuine innovation and long-term value. Whether Solana can successfully navigate this crisis and emerge stronger remains to be seen. But one thing is certain: the crypto world is watching closely, and the lessons learned from this experience will be invaluable for the entire industry. For investors, caution and informed decision-making are paramount as Solana charts its course through these choppy waters.